The SSS Pension Loan Program (PLP) is a financial assistance initiative pioneered by the Social Security System (SSS) designed for retiree-pensioners, allowing them to address financial needs through a low-interest cash loan. This program offers a secure way for retirees to obtain additional funds without using their ATM cards as collateral.

Understanding the eligibility requirements and application process can help retirees make informed decisions about their financial options. To make it easier, included in this guide is complete information about the eligibility conditions, loan details, application steps, and other relevant aspects of how to apply for this program and maximize its benefits as a retiree.

Program Overview

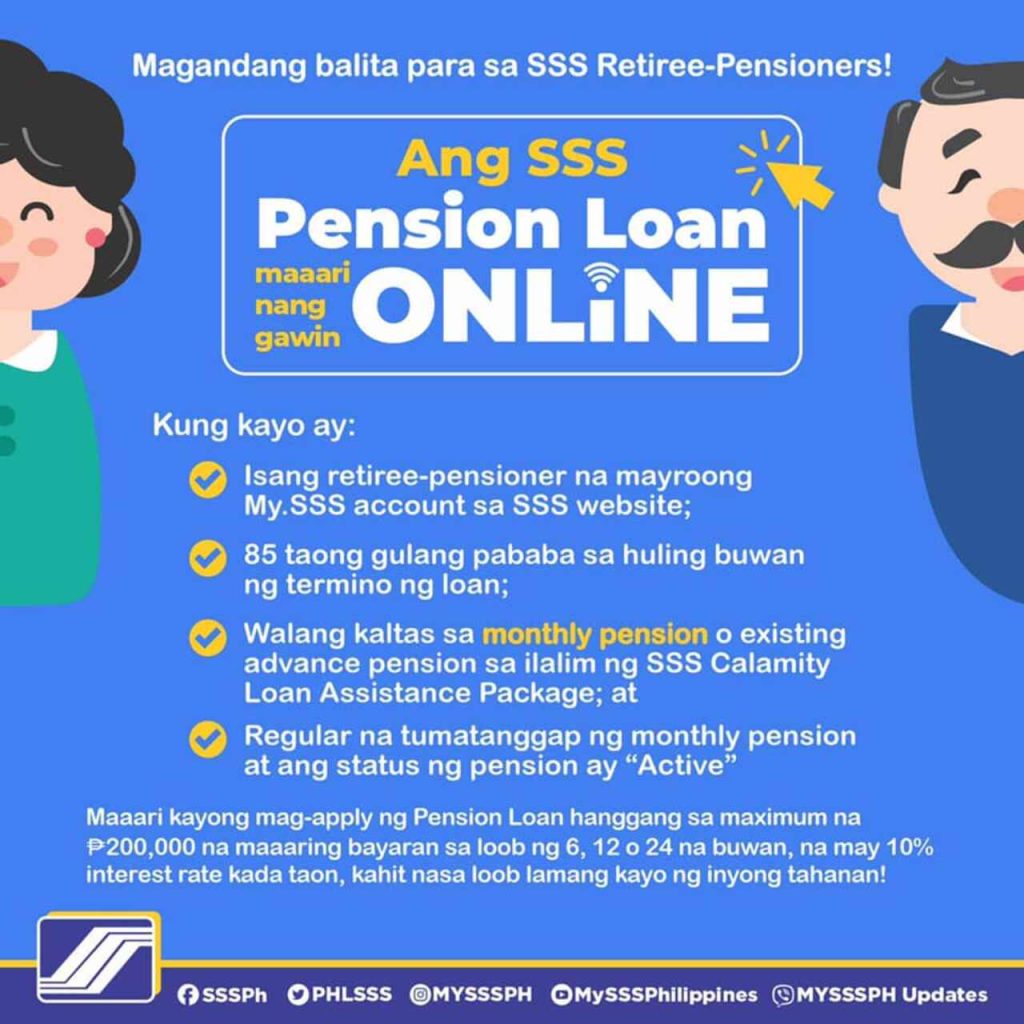

The SSS Pension Loan Program (PLP) was introduced to provide financial assistance to retiree-pensioners by offering a safe, affordable, and accessible loan facility. Launched in 2018, the program aimed to prevent pensioners from resorting to high-interest informal loans by providing a low-interest alternative. It covers all qualified SSS retiree-pensioners receiving a monthly pension, with loanable amounts based on their Basic Monthly Pension plus an additional ₱1,000 benefit. The program ensures convenience through automated repayment via pension deductions and includes Credit Life Insurance to settle loans in case of the borrower’s death. With maximum loanable amounts of up to ₱200,000, the PLP continues to address the financial needs of retirees across the Philippines.

