The Social Security System (SSS) offers retirement benefits to provide financial assistance to retired individuals who have stopped working due to old age. This benefit is part of the SSS program and is available in two forms: a monthly pension or a lump sum. Applying for the SSS retirement benefit can help retirees maintain financial stability during their retirement years.

Understanding the eligibility requirements and application process is critical for those planning to secure this benefit. This detailed guide outlines the types of retirement benefits, qualifying conditions, payment modes, and the steps involved in filing your claim.

Program Overview

The SSS Retirement Benefit is a financial program designed to provide income security to members who can no longer work due to old age. It offers either a monthly pension or a lump-sum amount, depending on the member’s eligibility and contribution record. It covers private-sector employees, self-employed individuals, voluntary members, and OFWs who have met the age and contribution requirements. Established in 1957 under the Social Security Act, the program aims to make sure that retirees have a steady source of income during their post-employment years.

Benefits

The SSS retirement benefit is available in two forms:

- Monthly Pension: This lifetime benefit is provided monthly to retirees who have contributed at least 120 months before their retirement. The amount depends on the member’s average monthly salary credit (AMSC) and credited years of service (CYS).

- Lump Sum Benefit: This one-time payment is offered to retirees who have contributed for less than 120 months. The amount is equivalent to the total contributions made by the member and their employer, including accrued interest.

Additional Benefits for SSS Retirees

- 13th Month Pension: All retirees receive an extra month’s pension every December.

- PHP 1,000 Pension Increase: Effective January 1, 2017, an additional PHP 1,000 is added to the monthly pension.

- Dependent’s Pension: Dependent children may receive an additional 10% of the monthly pension or PHP 250, whichever is higher.

Eligible dependents include children who are:

- Legitimate, legitimated, legally adopted, or illegitimate.

- Unmarried and below 21 years old.

- Incapacitated, regardless of age.

Benefit Payment and Deductions

- Payment Modes: The retirement benefit is credited to the retiree’s Unified Multi-Purpose Identification (UMID) card enrolled as an ATM. If the UMID card is unavailable, beneficiaries must register a preferred disbursement account via the My.SSS Portal’s Disbursement Account Enrollment Module (DAEM).

- Advance Pension Option: Retirees may opt to receive the first 18 months of their pension in advance as a lump sum. This amount is discounted at a preferential interest rate.

- Possible Deductions: Retirement benefits may have deductions for the following:

- Unpaid Loans: Any outstanding short-term loans.

- Unemployment Benefits: If re-employed within two months after receiving unemployment benefits.

- Overlapping Benefits: Sickness or disability benefits overlapping with the retirement benefit.

- Overpaid Pension: If dependents pass away, marry, or gain employment.

Target Beneficiaries

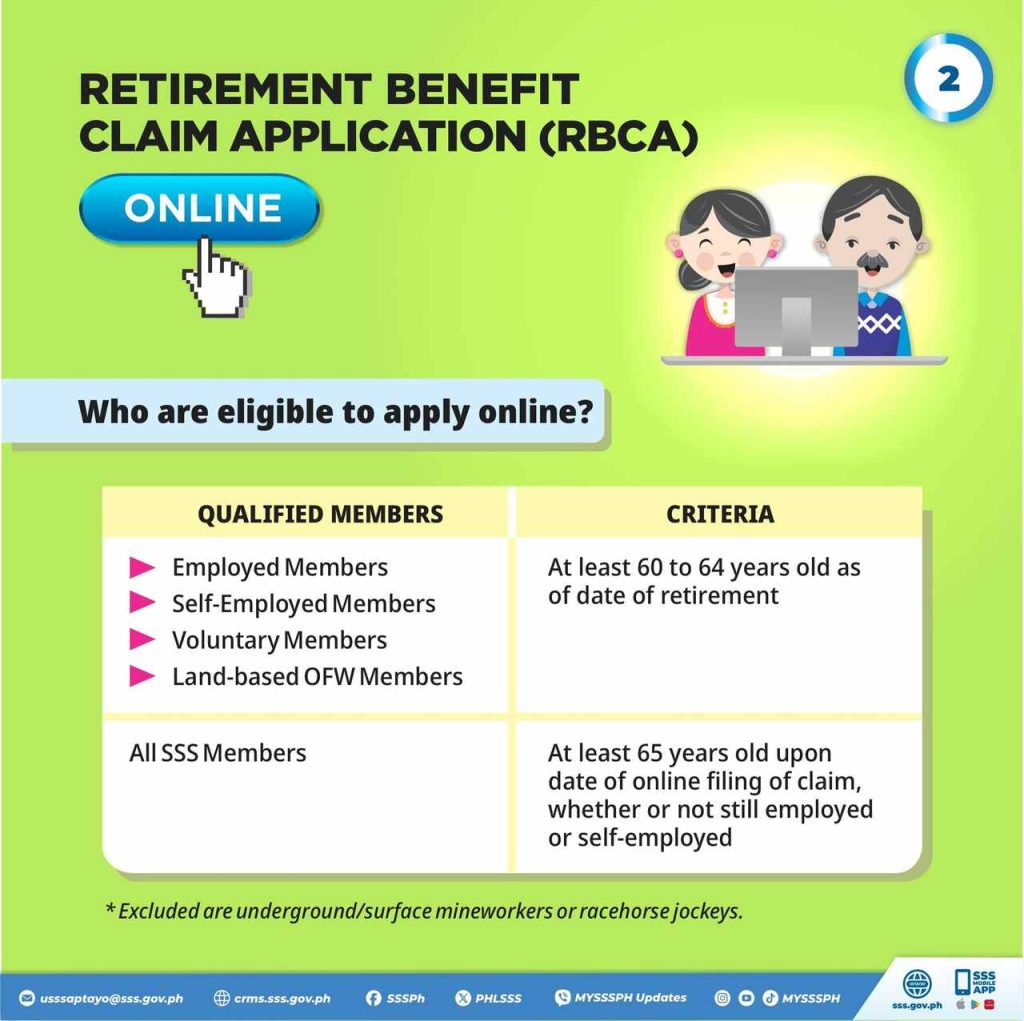

The SSS Retirement Benefit is designed to support specific groups of individuals who meet the eligibility requirements:

- Private-sector employees aged 60 to 64 who are separated from employment.

- Land-based Overseas Filipino Workers (OFWs) aged 60 and above.

- Voluntary members aged 60 and above.

- All members aged 65 and above, regardless of employment status.

- Underground or surface mineworkers and racehorse jockeys meeting specific retirement age requirements.

