The GSIS Pensioners’ Emergency Loan is a financial assistance program designed to provide immediate relief to qualified pensioners affected by natural disasters or calamities. With a loanable amount of Php20,000 and a 6% annual interest rate, this program offers manageable repayment terms over 36 months, making it accessible to retirees in need of urgent funds.

This program benefits pensioners under the Government Service Insurance System (GSIS) by providing quick access to funds during emergencies. Understanding the application process, eligibility requirements, and loan details can help pensioners secure financial aid efficiently during challenging times.

Program Overview

The GSIS Pensioners’ Emergency Loan Program is a financial assistance initiative designed to provide immediate aid to old-age and disability pensioners affected by natural disasters and calamities. First introduced in November 2013, the program was created in response to Super Typhoon Yolanda, which devastated several areas in the Philippines. Under the program, pensioners residing in calamity-declared areas can borrow up to Php20,000, repayable in 36 monthly installments with a 6% annual interest rate. This program continues to serve as a reliable financial relief mechanism, enabling pensioners to address urgent needs during emergencies.

The program operates under the authority of the GSIS Charter (RA 8291), which allows the GSIS to provide benefits and services to its members and pensioners. It is offered exclusively to qualified old-age and disability pensioners residing in areas declared under a state of calamity. The rationale behind the program is to support pensioners facing financial hardship caused by disasters, enabling them to recover and meet immediate needs. Its coverage includes pensioners who meet specific eligibility requirements, ensuring that the program remains financially sustainable while assisting those in urgent need.

Loan Features

The program was designed to provide accessible and flexible financial assistance to qualified pensioners, hence the following features:

- Loanable Amount: Pensioners can borrow up to Php20,000.

- The maximum loanable amount under the GSIS Pensioners’ Emergency Loan is Php20,000. The total amount to be repaid, including interest, is Php23,600 over three years.

- Interest Rate: Fixed at 6% per annum, ensuring affordability.

- Repayment Period: Payable in 36 equal monthly installments, automatically deducted from the monthly pension.

Here’s a breakdown of the loan repayment:

Loan Amount: Php20,000

Interest Rate: 6% per annum

Term: 3 years (36 months)

Total Interest: Php3,600 (Php20,000 x 6% x 3 years)

Total Loan Amount: Php23,600

Monthly Amortization: Php655.56

- Grace Period: The first monthly amortization is due three months after loan approval.

- The initial payment starts three months after loan approval, with the first monthly amortization due on or before the 10th day of the third month.

- It comes with an automatic deduction setup which simplifies the repayment process.

- Loan Redemption Insurance (LRI): Covers the remaining balance in case of the borrower’s death.

- The LRI premium is calculated based on the pensioner’s age at the time of loan approval.

- The LRI premium for the three-month grace period is deducted from the loan proceeds, while the succeeding premiums are deducted monthly.

- No Collateral Required: Accessible without the need to pledge any assets.