Benefits

Some benefits offered by the SSS PLP include:

- Financial Assistance: Provides retirees with accessible funds for personal or emergency use.

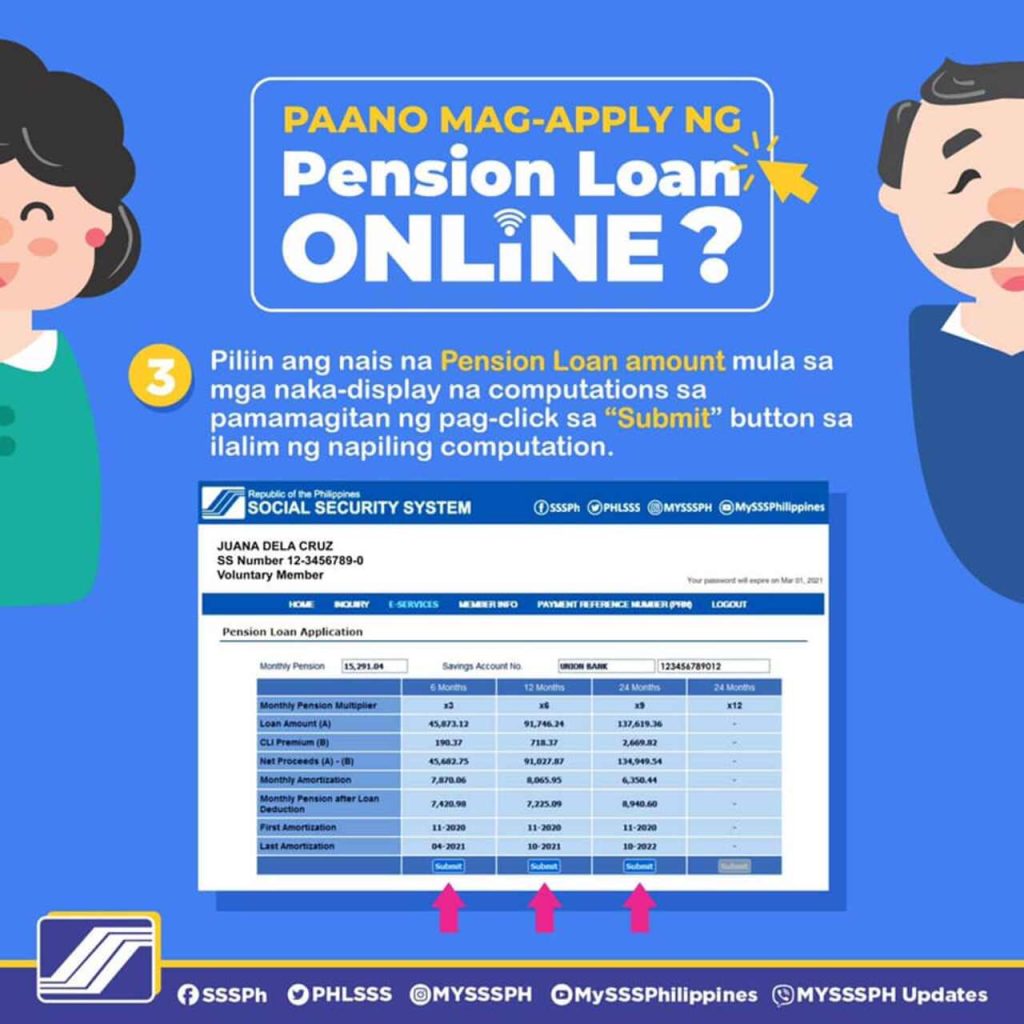

- The loanable amount depends on the retiree’s Basic Monthly Pension (BMP) plus a ₱1,000 additional benefit. The maximum loan amount is capped at ₱200,000.

- Loanable Amount: 3 x (BMP + ₱1,000 additional benefit)

- Repayment Term: 6 months

- Loanable Amount: 6 x (BMP + ₱1,000 additional benefit)

- Repayment Term: 12 months

- Loanable Amount: 9 x (BMP + ₱1,000 additional benefit)

- Repayment Term: 24 months

- Loanable Amount: 12 x (BMP + ₱1,000 additional benefit)

- Repayment Term: Based on loan term and age limit

- The loanable amount depends on the retiree’s Basic Monthly Pension (BMP) plus a ₱1,000 additional benefit. The maximum loan amount is capped at ₱200,000.

