The SSS Salary Loan is a financial assistance program offered by the Social Security System (SSS) in the Philippines. This loan helps qualified members address their short-term credit needs. Whether you’re dealing with unexpected expenses or looking for funds to support a personal project, this loan program provides a convenient and accessible solution.

In this guide, we’ll explain everything you need to know about applying for an SSS Salary Loan. From eligibility requirements to repayment terms, you’ll learn how to take full advantage of this program while staying compliant with its policies.

Program Overview

The SSS Salary Loan is a financial program designed to provide short-term cash assistance to qualified members of the SSS. Introduced to support members during times of financial need, the loan is based on the borrower’s contributions and repayment capacity. It is designed to provide short-term financial assistance, allowing borrowers to address urgent monetary needs of employed, self-employed, voluntary members, and OFWs who meet eligibility requirements, including a minimum number of posted contributions. The loan covers amounts equivalent to one or two months of the member’s salary credit, depending on their contribution history and eligibility. Payments are made in installments, and the loan is subject to interest, penalties for delays, and a service fee.

Benefits

This loan program provides members with a reliable way to access funds during financial emergencies. It offers several advantages, making it an accessible and reliable option for qualified individuals.

- Low Interest Rate: Offers an affordable interest rate compared to private lending institutions. The interest rate is set as follows:

- 10% per annum based on the diminishing principal balance

- Interest is amortized over a 24-month repayment period

- Quick Processing: Applications are processed online or through the mobile app for faster access to funds.

- Flexible Loan Amount: Borrow up to twice your monthly salary credit, depending on contributions. The amount you can borrow depends on the type of loan you qualify for:

- One-Month Loan: Equivalent to the average of the borrower’s 12 latest posted MSCs, rounded to the next higher MSC, or the applied amount, whichever is lower.

- Two-Month Loan: Twice the average of the borrower’s 12 latest posted MSCs, rounded to the next higher MSC, or the applied amount, whichever is lower.

- Convenient Repayment Terms: Loan repayments are automatically deducted from monthly contributions.

- The loan must be repaid within 24 months.

- Payments begin on the second month after loan approval.

- Payment deadlines fall on the last day of the month following the applicable month.

- Accessible Online: Applications can be submitted through the My.SSS portal or SSS Mobile App.

- No Need for a Guarantor: Members can apply without requiring a co-signer or collateral.

- Emergency Support: Ideal for covering urgent expenses such as medical bills or tuition fees.

- Eligibility for Renewals: Members can reapply for another loan after paying a portion of the current one.

Target Beneficiaries

The SSS Salary Loan program is especially designed to provide financial assistance to members who need short-term cash for personal or emergency use. Eligible members are categorized based on their employment status and contribution records.

- Employed Members – Active SSS members with employers contributing regularly to their accounts.

- Self-Employed Members – Individuals running their own businesses or earning income from their own work.

- Voluntary Members – Former employees, self-employed individuals, or OFWs who choose to continue their SSS contributions.

- Overseas Filipino Workers (OFWs) – Filipinos working abroad with updated SSS contributions.

- Household Workers – Domestic helpers whose employers remit their SSS payments regularly.

