The Philippine Guarantee Corporation (PhilGuarantee) is a government-owned and controlled corporation (GOCC) under the Department of Finance, established to enhance access to credit for key sectors of the economy. It is a credit guarantee institution that provides risk mitigation for lenders by offering a commitment to assume responsibility for a borrower’s debt in case of default. It provides credit guarantees to financial institutions, reducing lending risks and encouraging and facilitating loans for businesses, housing, agriculture, and infrastructure development. Formed through Executive Order No. 58 in 2018, PhilGuarantee emerged from the merger of the Home Guaranty Corporation (HGC) and the Philippine Export-Import Credit Agency (PhilEXIM), consolidating multiple guarantee programs into a single entity for greater efficiency.

The creation of PhilGuarantee aimed to strengthen financial support mechanisms for small businesses, housing projects, and priority industries by ensuring sustainable credit supplementation. By guaranteeing loans, the corporation encourages banks and lending institutions to extend credit to borrowers who may otherwise struggle to secure financing. Understanding PhilGuarantee is crucial for stakeholders in various sectors, as it serves as a bridge between financial institutions and underserved borrowers, fostering economic growth and financial stability in the Philippines. If you are unaware of PhilGuarantee and its services before today, then this guide should tell you everything you need to know—from PhilGuarantee’s background to its objectives, programs, and how it supports economic development in the Philippines.

What is a Credit Guarantee and Why is it Important?

A credit guarantee is a formal commitment by a third party (the guarantor) to cover a borrower’s debt obligations if the borrower fails to repay. This reduces the lending risk for financial institutions, making them more willing to extend loans.

Benefits of Having a Credit Guarantee

- Risk Reduction: Lenders are protected from loan defaults.

- Zero-Risk Weighted Loans: Guaranteed loans do not require additional capital reserves.

- Tax and Fiscal Incentives: Banks, real estate developers, and financial institutions benefit from reduced tax liabilities.

- Lower Interest Rates: Borrowers can negotiate better loan terms due to the reduced risk for lenders.

History

As an agency in-charge of offering credit guarantee in the country, PhilGuarantee has a pretty colorful history that started when Executive Order No. 58 was signed on July 23, 2018. This EO facilitated the merger of the Home Guaranty Corporation (HGC) and the Philippine Export-Import Credit Agency (PhilEXIM), creating the PhilGuarantee as it is today. Additionally, it transferred the guarantee functions, programs, and funds of the Small Business Corporation (SBC), as well as the administration of the Agricultural Guarantee Fund Pool (AGFP) and the Industrial Guarantee and Loan Fund (IGLF), to PhilEXIM, which was then renamed PhilGuarantee.

The merger became effective on August 31, 2019, as part of efforts to streamline government financial guarantee services and expand credit access to priority sectors.

Logo

The PhilGuarantee logo features a stylized blue color scheme. The design incorporates elements symbolizing security and growth, often reflecting the company’s focus on providing financial guarantees. The logo aims to evoke trust and stability, aligning with the organization’s mission to support economic development and facilitate access to credit.

Mission

“As the Principal Agency for State Guarantee Finance of the Philippines, we provide accessible, reliable, efficient and gender-responsive guarantee systems, to enable access to credit for stakeholders, in trade and investments, infrastructure, housing, agriculture, MSMEs and other priority sectors of the Government. By championing resilience as a dynamic and transformative organization, we contribute to building a more sustainable and equitable future for the Philippines.”

Vision

“By 2028, PhilGuarantee shall be a strong and trusted State-Owned Enterprise, the reliable and gender-responsive partner in championing inclusive growth, building resilience, and catalyzing regional development of economic sectors, and a key regional player for guarantee finance and actively contributing to a disaster-resilient ASEAN Community.”

Core Values

The agency operates under the guidance of these core values:

- Adaptability: The organization welcomes change and continuously evolves to meet the shifting demands of the business landscape, especially during challenging times.

- Resilience: With a strong foundation, PhilGuarantee remains steadfast in overcoming obstacles, ensuring long-term success for its stakeholders.

- Integrity: Every action is rooted in trust and unity, upholding transparency and accountability in public service.

- Sustainability: Committed to responsible economic and social development, PhilGuarantee takes steps today that lead to a better, more stable future for all.

- Proactive Service: Dedicated to efficiency and effectiveness, the organization delivers responsive solutions that adapt to the evolving needs of its stakeholders.

