The Agricultural Credit Policy Council (ACPC) is a government agency in the Philippines responsible for developing and implementing policies that promote accessible and sustainable credit for farmers, fisherfolk, and other rural stakeholders. Established in 1986 through Executive Order No. 113, ACPC operates under the Department of Agriculture (DA) and plays a crucial role in ensuring that small agricultural producers have access to financial services. Its primary goal is to enhance agricultural productivity and rural development by providing affordable credit, facilitating financial inclusion, and linking farmers to formal lending institutions.

ACPC was created in response to the need for a coordinated and strategic approach to agricultural credit, addressing challenges such as high-interest rates and limited access to formal financing. It serves as the policy-making body for agricultural credit programs, ensuring that funds are effectively allocated to support the growth of the sector. By implementing loan programs, capacity-building initiatives, and credit guarantees, ACPC aims to empower farmers and fisherfolks, reduce rural poverty, and contribute to national food security and economic stability. With this guide, you can learn more about this agency, and hopefully, it can serve its purpose and help you better if you belong to the agriculture industry.

History

The Agricultural Credit Policy Council (ACPC) was established in 1986 through Executive Order No. 113 to support the Department of Agriculture (DA) in harmonizing credit policies and programs for the agriculture and fisheries sectors. It reviews and evaluates agricultural credit programs—whether funded domestically or internationally—before approval and ensures that credit facilities remain accessible to farmers and fisherfolk.

In 1987, Executive Order No. 116 attached the ACPC to the DA, further solidifying its role in agricultural financial policies. Over the years, ACPC’s mandate expanded, particularly with the enactment of Republic Act No. 7607 (Magna Carta for Small Farmers) in 1992 and Republic Act No. 8435 (Agriculture and Fisheries Modernization Act) in 1997. These laws tasked ACPC with developing special projects, promoting innovative financing schemes, and phasing out directed credit programs (DCPs) to establish the Agro-Industry Modernization Credit and Financing Program (AMCFP).

ACPC’s Legal Framework

ACPC’s authority and responsibilities are based on various legal statutes, including:

- Executive Order No. 113 (1986): Established ACPC and the Comprehensive Agricultural Loan Fund (CALF).

- Executive Order No. 116 (1987): Attached ACPC to the Department of Agriculture.

- Republic Act No. 7607 (1992): Expanded ACPC’s mandate to support small farmers through institutional capacity-building programs.

- Republic Act No. 8435 (1997): Modernized agricultural financing, phasing out directed credit programs and creating the Agro-Industry Modernization Credit and Financing Program (AMCFP).

- Republic Act No. 10000 (2009): Allowed ACPC to accredit financial institutions and set compliance rules for banks investing in agriculture.

Logo

The ACPC logo features a stylized green design symbolizing growth, sustainability, and agricultural development. At its center, a yellow circle represents the sun, signifying hope, progress, and the role of agriculture in national prosperity. The two green leaf-like shapes below the sun form an abstract representation of both a plant and an open book, symbolizing knowledge, financial empowerment, and the agency’s commitment to agricultural education and credit access. An arching green line above the elements reinforces the idea of support and protection for farmers and fisherfolk. The simple yet meaningful design reflects ACPC’s mission to provide accessible financial services that nurture the growth of the Philippine agricultural sector.

Vision

“The ACPC is the Institution on agri credit policy and program development that promotes a sustainable and effective delivery of financial services to the countryside.”

Mission

“To develop and advocate agri-credit policies and orchestrate programs that promote farmers’ and fisherfolk’s access to sustained financial services.”

Core Responsibilities of ACPC

The core responsibilities of the ACPC include:

- Policy and Action Research: ACPC conducts research to provide reliable recommendations on agricultural credit policies and financing programs. This includes monitoring the credit flow to farmers and assessing the effectiveness of lending programs.

- Monitoring and Evaluation: It oversees the allocation and accessibility of government-backed financial assistance for farmers and fisherfolk. The council ensures that credit programs truly benefit their intended recipients.

- Capacity-Building and Institutional Support: The council facilitates training and capacity-building programs for rural financial institutions, cooperatives, and farmers’ organizations to strengthen their financial viability.

- Program Implementation: ACPC administers various government-backed loan programs designed to help small farmers, agripreneurs, and fisherfolk access much-needed capital.

- Advocacy and Information Dissemination: ACPC works to raise awareness about credit policies and available financial assistance programs for agricultural stakeholders. This includes collaborating with local government units (LGUs) and financial institutions.

- Accreditation of Financial Institutions: Under Republic Act No. 10000 (Agri-Agra Reform Credit Act of 2009), ACPC accredits financial institutions that serve as conduits for agricultural credit funds.

