The GSIS Emergency Loan program is a financial assistance initiative designed to help active members and pensioners during times of natural calamities or disasters. This program offers an accessible and manageable solution for those in need of immediate financial aid. Understanding how to apply and the qualifications required will help eligible individuals take advantage of this GSIS benefit.

In this guide, we will provide a detailed explanation of the application process for the GSIS Emergency Loan. We will also outline the eligibility requirements, loan terms, and various methods for submitting your application. Whether you are an active member or a pensioner, this guide will simplify your application process.

Program Overview

The GSIS Emergency Loan program provides financial assistance to active members and pensioners affected by natural calamities and disasters. Established to offer immediate support during crises, it is rooted in the Government Service Insurance Act of 1997 (RA 8291), which mandates the GSIS (Government Service Insurance System) to provide benefits for its members. The program aims to address urgent financial needs caused by disasters through accessible loans with affordable terms. It is available to GSIS members and pensioners residing or working in calamity-declared areas, with a loanable amount of ₱20,000 payable in 36 monthly installments. Covering both government employees and retirees, the program underscores GSIS’s commitment to ensuring member welfare during emergencies.

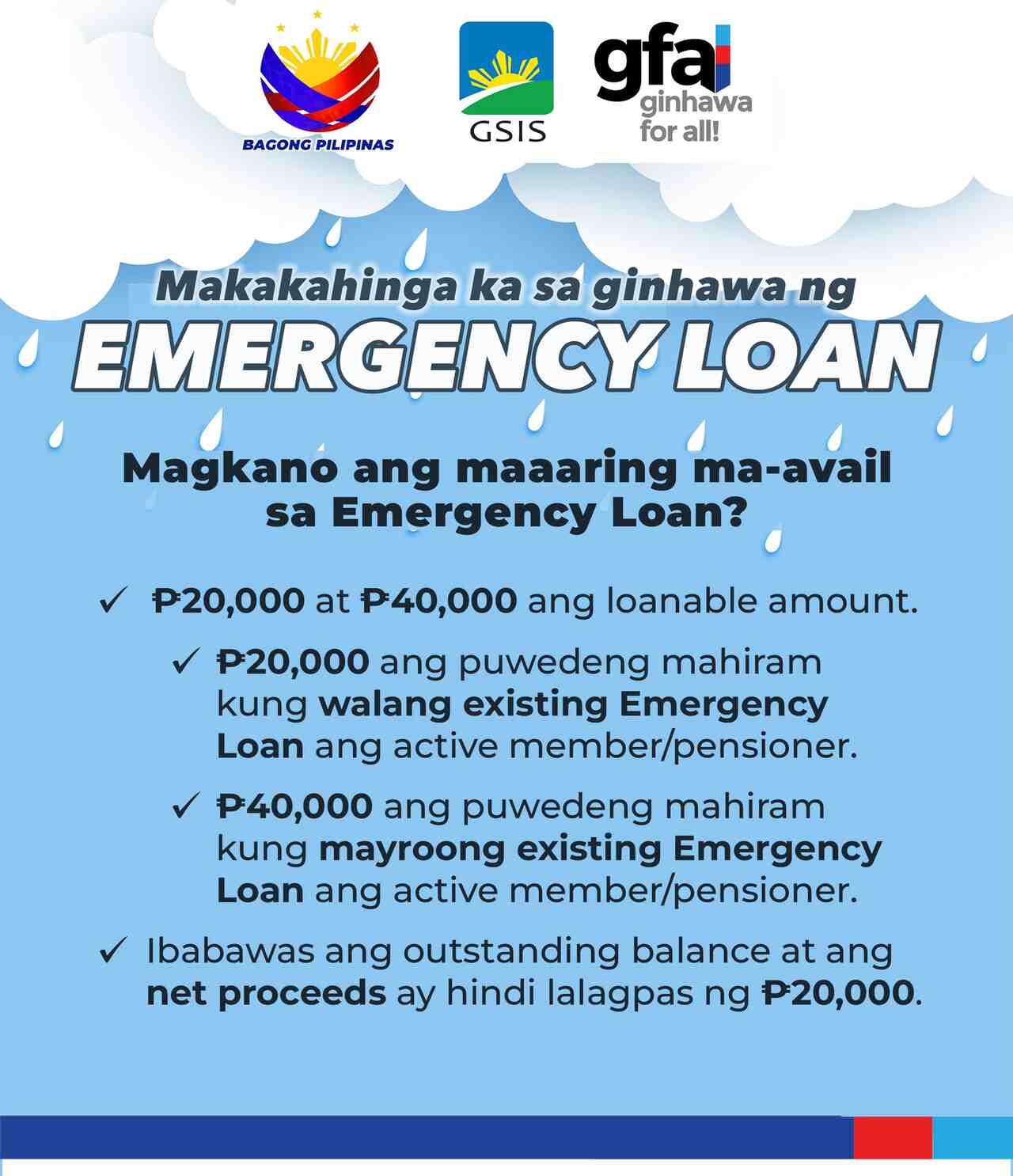

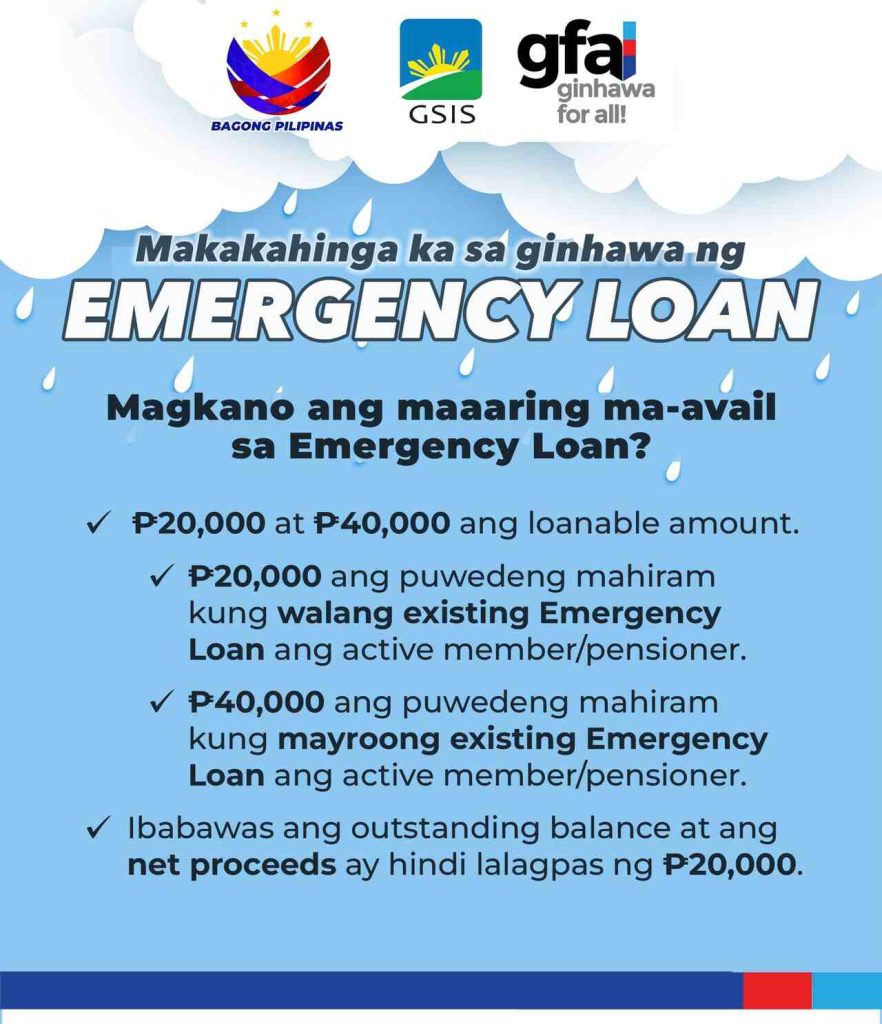

Loan Terms and Conditions

It also comes with the following terms:

- Loanable Amount: Active members and pensioners can borrow either ₱20,000 or ₱40,000, depending on the applicant’s loan status, with the interest rate of 6% per annum.

