Effective January 2025, the Philippine Social Security System (SSS) is implementing significant changes to its contribution structure, with the adjustments primarily featuring a 1% increase in the contribution rate, raising it from 14% to 15%, as mandated by Republic Act No. 11199, also known as the Social Security Act of 2018. Additionally, the minimum Monthly Salary Credit (MSC) will rise from ₱4,000 to ₱5,000, and the maximum MSC will increase from ₱30,000 to ₱35,000, all with the goal of strengthening the SSS fund and enhancing member benefits.

Understanding these updates is crucial for all SSS members, including employees, employers, self-employed individuals, and Overseas Filipino Workers (OFWs). Being informed ensures accurate contribution calculations and helps members maximize their benefits. This guide provides a comprehensive overview of the 2025 SSS contribution table, instructions on interpreting the table, and methods for calculating contributions, regardless of the type of SSS membership you have.

2025 SSS Adjustment Increase in Monthly Rates

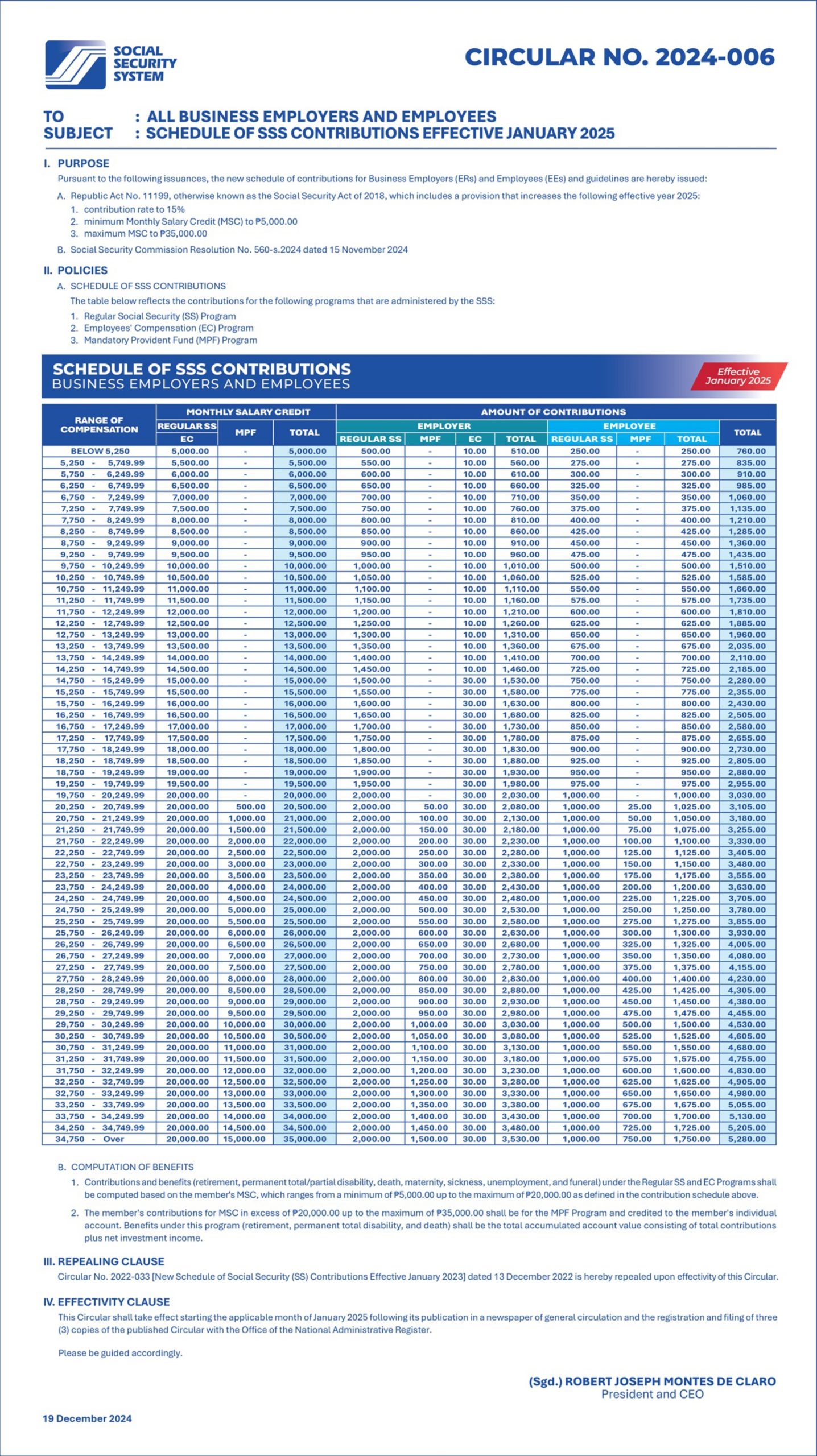