Mandate

The Agricultural Credit Policy Council (ACPC) is mandated to develop and implement policies that improve access to financial services for farmers, fisherfolk, and agrarian reform beneficiaries. It serves as the key agency under the Department of Agriculture responsible for coordinating and monitoring agricultural credit programs to ensure they are sustainable and effective. Through partnerships with financial institutions, ACPC facilitates affordable credit and funding assistance to boost agricultural productivity and rural development. Its mandate aligns with the goal of enhancing the livelihood of small farmers and fisherfolk by providing them with the financial resources needed to sustain and expand their agricultural activities.

Powers and Functions

The ACPC is mainly responsible for formulating policies and programs that enhance access to credit for farmers, fisherfolk, and rural enterprises. Its powers and functions also include:

- Policy Formulation: Develops policies and guidelines to improve credit access for the agricultural sector.

- Program Development: Designs and implements financial assistance programs to support farmers, fisherfolk, and agribusinesses.

- Credit Facilitation: Coordinates with banks, cooperatives, and lending institutions to ensure the availability of affordable credit.

- Monitoring and Evaluation: Assesses the effectiveness of agricultural credit programs and recommends improvements.

- Capacity Building: Provides training and technical assistance to improve financial literacy and management among stakeholders.

- Resource Mobilization: Secures funding from government and private sources to sustain agricultural credit initiatives.

- Policy Coordination: Works with the Department of Agriculture and other agencies to align credit policies with national agricultural goals.

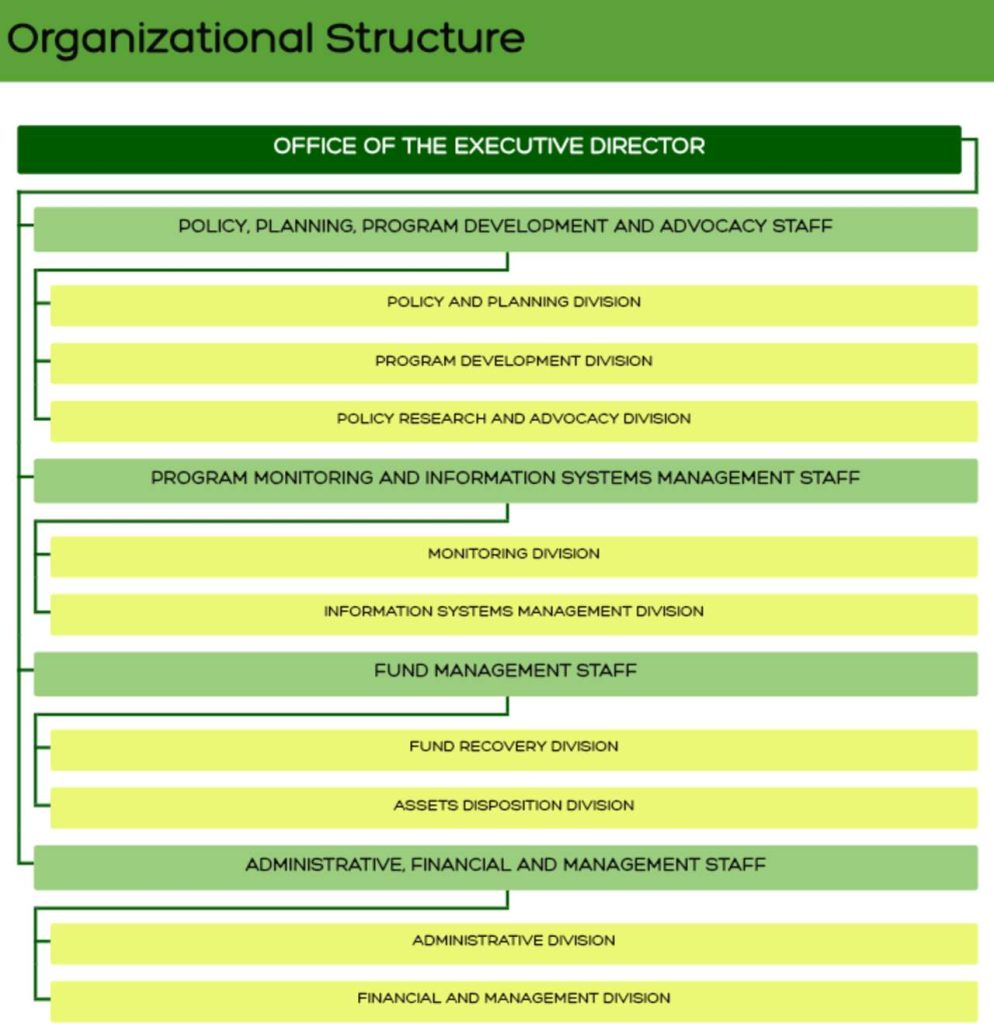

Organizational Structure

ACPC operates under the supervision of the Department of Agriculture (DA) and is governed by a council composed of the following members:

- DA Secretary (Chairperson)

- Bangko Sentral ng Pilipinas (BSP) Governor (Vice-Chairperson)

- Department of Finance (DoF) Secretary

- Department of Budget and Management (DBM) Secretary

- National Economic and Development Authority (NEDA) Director-General

How ACPC Supports Farmers and Fisherfolk

The ACPC offers the following benefits to both farmers and fisherfolks:

- Simplified Loan Access: Through its various programs, ACPC collaborates with accredited lending conduits, such as cooperatives and rural banks, to make credit easily accessible to farmers and fisherfolk.

- No Collateral, Low-Interest Loans: Most of ACPC’s loan programs require minimal or no collateral, with low-interest rates to accommodate small-scale farmers who typically struggle with traditional banking requirements.

- Agricultural Modernization Support: By promoting innovative financing schemes, ACPC helps farmers invest in modern equipment, technology, and sustainable agricultural practices.

- Disaster Recovery Assistance: Through the SURE Assistance Program, ACPC provides financial relief to farmers recovering from typhoons, droughts, and other natural disasters, ensuring continuity in agricultural production.

ACPC’s Loan and Credit Programs

Some of the notable programs initiated by the ACPC include:

1. Young Agripreneurs Loan (KAYA) Program: This program provides financial assistance to young entrepreneurs in agriculture, enabling them to start and expand agribusiness ventures.

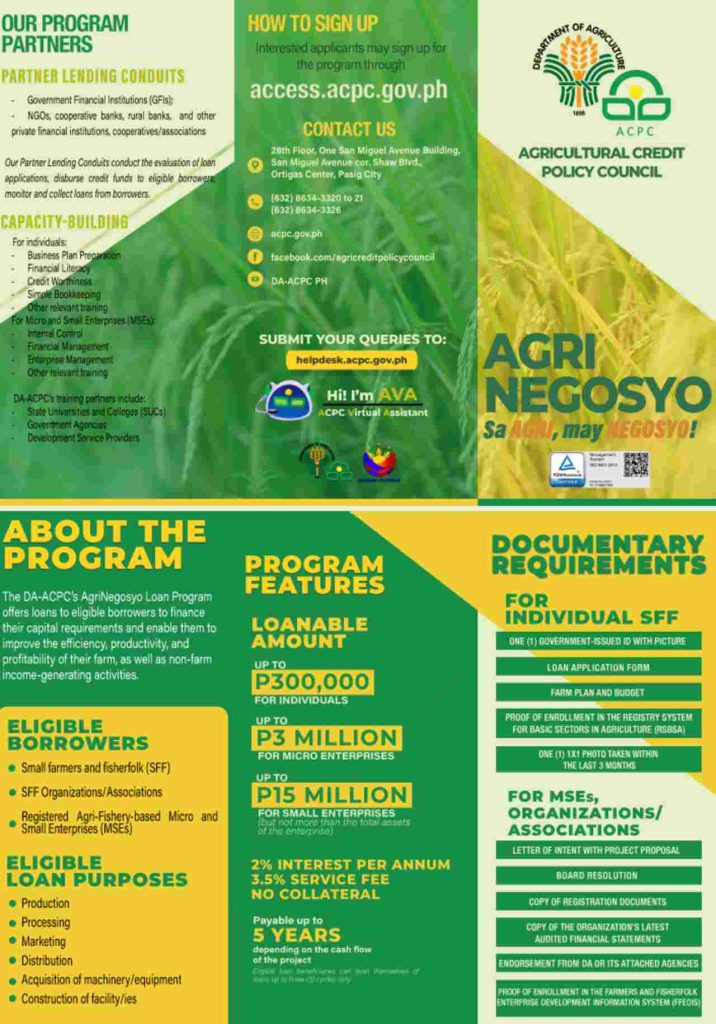

2. Agri-Negosyo (ANYO) Loan Program: Designed to support small and medium agribusinesses, this program offers credit to enterprises engaged in food production and processing.

3. Survival and Recovery (SURE) Assistance Program: Aimed at farmers and fisherfolk affected by natural disasters, the SURE Assistance Program provides emergency loans to help them recover from losses.

4. Alert ARBOs Program: This initiative supports agrarian reform beneficiaries’ organizations (ARBOs) by providing financing solutions to sustain agricultural productivity.