- Active members or pensioners without an existing Emergency Loan may borrow ₱20,000.

- Those with an existing Emergency Loan may borrow up to ₱40,000, but the outstanding balance will be deducted, ensuring the net proceeds do not exceed ₱20,000.

- Application Options: Applicants can apply through GWAPS kiosks, eGSISMO, email, or over the counter at any GSIS office.

- Payment Period: The loan must be paid over three years (36 equal monthly installments).

- Interest Rate: A fixed interest rate of 6% per annum is charged, computed in advance.

- Redemption Insurance: A fee amounting to 1.2% of the gross loan amount is deducted from the proceeds to cover redemption insurance.

Benefits

It offers a quick and reliable solution, along with other benefits for individuals facing financial challenges due to disasters or calamities. Here are some of them:

- Flexible Application Methods: Members and pensioners can apply online, in person, or via email, making the process accessible.

- Manageable Loan Terms: Borrowers benefit from affordable payment terms with a three-year installment plan and a low fixed interest rate.

- Calamity-Specific Aid: This loan is specifically designed to support individuals affected by calamities, addressing their immediate financial needs.

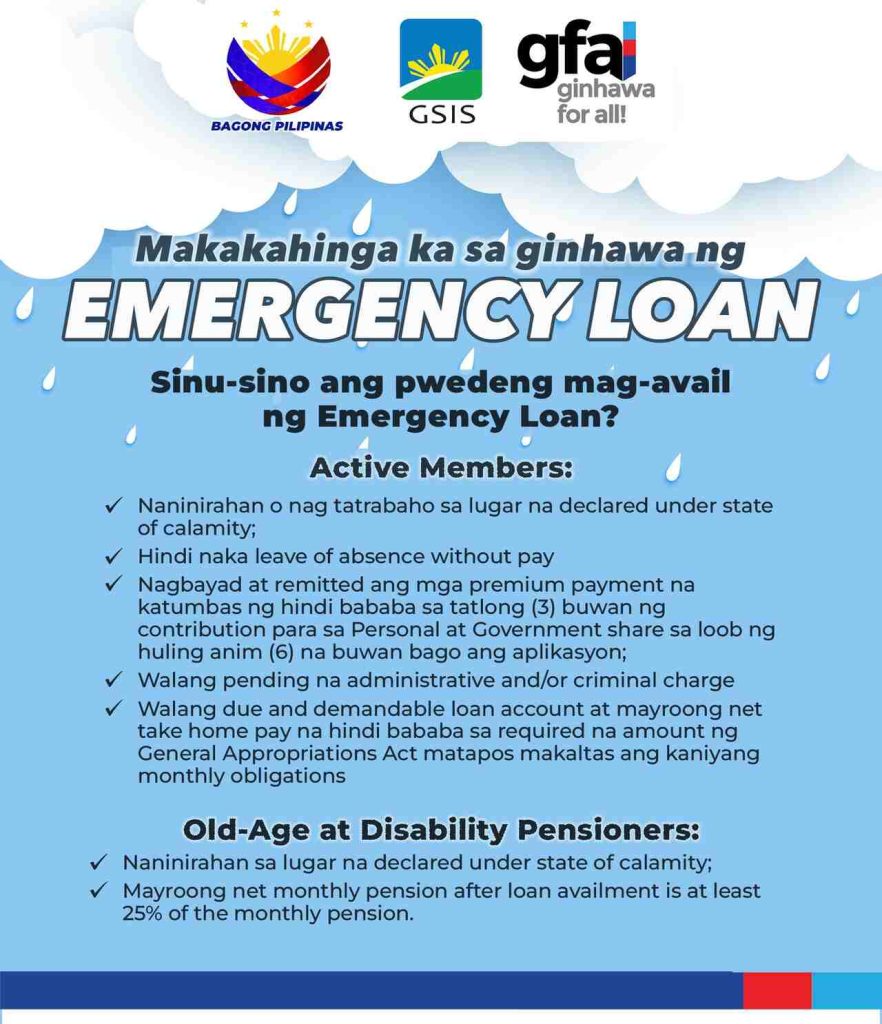

Target Beneficiaries and Qualifications

The program is designed specifically for the following:

1. Active GSIS Members

Active GSIS members are eligible to apply if they meet the following qualifications:

- Residence or Work in a Calamity Area: Applicants must either live or work in a declared calamity area.

