The concept of “Buy Now, Pay Later” (BNPL) has gained significant traction in the Philippines, offering consumers a flexible and convenient way to shop without immediate financial burden. With the increasing cost of living and the rise of e-commerce, many individuals are turning to installment shopping loans as an alternative to traditional payment methods, allowing them to purchase items while spreading the cost over time. Understanding the different types of BNPL programs available can help consumers make informed decisions about managing their finances.

As more Filipinos embrace this payment option, various lenders have emerged to provide tailored solutions for different consumer needs, from electronics to essential household goods. By exploring the various BNPL services available, users can find options that suit their shopping habits, improve financial planning, and enhance their purchasing power without compromising their budgets.

Buy Now, Pay Later (BNPL) Loan Types and their Intended Users

In the Philippines, shopping is something that many people enjoy. Not everyone has the capacity to pay in cash and in full, at all times, hence the rise of installment and/or BNPL options in the country. Here is a list of the different types of BNPL programs:

- Consumer Electronics and Gadgets: These loans primarily target consumers looking to purchase electronic devices such as smartphones, laptops, and other gadgets.

- General Shopping and Household Goods: These loans are designed for purchasing a variety of household products, appliances, and general shopping needs.

- Flexibility and Payment Plans: These options offer flexible repayment plans and terms for users who prefer variety in payment scheduling.

- Small Business and Seller Support: These loans are targeted towards sellers on platforms like Shopee, providing working capital to help grow their businesses.

- Short-Term Financing for Essentials: Loans focusing on quick access to funds for purchasing everyday essentials, typically with shorter repayment periods.

- Online Shopping and E-Commerce: These loans are tailored for users making purchases on specific online shopping platforms, emphasizing the online shopping experience.

Now that you are already aware of the different types of BNPL options, here’s an actual list of buy now pay later programs you can choose from:

1. Home Credit Cellphone Installment

Provider: Home Credit

Best for: Buying smartphones with manageable installment payments

Home Credit’s Cellphone Installment loan lets customers purchase smartphones through affordable monthly installments without needing a credit card. Designed for ease and flexibility, this program allows users to acquire their preferred device while distributing payments over time, making tech upgrades more accessible.

Features:

- Loan amount: Dependent on smartphone price and store offers

- Loan terms: Flexible terms, typically between 6 to 24 months

- Interest rate: Varies by store and loan term

- Requirements: Government-issued ID, proof of income, good credit standing

2. Home Credit Product Loan

Provider: Home Credit

Best for: Financing various products, from appliances to electronics

The Home Credit Product Loan provides a convenient solution for customers seeking to buy various products with installment options, even without a credit card. This service is suitable for household essentials, gadgets, and appliances, allowing users to spread payments into manageable monthly amounts for flexibility and convenience.

Features:

- Loan amount: Varies based on product and store

- Loan terms: Typically from 6 to 24 months

- Interest rate: Varies depending on the product and partner merchant

- Requirements: Valid ID, proof of income, active phone number

3. GGives

Provider: GCash

Best for: Shoppers who prefer flexible installment plans for purchases at partner merchants

GGives is a buy now, pay later option within the GCash app, allowing users to make purchases and repay in monthly installments. GGives is suitable for budget-conscious individuals without credit cards who want manageable payment terms. To qualify, applicants need a verified GCash account, a good GScore, and must be Filipino citizens aged 21-65.

Features:

- Loan amount: PHP 1,000 to PHP 125,000, based on eligibility and GScore

- Payment terms: 6, 9, 12, 15, 18, or 24 months, with an option for one-time payment after 14 days

- No. of loans you can avail: 1–5 loans simultaneously, depending on eligibility

- Interest rate: 0% to 5.49% per month, based on GScore and payment terms

- Processing fee: PHP 0

- Minimum spend: PHP 1,000, depending on eligibility

- Late payment fee: 1% of the loan amount for each missed due date, plus 0.15% of the outstanding balance for each day overdue

Note: GGives approval is subject to eligibility review.

