In the Philippines, a variety of financial assistance programs are available to support the growth and recovery of micro, small, and medium enterprises (MSMEs), startups, and specific community sectors impacted by economic and natural disruptions. These initiatives, administered by both government agencies and financial institutions, provide a range of tailored financing options that address diverse business needs—ranging from working capital and asset financing to venture capital for high-growth potential businesses.

Each program offers unique benefits and eligibility requirements, designed to enhance MSMEs’ viability and creditworthiness. By addressing gaps in traditional bank financing, these initiatives encourage sustainable growth for Filipino enterprises while promoting resilience and economic recovery, particularly for those sectors adversely affected by the COVID-19 pandemic and other economic challenges.

Types of Financial Assistance and Loan Programs for MSMEs

The financial assistance and loan programs available to MSMEs in the Philippines can be categorized as follows:

- Direct Lending for MSMEs: This program offers loans directly to micro, small, and medium enterprises, providing essential capital for business growth and operational expenses.

- Wholesale and Rediscounting Programs for SMEs and MFIs: These programs supply funds to financial institutions, enabling them to extend more credit to small businesses and microfinance clients at favorable terms.

- Equity and Venture Capital Programs: These initiatives provide capital investments in exchange for equity, helping MSMEs scale their businesses without the burden of traditional debt.

- Specialized Lending for Specific Sectors or Beneficiaries: Tailored financing is offered to targeted sectors, like women-led enterprises or underserved regions, to foster inclusive growth and sectoral development.

- Disaster and Economic Recovery Support Programs: These programs provide financial aid and loans to MSMEs affected by disasters or economic crises, facilitating recovery and resilience.

- Agricultural Sector Support: Aimed at agri-based MSMEs, this assistance helps fund agricultural productivity, processing, and distribution, ensuring food security and rural development.

- Programs for Overseas Filipino Workers (OFWs): Specialized financial products assist OFWs in starting or expanding businesses, empowering them to invest their earnings locally and support economic growth.

Each program supports different needs, from direct loans to wholesale financing, and provides specialized support for various sectors or groups like OFWs and disaster-affected businesses.

Here are some specific programs available for MSMEs in the Philippines:

1. Regular Retail Program Direct Loans for MSMEs

Provider: Small Business Corporation (SBC or SBCorp)

The Regular Retail Program provides direct loans to registered micro, small, and medium enterprises (MSMEs) that lack access to traditional bank financing. Targeting “pre-bankable but viable” MSMEs, it aims to support their business needs, help them develop a credit history, and enable future bank financing. The program fosters a supportive environment to empower MSMEs’ growth and financial readiness.

Purpose: To assist MSMEs by offering necessary financing and training to improve their viability and bankability.

Features:

- Direct loan facilities for MSMEs (including manufacturers, suppliers, traders, franchisers, and service providers)

- Borrower qualifications:

- At least 60% Filipino-owned

- Asset size up to P100 million (excluding land)

- Minimum of 2 years of profitable business history

- DTI or SEC registration required

- Excludes specific industries listed by SBC

2. Regular Retail Program Fixed Asset Financing

Provider: SBC

The Regular Retail Program Fixed Asset Financing provides loans to micro, small, and medium enterprises (MSMEs) that lack access to traditional bank financing. This program helps bridge the gap to make the “pre-bankable but viable” business by addressing their need to grow, fostering credit history development. It creates a supportive environment for MSMEs, paving the way for future access to bank financing.

Purpose: To enable MSMEs to fund building improvement and acquire service and delivery vehicles in order to help the business grow, improve bankability, and become sustainable through essential financing and development support.

Features:

- Repayment term: 3 to 5 years

- Collateral options: Real Estate Mortgage or Chattel Mortgage

3. Regular Retail Program Working Capital Financing

Provider: SBC

The Regular Retail Program Working Capital Financing is a lending initiative aimed at registered micro, small, and medium enterprises (MSMEs) that lack access to bank financing. This program enables the financing of “pre-bankable but viable” MSMEs using the business’ accounts receivable and/or inventory to support their growth and help them build a credit history. Through tailored assistance, it provides an opportunity for MSMEs to eventually qualify for bank loans.

Purpose: To empower MSMEs by providing necessary financing and support to increase their working capital, improving their viability and readiness for future bank financing.