Qualifications

To qualify, an individual must meet the following conditions:

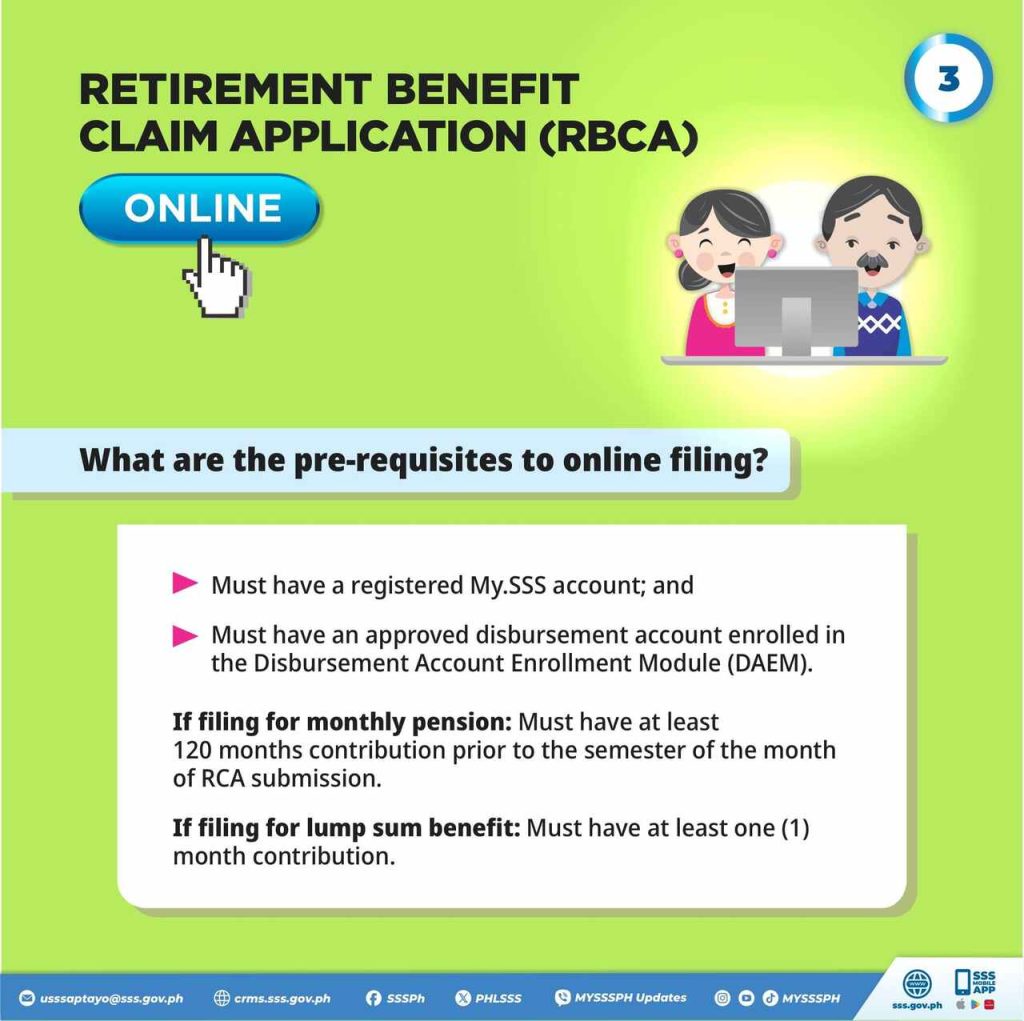

- Contribution Requirements: At least 120 monthly contributions prior to the semester of retirement.

- Age Requirements:

- Optional Retirement: At least 60 years old and no longer employed/self-employed.

- Technical Retirement: At least 65 years old, regardless of employment status.

Special conditions apply to certain professions:

- Mineworkers: Can retire at 50 (optional) or 60 (technical).

- Racehorse Jockeys: Can retire at 55.

- Former Retirees: Pensioners who resumed employment but have since retired again may reapply.

Documentary Requirements

Here’s a list of documentary requirements that the SSS Retirement benefit applicants need to prepare:

For Over-the-Counter (OTC) Filing

- Retirement Claim Application Form (RCA).

- Member’s/Claimant’s Photo and Signature Card (if no UMID card).

- Valid identification card(s) (original for verification and photocopy for submission).

- Disbursement account (e.g., bank account, e-wallet like Maya or GCash).

For Technical Retirement

- Retirement Claim Application (RCA) or RCA under Portability Law (1 original copy)

- Member’s/Claimant’s Photo and Signature Card (if no UMID card issued)

- Single Savings Account Proof (1 photocopy).

- Government-issued Identification Documents

Additional Supporting Documents

If Separated from Employment/Self-employment:

- Certificate of separation (from the last employer).

- Affidavit of separation from employment/self-employment.

If Filed by a Representative:

- Two valid IDs of the member and representative (1 photocopy each).

- Letter of Authority (LOA) or Special Power of Attorney (SPA) signed by the member.

For Members with Dependents:

- Birth certificates of dependent children (if unregistered in SSS).

- Marriage certificate (if spouse details are unregistered).

- For incapacitated dependents: medical certificate confirming the condition.

If Claim Includes More than Five Dependents:

- Marriage Certificate (if legal spouse is unregistered in the member’s records).

- Birth Certificates of dependent children.

- Adoption Decree or Certificate of Finality (if applicable).

If the Member is Incapacitated or Under Guardianship:

- Medical Certificate (issued within 3 months).

- In-Trust-For (ITF) Savings Account.

- Affidavit of Guardianship (if guardian is the legal spouse).

For Dependent Child Under Guardianship:

- ITF Account for the child.

- Claim for Dependent’s Pension Benefit Form or Representative Payee Application.

For Specific Professions:

- Underground/surface mineworkers: Certification of employment indicating job description and tenure.

- Racehorse jockeys: Certification of employment details from relevant employers.