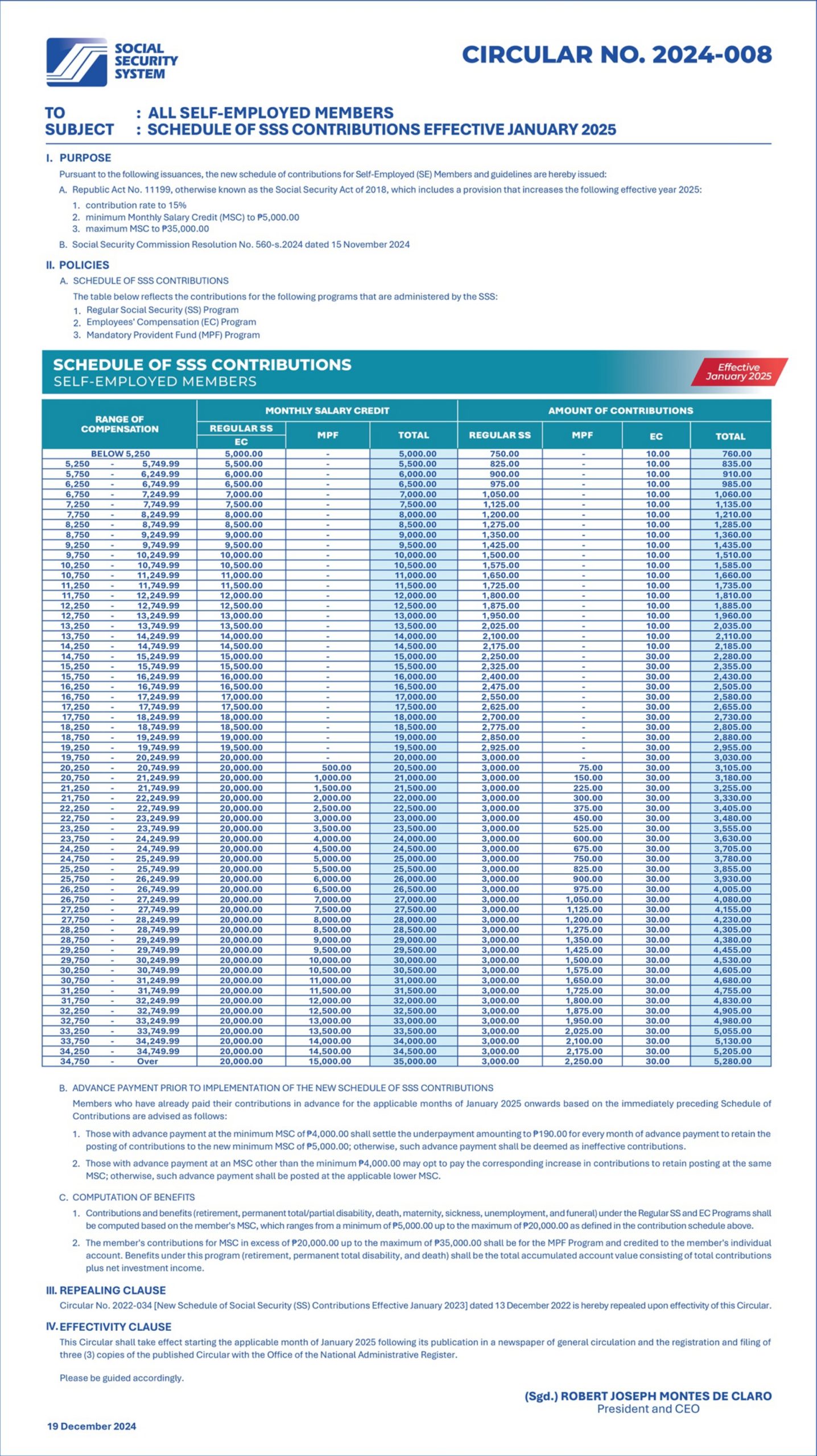

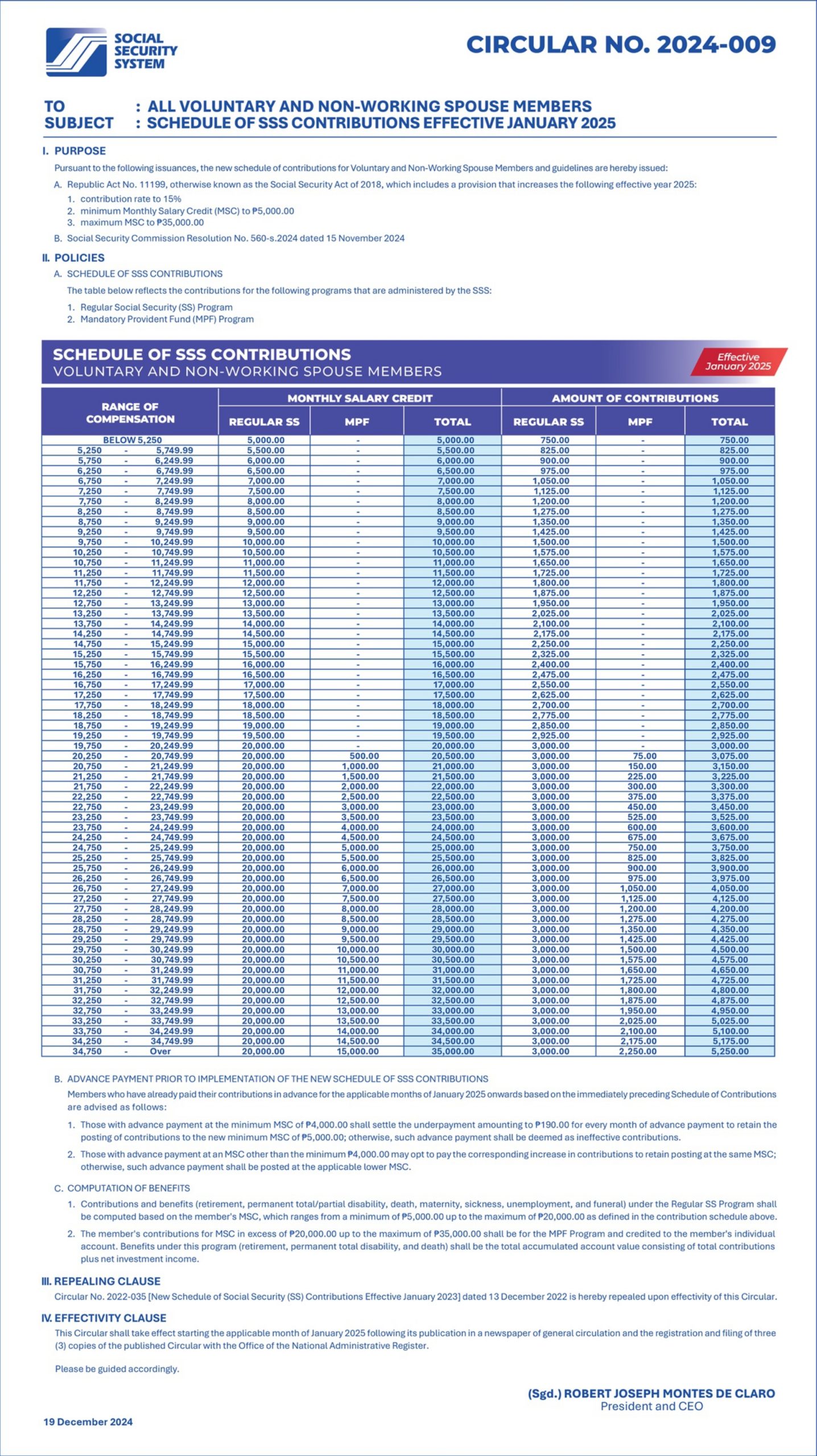

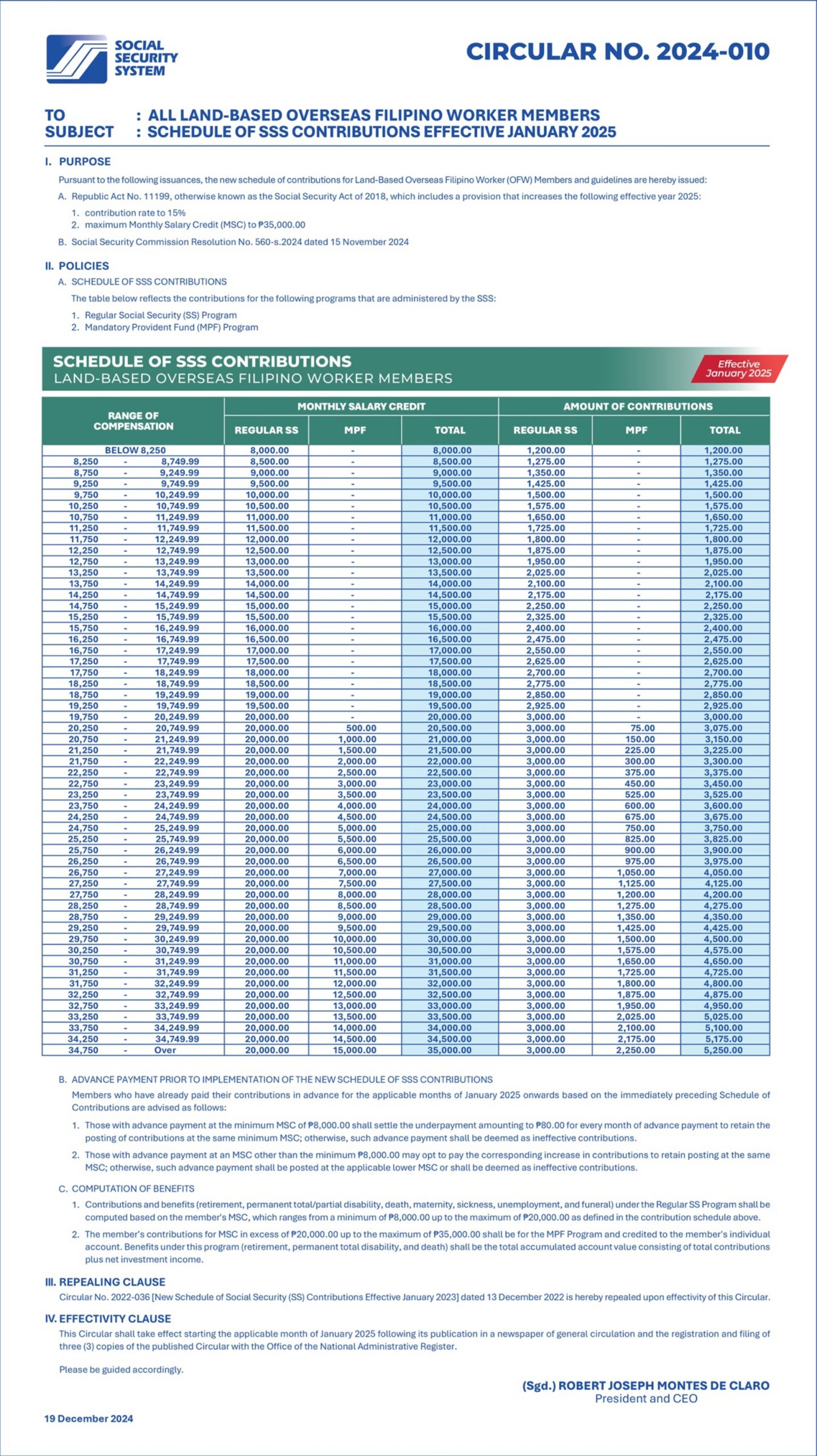

The SSS, in an effort to make this change clearer and more understandable for the public, has also released an updated 2025 Contribution Table—a structured chart that outlines the required monthly contributions based on an individual’s compensation and membership type.

