The SSS Funeral Benefit is a program designed to provide financial assistance to help cover funeral expenses in the event of a member’s death. This benefit is available to the dependents of an active member, permanent total disability pensioner, or retiree. The application process has been streamlined to make it easier for claimants, with options for online filing and in-branch submissions.

Understanding how to apply for the SSS Funeral Benefit is crucial for families managing end-of-life expenses. This guide will explain the eligibility criteria, required documents, and detailed application process to help claimants receive the financial aid they need.

Program Overview

The SSS Funeral Benefit is a financial assistance program designed to help defray the costs of funeral expenses for deceased SSS members, including retirees and those permanently totally disabled. It was established as part of the Social Security System’s mandate to provide social protection to Filipino workers and their families in times of need. The benefit covers qualified claimants who have paid for the funeral, with the amount depending on the member’s contributions and credited service years. Over the years, it has expanded its scope to include both local and overseas deaths, ensuring support for members and their beneficiaries regardless of location.

Benefits

The SSS Funeral Benefit offers financial support to help cover the funeral expenses of deceased SSS members, helping ease the financial burden for families while ensuring proper memorial arrangements for the deceased.

- Cash assistance for funeral costs, ranging from ₱20,000 to ₱60,000, depending on the member’s contributions. As of October 20, 2023, the benefit amounts are as follows:

- ₱20,000 to ₱60,000: For members who made at least 36 monthly contributions before their death

- ₱12,000: For those who made 1–35 contributions before their death

- Coverage for all SSS members, including retirees and permanently totally disabled individuals

- Support for both local and overseas deaths, with requirements adjusted to specific circumstances

- Quick disbursement of funds to qualified claimants through an enrolled disbursement account

Target Beneficiaries

The benefit is available to individuals who have paid for the funeral expenses of a deceased:

- SSS member

- Retiree receiving a pension

- Permanent total disability pensioner

Claimants can be any of the following:

- Legitimate surviving spouse

- Legitimate dependent children

- Illegitimate dependent children

- Dependent parents if no other beneficiaries are available

- Qualified claimants who paid for the funeral expenses of a deceased SSS member, retiree, or permanently totally disabled member

Eligibility

To apply for and receive the SSS Funeral Benefit, specific qualifications must be met by the deceased member and the claimant.

- The deceased must be an SSS member, retiree, or permanently totally disabled member

- The claimant must have paid or be responsible for the funeral expenses

- The deceased member’s SSS contributions must be verified for eligibility

- Proper documentation, such as the death certificate and proof of expenses, must be provided