- Premium Payments: They must have remitted at least three monthly premium contributions (personal and government share) within the six months before the application.

- Employment Status: Applicants must not be on leave of absence without pay.

- Clean Loan Record: No due and demandable loans, pending administrative cases, or criminal charges.

- Net Take-Home Pay: The net take-home pay after all deductions must meet the threshold required under the General Appropriations Act.

2. GSIS Pensioners

Old-age and disability pensioners can also apply for this loan if they satisfy the following criteria:

- Residence in Calamity Area: They must reside in a calamity-declared location.

- Net Pension Requirements: After loan availment, the net monthly pension must be at least 25% of their monthly pension.

Requirements

To get started, applicants need to prepare and submit the following documents based on their preferred application method:

- Duly Accomplished Application Form: This form is required for both active members and pensioners.

- GSIS UMID Card: If unavailable, provide two valid government-issued IDs (e.g., passport, driver’s license, or voter’s ID).

Note: Make sure all documents are clear, complete, and saved in JPEG or PDF format for smooth processing.

Application Procedures

There are multiple ways to apply for the GSIS Emergency Loan: via eGSISMO, email, or the GWAPS kiosk. Listed below is a detailed guide for each method:

1. Via eGSISMO (Online Portal)

The eGSISMO is an online platform designed for GSIS members to manage loans and other services remotely.

Step 1. Log In

Access your eGSISMO account using your BP number and password.

Step 2. Select Loan Type

Click the “Loans Application” icon, then choose “Emergency Loan” and specify whether it’s a new or renewal application.

Step 3. Upload Documents

Provide a picture of yourself holding your UMID or temporary card. If lost, upload two valid government IDs (JPEG or PDF format).

Step 4. Confirm Application

Review the loan agreement and click “SAVE.”

Step 5. Await Confirmation

Wait for an email from GSIS for further instructions.

2. Via Email

For those without access to eGSISMO or a GWAPS kiosk, you can submit your application through email by following these steps below.

Step 1. Prepare Documents

Fill out the Emergency Loan Application Form and scan your GSIS UMID card (or two valid government IDs).

Step 2. Send Application

Email these documents to your GSIS branch. You can find the branch-specific email addresses online.

Step 3. Wait for Updates

GSIS will contact you via email with the next steps.

3. Via GWAPS Kiosk

The GWAPS kiosk is yet another convenient way to apply for a loan. These kiosks are located nationwide in GSIS offices, provincial capitols, and select government offices.

Step 1. Insert Card

Place your eCard Plus or UMID in the kiosk card reader.

Step 2. Verify Identity

Use the biometrics scanner to authenticate your identity.

Step 3. Choose Loan Type

Select “Emergency Loan” from the “Loan Windows” menu.

Step 4. Confirm Application

Confirm your application by placing your finger on the scanner.

Step 5. Access Proceeds

Once approved, withdraw your loan proceeds from any Megalink, Bancnet, or Expressnet ATM.

Where to Secure the Application Form

The application form for the GSIS Emergency Loan, both for active members and pensioners, is available for download at the GSIS website. It can also be completed via the GWAPS kiosks located nationwide in GSIS offices, provincial capitols, and select government offices.

Video: Everything You Need to Know About the GSIS Calamity Loan

For more information on the GSIS Calamity/Emergency Loan program and how to apply for one, watch this video from UNTV News and Rescue:

Summary

The GSIS Emergency Loan provides a financial lifeline to active members and pensioners during times of crisis. With a loan amount of ₱20,000, low interest rates, and manageable payment terms, it offers an efficient way to recover from calamities. Applicants can choose from multiple application methods as well, ensuring accessibility for all. Check out this GSIS program for the complete application process and secure the financial assistance you need today.