With the 2025 adjustments, the table reflects the increased contribution rate and the updated MSC ranges. There are several tables in the guidelines issued by the SSS, and each table is divided into several columns with the following information:

- Range of Compensation: This column lists salary brackets. Members should locate the bracket that includes their monthly salary.

- Monthly Salary Credit (MSC): Once the appropriate compensation range is identified, the corresponding MSC is found in this column. The MSC serves as the basis for computing contributions.

- Amount of Contribution: The amount of contribution reflects the further divisions/breakdown of amount depending on the type of SSS membership.

- For Business Employers and Employees

- Employer’s Contribution (ER): This specifies the portion of the contribution that the employer is responsible for.

- Employee’s Contribution (EE): This indicates the portion deducted from the employee’s salary.

- For Household Employers and Kasambahays

- Household Employers: This specifies the portion of the contribution that the household employer is responsible for.

- Kasambahay: This indicates the portion deducted from the household employee’s salary.

- Self Employed Members: Unlike the other types, this member type should see the total amount of contribution to cover the regular SS payment as well as the EC and MPF charges.

- Voluntary and Non-Working Spouse Members: This portion should reflect the breakdown of the total amount of contribution they need to pay to cover the regular SS payment as well as the MPF charges.

- Land-based OFWs: This portion should reflect the breakdown of the total amount of contribution they need to pay to cover the regular SS payment as well as the MPF charges.

- For Business Employers and Employees

- Total Contributions: This column indicates the total monthly contribution, which is 15% of the MSC for 2025. The table is divided into several columns:

Regardless of the membership type, the SSS contribution table has information on the specific compensation range and the corresponding MSC and the equivalent contributions which remains proportional to the member’s earnings.

SSS Contribution Table Chart Sheet

To interpret the SSS contribution table that suits your membership type, here are the steps you need to follow:

For Employed Members

For employed members, the total contribution is shared between the employer and the employee. The employer contributes 10% of the MSC, while the employee contributes 5%. To determine the exact amounts:

Step 1. Identify the Salary Bracket

Find your monthly salary range in the “Range of Compensation” column.

Step 2. Determine the MSC

Locate the corresponding MSC in the adjacent column.

Step 3. Find the Contributions

Refer to the “Total Contribution,” “ER,” and “EE” columns to see the respective amounts.

Example: If an employee earns ₱20,000 monthly:

- Range of Compensation: ₱19,750 – ₱20,249.99

- MSC: ₱20,000

- Total Contribution: ₱3,000

- Employer’s Share (10%): ₱2,000

- Employee’s Share (5%): ₱1,000

For Self-Employed and Voluntary Members

Self-employed and voluntary members are responsible for the entire 15% contribution based on their declared monthly income. To compute:

Step 1. Declare Monthly Income

Choose an income amount within the allowable range.

Step 2. Find the MSC

Use the contribution table to match the declared income to the corresponding MSC.

Step 3. Calculate Contribution

Multiply the MSC by 15% to get the monthly contribution.

Example: For a declared income of ₱15,000:

- MSC: ₱15,000

- Total Contribution: ₱15,000 x 15% = ₱2,250

For Overseas Filipino Workers (OFWs)

OFWs can continue their SSS membership by contributing based on their monthly earnings abroad. The process is similar to that of self-employed members:

Step 1. Declare Monthly Income

Select an income amount within the allowable range.

Step 2. Determine the MSC

Refer to the contribution table to find the corresponding MSC.

Step 3. Compute Contribution

Multiply the MSC by 15% to determine the monthly contribution.

Example: For a declared income of ₱25,000:

- MSC: ₱25,000

- Total Contribution: ₱25,000 x 15% = ₱3,750

Employee Compensation (EC) Program

In addition to regular contributions, employers contribute to the Employee Compensation (EC) Program, which provides benefits for work-related injuries or illnesses. The EC contribution is solely shouldered by the employer and varies based on the MSC.