How to Apply for the SSS Retirement Benefit

There are different ways to apply for the SSS Retirement claims. These include:

Online Application

The majority of retirement benefit claims are processed online through the My.SSS Portal. To apply:

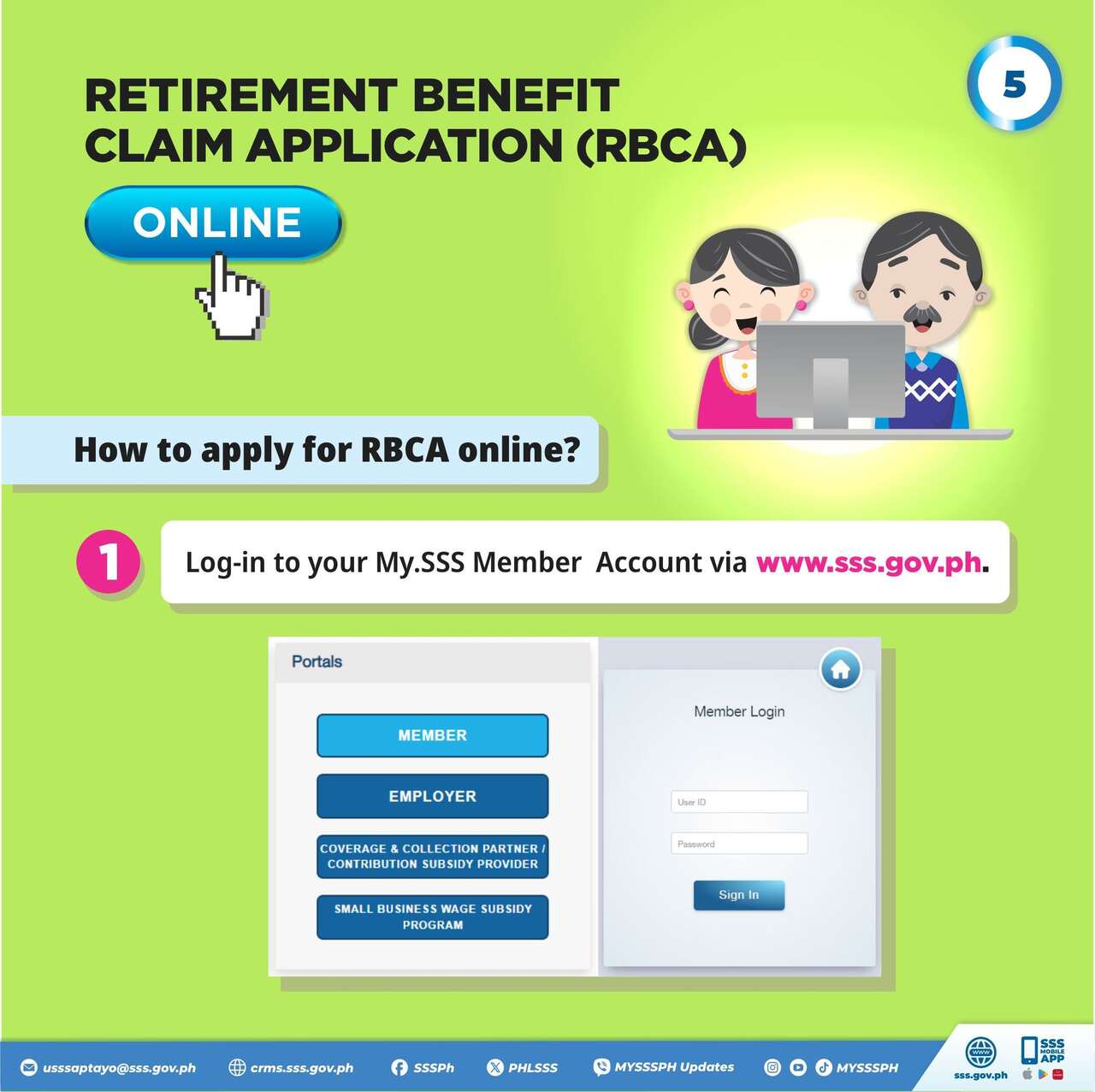

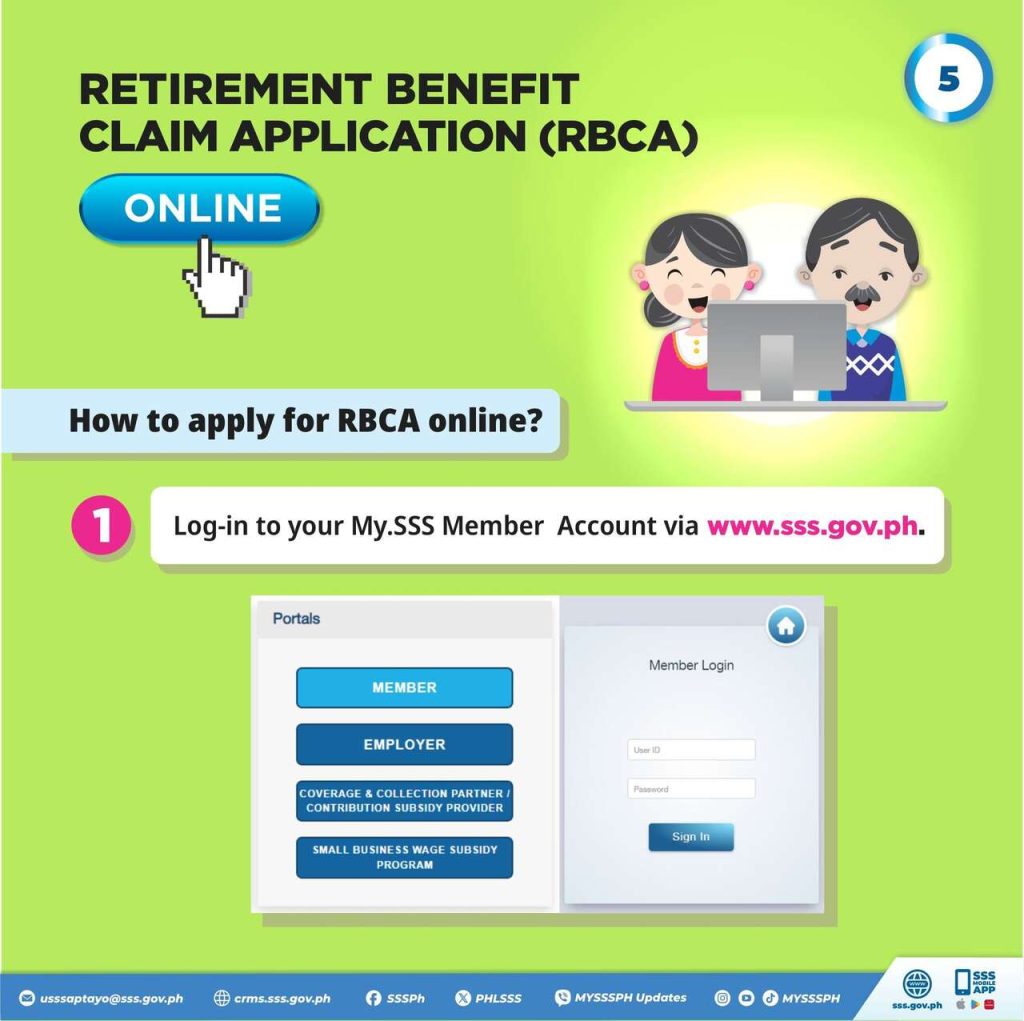

Step 1. Visit the SSS website (www.sss.gov.ph) and log in to the My.SSS Portal.