Features:

- Type of loan: 1-Year Credit Line

- Financing coverage: 80% of receivables; 60% of inventories

4. Regular SME Wholesale Program

Provider: SBC

The Regular SME Wholesale Program offers rediscounting solutions specifically for small and medium enterprises (SMEs) and microfinance institutions (MFIs) to meet their financing needs. The program provides multiple lending windows, such as SME Wholesale for qualified SMEs and Microfinance Wholesale for MFI clients. This program is designed to support the expansion of Filipino-owned businesses through affordable financing.

Purpose: To improve the financial stability of SMEs and MFIs by offering accessible and affordable credit options.

Features:

- Minimum qualifications:

- Must be at least 60% Filipino-owned

- Registered with DTI or SEC

- Positive net income in the prior year based on BIR-filed financial statements

- Debt-to-equity ratio (DER) not exceeding 80:20

- Exclusions:

- Agriculture (except post-production), real estate development (except MSME contractors), pure trading of imported goods (unless value-added), and vice-related activities.

5. Regular Graduating Micro Wholesale Program

Provider: SBC

This program provides rediscounting options for small and medium enterprises (SMEs) and microfinance institutions (MFIs) to support their funding needs. It offers lending windows customized for various business categories, including SME Wholesale and Microfinance Wholesale. Through this initiative, Filipino-owned businesses gain access to affordable credit, fostering growth and sustainability.

Purpose: To increase the financial capacity of SMEs and MFIs by providing accessible credit options to help them grow and succeed.

Features:

- Minimum Qualifications:

- At least 60% Filipino ownership

- Valid business permit (e.g., Mayor’s Permit, BMBE Registration)

- Positive net income in the previous year

- Debt-to-Equity Ratio (DER) not exceeding 80:20

- Total loans, including partner financial institutions (PFIs), not exceeding ₱500,000

- Exclusions:

- Certain industries, such as agriculture (except post-production), real estate development (except MSME contractors), pure trading of imported goods (unless value-added), and vice-generating activities.

6. Regular Microfinance Wholesale Program

Provider: SBC

The Regular Microfinance Wholesale Program provides rediscounting services to small and medium enterprises (SMEs) and microfinance institutions (MFIs) to meet their funding requirements. It includes various lending options like SME Wholesale for SMEs and Microfinance Wholesale for MFIs, designed to cater to different business needs. This program aims to support the growth of Filipino-owned businesses by offering affordable financing options.

Purpose: To strengthen the financial capabilities of SMEs and MFIs by offering accessible and affordable credit.

Features:

- Loanable amount

- Micro-Lead: For MFIs with at least 60% of their loan portfolio in microfinance.

- Micro-Local: For rural banks focused on MSME financing.

- Eligibility Requirements:

- Must be at least 60% Filipino-owned.

- Hold a valid business permit (e.g., Mayor’s Permit, BMBE Registration).

- Demonstrate positive net income for the prior year.

- Exclusions:

- Certain industries, including agriculture (except for post-production), real estate development (except MSME contractors), pure trading of imported goods (unless value-added), and activities that generate vice.

7. Venture Capital Program

Provider: SBC

This program offers equity financing to start-up enterprises with significant growth potential, enabling them to develop their businesses and effectively commercialize their products and services. It focuses on fostering sustainable growth in various sectors, including manufacturing and social services. The program aims to support enterprises that are poised for scalability and long-term success.

Purpose: To provide financial backing for start-ups to promote business development and sustainable growth.

Features:

- Investment range: P500,000 to P5,000,000

- Maximum investment: 40% of authorized capital stock

- Investment term: 5 to 10 years (extendable for an additional 2 years upon approval)

- Nature of investment: Common and preferred stocks

- Areas of financing: Industrial and manufacturing, social services, agribusiness, tourism, environmental

- Exit mechanisms: Redemption, sale to third party, IPO

8. P3 Retail – Regular and Special Facilities Lending Program

Provider: SBC

The P3 Lending Programs offer accessible financing options for micro-entrepreneurs to expand their businesses, with loans carrying a low interest rate of up to 2.5% per month on a diminishing balance. The special facilities program type offers targeted assistance to those affected by calamities or conflict (e.g., rebel returnees, Boracay residents).

Purpose: To provide affordable financial assistance to support the growth and recovery of micro-enterprises across the Philippines.

Features:

- Loan Amount: P5,000 to P200,000

- Interest Rate: Up to 2.5% per month

- Eligibility: Self-employed or micro-entrepreneurs with a business active for at least one year, barangay clearance, and proof of residence.

