Pag-IBIG Provident Benefit or Savings Claim provides members an opportunity to access their accumulated savings upon meeting specific conditions. This process ensures members can utilize their Pag-IBIG Fund contributions and dividends for retirement, emergencies, or other approved situations. Understanding the steps and requirements involved is crucial to streamline the application and avoid unnecessary delays.

Whether claiming under regular savings, MP2 maturity, or other qualifying scenarios, being well-informed simplifies the process. Here’s a detailed guide covering eligibility, required documents, filing procedures, and payment details to help you access your savings with ease.

Program Features and Benefits

The Pag-IBIG Provident Benefit program allows members to access or withdraw their savings, employer contributions (if applicable), and earned dividends for retirement, emergencies, or other approved purposes. It comes with the following terms, features, and benefits:

Terms:

- Membership maturity: 20 years with at least 240 contributions.

- Early withdrawal: Available for retirees, health issues, or permanent departure.

- Death claims: Legal heirs can claim benefits.

- Death Benefit: An additional amount provided to heirs, based on membership status at the time of death.

- If a member passes away before the claim is finalized, heirs may still claim the benefits. The process ensures that any uncredited TAV or unpaid checks are redirected to legal heirs, following the laws of succession.

- Special provision: Multiple Employers

- Members with contributions from multiple employers can claim their entire savings, provided the conditions for withdrawal are met.

Features:

- Total Accumulated Value (TAV): Includes member and employer contributions, plus dividends.

- Total Accumulated Value (TAV): Member contributions, employer contributions (if applicable), and declared dividends.

- Flexible claim options: Branch filing or Virtual .

- Pag-IBIG online application.

- Multiple payment modes: Bank crediting, checks, or other approved methods.

- Crediting to a disbursement or payroll account.

- Issuing a check.

- Other Board-approved methods

Benefits:

- Accessible funds for emergencies or long-term goals.

- Guaranteed dividend earnings declared annually by the Pag-IBIG Fund.

- Additional death benefit for the member’s heirs.

Note: Representatives can claim proceeds on behalf of a member or heir by presenting required authorization documents.

Target Beneficiaries

The Pag-IBIG Provident Benefit program is designed for Filipino workers, retirees, and their legal heirs seeking financial security through savings and dividends, as well as the following groups:

- Active Pag-IBIG Fund members with regular or MP2 savings.

- Retired individuals, whether from government, private, or self-employed sectors.

