The DA-ACPC AgriPinay Financial Assistance for Women in Agriculture is a government initiative designed to support women engaged in farming and fisheries. Established under the Department of Agriculture – Agricultural Credit Policy Council (DA-ACPC), this program seeks to enhance financial accessibility for women in rural communities, recognizing their significant contribution to the agricultural sector. By providing interest-free loans, the initiative helps improve productivity, strengthen gender inclusion, and promote sustainable agribusiness ventures.

Understanding this program is crucial for women in agriculture who need financial assistance to start or expand their farming activities. With a simplified application process and accessible funding, eligible beneficiaries can secure support without the burden of high-interest rates or collateral. Learning how to apply ensures that more women can take advantage of this opportunity to develop their agribusiness, enhance food security, and contribute to the growth of the agricultural economy in the Philippines and this guide is created to help you do exactly that.

Overview of the Program

The DA-ACPC AgriPinay Financial Assistance for Women in Agriculture is a loan program under the DA-ACPC. This initiative aims to expand women’s access to rural credit, supporting their involvement in the agriculture and fisheries sector to improve their livelihood opportunities, as well as fulfill the following objectives:

- Provide financial assistance to women in agriculture, particularly those affected by income loss.

- Strengthen gender equality in agribusiness.

- Support women in agricultural and fisheries-related enterprises.

Eligible Loan Purposes

Under this program, borrowers can fund various agricultural and agribusiness activities, including:

- Crop production

- Processing of agricultural goods

- Marketing agricultural products

- Purchasing machinery and equipment

- Constructing modern technology facilities

Features

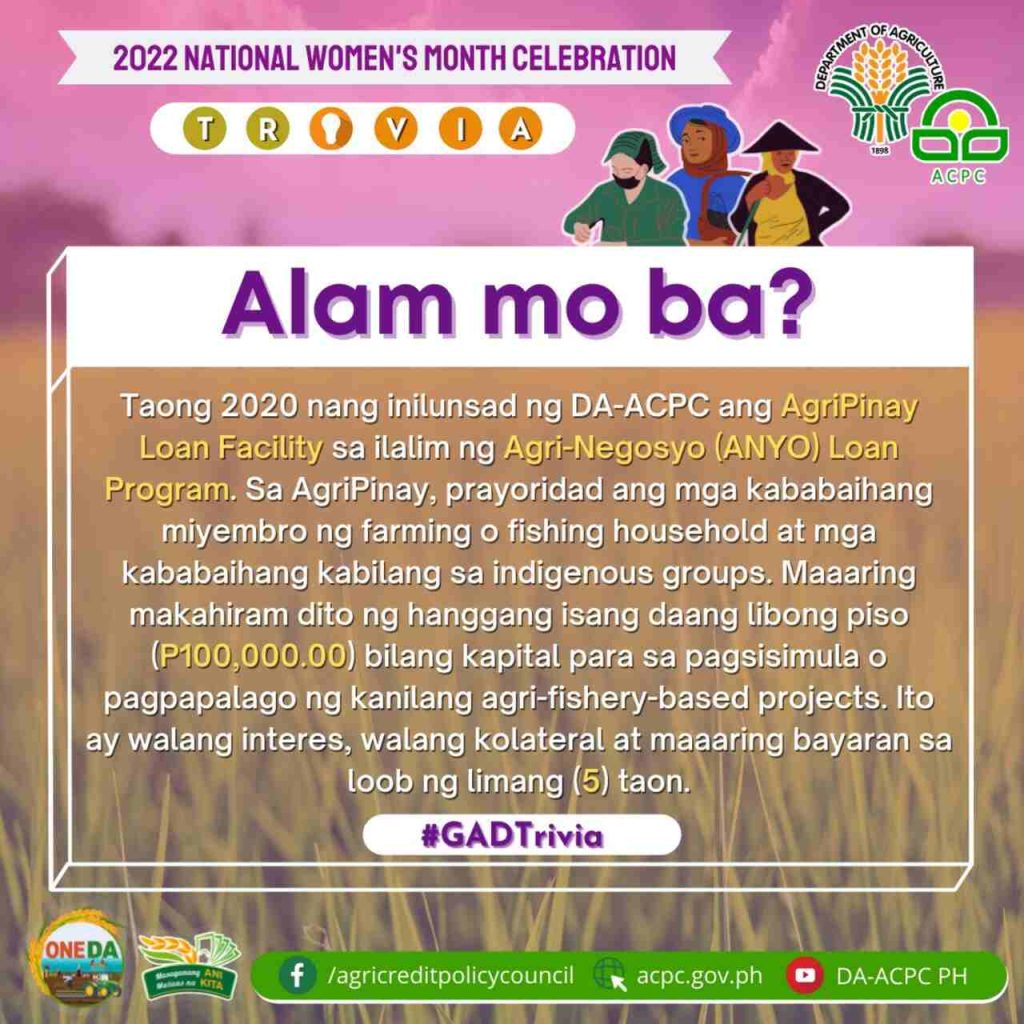

The AgriPinay Program offers flexible and accessible loan features designed to support women in agriculture.