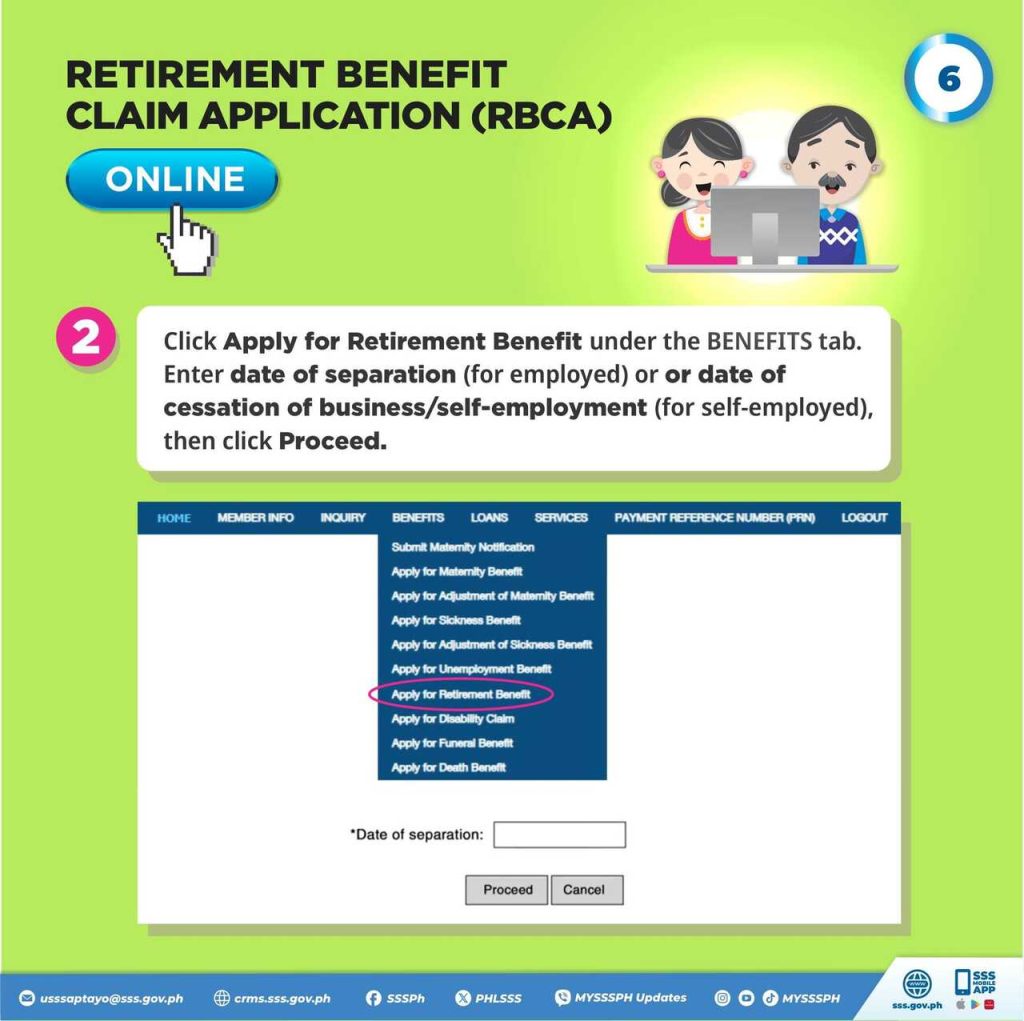

Step 2. Select “Apply for Retirement Claim Application” under the E-Services menu.