4. SPayLater

Provider: Shopee

Best for: Flexible installment payments on Shopee purchases

SPayLater provides select Shopee users with the flexibility to buy now and pay later or to divide payments over a period of up to 12 months. Aimed at making online shopping more manageable, it offers installment options directly within the Shopee app. Users can enjoy a simple application process, ideal for handling larger purchases without paying the full amount upfront.

Features:

- Loan amount: Based on Shopee credit profile and eligibility

- Loan terms: Up to 12 months

- Interest rate: 1-5% monthly on outstanding amount

- Processing fee: 0-2% per transaction

- Late payment fee: 2.5-5% per month

5. SLoan for Sellers

Provider: SeaMoney (Credit) Finance Philippines, Inc.

Best for: Shopee sellers needing working capital to grow their businesses

SLoan for Sellers is a financing solution tailored for eligible Shopee sellers in the Philippines. This service provides access to working capital with low-interest rates and flexible repayment terms, allowing sellers to expand inventory, boost sales, and enhance overall business operations. With a user-friendly online application process, sellers can secure loans efficiently without needing collateral.

Features:

- Loan amount: Up to ₱3,000,000

- Loan terms: Flexible repayment options of 3, 6, or 12 months

- Interest rate: Starting at 2% per month

- Requirements: Sellers must be eligible Shopee users, with only an ID required for application.

6. BillEase

Provider: FDFC (First Digital Finance Corporation)

Best for: Shopping with flexible installment options and building credit in the Philippines

BillEase is a user-friendly digital financing solution for Filipinos, designed to simplify shopping with a buy-now, pay-later model. Through its app, BillEase lets users apply for a credit line that can be used to make purchases from over 4,000 partnered merchants. Users can enjoy instant or quick approvals with access to easy installment plans and competitive loan terms.

Features:

- Loan amount: Up to PHP 40,000 for initial credit limit; may increase with responsible use

- Loan terms: Flexible options from 3 to 12 months

- Interest rate: Typically starts at 0% for selected partners; otherwise 3.49% per month

7. LazPayLater

Provider: Lazada

Best for: Flexible payment options for online shopping in the Philippines

LazPayLater is a Buy-Now, Pay-Later (BNPL) service offered by Lazada, enabling eligible customers to make purchases and pay later. Users can choose to pay within 45 days without interest or select an installment plan of up to 12 months with applicable interest rates. This service provides a credit limit ranging from PHP 1,000 to PHP 50,000, allowing shoppers to buy a wide variety of products, excluding digital goods and fine jewelry.

Features:

- Loan amount: PHP 1,000 to PHP 50,000; some users may receive a limit of up to PHP 15,000

- Loan terms: Pay later within 45 days (0% interest) or through installments up to 12 months (interest applies)

- Fees and charges: Interest and late fees apply for missed payments; no processing or subscription fees

- Eligibility: Available to pre-qualified users who submit an application

8. TikTok PayLater

Provider: TikTok Shop

Best for: Shoppers wanting flexible payment plans on TikTok Shop purchases in the Philippines

TikTok PayLater is a Buy-Now, Pay-Later (BNPL) service from TikTok Shop, launched in January 2024. It allows users to make purchases immediately and pay over time in up to 12 monthly installments. With a credit limit up to PHP 50,000, eligible customers can buy products on TikTok Shop and select a payment plan that suits their budget, giving them flexibility in managing their spending.

Features:

- Loan amount: Up to PHP 50,000, based on factors such as occupation and monthly income

- Loan terms: Payment in full up to 12 monthly installments

- Fees and charges: Terms include interest, with no mention of processing or hidden fees

- Eligibility: Open to TikTok Shop users who apply with valid identification

9. AEON Installment Plan

Provider: AEON Credit Service (Philippines) Inc.

Best for: Financing appliances, furniture, and gadgets with low interest rates

The AEON Installment Plan provides an easy financing solution for purchasing appliances, gadgets, furniture, and more. With interest rates between 5.05% for general products and 6.25% for gadgets, customers can access various products through manageable installment terms. Applications require only two valid IDs, and loan terms range from 6 to 24 months based on the product and payment capacity.