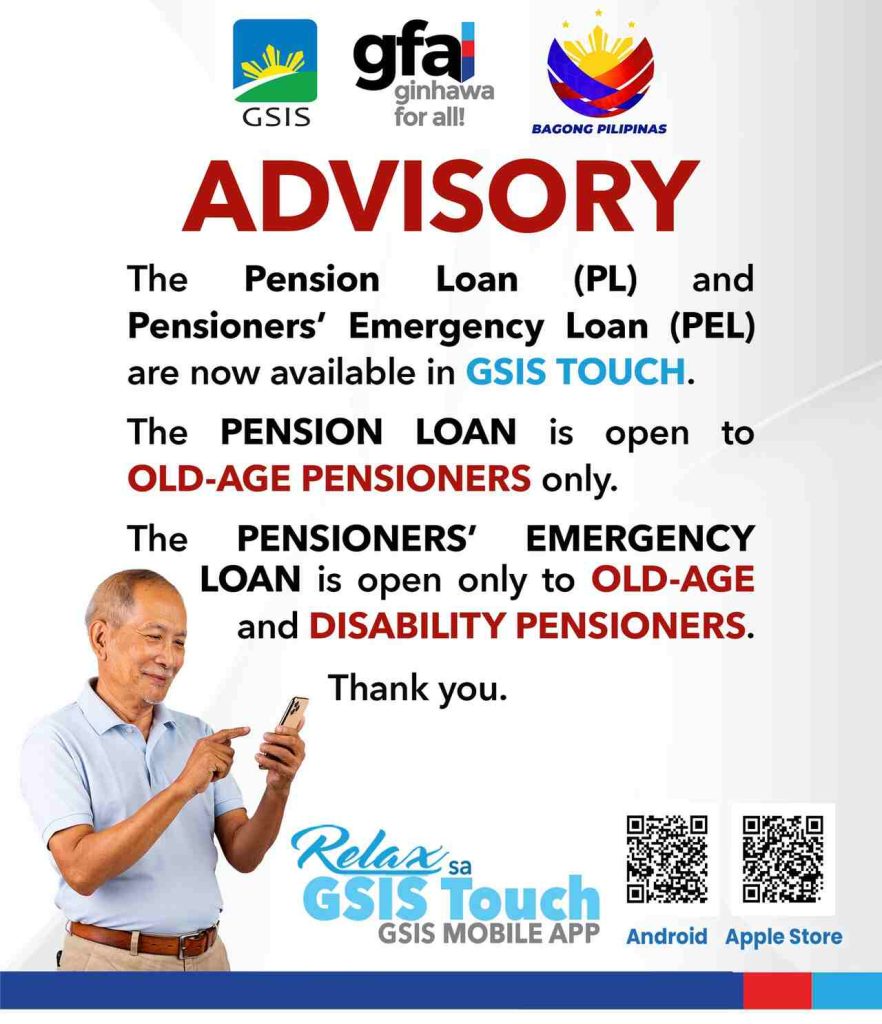

- Convenient Application Options: Applications can be made through GWAPS kiosks, GSIS offices, eGSISMO, or via email.

- Loan Maturity: The loan matures either at the end of the 36-month term or upon the pensioner’s death.

- Pretermination: Pensioners can pre terminate the loan anytime by paying the full outstanding balance, including accrued interest, penalties, or surcharges, if applicable.

- Loan Cancellation: Once the loan proceeds are credited to the pensioner’s eCard or UMID account, the loan cannot be canceled. However, pre termination is allowed.

These features make the loan an effective financial tool for pensioners during emergencies.

Why Should Pensioners Apply for this Emergency Loan?

The GSIS Pensioners’ Emergency Loan provides immediate access to funds during natural disasters or emergencies, enabling pensioners to cover urgent expenses such as home repairs, medical needs, or daily necessities while offering practical financial solutions along with the following benefits:

- Immediate Financial Assistance: The loan helps cover urgent expenses like medical bills, home repairs, or daily needs in times of crisis.

- Manageable Repayment Terms: With a 6% annual interest rate and a 36-month repayment period, pensioners can repay the loan without significant financial strain.

- Loan Redemption Insurance (LRI): The loan is insured, ensuring that any outstanding balance is cleared in case of the borrower’s death, protecting their family from additional debt.

- Multiple Application Channels: Pensioners can apply conveniently through GWAPS kiosks, GSIS offices, eGSISMO, or email.

- No Collateral Required: The loan is unsecured, making it easily accessible to eligible pensioners without the need for assets as security.

Who Can Apply?

Not all pensioners are eligible for this loan program. Interested applicants must first meet the following criteria:

- Be an active old-age or disability pensioner under RA 660, PD 1146, or RA 8291.

- Reside in an area declared under a state of calamity through a Presidential Proclamation or local government declaration.

- Ensure that their net monthly pension after loan deduction is at least 25% of their regular monthly pension.

- Have no outstanding service loans being amortized under the Choice of Loan Amortization Schedule for Pensioners (CLASP).

This ensures that pensioners have the financial capacity to repay the loan without significant strain on their monthly pension.

Required Documents

For applications submitted over-the-counter, via email, or through eGSISMO, you need to prepare:

- Duly accomplished Application Form for Pensioners’ Emergency Loan (available at GSIS offices or online).

- Two valid government-issued IDs (e.g., GSIS UMID, temporary eCard Plus, passport, or driver’s license).

How to Apply

Applying for this GSIS program is straightforward. Pensioners can simply choose from any of these convenient methods and follow the steps listed below:

1. GSIS Wireless Automated Processing System (GWAPS) Kiosks

Located in GSIS branches and partner offices nationwide.