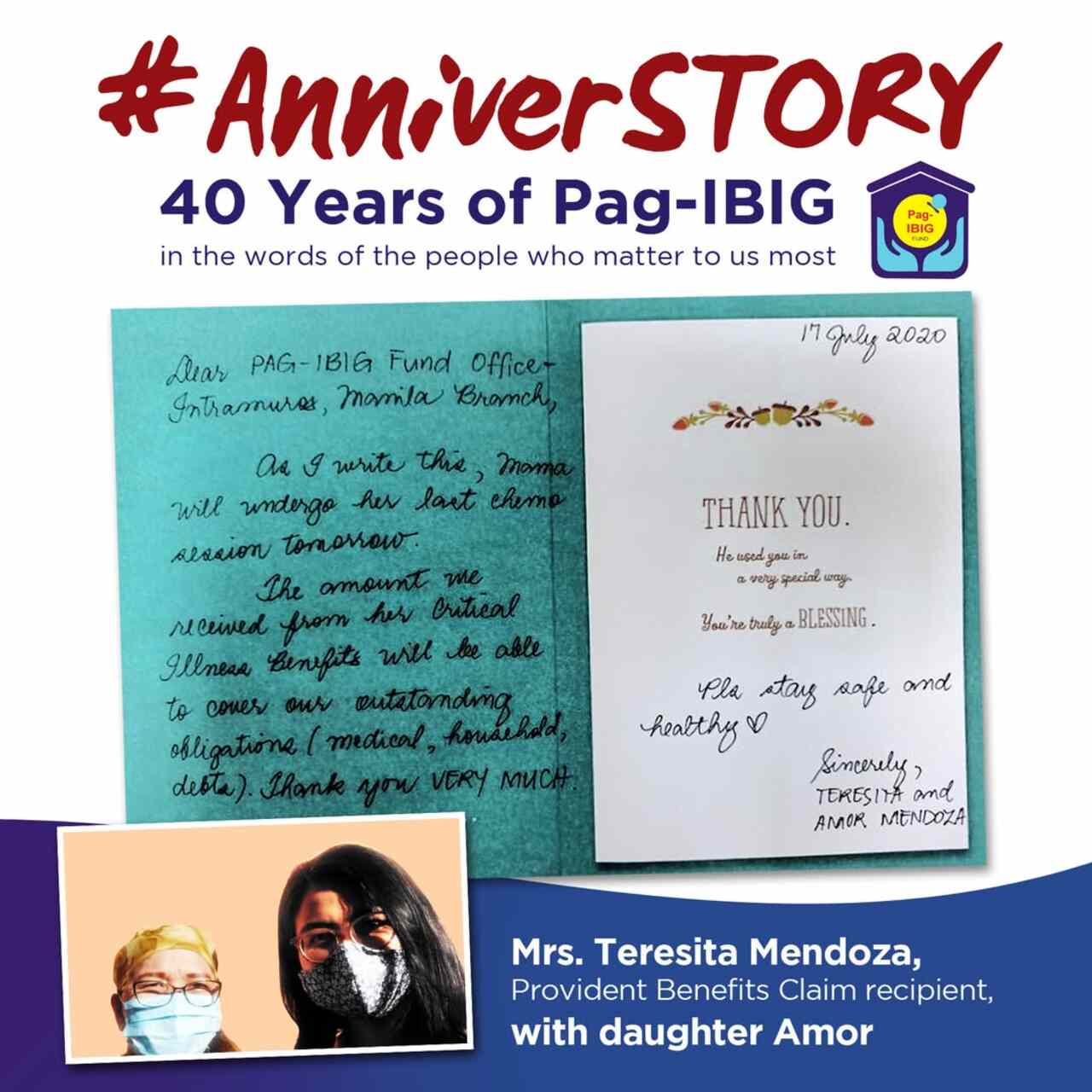

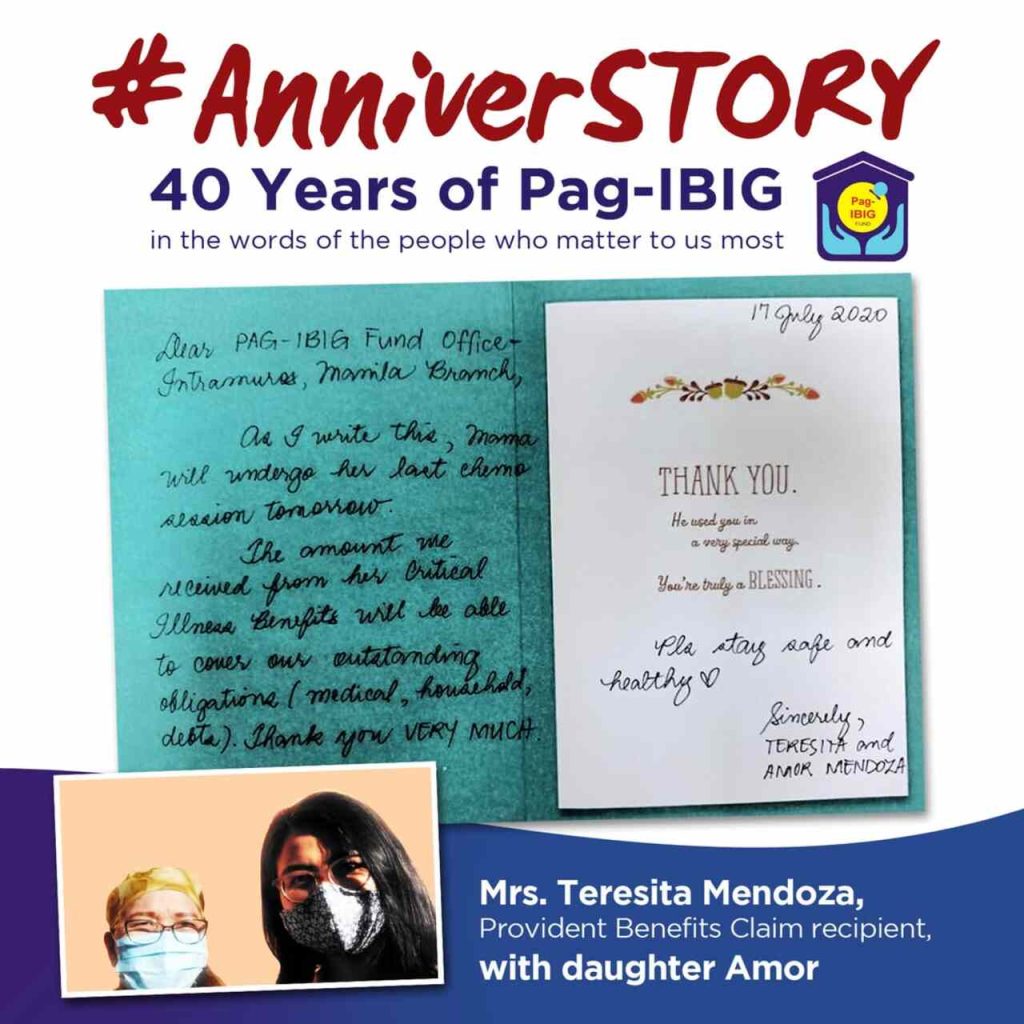

- Members diagnosed with permanent total disability or critical illnesses.

- Filipinos permanently migrating to another country.

- Legal heirs or representatives of deceased members.

- Overseas Filipino workers (OFWs) contributing to the Pag-IBIG Fund.

- Members opting for early savings withdrawal after 15 years of continuous contributions.

Eligibility Criteria and When to File

To find out if it’s the right time to file your Pag-IBIG Savings Claim, please check this list of criteria that applicants need to meet to be able to do so:

- Membership Maturity and Retirement

- Members can claim their savings after completing 20 years of membership with at least 240 monthly contributions.