5. Agri-Pinay: This program is a financial assistance initiative aimed at empowering women in agriculture and fisheries by providing accessible, no-interest, and collateral-free loans of up to ₱100,000 to support production, processing, marketing, and technological advancements in the agri-fishery sector.

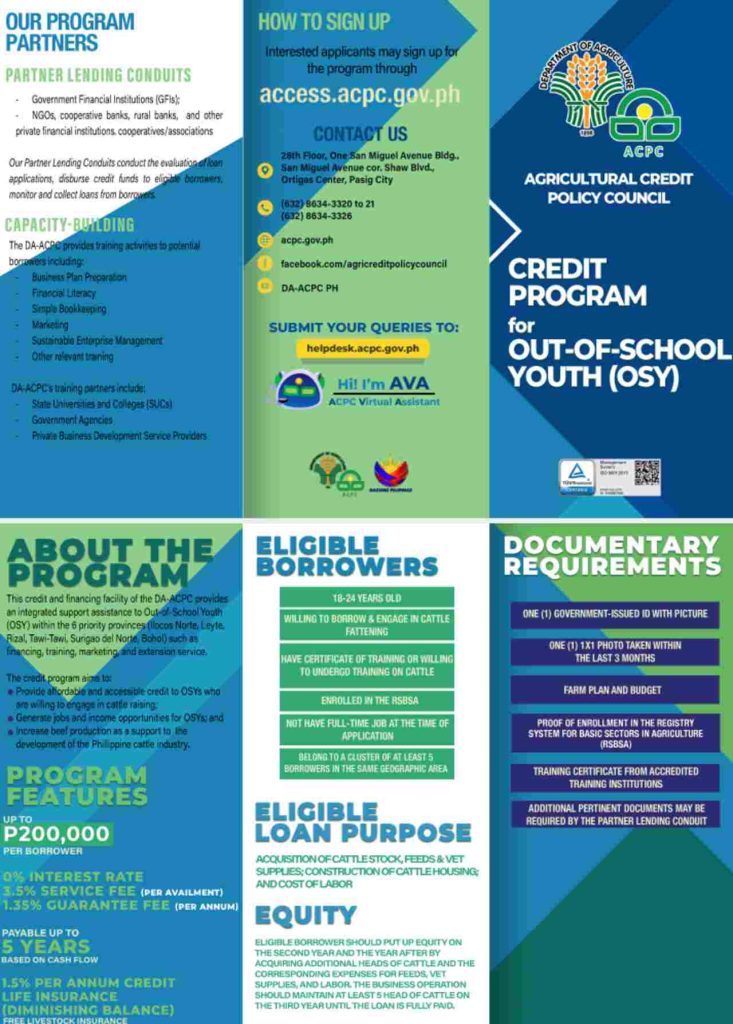

6. Credit Programs for Out-of-School-Youth (OSY): This initiative is designed to provide financial assistance of up to ₱200,000 with zero interest to young individuals aged 18-24 in six priority provinces, supporting them in cattle raising while also offering training, marketing, and extension services to generate income opportunities and boost beef production in the Philippines.

How to Apply for ACPC Loan Programs

Farmers, fisherfolk, and agripreneurs can apply for ACPC loans through its partner lending institutions. The application process involves:

Step 1. Check eligibility

Requirements vary per program, but generally include proof of agricultural involvement.

Step 2. Prepare the necessary documents

This may include government-issued IDs, business registration (if applicable), and project proposals.

Step 3. Submit the applications

Farmers can apply through accredited rural banks, cooperatives, or the DA-ACPC website.

Step 4. Wait for the approval

Processing time varies depending on the program and lending institution.

Video: Getting to Know the DA-ACPC

The Agricultural Credit Policy Council (ACPC) is instrumental in developing sustainable financial solutions for the Philippines’ agriculture and fisheries sector. By facilitating access to credit, promoting innovative financing strategies, and ensuring the proper flow of funds, ACPC contributes significantly to agricultural modernization, food security, and rural development. Farmers and fisherfolk seeking financial assistance can explore ACPC’s various loan programs. To better understand what ACPC is and what it does, watch this explainer video from the agency itself:

Contact Information

For more information about ACPC programs, farmers and fisherfolks can reach out through:

Agricultural Credit Policy Council (ACPC)

Main Office Address: 28th Floor, One San Miguel Avenue Bldg., San Miguel Avenue cor. Shaw Blvd., Ortigas Center, Pasig City

Contact Number: (632) 8634-3320 to 21 / (632) 8634-3326 / (632) 8636-3391

Email Address: info@acpc.gov.ph

Official Website: https://acpc.gov.ph/

Official Facebook Page: https://facebook.com/agricreditpolicycouncil

Helpdesk: https://helpdesk.acpc.gov.ph/