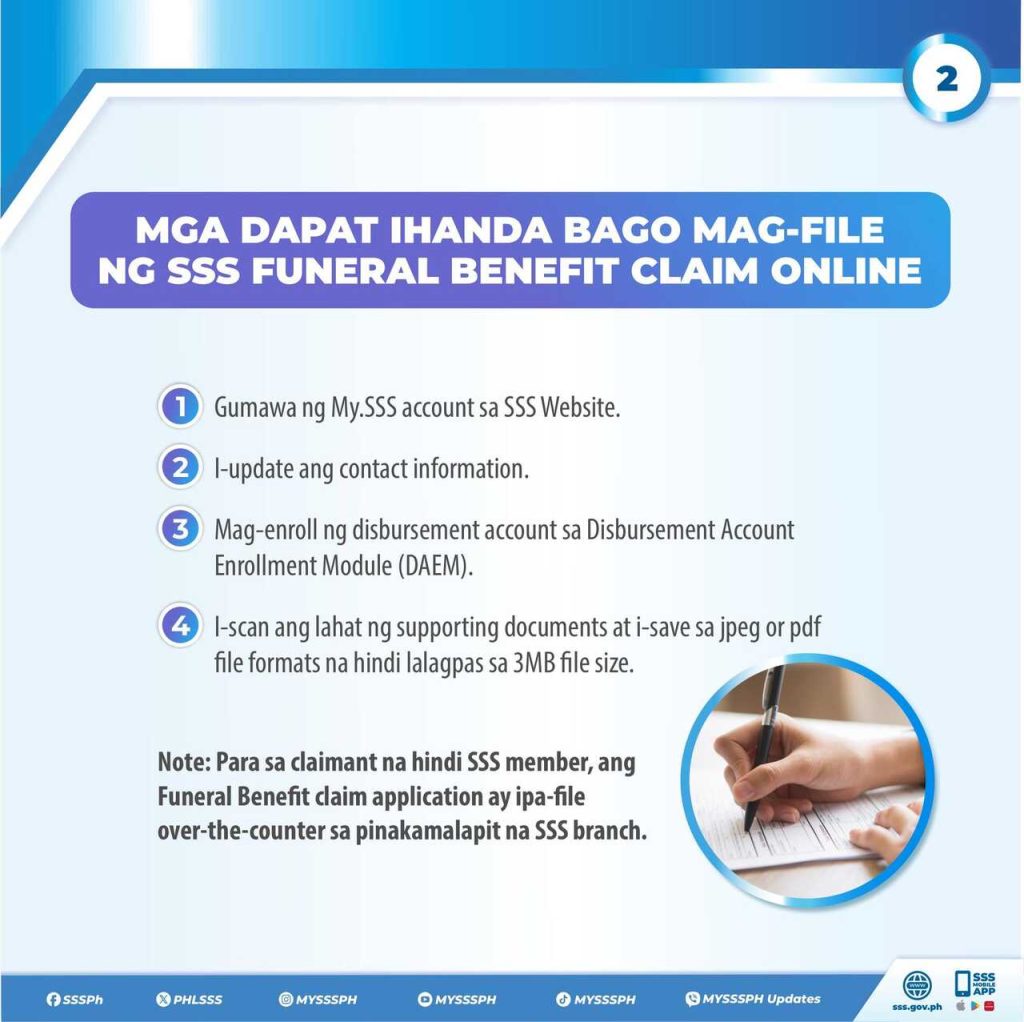

- SSS Registration: The claimant must have an active SS number and a registered My.SSS account

- Disbursement Account: Ensure that your bank account or e-wallet is enrolled in the Disbursement Account Enrollment Module (DAEM) on the SSS website

- No Need for UMID Card: Possession or application for the UMID card is no longer required

Documentary Requirements

When applying for the SSS Funeral Benefit, you need to prove your eligibility and provide the following documents:

Basic Documentary Requirements

- Funeral Claim Application (FCA) Form (1 original copy)

- Claimant’s Identification

- Present original and submit photocopy of valid government-issued ID

- In the absence of a primary ID, submit two secondary IDs (one must have a photo)

- Proof of SSS Membership of the Deceased

- Any of the following: SSS card, UMID card, employment records, or SSS certifications

- Proof of Death

- Issued by the Philippine Statistics Authority (PSA) or Local Civil Registry Office (LCR)

- If unavailable: Certification of non-availability and other proof, such as burial or cremation certifications

- Proof of Funeral Expenses

- Original receipt from the funeral home with the claimant’s name and the deceased member’s name

- Funeral Service Contract, if OR is unavailable

- Certification of payment or provisional receipt if payment is incomplete

- If lost: Certified true copy of OR or a certification from the funeral home

- Disbursement Account Details

- Bank passbook, ATM card, or bank certificate

- For e-wallets like Maya or GCash, provide the claimant’s registered mobile number

Additional Documents

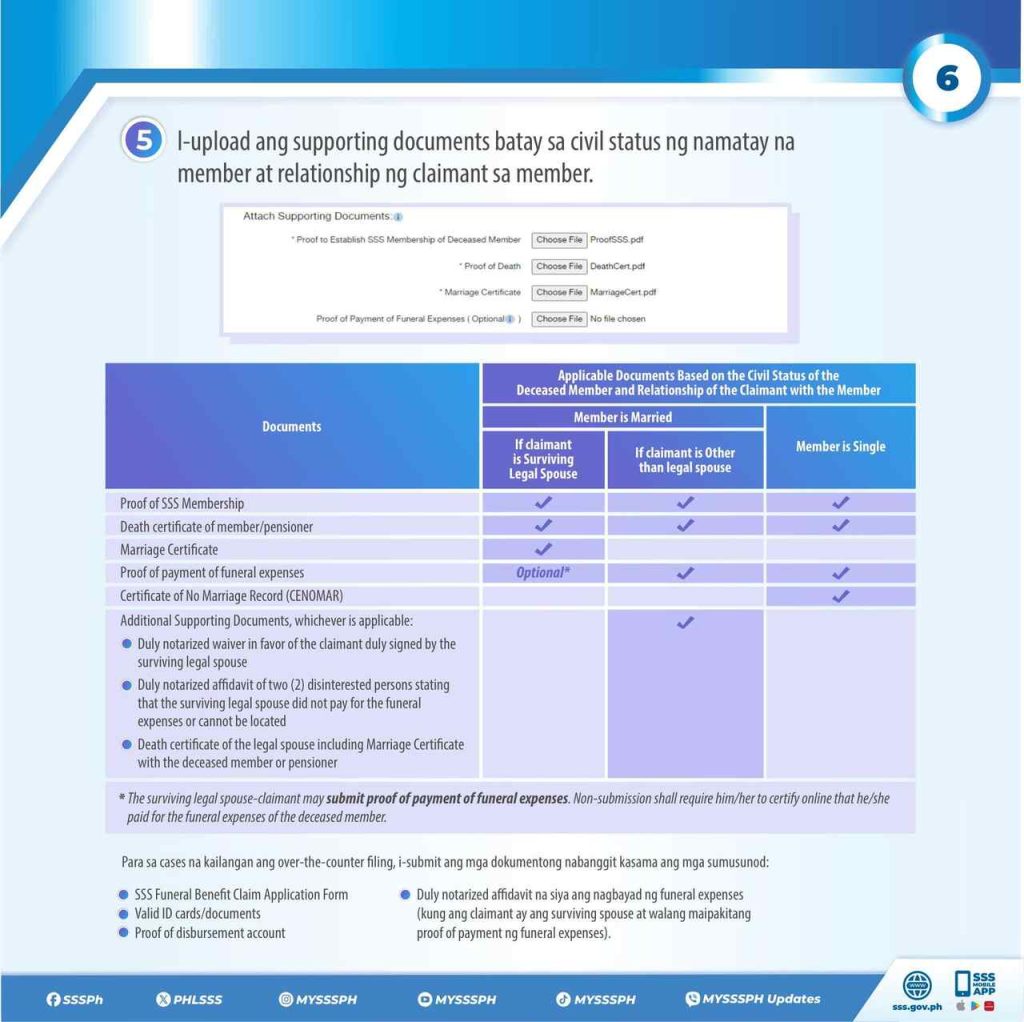

Depending on the claimant’s relationship with the deceased, additional documents may be required:

- For Surviving Legal Spouses

- Marriage certificate issued by the PSA or local civil registrar

- Online certification that the spouse paid for the funeral

- For Deceased Members Married Abroad

- Divorce decrees, annulment papers, or adoption decrees (if applicable)

- For Children of the Deceased

- Birth certificates or educational records

- For Authorized Representatives

- Claimant’s ID and representative’s ID

- Letter of Authority (LOA) or Special Power of Attorney (SPA), valid within 6 months (if issued locally) or 1 year (if issued abroad)

- For Other Claimants

- Affidavits or certifications, such as proof that the legal spouse did not cover funeral expenses

- Waiver from the legal spouse, if applicable

- Affidavits for late registration of death certificates or other justifications

- Certification of availment if the funeral expenses were covered by a memorial or insurance plan

Note: For online submissions, make sure that all scanned documents are in PDF or image format and under 2MB in size.

Application Procedures

Follow these steps for filing of SSS Funeral claims:

Online Filing (For SSS member claimants)

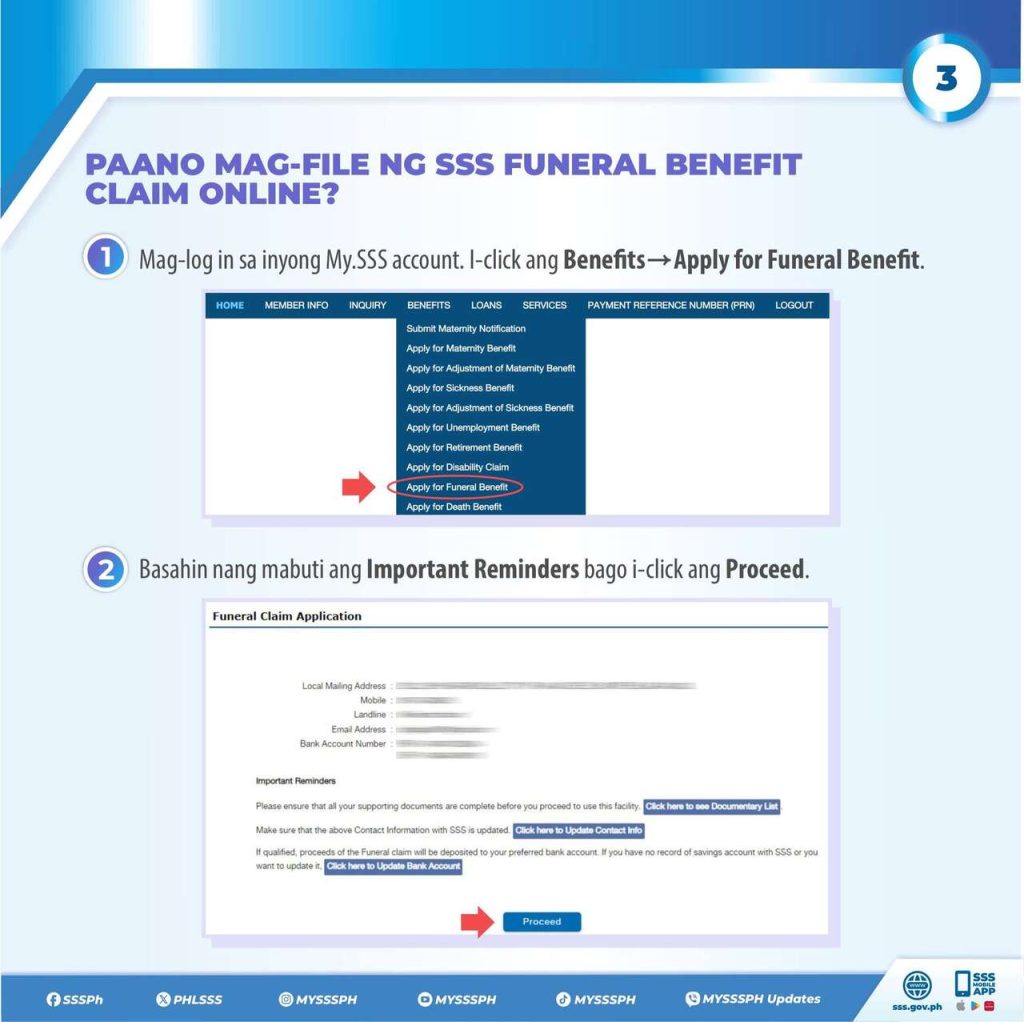

Step 1. Log in to My.SSS Portal

- Select “Submit Funeral Claim Application” under the E-Services menu.

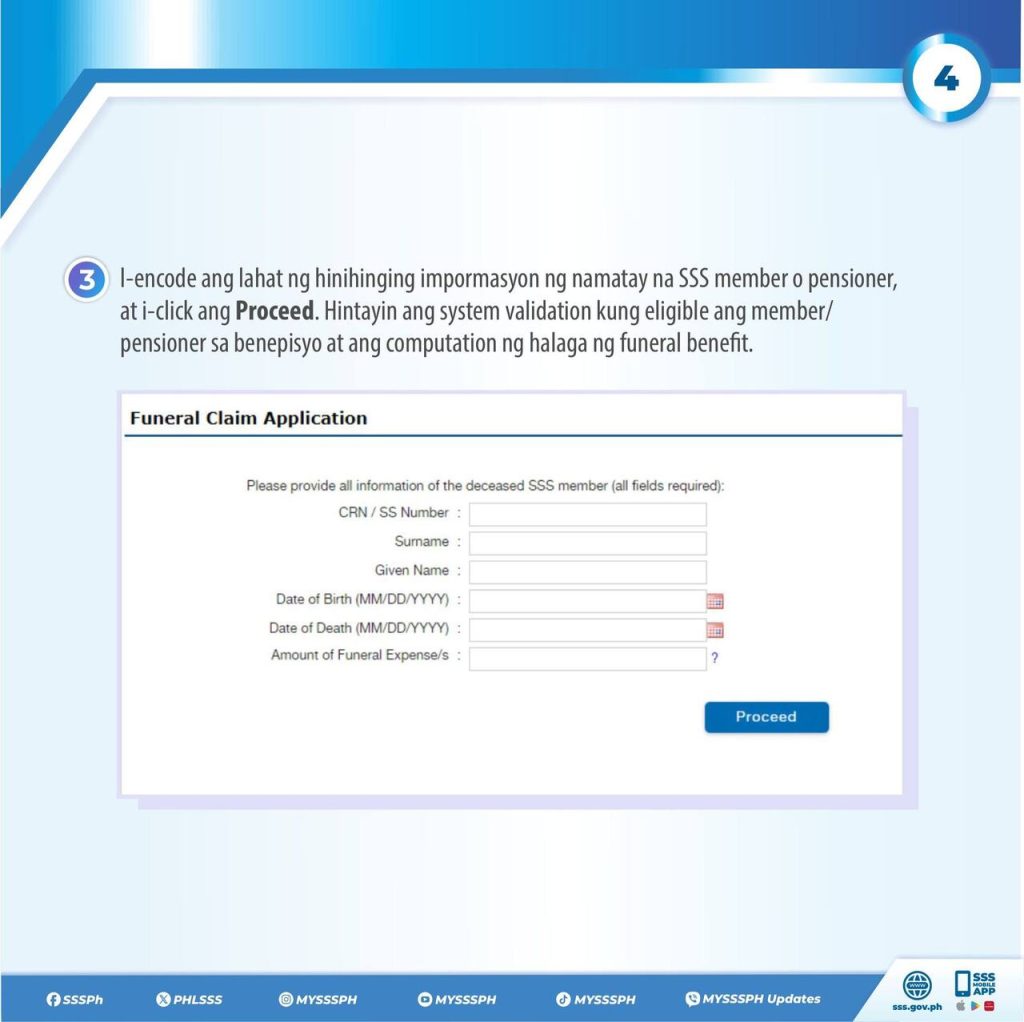

Step 2. Provide Required Details

- Enter the deceased member’s SS Number, name, birth date, death date, and funeral expense amount.

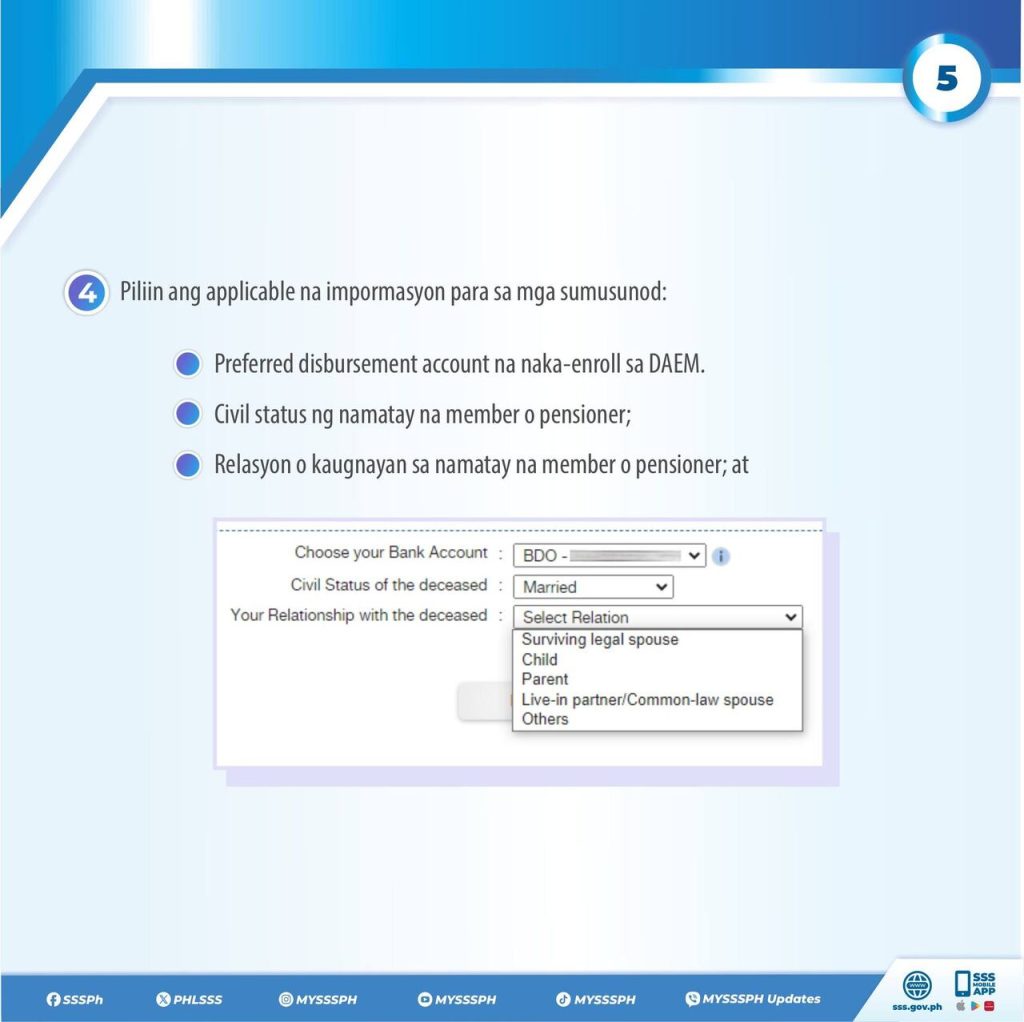

- Provide Claimant Information: Indicate your relationship to the deceased and select your preferred disbursement account.

Step 3. Upload Documents

- Proof of SSS membership, death certificate, and funeral expense receipt.

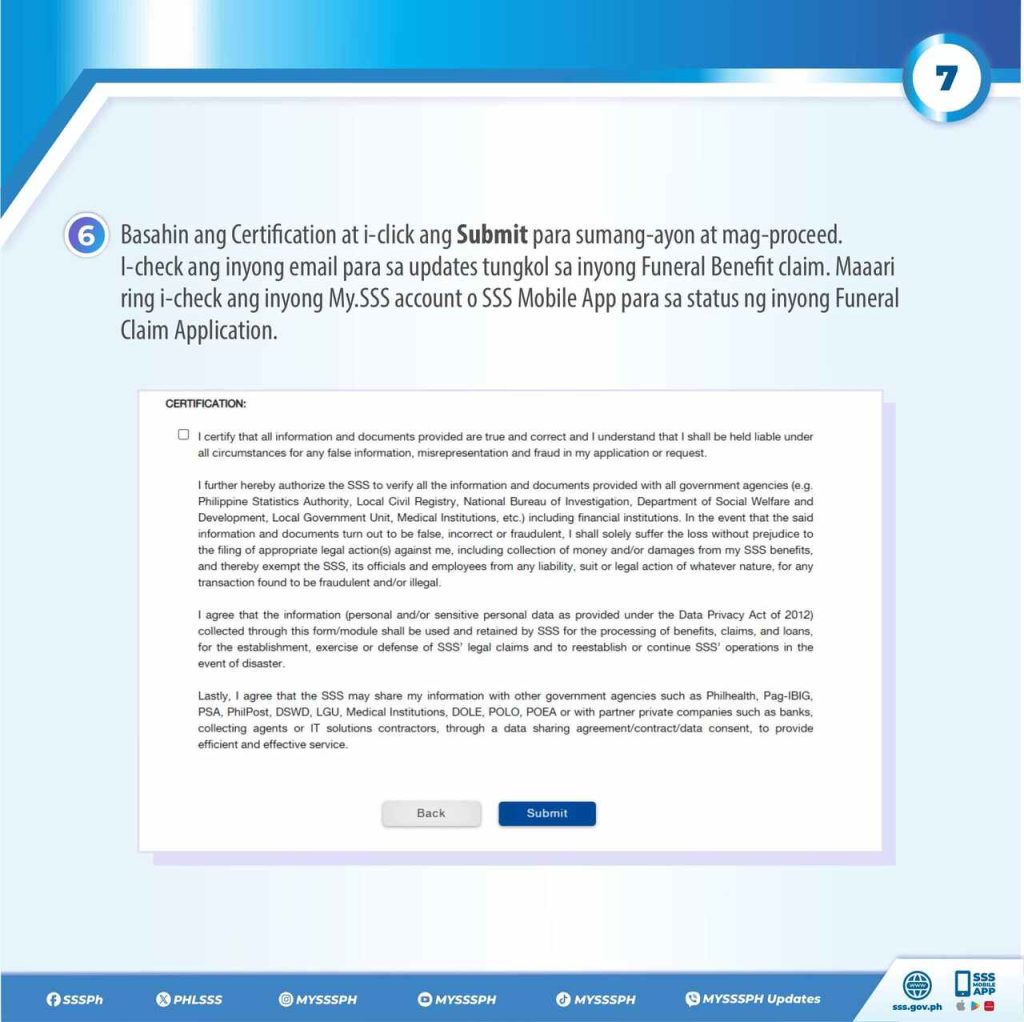

Step 4. Certify and Submit

- Review and agree to the certification by clicking “Submit.”

- Wait for an email notification regarding the status of your application.

Step 5. Monitor Status

- Check your email or log in to My.SSS Portal for updates on approval or additional requirements.

- The benefit will be credited directly to your DAEM-registered bank account or UMID ATM card.

Over-the-Counter (OTC) Filing (For non-members)

Step 1. Download and Prepare Forms

- Obtain the Funeral Claim Application (FCA) form from the SSS website or branch office.

Step 2. Complete the Application

- Fill out the FCA and attach all required documents.

Step 3. Queue Number

- Visit the SSS branch office, secure a queue number, and wait for your turn.

Step 4. Submit Documents

- Hand over the completed application and supporting documents to the assigned SSS personnel.

Step 5. Verification

- SSS staff will verify the deceased’s membership, the claimant’s identity, and document accuracy.

Where to Get the Funeral Claim Application Form

The SSS Funeral Claim Application Form can be obtained through the SSS website or at any SSS branch office. Members can log in to their My.SSS account and download the form from the E-Services section. Alternatively, the form is available for pick-up at the nearest SSS branch for those applying in person.

Tips for a Smooth Application Process

To make the application procedures a little less painful, make sure to keep these tips in mind:

- Ensure that all details about the deceased member (e.g., SS number and dates) are accurate and consistent across all documents to avoid delays.

- All documents must be legible to avoid delays.

- SSS will send updates regarding the status of your application.

- Claimants are not required to pay any fees.

- Claims are processed within 1 working day after submission of complete documents.

- If filing through a representative, a Letter of Authority or Special Power of Attorney is required, along with valid IDs.

- Claims filed for members who died abroad may require English translations for non-English documents, certified by the DFA or Philippine Embassy.

- The funeral benefit amount will be credited directly to the claimant’s registered disbursement account or UMID ATM card.

- If no UMID ATM card is available, the system will use the claimant’s bank details enrolled in the DAEM.

Video: Applying for the SSS Funeral Benefit

If you prefer a visual guide, MYSSSPH provides a step-by-step tutorial video showing how to navigate the My.SSS portal, upload documents, and track your application. Watching this til the end can help clarify any uncertainties.

Summary

The SSS Funeral Benefit helps families manage funeral expenses by providing financial aid that varies depending on the deceased member’s contributions. Applications can be made online through the My.SSS portal or over-the-counter at SSS branches. Claimants must meet eligibility requirements and submit complete documentation, but regardless whether applying online or in person, following the steps outlined in this guide will help streamline the process, allowing claimants to access their benefit as quickly as possible.