9. P3 Equity Investment for Families of KIA/WIA (Killed or Wounded in Action) Lending Program

Provider: SBC

The P3 Lending Programs offer accessible financing options for micro-entrepreneurs to expand their businesses, with loans carrying a low interest rate of up to 2.5% per month on a diminishing balance. This program type caters to families of fallen or injured soldiers, especially those who were KIA/WIA (Killed or Wounded in Action):

Purpose: To provide affordable financial assistance to support the growth and recovery of micro-enterprises across the Philippines.

Features:

- Loan Limit: Up to P100,000, interest-free if repaid within two years, 2% per annum thereafter.

- Benefits: Training and starter kits by DTI, monthly business monitoring support.

- P3 Wholesale (for Microfinance Institutions):

- Loan Amount: Based on assessment

- Interest Rate: 0% in the first year, 2% per annum from the second year

- Terms: No collateral required, flexible release and repayment options.

- Enterprise Rehabilitation Facility (ERF) for Microenterprises:

- Loan Amount: Up to P200,000 for disaster-affected businesses

- Interest Rate: Up to 1.5% per month

- Terms: Up to 24 months repayment, 6-month principal grace period

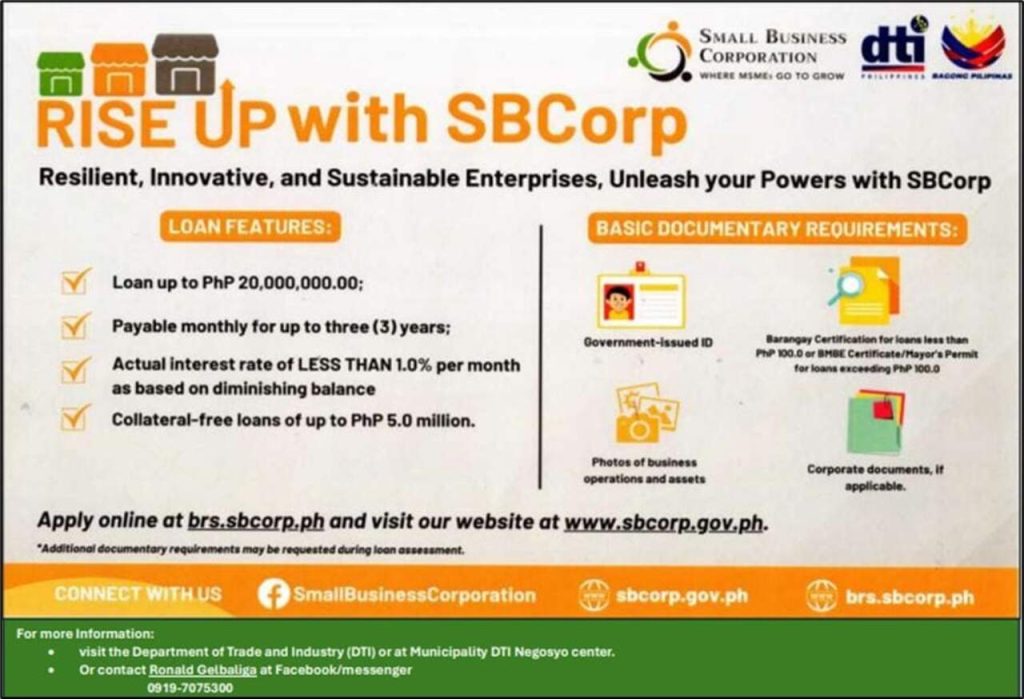

10. RISE UP Multi-Purpose Loan (Micro Multi-Purpose Loan)

Provider: SBC

The RISE UP Multi-Purpose Loan supports MSMEs (Micro, Small, and Medium Enterprises) by providing accessible financing to help them recover and grow after recent economic challenges. It offers loans tailored to microenterprises and has low collateral requirements, competitive interest rates, and flexible terms designed to aid long-term growth for various business sectors.

Purpose: To provide MSMEs with affordable financing options for business rehabilitation and growth.

Features:

- Loan Amount: Up to PHP 300,000

- Term: Up to 3 years

- Interest: 12% per annum

- Requirements: Business permits, business photos, ID

11. RISE UP Multi-Purpose Loan (SME First Time Borrowers)

Provider: SBC

The RISE UP Multi-Purpose Loan supports MSMEs (Micro, Small, and Medium Enterprises) by providing accessible financing to help them recover and grow after recent economic challenges. It offers loans to first-time SME borrowers with low collateral requirements, competitive interest rates, and flexible terms designed to aid long-term growth for various business sectors.