- Loan Amount: Up to ₱100,000 per beneficiary

- Interest Rate: No interest

- Collateral: No collateral required

- Repayment Period: Payable for up to 5 years, depending on the project’s cash flow

- Service Fee: 3.5% of the loan amount

Benefits

The program also offers valuable benefits to successful applicants, helping them grow their agricultural ventures and improve their livelihoods.

- Zero Interest, No Collateral: Borrow up to ₱100,000 without worrying about interest rates or collateral requirements.

- Flexible Repayment Terms: Loans are payable for up to five years, depending on the project’s cash flow.

- Multiple Loan Purposes: Funds can be used for production, processing, marketing, equipment acquisition, or facility construction.

- Capacity-Building Support: Access training in financial literacy, bookkeeping, business planning, and creditworthiness.

- Inclusive Eligibility: Open to women in farming and fisheries, including those from indigenous communities.

- Government-Endorsed Program: Backed by the Department of Agriculture and managed by trusted lending conduits.

Who Can Apply?

The program is open to:

- Female members of households of small farmers and fisherfolk (SFF).

- Women from indigenous communities.

- Applicants must be endorsed by the DA Regional Gender and Development (GAD) focal person in their area.

Qualifications

To qualify for the DA-ACPC AgriPinay Financial Assistance for Women in Agriculture, applicants must meet specific eligibility criteria to ensure they are part of the program’s target beneficiaries.

- Must be a woman: The program is exclusively for female beneficiaries.

- Must belong to a small farming or fishing household: Applicants should be part of a household engaged in small-scale agriculture or fisheries.

- Can be a member of an indigenous community: Women from indigenous groups are also eligible.

- Must be endorsed by the DA Regional Gender and Development (GAD) Focal Person: Applicants need a recommendation from the designated DA representative in their area.

- Must provide required documents: These include a government-issued ID, a completed loan application form, a farm plan and budget, proof of enrollment in the Registry System for Basic Sectors in Agriculture (RSBSA), and a recent 1×1 photo.

Documentary Requirements

Applicants must submit the following documents:

- One (1) government-issued ID with a photo

- Duly accomplished loan application form

- Farm plan and budget

- Proof of enrollment in the Registry System for Basic Sectors in Agriculture (RSBSA)

- One (1) recent 1×1 photo (taken within the last three months)

How to Apply

To apply, you will simply need to follow these steps:

Step 1: Sign Up Online

Interested applicants can register through the official DA-ACPC online portal: access.acpc.gov.ph

Step 2: Attend Capacity-Building Training

Before receiving financial assistance, borrowers participate in training sessions, which cover:

- Business plan preparation

- Financial literacy

- Creditworthiness

- Simple bookkeeping

- Other relevant topics

These sessions are conducted in partnership with state universities and colleges (SUCs), government agencies, and private business development service providers.

Step 3: Endorsement and Loan Processing

- The DA Regional GAD focal person endorses eligible borrowers to the partner lending institutions.

- Partner lending conduits (PLCs) process the applications, disburse funds, and manage loan monitoring and collection.

- The DA-ACPC oversees the program and ensures proper fund management.

Step 4: Loan Disbursement

Once approved, the loan is released based on the agreed project timeline. The repayment period is determined based on the projected cash flow of the business.

Where to Secure the Application Form

Applicants can complete the AgriPinay loan application form by visiting access.acpc.gov.ph, the official portal of the Agricultural Credit Policy Council (ACPC). Once completed, the form, along with the required documents, must be submitted to the designated DA Regional Gender and Development (GAD) Focal Person for endorsement. For further inquiries or assistance, applicants can contact the ACPC through their website, helpdesk, or official Facebook page.

Important Reminders

Before applying for the DA-ACPC AgriPinay Financial Assistance for Women in Agriculture, applicants should keep these important reminders in mind to ensure a smooth application process.

- Endorsement is required: Applicants must secure a recommendation from the DA Regional GAD Focal Person.

- Submit complete documents: Incomplete applications may result in delays or disqualification.

- Loan approval depends on eligibility and assessment: Meeting the criteria does not guarantee automatic approval.

- Funds must be used for approved purposes: Loans should only be used for production, processing, marketing, equipment acquisition, or facility construction.

- Check official sources for updates: Visit acpc.gov.ph or their Facebook page for announcements and program changes.

Video: DA-ACPC AgriPinay Loan Program

The DA-ACPC AgriPinay Financial Assistance for Women in Agriculture provides accessible financial support for women engaged in agriculture and fisheries. By following the application steps and meeting the requirements, eligible borrowers can secure funding for their agricultural projects and contribute to the growth of the sector in the Philippines. To learn more about the program, you may also check out this video from ACPC:

Where to Get More Information

For inquiries and assistance, applicants may contact:

Agricultural Credit Policy Council (ACPC)

- Main Office Address: 28th Floor, One San Miguel Avenue Bldg., San Miguel Avenue cor. Shaw Blvd., Ortigas Center, Pasig City

- Contact Number: (632) 8634-3320 to 21 / (632) 8634-3326 / (632) 8636-3391

- Email Address: info@acpc.gov.ph

- Official Website: https://acpc.gov.ph/

- Facebook: https://facebook.com/agricreditpolicycouncil

- Helpdesk: https://helpdesk.acpc.gov.ph/

For quick assistance, applicants may also use AVA (ACPC Virtual Assistant) via the ACPC official website.