In the Philippines, pensioners often face financial challenges that require quick and accessible solutions. Understanding the various pension loans available can empower retirees to meet their needs effectively, whether it’s for medical emergencies, family obligations, or unexpected expenses. This article provides a comprehensive overview of the different loan programs specifically designed for pensioners, highlighting the benefits and eligibility criteria for each option.

From government-backed loans like those offered by the Social Security System (SSS) and the Government Service Insurance System (GSIS) to private banking solutions, there are numerous avenues for pension loan access. Each program caters to unique needs and circumstances, ensuring that pensioners in the Philippines can secure the financial support they require for a stable and comfortable retirement.

Loan Types for Pensioners in the Philippines

The loan programs available to pensioners can be categorized according to the service providers that offer them. Some of the different kinds of pensioners’ loans include:

- Government Pension Loans: In the Philippines, government agencies like the SSS and GSIS offer pension loan options. These loans cater to pensioners who receive regular benefits from these organizations, providing accessible funding options backed by their pension income.

- Personal Loans for Senior Citizens: Certain banks and financial companies offer personal loans designed exclusively for senior citizens. These loans, available both online and at branch locations, provide seniors with flexible financing options tailored to meet their financial needs.

- Cash Loans for Pensioners: Cash loans tailored to pensioners are a convenient way for retirees to access funds promptly. These loans typically have simple application requirements, ensuring retirees can quickly receive the funds they need.

These different kinds of pensioners’ loans almost always have the same purpose—to offer quick financial relief to our pensioners or retired public or private workers with pension. To find the one that suits your needs best, please check this list below:

1. Pension Loan

Provider: GSIS

Best for: GSIS pensioners under RA 660, PD 1146, and RA 8291

The GSIS Pension Loan offers financial support for old-age pensioners by allowing them to borrow against their Basic Monthly Pension (BMP). Loan eligibility and amounts vary based on the age of the pensioner, providing flexibility to meet individual needs. Applications can be made conveniently at GWAPS kiosks, making this a practical solution for pensioners.

Features:

- 60-64 years old: Up to 6x BMP, max Php100,000

- 65-69 years old: Up to 4x BMP, max Php60,000

- 70 years and above: 2x BMP, max Php20,000

- Interest rate: 10% per annum

- Payment term: Up to 24 months

- Disbursement time: 3-5 working days

2. Pensioners Emergency Loan

Provider: GSIS

Best for: GSIS pensioners in calamity-affected areas

The Pensioners Emergency Loan provides immediate financial aid to GSIS pensioners affected by disasters or emergencies. With a straightforward application process at GSIS offices, this loan offers an affordable way to manage unexpected expenses in crisis situations. Its low-interest rate and extended repayment terms make it accessible to those in need.

Features:

- Loan amount: Php20,000

- Interest rate: 6% per annum

- Term: 36 months

- Monthly amortization: Php655.56

- Eligibility: GSIS old-age pensioners in state of calamity areas

- Application: Over-the-counter at GSIS offices

3. SSS Pension Loan

Provider: SSS

Best for: SSS retiree pensioners in need of financial assistance

The SSS Pension Loan program allows qualified retirees to secure low-interest loans based on their monthly pension amount, providing a financial lifeline for various needs. With competitive terms, the loan amount is calculated based on the pensioner’s contribution history. This program helps SSS pensioners manage their finances effectively.

Features:

- Loan amount: Based on pension amount and contribution history, max Php200,000

- Interest rate: 10% per annum

- Repayment period: 6, 12, or 24 months

- Eligibility: Retiree pensioners with My.SSS accounts, 85 years old or younger

- Restrictions: No existing deductions from monthly pension or active calamity loan

4. PNB SSS Pensioner Loan Program

Provider: Philippine National Bank (PNB)

Best for: Active SSS pensioners up to 70 years old seeking quick and secure cash access with additional benefits.

The PNB SSS Pensioner Loan Program offers a streamlined process for pensioners by directly crediting funds to their PNB accounts, enabling immediate cash access. With a monthly interest rate of 1.25%, this loan program provides added security through complimentary insurance. Pensioners benefit from Credit Insurance, which covers any outstanding balance upon their passing; ATMSafe protection against ATM-related theft, and Healthy Ka Pinoy, offering emergency treatment at accredited hospitals and clinics nationwide.

Features:

- Low 1.25% monthly interest rate

- Credit Insurance: Settles remaining loan balance upon pensioner’s death

- ATMSafe: Protection against ATM fraud and skimming

- Healthy Ka Pinoy: Emergency medical assistance at 890+ facilities across the Philippines

- Initial program launched May 27, 2015, well-received with over 700 clients

5. Quick Loan SSS Pension

Provider: Penbank, Inc.

Best for: SSS pensioners needing immediate cash for medical or emergency expenses

Penbank’s Quick Loan allows qualified SSS pensioners to access funds with same-day approval and a low monthly interest rate of 2%. It aims to provide quick assistance for those with urgent financial needs, such as medical expenses. This loan is available for pensioners up to age 70 who meet specific residency and eligibility requirements.

Features:

- Loan amount: Up to PHP 150,000

- Terms: 1-year term for ages 65-70; 2-year term for ages below 64

- Interest rate: 24% per annum (based on diminishing principal balance)

- Repayment: Monthly payments covering principal and interest

- Eligibility: SSS pensioner up to age 70, residing in Penbank service area, permanent resident for at least 5 years, SSS beneficiary

- Requirements: DDR Pension and Lump sum documentation, SSS Employee Static Information, ATM/passbook, valid IDs for borrower and co-maker

- Payment method: Auto debit via POS machine

- Additional fees: PHP 10 per successful transaction

6. PVAO Pension Loan

Provider: Philippine Veterans Bank (PVB)

Best for: PVAO pensioners, including World War II veterans, post-WWII retirees, and AFP retirees aged 65 and above, as well as surviving spouses of deceased pensioners.

The PVAO Pension Loan is designed to support veterans and their families by providing accessible financing. Eligible applicants can borrow up to PHP 200,000, with terms that offer flexibility based on age and other factors. Loan processing is quick for those with an existing PVB pension account, ensuring fast access to funds.

Features:

- Maximum loan amount: Up to PHP 200,000 (subject to age, loan term, and conditions)

- Loan term: Flexible, up to 5 years

- Credit Redemption Insurance (CRI) included

- Same-day processing available for PVB account holders

- Requirements include PVAO ID, 2×2 and 1×1 photos, CENOMAR (for surviving spouses under 65), and government-issued ID

7. Pensionado Loan

Provider: PERA HUB or City Savings Bank, Inc.

Best for: Pensioners seeking financial security and flexible loan terms.

The Pensionado Loan is available at all PERA HUB locations, designed to provide retirees with accessible funding during their retirement years. This loan offers flexible terms and competitive interest rates, making it an ideal choice for pensioners in need of additional financial support. Borrowers enjoy straightforward terms with optional credit life insurance coverage.

Features:

- Maximum Loanable Amount: Up to PHP 500,000

- Bank Charge: 5% of the loan amount

- Loan Term: Flexible, ranging from 12 to 24 months

- Interest Rate: 1.5% per month

- Credit Life Insurance: One-time payment based on loan amount

- Eligibility: Ages 40–84, receiving a pension for at least one month, with a valid UnionBank or GSIS UMID/eCard

8. SSS, GSIS, and PVAO Pension Loans

Provider: FastCash Finance Company, Inc.

Best for: Retired individuals receiving SSS, GSIS, or PVAO pensions needing quick and accessible funds

FastCash offers a convenient, straightforward pension loan program tailored for SSS, GSIS, and PVAO pensioners. They provide a quick, no-fuss application process with door-to-door services and a fast 24-hour loan approval timeline. With legit, secure transactions, this loan aims to give retirees reliable access to the cash they need.

Features:

- 24-hour loan approval process

- Door-to-door service available for convenience

- Easy, straightforward requirements for faster processing

- Free consultation via online form, call, or branch visit

- Principal office located at Regalia Tower Suites, P. Tuazon Blvd., Cubao, Quezon City

- Contact: (02) 8911-9800 / 0918-639-2972

- SEC Registration Number: CS201729284

9. Pension Loan

Provider: Air Materiel Wing Savings and Loan Association, Inc. (AMWSLAI)

Best for: AFP and PNP pensioners seeking a low-interest loan option with no hidden charges

AMWSLAI’s Pension Loan offers retirees from the Armed Forces of the Philippines (AFP) and the Philippine National Police (PNP) a convenient way to access funds with competitive interest rates. This loan includes flexible payment terms ranging from one to five years, with automatic deductions from monthly pensions for easy repayment. Designed specifically for pensioners, the program ensures straightforward terms with no surprise fees.

Features:

- Interest Rate: As low as 6.63%

- Repayment Terms: 1 to 5 years

- Repayment Method: Auto pension deduction

- Eligibility: AFP and PNP pensioners

- Requirements:

- Latest AFP Pensioner ID, PNP Pensioners ID, or AMWSLAI ID

- Valid government-issued ID

- Retirement Order

- Certificate of Pension (for new pensioners)

- Additional documentation for survivors and loan buyouts, including marriage and death certificates

10. PVAO Loan

Provider: Air Materiel Wing Savings and Loan Association, Inc. (AMWSLAI)

Best For: AFP and PNP retirees receiving PVAO pensions

The PVAO Loan offers a low-interest rate option specifically for retirees of the Armed Forces of the Philippines (AFP) and the Philippine National Police (PNP) who are beneficiaries of PVAO pensions. With competitive interest rates starting at 7.20%, this loan provides a manageable repayment plan over a term of 1 to 5 years. This program is designed to assist pensioners in meeting their financial needs while ensuring deductions are made directly from their pensions.

Features:

- Interest Rate: As low as 7.20%

- Payment Terms: 1 to 5 years

- Payment Method: Automatic deduction from PVAO pension

- Requirements:

- Photocopy of PVAO and AMWSLAI ID with three specimen signatures

- Photocopy of government-issued ID or financial institution’s ID with three signatures

- Loan promissory note and disclosure statement

- Authorization to debit

- Notarized Deed of Undertaking

- CENOMAR (for applicants 60 years old and below)

- For buyout: Certificate of Loan Balance/Verification Slip and Official Receipt/Certificate of Full Payment

11. Pension Loan

Provider: Public Safety Savings and Loan Association, Inc. (PSSLAI)

Best For: PNP and BFP pensioners in need of financial assistance for various expenses.

The Pension Loan is a tailored financial solution for retired personnel from the Philippine National Police (PNP) and the Bureau of Fire Protection (BFP). It covers a wide range of expenses, including medical, family needs, travel, and insurance, all under a single loan package. The program offers guaranteed low interest rates and fast approval processing.

Features:

- Maximum Loanable Amount:

- Up to Php 3 Million for pensioners aged 65 and below

- Up to Php 1 Million for pensioners aged 66 to 75

- Payment Terms: Flexible repayment options of up to 60 months (5 years)

- Requirements for PNP Pensioners:

- Retirees: No additional requirements

- Survivors and Transferees:

- PNP Survivor’s/Transferee’s ID

- Certificate of Legal Beneficiary

- Latest CENOMAR (with 1-year validity)

- Decree of Entitlement

- Requirements for BFP Pensioners:

- Retirees:

- BFP Pensioner ID

- One valid ID

- BFP Pensioner ID

- Survivors and Transferees:

- BFP Survivor’s/Transferee’s ID

- One valid ID

- Certificate of Legal Beneficiary

- Latest CENOMAR (with 1-year validity)

- BFP Survivor’s/Transferee’s ID

- Retirees:

- Additional Requirements for Buy-Out:

- Outstanding loan balance from other financial institutions

- Charges:

- Insurance charges (subject to board approval)

- Documentary Stamp Tax: Php 1.50 for every Php 200 for loans above Php 250,000

- Buy-out charge: Php 250 per financial institution

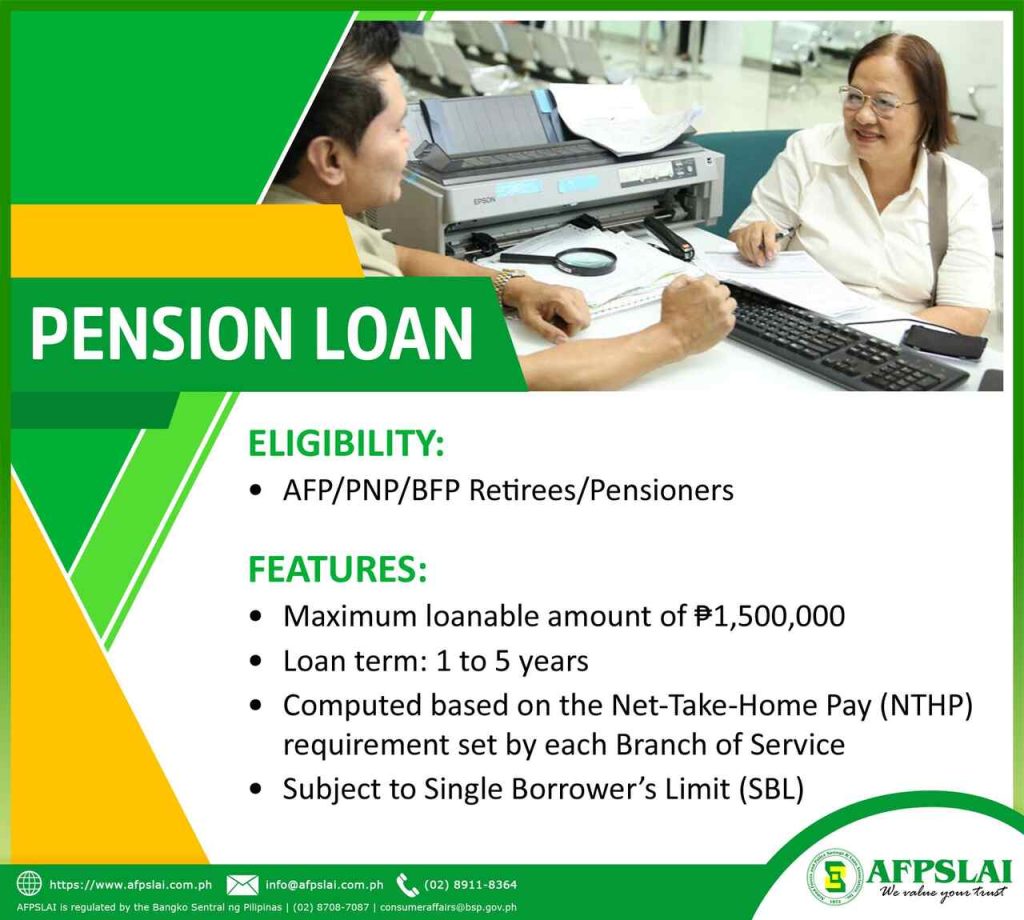

12. AFPSLAI Pension Loan

Provider: Armed Forces and Police Savings & Loan Association, Inc. (AFPSLAI)

Best For: Regular members seeking financial assistance based on their pension.

The AFPSLAI Pension Loan is designed for regular members who wish to access funds through their pension. With a maximum loanable amount of ₱1,500,000, this program provides flexible terms ranging from 1 to 5 years. Borrowers can calculate their loan eligibility based on the Net-Take-Home Pay requirement specific to their branch of service.

Features:

- Maximum loanable amount: ₱1,500,000

- Loan term: 1 to 5 years

- Computed based on Net-Take-Home Pay (NTHP)

- Subject to Single Borrower’s Limit (SBL)

- Requires completion of Loan Application Form (including Promissory Note and Authorization to Deduct)

- Application available at branch offices or online

- Credit Redemption Insurance (CRI) covers outstanding loans in case of the borrower’s death

13. Pension Loan

Provider: Diamond Finance

Best for: Retired personnel from the Armed Forces, Bureau of Fire Protection, Philippine Coast Guard, and pensioners from PVAO, GSIS, and SSS.

The Pension Loan is designed for retired members of various government agencies in the Philippines, providing financial assistance to help cover expenses. Eligible applicants can include both primary pensioners and their legal beneficiaries. This loan program aims to offer quick access to funds while ensuring a straightforward application process.

Features:

- Loan Amount: Varies depending on the pensioner’s monthly pension and agency guidelines.

- Eligibility: Retired personnel must be under 70 years old and physically healthy.

- Requirements:

- Retirement order or ID from relevant agency

- One government-issued ID

- Proof of billing or barangay clearance

- ATM card (for ATM release)

- 1×1 or 2×2 ID picture

- Additional documents for legal beneficiaries, such as marriage contracts and death certificates

- Depository Bank Options:

- Philippine Veterans Bank for PVAO

- Union Bank or Philippine National Bank for GSIS and SSS

14. AGDAO COOP Pensioners’ Loan

Provider: Agdao Multipurpose Cooperative (AMPC)

Best For: Private and government pensioners needing urgent funds

The AGDAO COOP Pensioner’s Loan is designed for pensioners facing unexpected financial needs or those with specific goals. By using future pension payments as collateral, this loan offers a reliable solution for retirees. With a low interest rate and fast processing, it makes accessing funds straightforward and efficient.

Features:

- Low interest rate

- No co-maker required

- Quick loan processing

Video: Enhanced SSS Pension Loan Available Online

The Enhanced SSS Pension Loan is a financial program designed to provide additional support for retirees who are members of the Social Security System (SSS) in the Philippines. Unlike the standard SSS Pension Loan, the enhanced version offers larger loan amounts and more flexible terms, making it easier for pensioners to meet their financial needs. This program caters to the unique circumstances of older pensioners, allowing them to secure funding for emergencies, medical expenses, or other urgent financial obligations. Accessible through the SSS online portal and various branches, the Enhanced SSS Pension Loan aims to simplify the application process and expedite access to funds for retirees. Learn more about it from this video from MySSSPH.

Summary

Understanding the various pension loans available in the Philippines can significantly assist retirees in managing their financial needs effectively. By exploring both the government and private loan options, pensioners can find suitable loans tailored to their specific situations, ensuring they maintain financial stability during retirement. For more personalized guidance and assistance in selecting the right pension loan, you may want to reach out to financial advisors or loan providers today to secure the support you need.