Purpose: To provide MSMEs with affordable financing options for business rehabilitation and growth.

Features:

- Loan Amount: Up to PHP 20 million (collateral-free up to PHP 3 million)

- Term: Up to 3 years

- Interest: 12% per annum

- Requirements: Business permits, financial statements, business photos

12. RISE UP Multi-Purpose Loan (SME Multi-Purpose Suki Loan)

Provider: SBC

The RISE UP Multi-Purpose Loan supports MSMEs (Micro, Small, and Medium Enterprises) by providing accessible financing to help them recover and grow after recent economic challenges. It offers loans especially designed for repeat SB Corp clients with good repayment history. The program has low collateral requirements, competitive interest rates, and flexible terms designed to aid long-term growth for various business sectors.

Purpose: To provide MSMEs with affordable financing options for business rehabilitation and growth.

Features:

- Loan Amount: Up to PHP 20 million (collateral-free up to PHP 5 million)

- Term: Up to 5 years

- Interest: 8%-12% per annum

- Requirements: Proof of sales, financial statements, asset valuation

13. RISE UP Micro Tindahan Loan

Provider: SBC

RISE UP Micro Tindahan Loan is a loan program tailored for sari-sari stores and smaller retail stores connected with FMCG companies accredited by SB Corp. It offers Micro Tindahan loans specifically designed to help sari-sari stores grow their operations and enhance their role in the supply chain.

Purpose: To provide financial assistance to small retail businesses, particularly those in the FMCG supply chain, to help them stabilize and expand.

Features:

- Maximum Loan: Up to PhP 300,000

- Loan Basis: 40% of annual FMCG-related sales

- Term: Up to 3 years, payable monthly

- Interest Rate: 10% per annum, diminishing balance

- Requirements: Government ID, Barangay Business Permit or BMBE Certificate/Mayor’s Permit, business documentation, and FMCG reference number

- Eligibility: Minimum 1-year business track record with FMCG

14. RISE UP SME Tindahan Loans

Provider: SBC

RISE UP SME Tindahan Loans is a loan program tailored for bigger retail stores, dealers, and distributors connected with FMCG companies accredited by SB Corp. It offers SME Tindahan loans designed for larger retail businesses and distributors in an effort to help them grow their operations and stabilize their positions in the supply chain.

Purpose: To provide financial assistance to small retail businesses, particularly those in the FMCG supply chain, to help them stabilize and expand.

Features:

- Maximum Loan: Up to PhP 5 million

- Loan Basis: 40% of annual FMCG-related sales for retail stores; 15% for dealers and distributors

- Term: Up to 3 years, payable monthly

- Interest Rate: 8% per annum, diminishing balance

- Requirements: Government ID, Mayor’s Permit, corporate documents, FMCG accreditation number, proof of asset size (≤ PhP 100M), and business documentation

- Eligibility: Minimum 1-year business track record with FMCG; 3 years for loans over PhP 1 million

15. I-RESCUE Lending Program

Provider: Land Bank of the Philippines (LBP)

The I-RESCUE Lending Program supports the “Bayanihan to Heal as One Act” (RA No. 11469) by offering financial assistance to Small and Medium Enterprises (SMEs), cooperatives, and microfinance institutions (MFIs) affected by the COVID-19 pandemic. This program provides loans and restructuring options under flexible terms to help these businesses recover. LANDBANK extends this support by providing emergency funds for working capital and enabling debt restructuring to improve operational cash flow.

Purpose: To provide financial relief and rehabilitation support to SMEs, cooperatives, and MFIs facing challenges due to the economic impact of COVID-19.

Features:

- Program Fund: Php10 billion

- Loan Availability: Until December 31, 2020

- Eligible Borrowers: SMEs, cooperatives, and MFIs

- Types of Assistance:

- Emergency fund for working capital (up to 85% of actual need)

- Loan restructuring and extended repayment options

- Loan Tenor: Up to 5 years for initial loans; up to 10 years for restructured loans

- Interest Rate: 5% p.a. fixed for three years, subject to annual repricing

- Grace Period: Up to two years for initial loans; up to three years for restructured loans

- Mode of Payment: Monthly, quarterly, semi-annually, or annually

- Collateral: Any acceptable collateral, such as PDCs for amortizations

- Waived Fees: Application, credit investigation, commitment, and pre-termination fees

- Additional Services: Training support for coops and MFIs, access to Point of Sale terminals

16. MSME Credit Guarantee Program (MCGP)

Provider: Philippine Guarantee Corporation (PhilGuarantee)

The MCGP is a credit guarantee facility aimed at supporting micro, small, and medium enterprises (MSMEs) affected by the COVID-19 pandemic. By providing a credit guarantee for loans from BSP-regulated financial institutions, this program enables businesses to secure working capital for recovery. It encourages financial institutions to extend loans to MSMEs, thus helping them to sustain and grow their operations.