- Low Interest Rates: The 10% annual rate on diminishing balance until fully paid is more affordable compared to private loan providers.

- Credit Life Insurance: Covers the outstanding loan balance in case of the borrower’s death.

- Convenient Application: Options for online or in-person applications ensure accessibility

Target Beneficiaries

The PLP is specifically designed to cater to the financial needs of qualified retirees receiving monthly pensions from the SSS. Below is a complete list of the target beneficiaries for this program:

- Retiree-pensioners aged 85 years or below at the end of the loan term.

- Pensioners with active monthly pension status for at least one month.

- Retirees without existing deductions, such as outstanding loan balances or benefit overpayments.

- Pensioners with an enrolled disbursement account in the Disbursement Account Enrollment Module (DAEM).

- Retirees who have not received advanced pensions under calamity assistance programs.

Eligibility

To qualify for the PLP, retiree-pensioners must meet the following conditions first:

- Age Requirement:

- Must be 85 years old or below at the end of the loan term.

- The sum of the applicant’s age and the loan term should not exceed 85 years.

- Active Pension Status:

- Must be receiving a regular monthly pension for at least one month.

- The pension status must be marked as “active.”

- No Pension Deductions:

- Applicants must not have deductions from their monthly pension, such as for outstanding loans or benefit overpayments.

- No Advance Pension Under Calamity Assistance:

- Pensioners with an existing advance pension from the SSS Calamity Assistance Package are not eligible.

- Disbursement Account:

- Must have an approved disbursement account enrolled in the Disbursement Account Enrollment Module (DAEM).

- Updated Contact Information:

- Applicants must provide a valid mobile number, email address, and mailing address.

Exclusions

- Pensioners under the Portability Law or those under a guardian’s care cannot apply for the SSS pension loan.

Documentary Requirements

To apply, you will need the following:

- Pension Loan Application and Disclosure Statement (PLADS) Form

- One copy and a photocopy of a valid ID

- One government or company-issued valid primary photo ID (e.g., UMID Card, driver’s license, or passport) or

- Two (2) secondary ID cards/documents, both with signature and at least one (1) with photo.

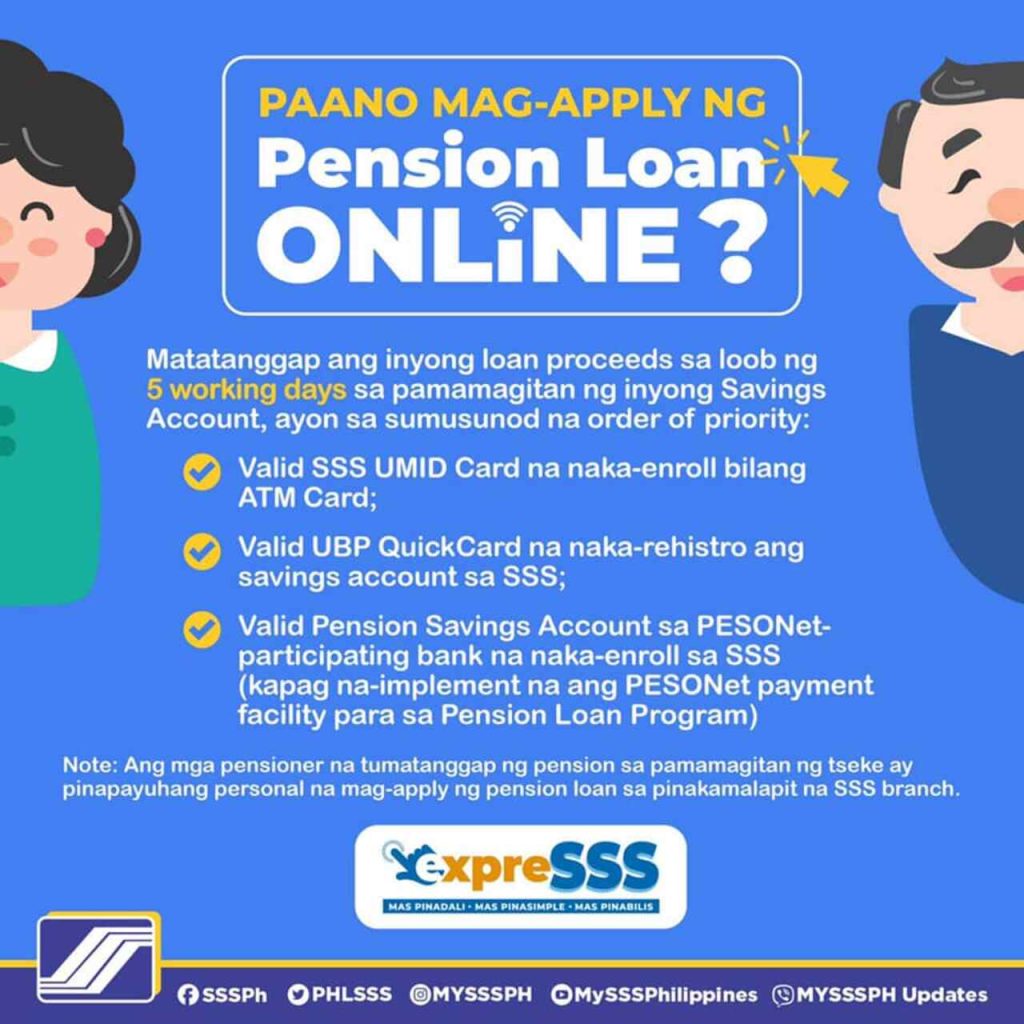

- Valid UMID-ATM enabled ID Card; or

- Valid UBP QuickCard with Savings Account Number registered with SSS; or

- Valid Pension Savings Account Number registered with SSS (upon of PESONEt payment facility) implementation

Application Procedures

You can apply for the SSS pension loan either online through the My.SSS portal or over-the-counter (OTC) at an SSS branch.

Online Application via My.SSS Portal

Step 1. Log In

Access your My.SSS Member Account using your credentials.

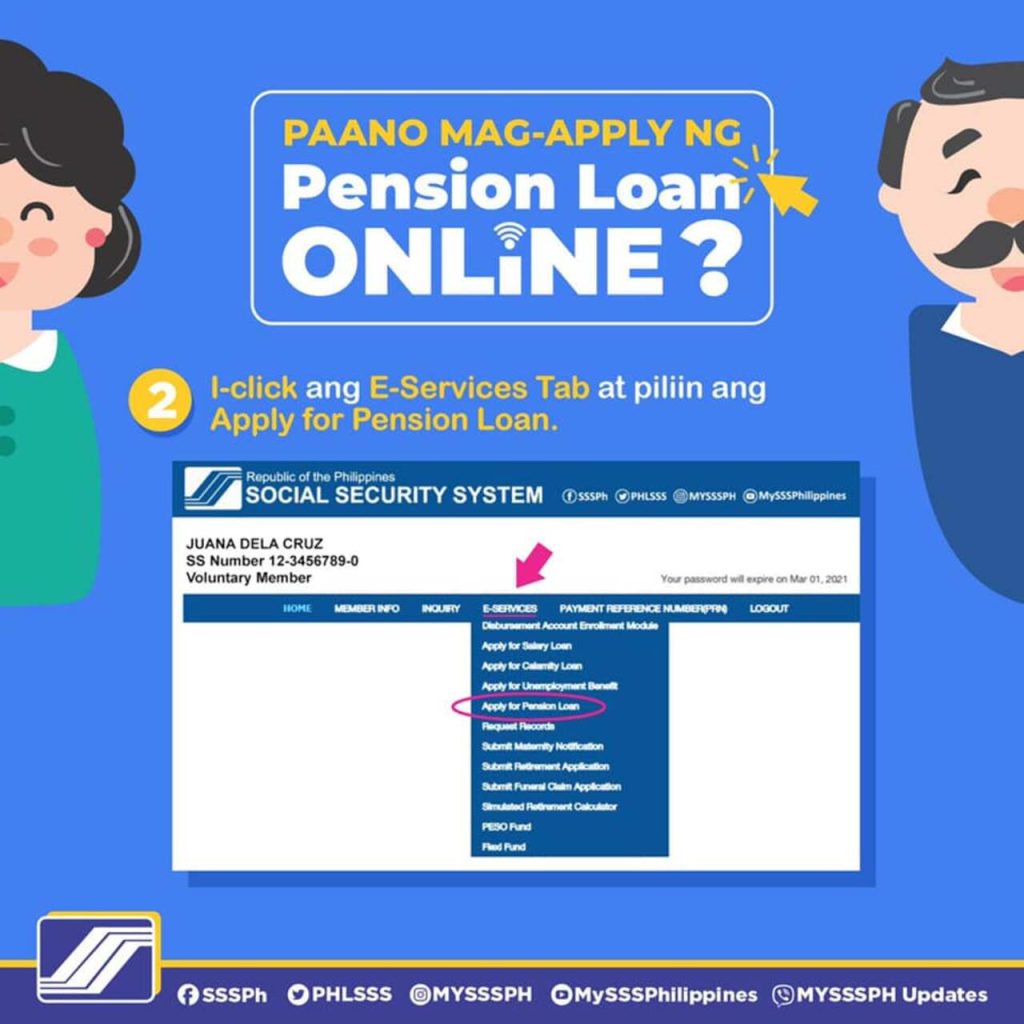

Step 2. Navigate to Loan Section:

Go to the Loans tab and select “Apply for Pension Loan.”

Step 3. Select Loan Amount:

Choose your preferred loan amount and repayment term from the available options.

Step 4. Verify Disbursement Account:

Ensure that your disbursement account is enrolled in the DAEM. If not, you won’t be able to proceed with the application.

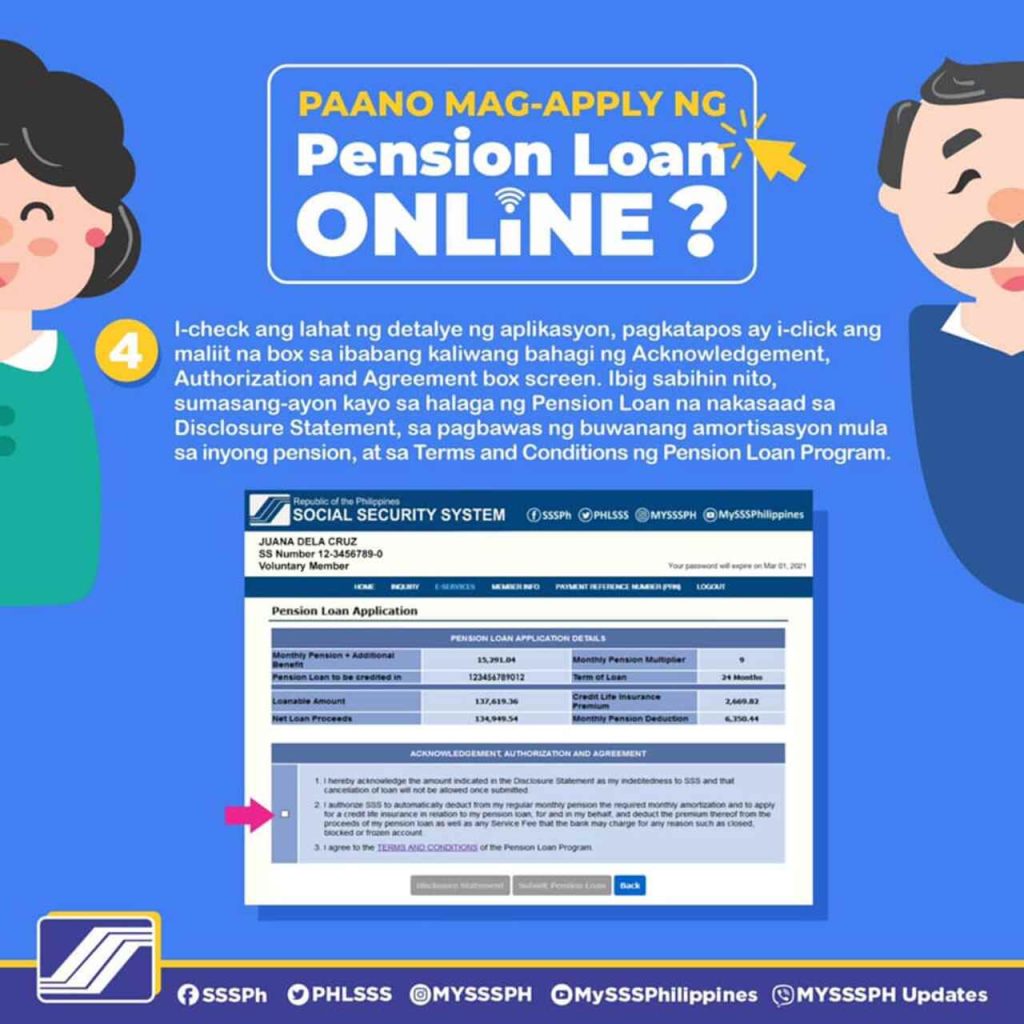

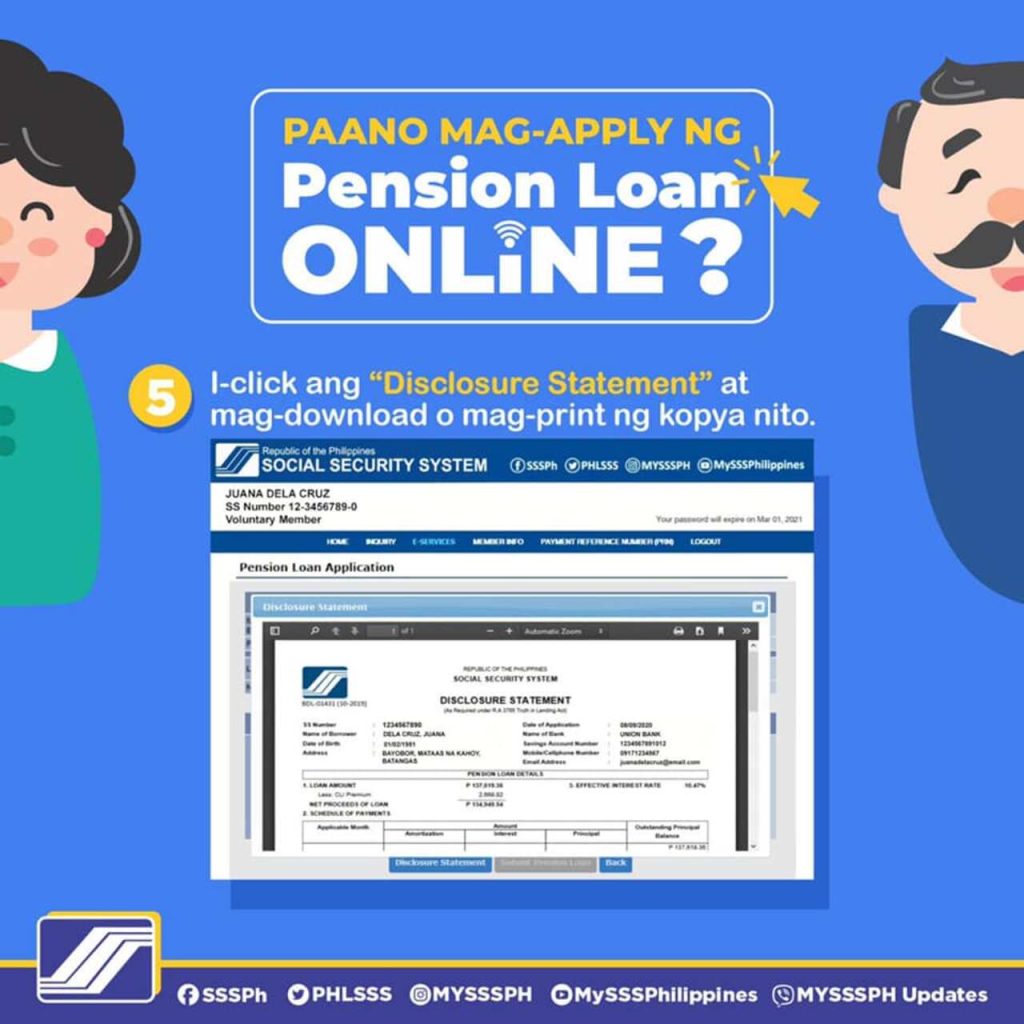

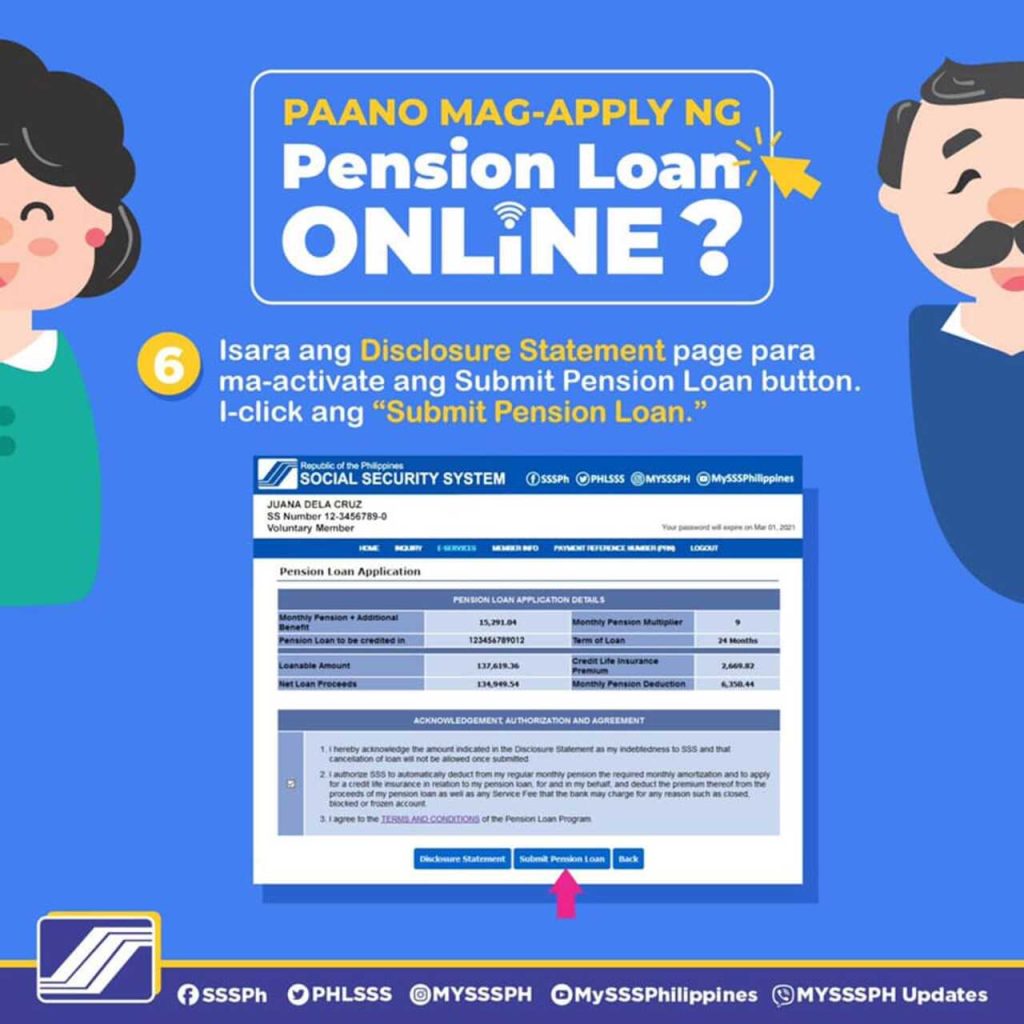

Step 5. Acknowledge Terms:

Review the loan details, acknowledge the terms, and click “Submit Pension Loan.”

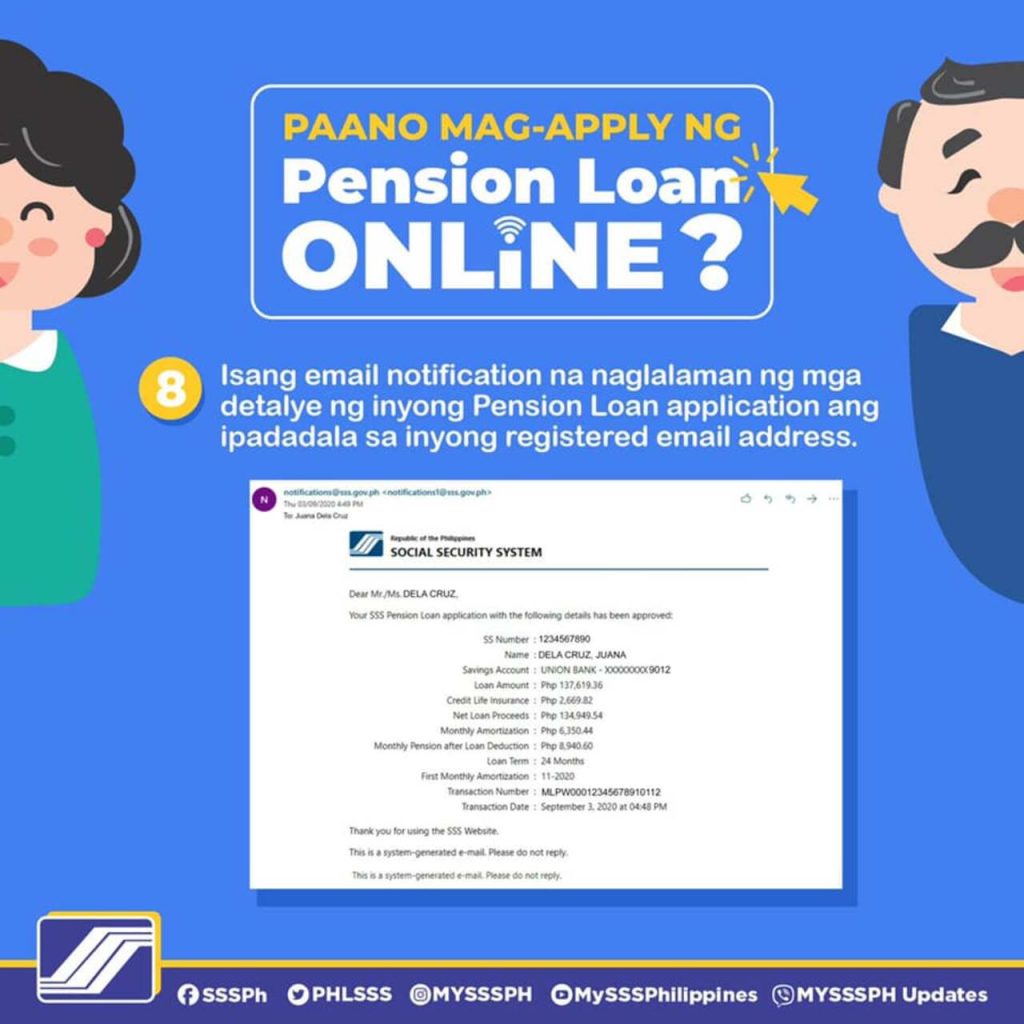

Step 6. Receive Confirmation:

A notification of your application’s success will appear on the screen and will also be sent to your registered email address.

Over-the-Counter Application

Step 1. Visit an SSS Branch:

Go to the nearest SSS branch and request a queue number.

Step 2. Submit Documents:

Provide the required documents to prove your eligibility:

Step 3. Verification and Processing:

An SSS officer will verify your eligibility and process your loan application.

Step 4. Receive Loan Proceeds:

After approval, the loan proceeds will be credited to your account within five working days.

Fees and Deductions

Some fees and deductions related to the Plp disbursement include:

- Minimal Fees: A ₱25 fee is charged for the Quick Card or Cash Card, which is deducted from the loan proceeds.

- No Service Fee: The usual 1% service fee is waived, and this amount is used to cover the Credit Life Insurance (CLI) premium.

- Monthly Amortization: Loan repayments are automatically deducted from the pension. The first deduction occurs two months after the loan is granted.

Loan Renewal

Pensioners can also renew their pension loans, but only after fully repaying the current loan balance. The process for renewal follows the same steps as the initial application.

Frequently Asked Questions (FAQs)

For your reference, here are some common questions and answers related to SSS PLP:

1. How soon will I receive the loan proceeds?

- Online applications are processed within 3 working days.

- Over-the-counter applications take 5 working days.

2. Can I apply if I’m under the care of a guardian?

No. Pensioners under a guardian’s care are not eligible for the SSS pension loan.

3. What happens if I pass away before the loan is fully paid?

The loan balance is covered by the Credit Life Insurance (CLI), so no repayment will be required from your family or beneficiaries.

4. Can I apply for another loan while still repaying my current one?

No. You must fully settle your existing loan before applying for a new one.

Video: How to Apply for the SSS Pension Loan

For a visual walkthrough on how to apply for the SSS PLP, you may check out this video from Angelie Giltendez, CHRA:

Summary

The SSS Pension Loan Program offers retirees a practical solution to financial challenges through accessible and affordable loans. By meeting the eligibility requirements and following the application process, pensioners can take advantage of this program to address immediate or unforeseen financial needs. Whether you apply online or in-person, the program’s straightforward terms and benefits make it an appealing option for retirees seeking additional financial support.