Benefits of Understanding the Contribution Table 2025

Familiarity with the SSS contribution table empowers members and offers several advantages:

- Accurate Contribution Calculation: By referencing the table, members can determine the exact amount they need to contribute based on their Monthly Salary Credit (MSC), ensuring compliance with the updated 15% contribution rate.

- Enhanced Benefit Planning: Knowledge of one’s MSC and corresponding contributions allows members to anticipate potential benefits, such as retirement pensions, disability, or maternity benefits, facilitating better financial planning.

- Employer-Employee Contribution Clarity: For employed individuals, the table delineates the specific shares of contributions between employers and employees, promoting transparency and mutual understanding.

- Informed Decision-Making for Self-Employed and Voluntary Members: Self-employed and voluntary contributors can use the table to select an appropriate MSC that aligns with their income levels, ensuring they contribute amounts that correspond to their desired benefit levels.

- Awareness of Contribution Rate Changes: The table reflects the 1% increase in the contribution rate effective January 2025, helping members stay informed about the latest adjustments and their implications.

By understanding the SSS Contribution Table, members can also ensure accurate contributions, optimize their benefits, and maintain compliance with the latest SSS regulations.

Payment Deadlines

Timely payment of contributions is also a part of understanding the importance of this table as it helps to avoid penalties and ensure continuous coverage. The deadlines are as follows:

- Employers: Payments are due on or before the last day of the month following the applicable month.

- Self-Employed/Voluntary Members: Payments can be made monthly or quarterly, with deadlines on or before the last day of the month following the applicable month or quarter.

- OFWs: Contributions can be paid monthly, quarterly, or annually, with flexibility in payment schedules.

Implications of the Recent Contribution Rate Increase

The 1% increase in the contribution rate is part of a series of scheduled adjustments under the Social Security Act of 2018, aiming to strengthen the SSS fund’s sustainability. This increment is projected to generate an additional ₱51.5 billion in 2025, with approximately 35% (₱18.3 billion) allocated directly to the Mandatory Provident Fund (MPF) accounts of SSS members. While these additional funds enhance the SSS’s capacity to support members during contingencies, it also results in the following implications for the SSS members:

- Higher Contributions: Members will experience an increase in their monthly contributions, which may affect their disposable income.

- Enhanced Benefits: Higher contributions are expected to lead to improved benefits, including retirement, disability, and sickness benefits, as these are calculated based on the MSC.

- Long-Term Fund Stability: The adjustments aim to ensure the long-term viability of the SSS fund, securing social security benefits for future generations.

- Changes in Minimum and Maximum MSC: The adjustment of the minimum MSC to ₱5,000 and the maximum MSC to ₱35,000 means that members earning below ₱5,000 will have their contributions calculated based on the ₱5,000 MSC, while those earning above ₱35,000 will have contributions capped at the ₱35,000 MSC. This ensures that contributions and potential benefits are more aligned with current economic conditions and wage levels.

Plans for 2025 and Beyond

In 2025, the SSS aims to prioritize service excellence by enhancing programs and systems to provide superior customer service. Initiatives like the KaSSSangga Collect and E-Wheels Programs are designed to extend coverage to self-employed workers across the Philippines.

Additionally, with a positive market outlook, the SSS plans to improve investment income performance from various asset classes, contributing to job generation as companies expand their businesses.

SSS Contribution Table 2025 PDF File Download

Filipinos who want to get a copy of the SSS Contribution Table 2025 can rely on this PDF document to stay updated with the latest contribution rates and guidelines. This comprehensive guide is designed to help both employers and employees understand the adjustments that may affect payroll, deductions, and benefits. You can get a copy of the PDF download file below:

SSS Table 2025 PDF here –

Staying informed about these changes is crucial for maintaining compliance and ensuring accurate financial management. Download the file today to access all the essential details and manage your SSS contributions with confidence.

Video: SSS Contribution Table 2025

The SSS contribution changes effective January 2025 include a 1% increase in the contribution rate to 15%, and adjustments to the minimum and maximum MSCs to ₱5,000 and ₱35,000, respectively.

Understanding how to read the updated contribution table and calculate contributions is essential for all members to ensure compliance and maximize benefits. For a visual explanation of the 2025 SSS contribution updates, including how to read the contribution table and calculate your contributions, please watch the following video from Info Pilipinas: