The AFPSLAI Emergency Loan program is a financial assistance program offered by the Armed Forces and Police Savings and Loan Association, Inc. (AFPSLAI) exclusively for regular members who need quick funds during emergencies. It offers flexible loan terms and a reasonable interest rate, helping uniformed personnel and their families recover from their urgent financial situations without resorting to taking out loans from high-interest lending options.

If you’re a member of the Armed Forces and Police Savings and Loan Association, Inc. (AFPSLAI) and suddenly face unexpected expenses — such as medical bills, family emergencies, or urgent repairs — the AFPSLAI Emergency Loan Program offers fast and reliable financial assistance. This guide will walk you through everything you need to know — from eligibility and requirements to step-by-step application procedures — so you can easily apply for an AFPSLAI Emergency Loan.

Program Features

The AFPSLAI has long been a trusted financial partner of uniformed personnel in the Philippines. Established to provide reliable savings and affordable credit services, AFPSLAI continues to support members of the AFP, PNP, BJMP, and BFP through loan programs designed for their needs — including the Emergency Loan Program, which offers quick financial aid during unexpected situations.

Here are some of the key features of the AFPSLAI Emergency Loan program:

- Maximum Loanable Amount: Up to ₱1,000,000

- Flexible Loan Term: From 6 months to 60 months

- Eligibility: Open to all regular AFPSLAI members

- Computation Basis: Determined by each branch of service based on Net Take-Home Pay (NTHP) requirements

- Subject to Single Borrower’s Limit (SBL): The maximum amount a member can borrow based on salary, bonuses, and deposits

- Can Be Availed Alongside Other Loans: Members may still apply even with an existing Salary or Multi-Purpose Loan, depending on paying capacity

- Loan Proceeds Release Options: Available through cash, Savings Deposit Account (SD-02), or Remittance Facility

- Covered by Credit Redemption Insurance (CRI): Protects the borrower’s family by settling the remaining balance in case of the borrower’s death (subject to terms)

- Fast Processing: Loan may be released within the same day if requirements are complete

- Multiple Application Channels: Can be processed in-branch or through the online e-Loan Application system on www.afpslai.com.ph

These features make the AFPSLAI Emergency Loan a practical and dependable choice for members who need immediate financial assistance with flexible repayment options.

Benefits

Getting an AFPSLAI Emergency Loan comes with several practical advantages that help members handle urgent financial situations with less stress and more confidence.

Here are some of them:

- Quick Financial Relief: Funds can be released within the same day if requirements are complete — perfect for emergencies that need immediate attention.

- Flexible Payment Terms: Choose from 6 to 60 months to repay your loan based on your income and financial capacity.

- Low and Competitive Interest Rates: Designed for uniformed personnel, AFPSLAI offers lower interest rates than most private lenders.

- Simple Requirements: Uses the same documents as other AFPSLAI loan types, making it easy and straightforward to apply.

- High Loanable Amount: Borrow up to ₱1,000,000, depending on your Net Take-Home Pay (NTHP) and Single Borrower’s Limit (SBL).

- Accessible to All Regular Members: Available to members of the AFP, PNP, BJMP, and BFP, ensuring inclusive assistance for all service branches.

- Multiple Fund Release Options: Receive your loan proceeds through cash, Savings Deposit Account (SD-02), or remittance, whichever is most convenient.

- Credit Redemption Insurance (CRI) Coverage: Protects your family from financial burden — the insurance will settle your remaining loan balance in case of death (subject to policy conditions).

- Online and Walk-in Application Options: Apply conveniently through the AFPSLAI e-Loan system or submit your documents at any AFPSLAI branch nationwide.

- Responsive Customer Support: Members can easily reach AFPSLAI through its Consumer Assistance Group or local branch offices for inquiries and updates.

Who Can Apply?

The program is open to all regular AFPSLAI members, including those under:

- Armed Forces of the Philippines (AFP)

- Philippine National Police (PNP)

- Bureau of Jail Management and Penology (BJMP)

- Bureau of Fire Protection (BFP)

Requirements

You only need to submit the same requirements as a Salary, Pension, or Multi-Purpose Loan, which include:

- Duly accomplished Loan Application Form (LAF)

- Latest Payslip or Pension Slip

- Valid AFPSLAI ID or Government-issued ID

- Other documents as required by your branch of service

Tip: Always double-check with your nearest AFPSLAI branch for any updated requirements before visiting.

How to Compute Your Loan or Monthly Amortization

You can estimate your monthly payments or even check how much you can borrow depending on your preferred amortization through the AFPSLAI EL Loan Calculator available on their website:

To compute monthly amortization:

- Enter your desired loan amount.

- Select your preferred loan term (6–60 months).

- Click “COMPUTE” to view your estimated monthly payment.

To check how much you can borrow:

- Enter your preferred monthly amortization.

- Choose the loan term.

- Click “COMPUTE” to see your estimated loanable amount.

Note: This computation is only indicative. For actual figures, visit or contact your nearest AFPSLAI branch.

Requirements

When applying for this loan, you’ll need to prepare this list of required documents:

- Duly Accomplished Loan Application Form (LAF) — available at any AFPSLAI branch or through the official website www.afpslai.com.ph

- Valid AFPSLAI ID or any Government-Issued ID (e.g., UMID, Driver’s License, Passport, etc.)

- Latest Payslip or Pension Slip (showing your current salary or pension deductions)

- Service Clearance or Certification, if required by your specific branch of service

- Other Supporting Documents as may be requested by AFPSLAI based on your loan type or status

How to Apply for an AFPSLAI Emergency Loan

To apply, here are the steps you need to follow:

Walk-In Application (Branch Office)

If you are visiting the nearest branch office, just follow these steps:

Step 1. Submit your Loan Application Form (LAF) and all required documents at any AFPSLAI branch.

Step 2. Once verified and complete, the Loan Specialist will process your application (for new or renewal).

Step 3. After approval, proceed to the Releasing or Tellering Section for the release of your funds via:

- Cash,

- Savings Deposit Account (SD-02), or

- Remittance Facility.

Step 4. Sign the Loan Release Form to finalize your transaction.

Note: If all documents are complete, the loan can be released on the same day.

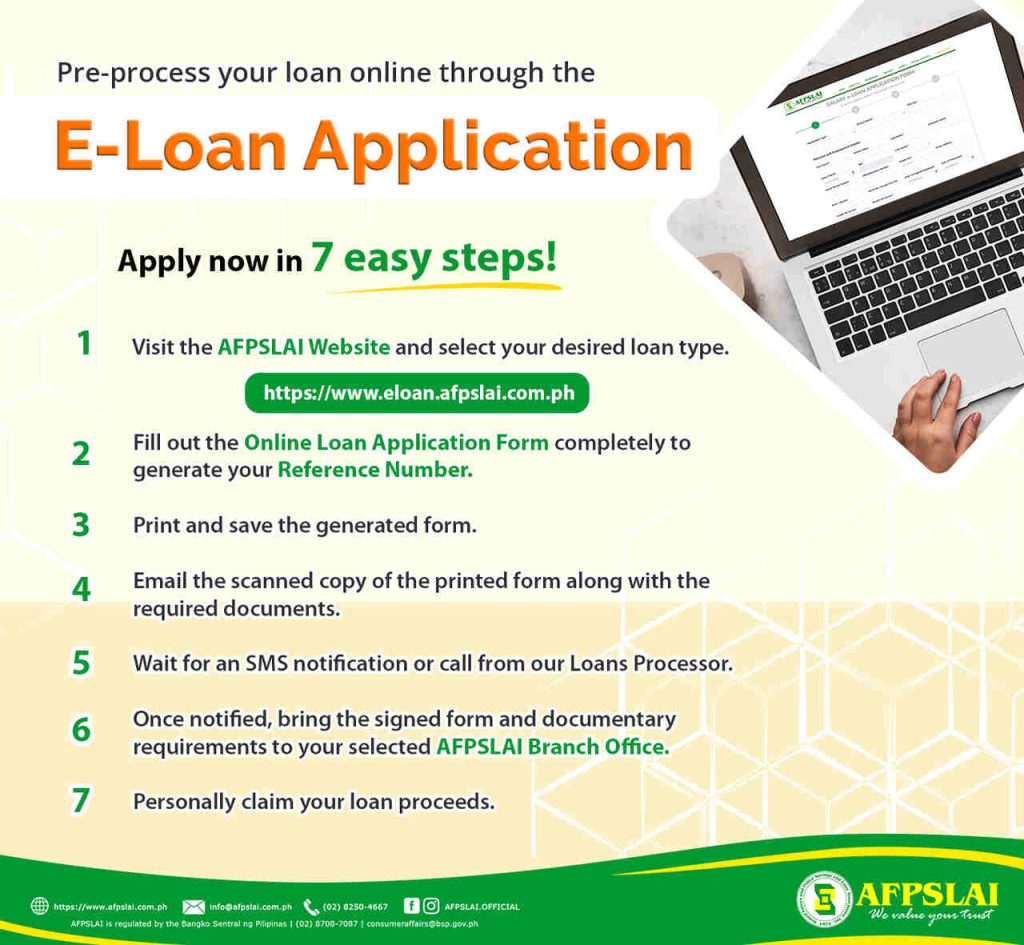

Online Application (e-Loan Application)

If you prefer the convenience of online applications, then these are the steps for you:

Step 1. Visit the official website: https://www.afpslai.com.ph

Step 2. Click the “e-Application” tab and select “e-Loan Application.”

Step 3. Fill out the online form completely and take note of your reference number.

Step 4. Print and sign the generated form.

Step 5. Submit the signed form and requirements at your chosen AFPSLAI branch.

Step 6. The Loan Specialist will process your loan.

Step 7. Upon approval, you can claim your proceeds through cash, deposit, or remittance.

Step 8. Finally, sign the Loan Release Form.

Fees and Processing Time

Applying for an AFPSLAI Emergency Loan is generally free of charge. Processing is quick and convenient — as long as your requirements are complete, loan approval and release can happen within the same day. Both walk-in and online applicants can expect the same level of service.

Note: All loans granted after January 17, 2011 are covered by Credit Redemption Insurance (except Back-to-Back Loans or members over 80). The insurance provider settles the remaining balance, provided the loan isn’t past due.

Video: AFPSLAI e-Loan Facility

The AFPSLAI Emergency Loan Program offers flexible terms, reasonable rates, and same-day processing — giving you the support you deserve when you need it the most. Whether you choose to apply in person or online, make sure your documents are complete and your contact information is updated. For a visual walkthrough on the AFPSLAI online applications process, you may check out this video below:

Contact Information

For the most accurate and updated information regarding your inquiries or feedback, you may reach out to:

- Consumer Assistance Group: (02) 8911-8364

- Email Address: info@afpslai.com.ph

- Official website: https://www.afpslai.com.ph