Features:

- Loan terms: 6 to 24 months

- Interest rates: 5.05% for most items; 6.25% for gadgets

- Fees: Processing fees apply; downpayment may be required

- Eligibility: Applicants must present two valid IDs

- Payment methods: Multiple channels, including over-the-counter payments, ATMs, and online banking (some channels may charge a fee)

10. Tonik Shop Installment Loan

Provider: Tonik Digital Bank

Best for: In-store purchases with installment options for a range of household essentials and electronics

The Tonik Shop Installment Loan allows eligible customers to buy products from partner stores and pay later. With flexible payment terms, this loan supports purchases of appliances like air conditioners, TVs, refrigerators, and laptops, making it ideal for those seeking immediate access to goods with manageable repayment plans. Tonik provides loans up to PHP 100,000 without requiring collateral or credit history, aiming to make in-store shopping more accessible and budget-friendly.

Features:

- Loan amount: PHP 5,000 to PHP 100,000

- Loan terms: 3, 6, 9, or 12-month installment options, with a fixed interest rate of 4.5% per month

- Requirements: Minimum 10% downpayment, one valid ID, no credit history needed

- Fees and charges: No processing fees; early repayment is allowed without penalty

11. Plentina

Provider: Plentina Lending, Inc.

Best for: Quick access to credit for purchasing essential goods in the Philippines

Plentina is a mobile-based credit solution allowing users to access instant credit to buy essentials like food, medicine, and mobile top-ups from a wide range of partner merchants, including 7-Eleven, PureGold, and Lazada. The application process is simple and takes about five minutes, with approvals allowing users to receive an initial credit limit. Users can increase their limit through timely repayments, building their credit score along the way.

Features:

- Loan amount: PHP 500 to PHP 5,000, varies based on the user’s credit profile and repayment history

- Loan terms: Short-term, 2 to 6 months, typically used for immediate purchases with participating merchants

- Fees and charges: Interest may apply depending on the terms chosen for each transaction

- Partners: Popular merchants like 7-Eleven, Smart, Shopee, PLDT, McDonald’s, and others

12. TendoPay Installment Loan

Provider: Templetech Finance Corp.

Best for: Employees seeking installment loans with flexible repayment options for financial wellness

TendoPay is an employee-focused financial service providing installment loans to enhance financial security and wellness. Through TendoPay, employees can access a full suite of financial tools that allow them to make purchases, set budgets, and manage personal finances effectively. This program helps users meet financial goals by offering installment loans that are easy to manage through automated repayments, empowering employees with a structured way to meet financial needs.

Features:

- Loan amount: Varies based on eligibility and employer agreements up to PHP 30,000

- Loan terms: 3 to 24 months installment-based repayment schedule

- Fees and charges: Specific interest rates and any fees are subject to terms of service and loan agreement

- Eligibility: Limited to employees of participating companies; requires onboarding and company integration

- Partners: Retailers and merchant partners, with full access through TendoPay

13. UnaCash Buy Now Pay Later

Provider: UnaCash by Digido Finance Corp.

Best For: High-value purchases

UnaCash offers buy-now, pay-later services tailored for significant transactions, making it an excellent choice for expensive items. The application is designed for fast loan processing, suitable for emergencies or substantial purchases. It is ideal for users seeking extended repayment plans to manage their finances effectively.

Features:

- Loan Amount: Up to PHP 50,000

- Term: 2 to 6 months

- Account Registration Requirement: Mobile number under Republic Act 11934 (SIM Registration Act)

- Payment Channels: Only accredited channels for repayments

- Late Payment Fee: PHP 800 per late installment

- Interest Rate: Effective interest rate capped at 15% per month for unsecured loans under PHP 10,000 and up to four months in tenor.

- Pretermination Fee: Applicable for early loan settlement

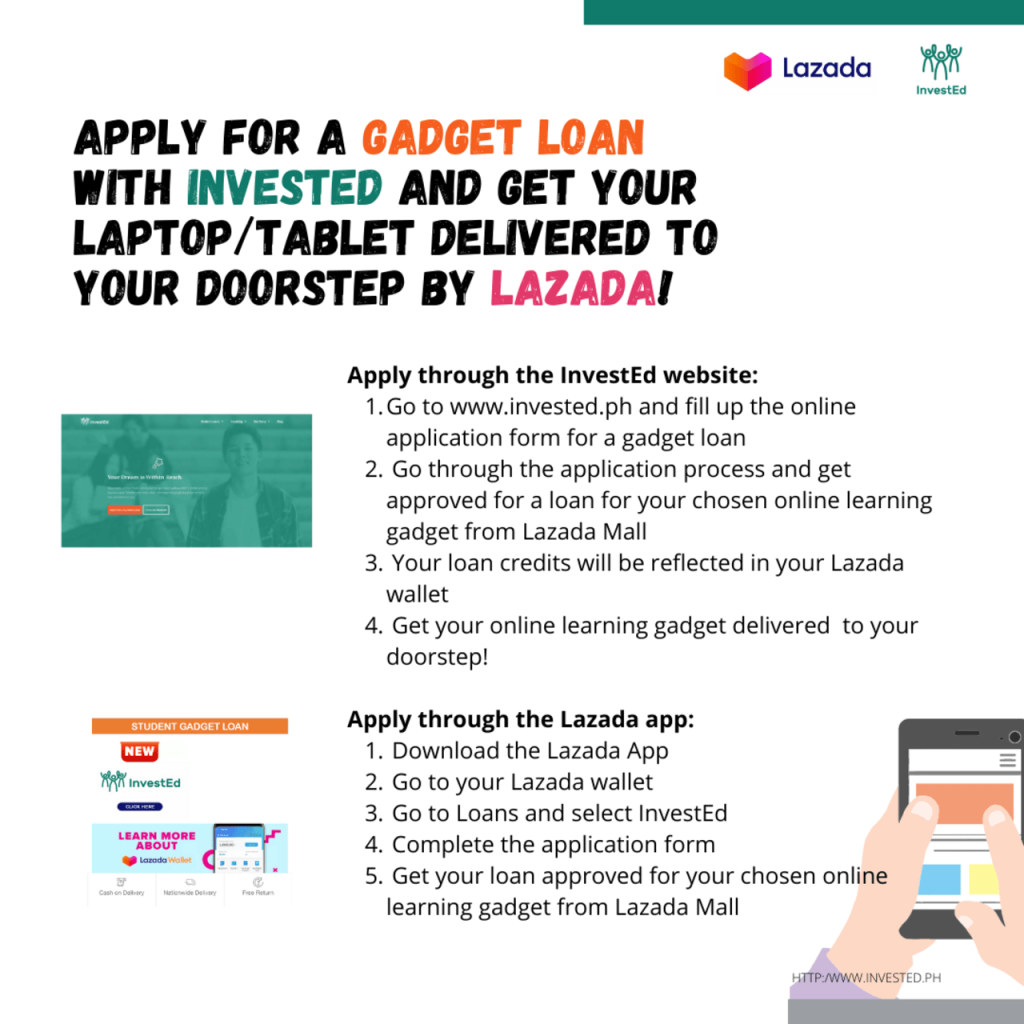

14. InvestEd Student Gadget Loan

Provider: InvestEd

Best for: Students in the Philippines seeking financial assistance for gadgets required for online learning

The InvestEd Student Gadget Loan allows students to finance essential gadgets, such as laptops and mobile phones from platforms like Lazada. This user-friendly loan process eliminates the need for a bank account, making it accessible for students enrolled in their final two years of school. Approved applicants may also benefit from InvestEd’s success coaching program to enhance their future employment prospects.