- Early claims are allowed for retirees at age 60 or those retiring under private or government plans starting at age 45.

- Compulsory retirement occurs at age 65.

- Other Qualifying Events: Claims can also be filed for:

- Permanent Total Disability (PTD) – Impairments preventing work.

- Critical Illness – For the member or immediate family (e.g., spouse, parent, children, sibling, grandparents, grandchildren, and legally adopted children shall only be included insofar as applications for withdrawal of savings of their approval mothers or adoptive fathers).

- Cancer

- Organ Failure

- Heart-related illness

- Stroke

- Neuromuscular-related illness

- Health-Related Termination – Certified inability to continue employment.

- Death – Legal heirs may apply.

- Permanent Departure – For members leaving the Philippines permanently.

- Optional Withdrawal – Available after 15 years of continuous membership.

Required Documents for Application

To apply, the first thing you need to do is to gather and prepare the following documents:

General Requirements

- Completed Application for Provident Benefits (APB) Claim Form (HQP-PFF-285).

- Two valid IDs (original and photocopy). If IDs do not show the date of birth, provide additional proof, such as:

- PSA Birth Certificate

- Joint Affidavit of Two Disinterested Persons (notarized).

- Supporting documents depending on the reason for the claim (e.g., medical certificates for health-related claims).

Other Requirements

- If thePag-IBIG Loyalty Card Plus is not available, applicants may present two (2) valid IDs (original and submit photocopy).

- For retirement purposes: The valid IDs must reflect the member’s date of birth.

- If the valid IDs do not reflect the date of birth, applicants.must submit any of the following:

- Birth Certificate of Member issued by Philippine Statistics Authority (PSA)

- Non-availability of Birth Record issued by PSA and Joint Affidavit of Two Disinterested Persons (notarized)

The list of accepted valid IDs include:

- Philippine Identification (PhilID) Card

- Passport including those issued by foreign governments

- Driver’s License

- Professional Regulation Commission (PRC) ID

- National Bureau of Investigation (NBI) Clearance

- Police Clearance

- Postal ID

- Voter’s ID

- Tax Identification Number (TIN) ID

- Barangay Certification or Barangay IDs or similar documents bearing picture of the Member

- Government Service Insurance System (GSIS) e-Card

- Social Security System (SSS) Card

- Senior Citizen Card

- Overseas Workers Welfare Administration (OWWA) ID

- Overseas Filipino Worker ID

- Seaman’s Book or Seafarer’s Identification and Record Book (SIRB)

- Alien Certification of Registration/Immigrant Certificate of Registration

- Government Office and GOCC ID, e.g. AFP ID, Pag-IBIG Fund Loyalty Card

- ID issued by the National Council on Disability Affairs (NCDA)

- Department of Social Welfare and Development (DSWD) Certification

- Integrated Bar of the Philippines ID

- Company ID issued by Private Entities or Institutions Registered with or supervised or regulated either by the BSP, SEC or IC

- PhilHealth Health Insurance Card ng Bayan.

How to File Your Claim

There are two ways to file for a Pag-IBIG Savings Claim. Regardless of the method you prefer, you simply need to follow the steps listed below to do so:

Filing at a Pag-IBIG Branch

Step 1. Secure an APB Claim Form from a Pag-IBIG branch or download it from their website.

Step 2. Complete the form and attach the necessary documents, including a disbursement card copy for electronic fund transfers.

Step 3. Submit your application at any branch. Ensure all requirements are complete to avoid delays.

Filing Online Through Virtual Pag-IBIG

Eligible claims for maturity, retirement, and MP2 savings can be filed online by:

Step 1. Preparing scanned copies of the APB form, one valid ID, and required supporting documents.

Step 2. Taking a selfie with your ID for verification.

Step 3. Accessing Virtual Pag-IBIG on their website and submitting your application.

Where to Secure the Application Form for Provident Benefits or Savings Claims

The Application for Provident Benefits (APB) Claim Form can be obtained from any Pag-IBIG Fund branch or downloaded from the official Pag-IBIG website (via this link: https://www.pagibigfund.gov.ph/document/pdf/dlforms/providentrelated/PFF285_ApplicationProvidentBenefitsClaim_V09.pdf) Processing of the claim begins once all required documents are submitted, and there are no fees charged for filing the application. Timelines for the release of claim proceeds may vary but are typically completed within 5 to 20 working days, depending on the completeness of the requirements and verification process.

Key Notes on Updating Information

Members can update contact details directly on their application form during submission. Changes to other personal information require the Member’s Change of Information Form (MCIF) and supporting documents.

Video: When Can I Withdraw my Pag-IBIG Savings?

Applying for a Pag-IBIG Provident Benefit or Savings Claim is straightforward when you understand the requirements and procedures. Members or their heirs can file claims for retirement, maturity, health-related issues, or death by preparing the necessary forms and documents. Payments are issued securely through bank accounts or checks, with online options available for convenience. To help you better, watch this helpful tutorial from Prof. Allan Noguerra MBA, LPT and learn about withdrawing your Pag-IBIG savings. The video covers information on the application procedures, documentary requirements, and even tracking the application status so you will need to watch this until the end.