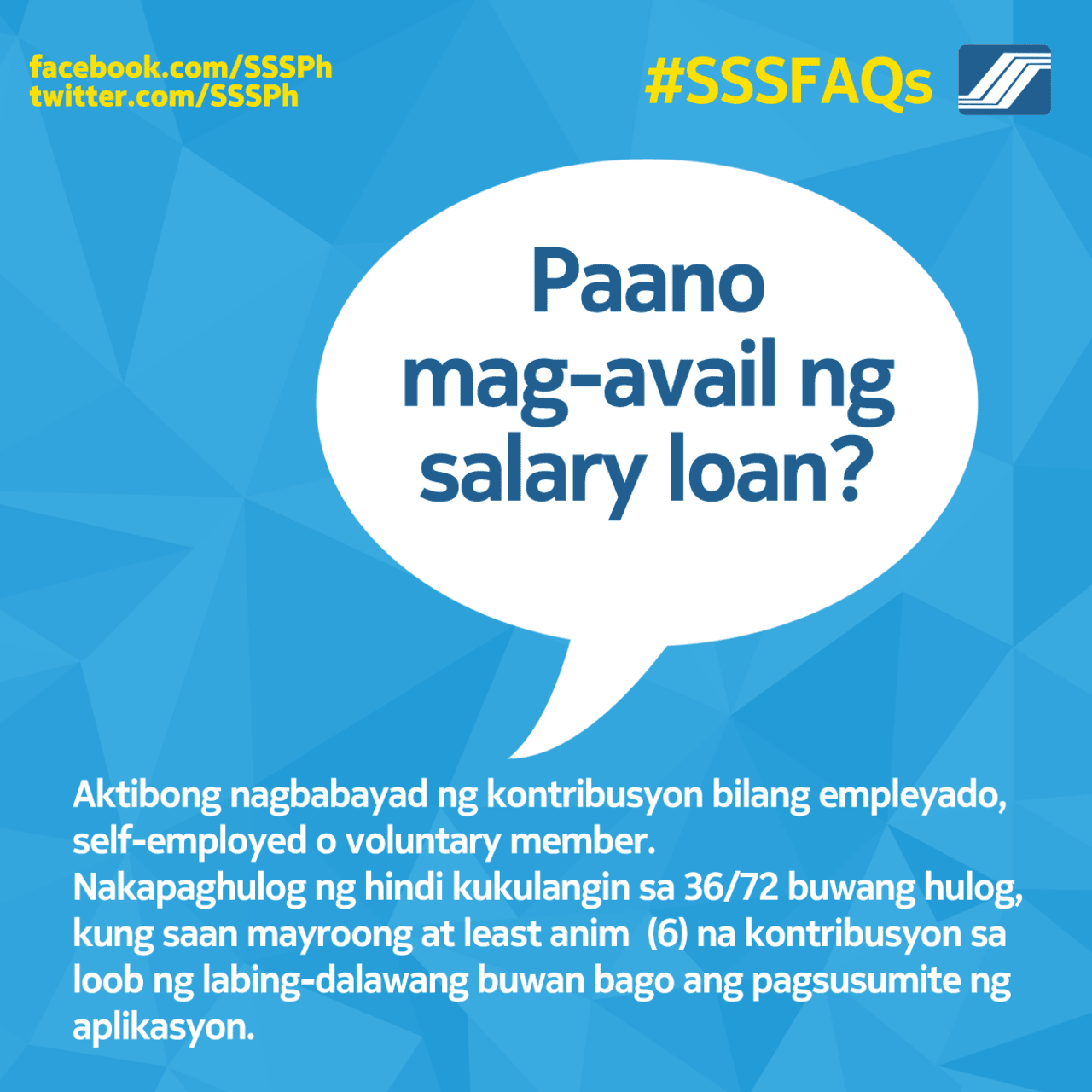

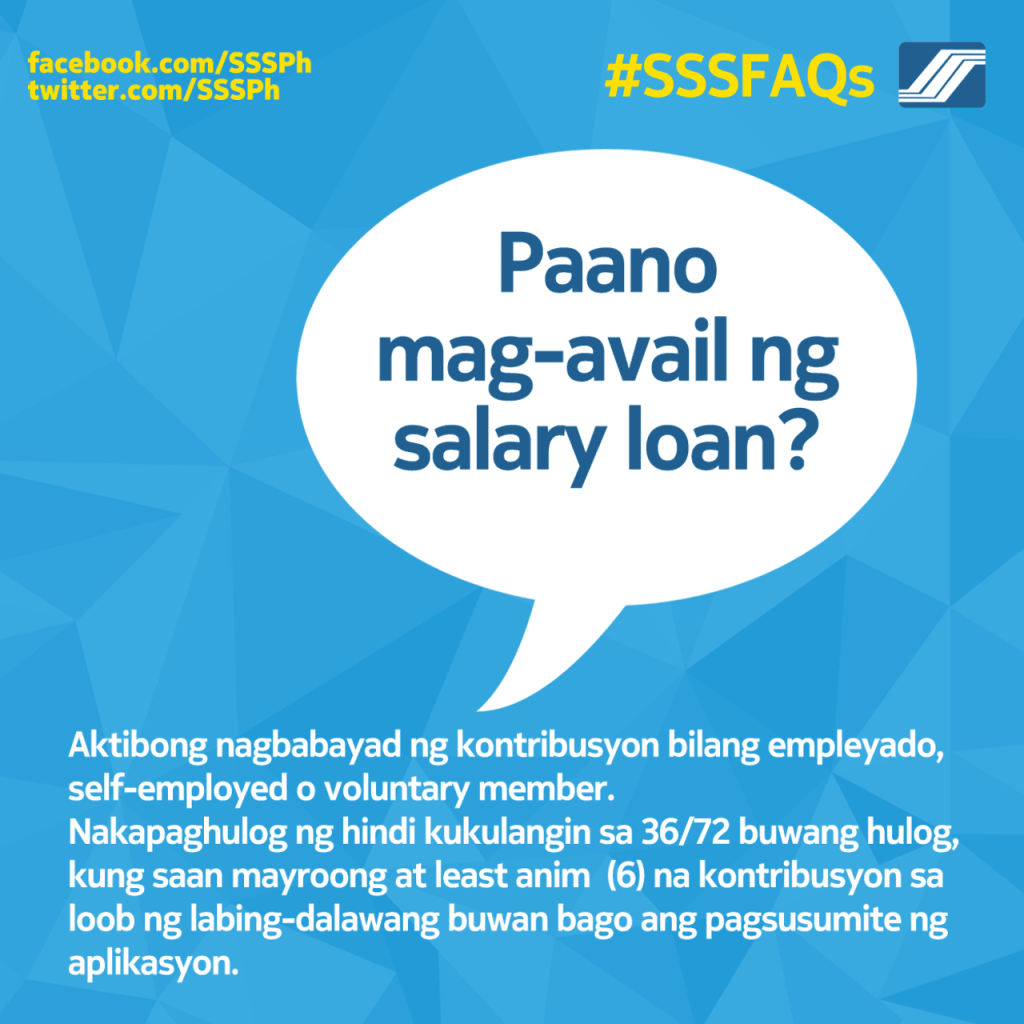

Eligibility

To qualify for an SSS Salary Loan, members must meet specific conditions based on their contributions, membership type, and age.

- The borrower must be under 65 years old at the time of loan application.

- The borrower should not have received final benefits such as retirement, total disability, or death benefits.

- The employer of employed members must be up-to-date with all SSS contributions and loan remittances.

- Self-employed and voluntary members must have at least 6 posted monthly contributions under their current membership type prior to applying.

- Members must not have been disqualified due to fraud committed against SSS.

- Contribution Requirements

- For a One-Month Loan: The member must have at least 36 posted monthly contributions, with 6 of those contributions made within the last 12 months before filing the loan application.

- For a Two-Month Loan: The member must have at least 72 posted monthly contributions, with 6 of those contributions made within the last 12 months before filing the loan application.

Documentary Requirements

When applying for an SSS salary loan, specific documents are required to ensure eligibility and proper processing. Below is a comprehensive list of the necessary requirements based on the member type and application method:

- My.SSS Account: Registered My.SSS user ID and password.

- Valid Identification: Government-issued ID (e.g., UMID, Passport, Driver’s License).

- Contribution Record: Proof of sufficient contributions (minimum of 36 posted contributions for a one-month loan).

- Employer Certification: For employed members, employer confirmation of updated contributions and loan remittances.

- Bank Account Details: Enrolled disbursement account (UMID-ATM or other participating bank accounts).

- UMID-ATM Card: If you have an activated UMID card, loan proceeds are credited automatically.

- PESONet Bank Account: Ensure your active bank account is enrolled in DAEM for direct transfer.

- Email Address: Valid and active email for notifications.

Additional Requirements for Mobile App Application

- Compatible smartphone with the SSS Mobile App installed.

- Internet access for login and submission.

Special Note: For OFWs, a verified mailing address or enrolled bank account is required if a UMID-ATM is unavailable. Always ensure your SSS account information is updated to avoid delays.

How to Apply for an SSS Salary Loan

Applying for an SSS Salary Loan is straightforward and can be done online through the My.SSS portal or the My.SSS mobile app.