Mandate

It is a government-owned and controlled corporation (GOCC) that emerged from the merger of five Philippine Guarantee Programs and Agencies (PGPAs) under Executive Order No. 58, Series of 2018. Previously known as the Philippine Export-Import Credit Agency (PhilEXIM), it serves as the country’s primary institution for state-backed credit guarantees. This consolidation aimed to streamline and strengthen the government’s guarantee programs, enhancing their efficiency and impact.

As the leading state guarantee finance agency, PhilGuarantee provides credit guarantees to financial institutions, helping businesses and key industries secure funding. It supports economic growth by facilitating access to credit in sectors such as trade, exports, infrastructure, energy, tourism, agriculture, housing, and micro, small, and medium enterprises (MSMEs). Through these initiatives, the agency promotes financial inclusion and regional development, fostering a more robust and resilient economy.

Objectives

PhilGuarantee aims to support economic growth and regional development by offering credit guarantees in the following sectors:

- Housing: Facilitating access to affordable home financing.

- Agriculture: Supporting farmers, fisherfolk, and agribusinesses.

- MSMEs: Enhancing credit opportunities for small businesses.

- Infrastructure: Assisting in financing for development projects.

- Exports: Encouraging international trade through financial support.

- Sustainable Energy: Promoting eco-friendly investments and projects.

Powers and Functions

It serves as the government’s principal credit guarantee institution, consolidating functions from several agencies to support various sectors of the economy and enhancing the efficiency and effectiveness of government credit guarantee programs to foster economic growth across various industries. Its key functions, as outlined in Section 1 of Executive Order No. 58, include:

- Merging the Home Guaranty Corporation (HGC) into PhilGuarantee: Integrating HGC’s guarantee functions, programs, personnel, assets, and liabilities to streamline housing finance support.

- Assuming guarantee-related functions from the SBC: Taking over programs and funds aimed at assisting micro, small, and medium enterprises (MSMEs) in accessing credit.

- Administering the Agricultural Guarantee Fund Pool (AGFP): Managing funds and programs designed to mitigate risks associated with agricultural lending, thereby encouraging financial institutions to support farmers and agribusinesses.

- Overseeing the Industrial Guarantee and Loan Fund (IGLF): Handling programs that provide guarantees and loans to promote industrial development and support enterprises in priority sectors.

Organizational Structure

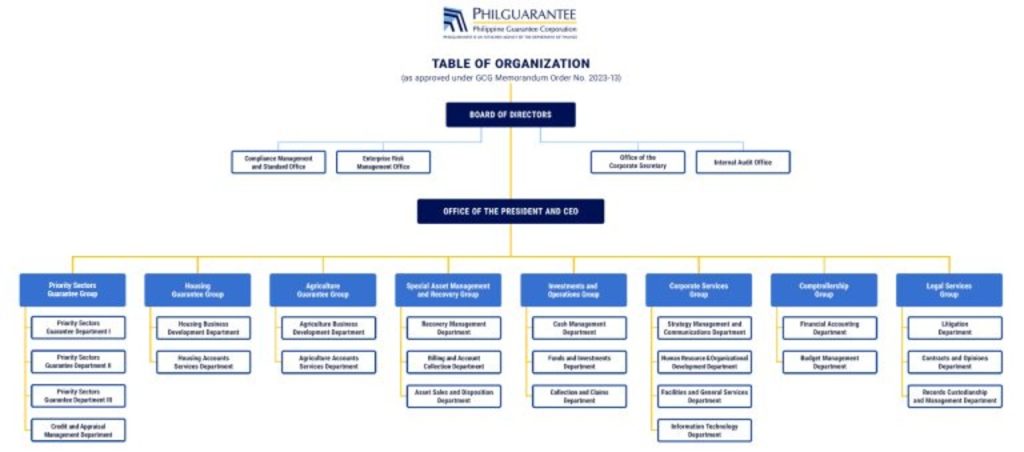

As an agency, PhilGuarantee has a structured organization to efficiently manage and implement its guarantee programs. At the top is the Board of Directors, which provides governance and strategic direction, supported by four offices handling compliance, risk management, corporate records, and internal audits. Directly under the board, the Office of the President and CEO oversees the corporation’s operations, ensuring its services align with its mandate. Several specialized groups handle key areas such as housing, agriculture, priority sectors, asset recovery, investments, corporate services, finance, and legal affairs. This structure enables PhilGuarantee to operate effectively while maintaining financial stability and regulatory compliance across various economic sectors.

Who Benefits from PhilGuarantee?

PhilGuarantee’s credit guarantee programs help multiple stakeholders such as:

- Housing borrowers: Individuals and developers seeking financing.