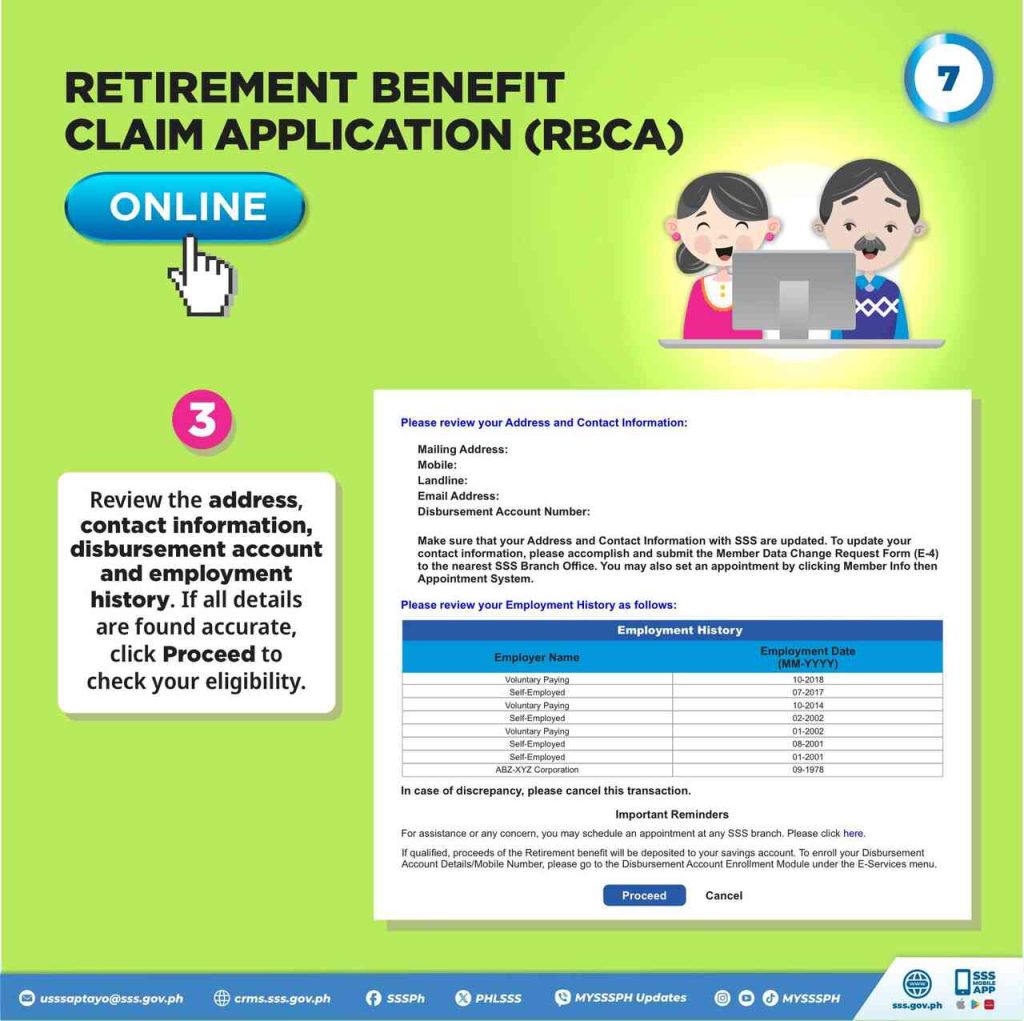

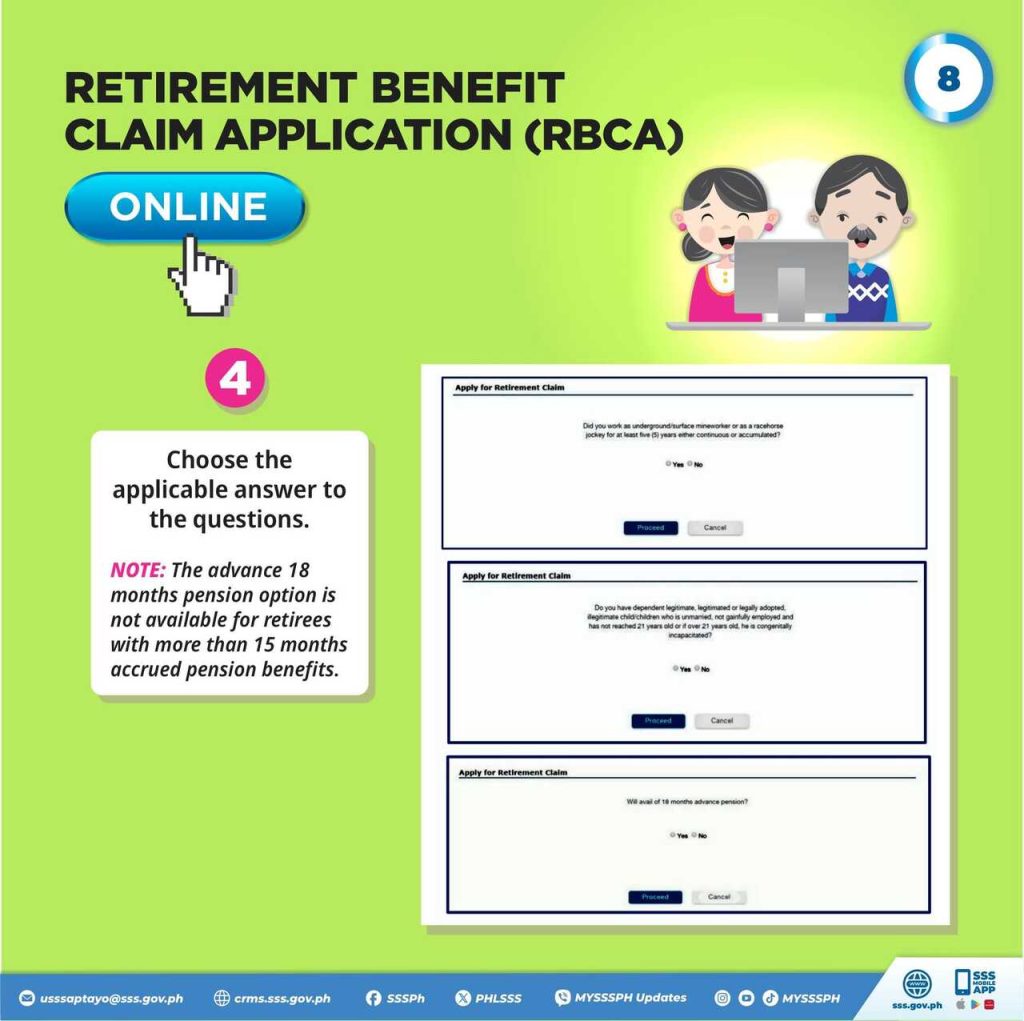

Step 3. Fill out the required details and review the instructions.

Step 4. Choose to avail of the advance 18-month retirement pension, if applicable.

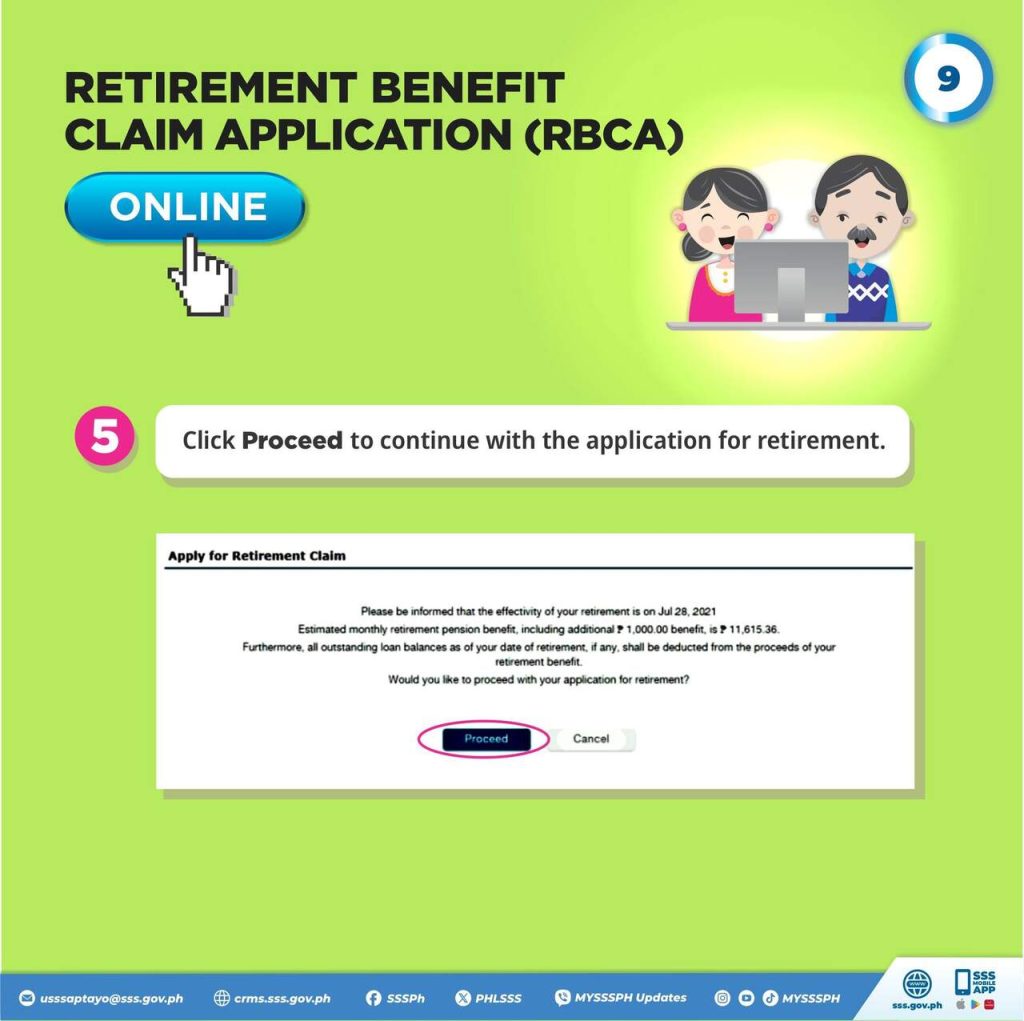

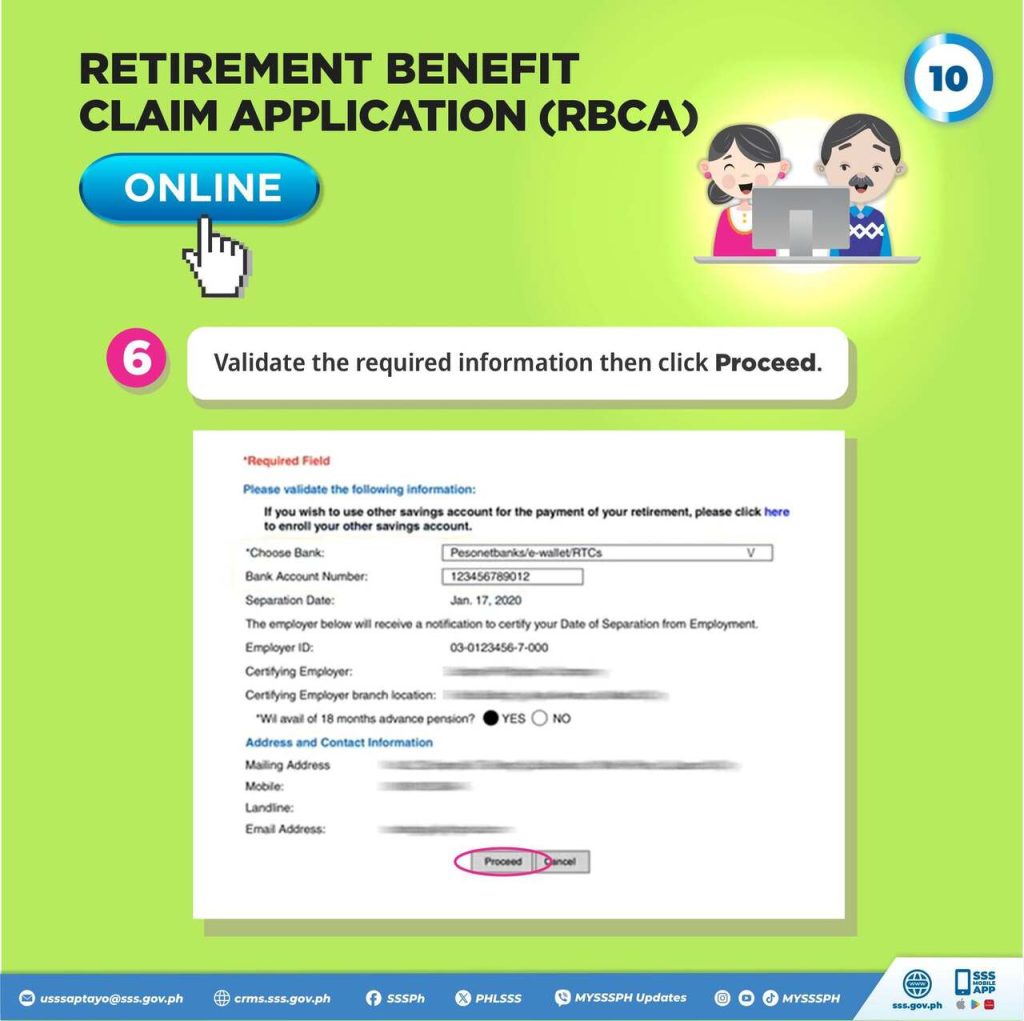

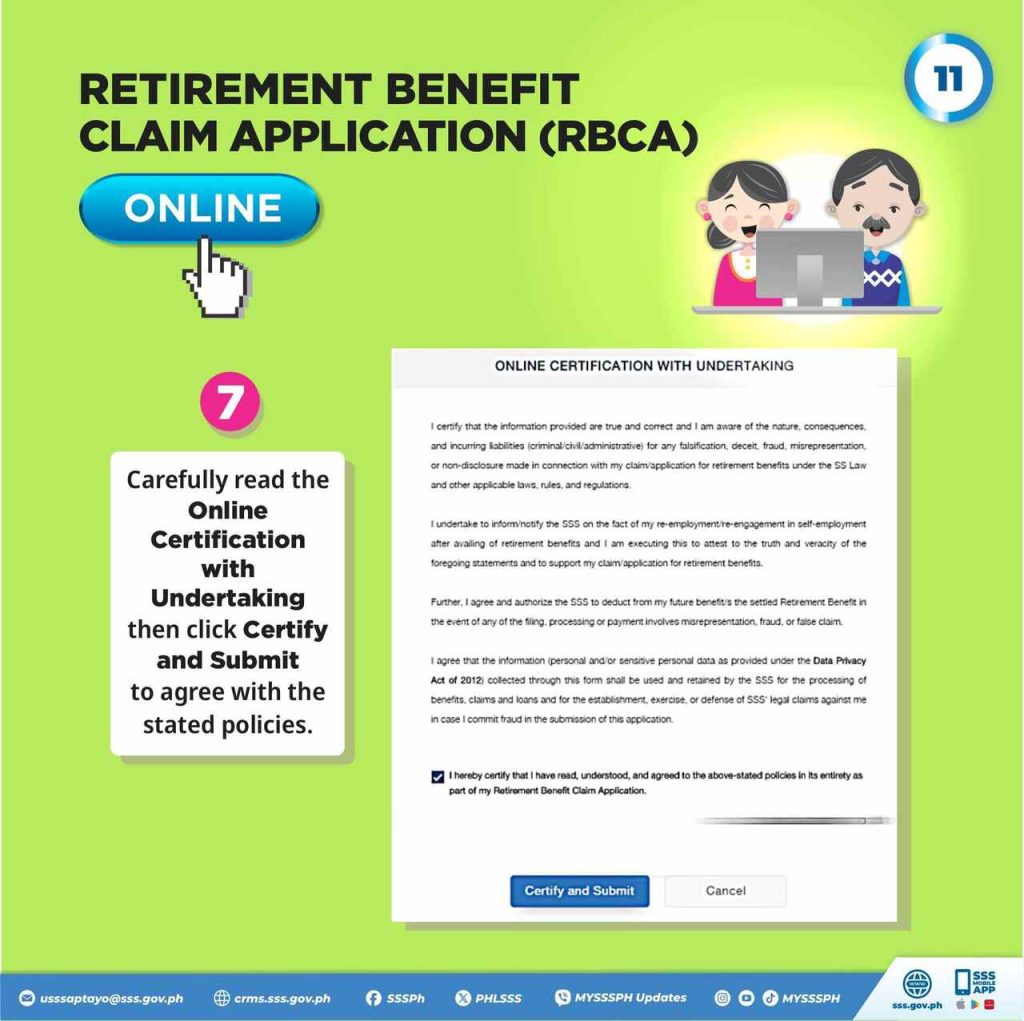

Step 5. Agree to the certification terms by selecting the “Certify and Proceed” option.

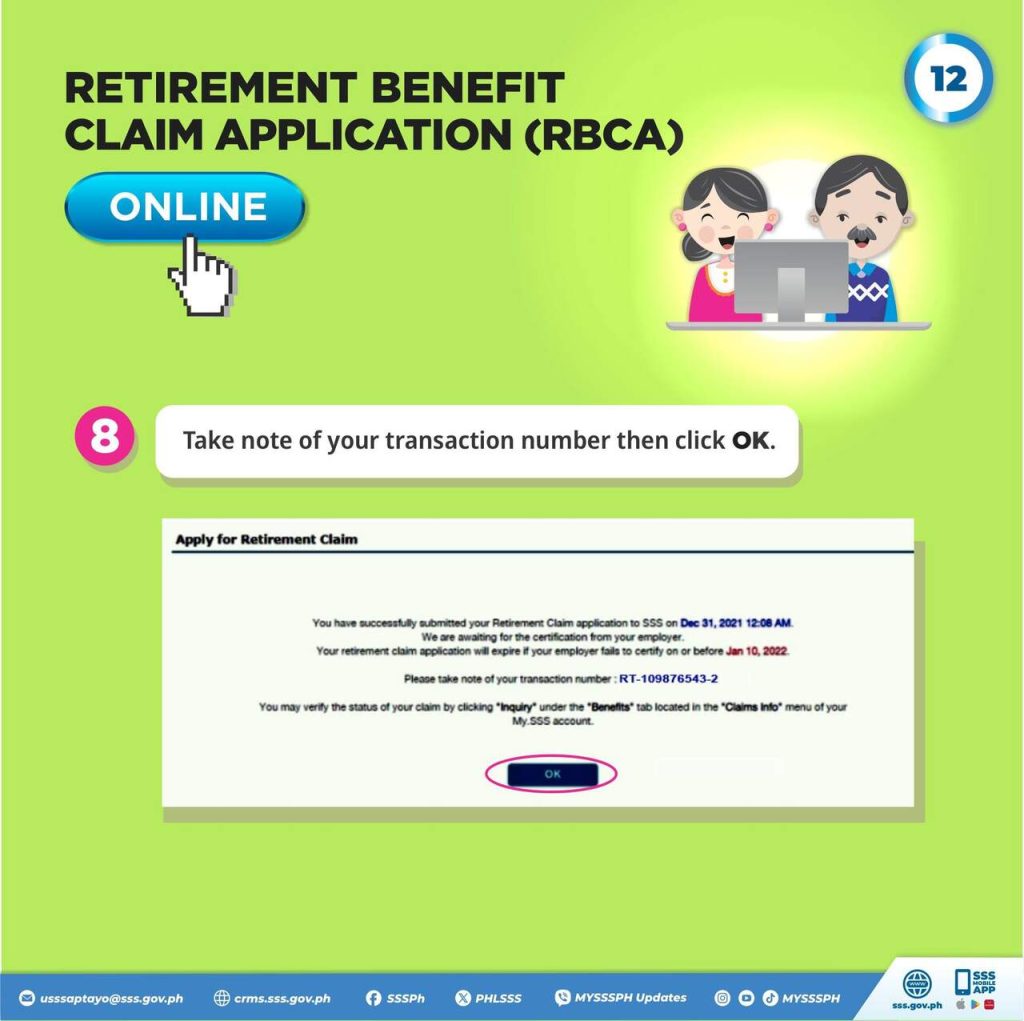

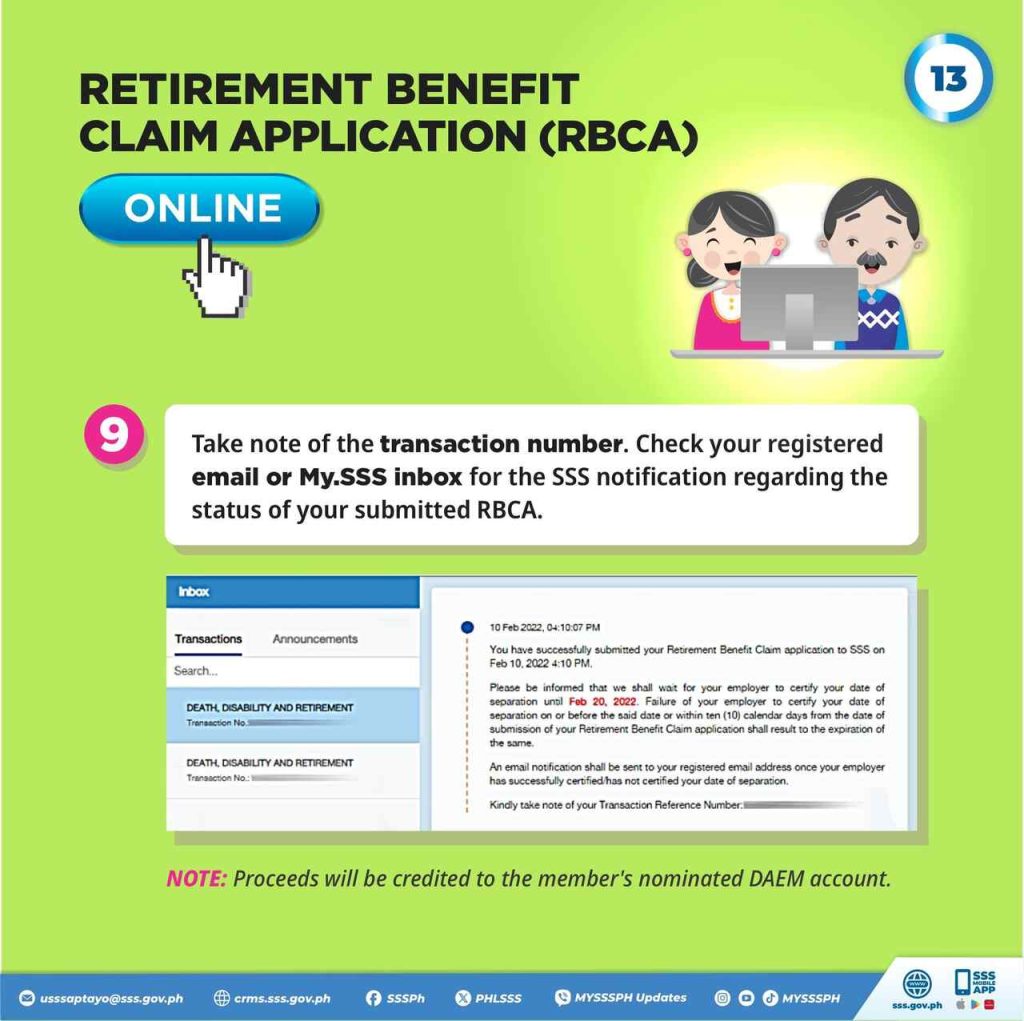

Step 6. Check for notifications in the My.SSS inbox or email regarding the claim status.

Over-the-Counter (OTC) Filing

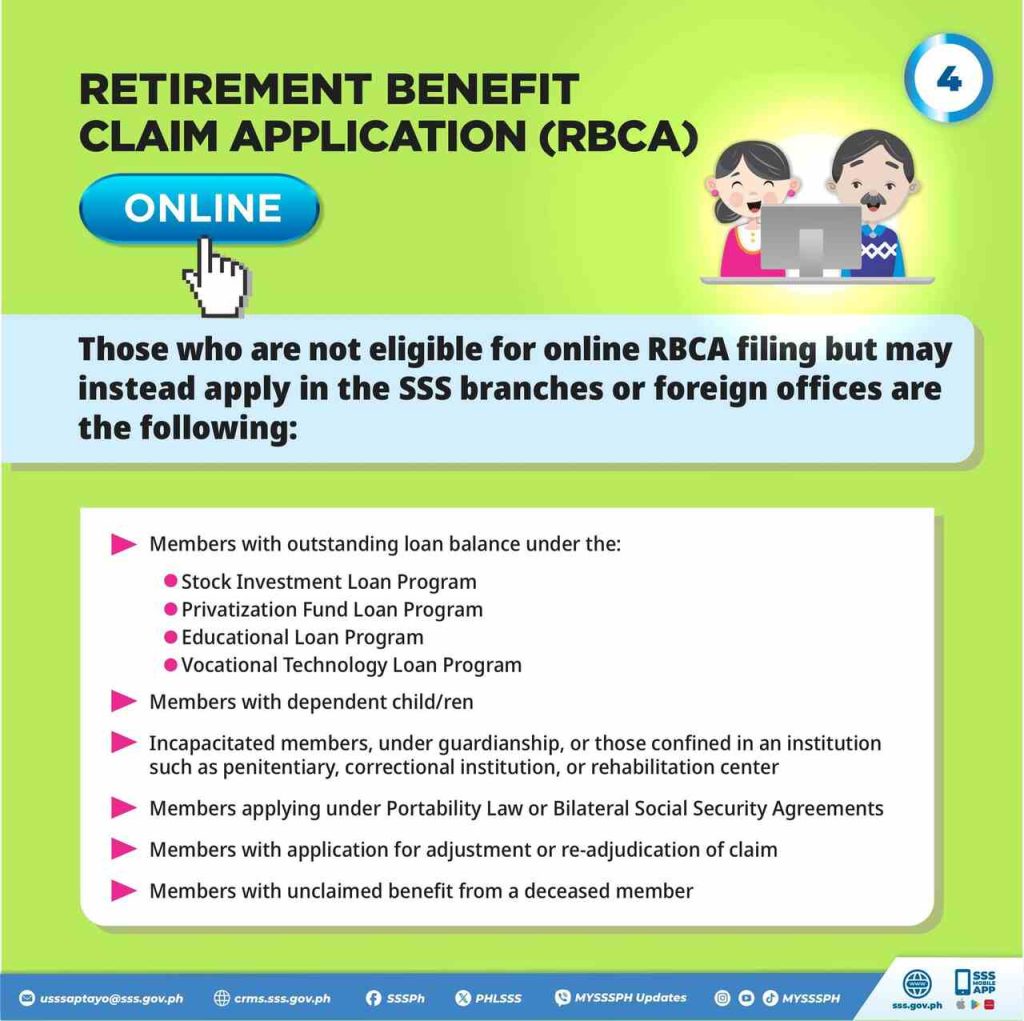

In special cases, members may file their claims OTC. These cases include:

- Having dependent children.

- Being incapacitated, under guardianship, or confined in an institution.

- Applying under international agreements or portability laws.

Here are the steps to follow:

Step 1. Ensure all pre-requisites and documents are complete.

Step 2. Submit the application and supporting documents at the nearest SSS branch.

Step 3. Wait for notification or confirmation regarding the status of your claim for at least 15 days.

For Technical Retirement

Step 1. Submit original and photocopy of all requirements for authentication.

Step 2. File the Retirement Claim Application (RCA) or Member’s Information Sheet at an SSS Branch.

Step 3. SSS personnel will verify documents, encode data, and conduct a Q&A session.

Step 4. Confirm Q&A results and sign the electronic RCA and acknowledgment letter.

Step 5. Receive an acknowledgment letter if the claim is complete, or a rejection letter if denied.

Step 6. Scanned documents will be sent to the Processing Center for review and approval

Important Notes for Retirees

For your reference, here are some important reminders you need to take note of to ensure hassle-free application procesures:

- Voluntary Contributions: Members with less than 120 contributions may continue paying voluntarily until they meet the required 120 months to qualify for the monthly pension.

- Dependent Benefits: Dependent children can receive benefits as long as they meet the eligibility criteria.

- Portability Law: Members with combined contributions from foreign social security systems may apply under international agreements.

- Claims requiring employer certification expire after 10 calendar days if the employer fails to certify. Members will need to refile.

- Processing time is generally 15 working days.

Video: Online Application for the SSS Retirement Benefits

For a visual walkthrough on how to claim the SSS retirement benefits via the My.SSS portal, please check this video from MYSSSPH:

Summary

The SSS retirement benefit provides financial support for retirees through a monthly pension or a lump sum payment. Eligibility depends on age, contribution history, and employment status. Applying is convenient through the My.SSS Portal, but special cases allow for OTC filing. Retirees can enjoy additional perks such as a 13th-month pension and dependent benefits. By understanding the requirements and process, you can make the most of the SSS program for a comfortable retirement.