Step 1. Visit the nearest GSIS Wireless Automated Processing System (GWAPS) kiosk.

Step 2. Insert your UMID card into the card reader.

Step 3. Select “Loans” from the menu and choose “Pensioners’ Emergency Loan.”

Step 4. Review the loan details displayed on the screen and confirm your application.

Step 5. Wait for the confirmation message indicating the successful submission of your loan application.

2. Over-the-counter

Submit your application in person at any GSIS office.

Step 1. Go to the nearest GSIS branch office.

Step 2. Secure and complete the Pensioners’ Emergency Loan Application Form from the office or download it from the GSIS website.

Step 3. Prepare two valid government-issued IDs, such as your GSIS UMID or temporary eCard Plus.

Step 4. Submit the completed application form and ID copies to the GSIS personnel.

Step 5. Wait for notification regarding the status of your loan application.

3. eGSISMO

Apply online through the official GSIS Member Online platform.

Step 1. Log in to your eGSISMO account on the GSIS website. (Register if you do not have an account.)

Step 2. Navigate to the “Loans” section and select “Pensioners’ Emergency Loan.”

Step 3. Fill out the online application form with the required details.

Step 4. Upload scanned copies of your valid IDs.

Step 5. Submit your application and monitor your email or eGSISMO dashboard for updates.

4. Email

Send your completed application and requirements to the handling GSIS branch.

Step 1. Download the Pensioners’ Emergency Loan Application Form from the GSIS website.

Step 2. Complete the form and attach scanned copies of two valid government-issued IDs.

Step 3. Email your application and documents to the handling GSIS branch. Ensure the subject line indicates your loan type for quicker processing.

Step 4. Wait for confirmation and updates on your application status.

By following these steps, pensioners can apply for the GSIS Emergency Loan through the method most convenient for them.

Where to Get the Application Form

The Pensioners’ Emergency Loan Application Form can be obtained for free from any GSIS branch office or downloaded from the official GSIS website at https://www.gsis.gov.ph/downloads/forms/2023/20240725-Emergency-Loan-Pensioners.pdf. Pensioners can also request the form when applying via email or over the counter. Once submitted, applications are typically processed within a few working days, and no additional fees are charged for the form or the loan application.

Important Reminders

For your reference, here are some important reminders that would make the application smoother:

- Make sure you meet the requirements, such as residing in a calamity-declared area and having no outstanding loans under the Choice of Loan Amortization Schedule for Pensioners (CLASP).

- Your net monthly pension after loan deductions must not fall below 25% of your total monthly pension to qualify.

- Prepare all necessary documents, such as the accomplished application form and two valid government-issued IDs, to avoid delays in processing.

- Allocate the loan amount for urgent needs, such as medical expenses, home repairs, or other immediate financial requirements.

- Regularly check your email, eGSISMO account, or communicate with your GSIS branch for updates on your application.

- Familiarize yourself with the 36-month repayment period, 6% annual interest rate, and the three-month grace period before amortization starts.

- Payments are due on or before the 10th of each month starting three months after loan approval.

- The loan includes insurance that clears the balance in the event of the borrower’s death, providing peace of mind to grantees and their families.

- You may fully settle the loan anytime during the term to save on interest charges, if financially feasible.

- Adhere to the application process and provide accurate information to avoid complications or rejection of your loan request.

Video: Can Pensioners with Enhanced Pension Loan Apply for the Pensioners’ Emergency Loan?

Learn more about the GSIS Pensioners’ Emergency Loan, how it can help retirees manage financial challenges caused by natural disasters, as well as other important information including the loan process, eligibility criteria, conditions, and payment terms to help you access funds quickly and efficiently by watching this video from Bing Repole today:

Summary

The GSIS Pensioners’ Emergency Loan is a practical financial assistance program for retirees living in calamity-declared areas. It offers a loanable amount of Php20,000 at a 6% annual interest rate, payable over 36 months, with Loan Redemption Insurance for added security. Pensioners can apply through GWAPS kiosks, GSIS offices, eGSISMO, or email by submitting the required forms and IDs. By understanding the application process and repayment terms, pensioners can take advantage of this GSIS benefit to cover emergency expenses during natural disasters. For retirees, this program offers a dependable solution to unexpected financial challenges brought by calamities.