- Small farmers and fisherfolk: Agricultural producers needing capital.

- MSMEs: Small business owners expanding their operations.

- Financial institutions: Banks and lenders gaining risk protection.

PhilGuarantee’s Programs and Services

It offers several guarantee programs tailored for different sectors:

1. Priority Sector Guarantee Programs

PhilGuarantee’s Priority Sector Guarantee Programs provide financial support to key sectors in the Philippine economy by offering credit guarantees to institutions and businesses that might otherwise face difficulties accessing loans, promoting economic growth and stability.

- MSME Credit Guarantee Facility (MCGF): The MSME Credit Guarantee Facility (MCGF) aims to enhance the access of Micro, Small, and Medium Enterprises (MSMEs) to financial resources by providing guarantees to banks, reducing the risk for lenders and encouraging investment in this vital sector.

- Medium and Large Enterprises-Credit Guarantee Facility (MLE-CGF): The MLE-CGF supports medium and large enterprises by offering credit guarantees to banks, facilitating their access to financing, and promoting business expansion, job creation, and economic development in the country.

- Electric-Cooperative Partial Credit Guarantee Facility (ECPCG): The Electric Cooperative Partial Credit Guarantee Facility (ECPCG) provides guarantees to electric cooperatives, enabling them to access financing for infrastructure projects, improvements, and sustainability initiatives, ensuring the continued delivery of reliable power services.

- Sustainable Energy Credit Guarantee Facility (SEGF): The Sustainable Energy Credit Guarantee Facility (SEGF) supports the development of renewable and sustainable energy projects by offering guarantees that reduce the risks for lenders, encouraging investments in the green energy sector to promote environmental sustainability.

2. Housing Credit Guarantee Programs

These programs provide credit guarantees to financial institutions offering housing loans, encouraging them to lend more to borrowers, including those who may not qualify under traditional lending terms.

- Housing Retail Guarantee Facility: This facility guarantees loans provided to retail borrowers, making home financing more accessible by securing loans for individual buyers who may face challenges in obtaining traditional mortgage loans.

- Unsecured Small Housing Loans Guarantee Facility: This program guarantees unsecured housing loans for low-income individuals, providing them access to affordable housing finance without requiring property collateral.

- Housing Developers Credit Guarantee Facility: This facility offers guarantees to developers to secure loans for the construction of residential housing units, particularly in areas that provide affordable housing options for various income groups.

- Cash Flow Guarantee (CFG) on Asset-Backed Securities: This program provides guarantees on the cash flow of asset-backed securities, enhancing the liquidity of residential and socialized housing projects, encouraging further investments in affordable housing.

- Cash Flow Guarantee on Socialized Housing Loans: Aimed at supporting socialized housing developers, this guarantee facility ensures the cash flow of loans, helping provide more affordable housing to low-income families.

3. Agriculture Credit Guarantee Programs

Designed to improve financial access for farmers, fisherfolk, and agribusinesses.

How to Access PhilGuarantee’s Services

PhilGuarantee does not directly provide loans to individuals. Instead, it works through partner lending institutions, which include:

- Universal and commercial banks

- Thrift and rural banks

- Cooperative banks and cooperatives

- Microfinance institutions

- Farmers and fisherfolk associations

- Housing developers and builders

Individuals and businesses looking for guaranteed loans must apply through these institutions.

PhilGuarantee’s Financial Stability

PhilGuarantee operates with the backing of the National Government, ensuring its credit guarantee programs remain sustainable. It follows a risk-based approach, maintaining adequate reserves to cover potential losses while continuously improving its financial management systems.

Based on current risk-weighted assets, PhilGuarantee can support an economic portfolio up to 14 times its qualifying capital, encouraging lending institutions to finance more projects across key industries.

Video: Get to Know PhilGuarantee Better

PhilGuarantee is a key institution in the Philippines’ financial landscape, providing credit guarantees that improve access to loans for housing, agriculture, MSMEs, and other critical sectors. By reducing lender risk and facilitating economic development, PhilGuarantee strengthens financial inclusion and investment opportunities across the country. Learn more about it by watching this video today:

How to Get More Information

For more details about PhilGuarantee’s programs and services, visit their official website or contact their office at:

- Main Office Address: 22nd – 24th Floors, BPI Philam Life Makati, 6811 Ayala Avenue, Makati City, 1209 Metro Manila, Philippines

- Contact Number: (02) 5322-8100

- Official Website: https://www.philguarantee.gov.ph/