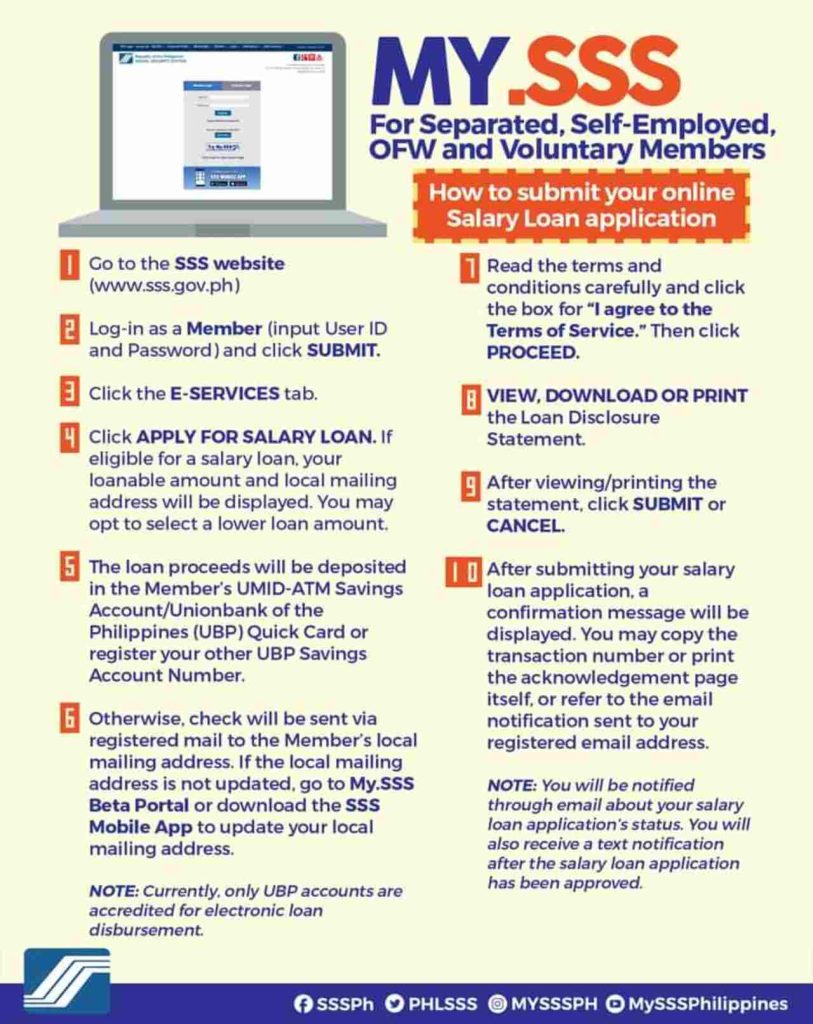

Via My.SSS for Self-Employed, Voluntary Members, and OFWs (SE/VM/OFWs)

Step 1. Visit the SSS website and log in using your My.SSS account.

Step 2. Navigate to “E-Services” and select “Apply for Salary Loan.”

Step 3. Follow the system prompts:

- Eligible members proceed with the loan application.

- Ineligible members are shown reasons for disqualification.

Step 4. Select loan amount, agree to terms, and submit.

Step 5. Check your registered email for confirmation.

Via My.SSS for Employed Members

Step 1. Log in to My.SSS through the SSS website.

Step 2. Go to “E-Services” and choose “Apply for Salary Loan.”

Step 3. Select the loan amount and provide required information:

- If you have a registered bank account, choose the disbursement account.

- For members without an account, loan proceeds will be mailed.

Step 4. Agree to the terms and submit your application.

Step 5. Check your email for confirmation.

Via SSS Mobile App

Step 1. Log in to the SSS Mobile App.

Step 2. Tap “My Loans” and select “Apply for Salary Loan.”

Step 3. Complete the required details (e.g., loanable amount, employer info).

Step 4. Review the Loan Disclosure Statement and tap “Submit.”

Step 5. Check for confirmation and log out of the app.

Deductions and Penalties

The loan amount may not always be the same exact amount received upon loan disbursement due to the following:

Deductions

From the approved loan amount, deductions include:

- A 1% service fee

- Pro-rated interest until the first scheduled amortization

- Outstanding balances from previous loans, if any

Penalties

- 1% penalty per month for late payments (even partial delays are charged for the entire month).

- Default occurs when unpaid obligations exceed 6 monthly amortizations, making the entire balance immediately payable.

Loan Renewal and Non-Payment Consequences

Loan Renewal

Members can renew their loan after paying at least 50% of the original principal and completing at least 12 months of payments. The outstanding balance of the previous loan will be deducted from the new loan amount.

Non-Payment Consequences

Unpaid loans may also result in:

- Deduction of arrears, interest, and penalties from the member’s final benefits (e.g., retirement, total disability, or death benefits).

- Deduction from short-term benefits (e.g., sickness, maternity, or partial disability) for self-employed and voluntary members.

Employer and Member Responsibilities

For Employed Members

Employers must certify the loan application and confirm the borrower’s employment status. They are also responsible for:

- Deducting the loan payments from the employee’s salary.

- Remitting payments to SSS promptly.

- Reporting separation from employment and deducting the outstanding balance from any final benefits.

For Member-Borrowers

Members must:

- Keep contact details updated through My.SSS or by submitting a Member Data Change Request Form.

- Inform new employers about the loan and authorize deductions for repayments.

Video: How to Apply for SSS Salary Loan

For a visual walkthrough on how to apply for the SSS Salary Loan, you may check out this video from HowToPaanoTo:

Summary

The SSS offers the Salary loan program as a financial assistance program designed to meet the short-term credit needs of eligible SSS members. Borrowers can apply for this loan program in multiple ways: via My.SSS for self-employed, voluntary, and employed members, or via the SSS Mobile App. Each method requires an active My.SSS account, stable internet, and sufficient contributions. Processing is quick and user-friendly, and the loan and repayment terms are convenient enough, ensuring members can access and use the funds to address their financial challenges easily.