Features:

- Loan amount: Specific amounts depend on the gadget purchased up to PHP 40,000

- Eligibility: Must be at least 18 years old and enrolled in a college or university in the Philippines, specifically in the last two years of study

- Application process: Apply via the Lazada app or InvestEd website, completing all required information

- Approval time: 2 to 14 days, with priority given to students in medicine or agriculture from partner schools

- Additional benefits: Enrollment in InvestEd’s success coaching program for successful applicants

15. Atome PH BNPL

Provider: Atome PH

Best for: Individuals seeking flexible payment options for purchases

Atome PH offers a Buy Now Pay Later (BNPL) service that allows users to make purchases and pay for them later. Users can shop with a minimum spend of PHP 100, making it accessible for everyday transactions. The app requires a simple registration process to verify identity and link a payment card.

Features:

- Loan Amount: Minimum purchase of PHP 100 up to PHP 20,000

- Term: 3 months

- Age requirement: Must be at least 18 years old

- Registration requirements: Mobile number (Philippine prefix), full legal name, accepted ID, date of birth, valid email address, and credit/debit card from a financial institution

- Identity verification: Requires a clear photograph of the user’s ID

16. Cashalo Lazada Loan

Provider: Paloo Financing, Inc.

Best for: Shoppers on Lazada who want flexible payment options

Cashalo Loan allows users to shop on Lazada and pay later by receiving their loan amount directly in their Lazada wallet. Borrowers can choose to repay in either 3 or 6 monthly installments, making it easier to manage their finances. Paloo Financing, Inc., which is licensed by the Securities and Exchange Commission, processes all loans through the Cashalo platform.

Features:

- Loan amount: Varies based on the user’s credit profile up to PHP 50,000

- Repayment terms: 3 or 6 monthly installments

- Eligibility: Available to Filipinos aged 21 and older with a stable income

- Interest rates: Check applicable rates during the loan selection process but is approximately 3.5% per month (may vary based on loan term)

- Application process: Requires logging into the Cashalo app and selecting the Cashalo Loan option

17. Maya Pay in 4

Provider: Maya Bank, Inc.

Best for: Individuals looking for interest-free installment payments on purchases

Maya Pay in 4 is a loan product that allows users to pay for goods and services in four equal installments, with payments due every two weeks. This service offers the advantage of 0% interest when using the Maya Wallet. Currently in beta testing, this feature aims to enhance the shopping experience by providing flexible payment options.

Features:

- Loan amount: Minimum of PHP 1,000 up to PHP 10,000

- Eligibility: Filipinos aged 21 to 65 with an upgraded Maya account

- Usage: Available only at partner merchants that offer Maya Pay in 4

- Approval time: Users receive their approval status within 5 minutes

- Payment method: Automatic deductions from the Maya Wallet on due dates, with SMS notifications sent before payment is due

Note: Maya Pay in 4 is currently unavailable since January 17, 2024. According to their website, the provider is working to improve the overall product experience for both Maya users and merchants looking for easy installment options.

Summary

In the Philippines, Buy Now, Pay Later (BNPL) options have become increasingly popular among shoppers who prefer flexible payment plans for their purchases. With various programs available, individuals can choose from tailored financing solutions that fit their needs, whether for consumer electronics, household items, or even business support. This approach not only enhances accessibility to goods and services but also promotes financial literacy by encouraging users to manage their budgets effectively through installment payments. Understanding the diverse BNPL offerings allows consumers to make informed decisions and better navigate their shopping experiences without the burden of upfront costs.

Furthermore, the rise of BNPL solutions has opened opportunities for both consumers and merchants, creating a more inclusive financial ecosystem in the country. Programs like Home Credit, GCash, and Lazada’s BNPL options cater to different user needs, allowing customers to enjoy their purchases while spreading out the costs over time. However, it is essential for users to be mindful of the terms, fees, and potential risks associated with these loans to ensure they remain financially responsible. As more people embrace these payment options, they can leverage BNPL to enhance their shopping experience while also promoting better financial habits. If you are ready to experience the convenience of the Buy Now, Pay Later service, then go and explore your options today!