Purpose: To increase access to working capital for MSMEs, promoting economic recovery and resilience post-pandemic.

Features:

- Loan Amount Per Borrower: Up to Php 50 million, with exceptions on a case-to-case basis.

- Guarantee Coverage: 50% of the principal loan amount.

- Loan Term: 1 to 5 years.

- Guarantee Term: 1 year, with annual review.

- Fees: 1% guarantee fee per annum (GRT applies); origination fee waived.

- Collateral: Determined by the lending institution.

- Eligibility: MSMEs impacted by COVID-19 across various sectors (e.g., industry, agribusiness, services).

17. DBP Rehabilitation Support Program on Severe Events (RESPONSE)

Provider: Development Bank of the Philippines (DBP)

DBP RESPONSE offers financial assistance to both public and private institutions impacted by calamities or significant events. This program enables eligible organizations to access funds, facilitating faster recovery and contributing to the socio-economic rehabilitation of affected areas. Institutions can borrow up to 95% of their project or cash requirements to aid in recovery efforts.

Purpose: To support disaster-affected businesses and communities by providing funds for rehabilitation, risk reduction, and socio-economic recovery.

Features:

- Loan Amount: Up to 95% of project or minimum cash requirements.

- Interest Rate: Benchmark rate plus applicable spread, or cost of funding if ODA funds are used.

- Loan Terms:

- Public Institutions (LGUs, water districts, etc.): Up to 15 years, with a 3-year grace period.

- Private Institutions: Up to 10 years, with a 3-year grace period.

- Permanent Working Capital: Up to 5 years, with a 1-year grace period.

- Loan Restructuring: Additional extension of up to 5 years, with condonable charges waived.

- Collateral Requirements: Assignment of IRA (for LGUs), real estate or chattel mortgage, or hold-out on deposits for non-LGU borrowers.

- Additional Conditions: Waived fees (front-end, commitment, prepayment) for new loans.

18. Rice Farmer Financial Assistance (RFFA)

Provider: Department of Agriculture (DA)

The Rice Farmer Financial Assistance (RFFA) program provides a one-time financial aid of up to five thousand pesos to smallholder rice farmers with 1 hectare or less of farmland. Eligible farmers must be registered with the Registry System for Basic Sectors in Agriculture (RSBSA). This initiative is designed to offset income losses due to the drop in palay (unmilled rice) prices.

Purpose: To support rice farmers financially by compensating for income reductions and enhancing their productivity and profitability.

Features:

- Cash grant of Php 5,000

- Eligibility limited to registered farmers with 0.5 to 2 hectares of farmland

- Implementation prioritized in provinces affected by low palay prices

- Distributed through Development Bank of the Philippines (DBP) and Land Bank of the Philippines (LandBank)

19. Survival and Recovery (SURE) Assistance Program

Provider: Department of Agriculture – Agricultural Credit Policy Council (ACPC)

The SURE Assistance Program offers financial support to small farmers and fishers impacted by calamities, including those under the Enhanced Community Quarantine. Launched in 2017, the program provides a combination of loans and grants to help affected individuals recover their livelihoods. It targets those in state-of-calamity areas, ensuring they can continue or restart their farming and fishing activities.

Purpose: To provide immediate financial relief and help calamity-affected small farmers and fisherfolk restore their earning capacities.

Features:

- Loan up to PHP 25,000

- 0% interest (3% service fee may apply from Partner Lending Conduits)

- No collateral required

- Payable within 3 years

- 1-year moratorium on payments for loans under other ACPC programs

- Distributed through Partner Lending Conduits, such as cooperatives and rural banks

20. Helping the Economy Recover through OFW Enterprise Startups (HEROES) Program

Provider: Philippine government, through the P3 program

The HEROES program offers repatriated Overseas Filipino Workers (OFWs) a chance to establish their own businesses with a loan facility of Php100 million. This initiative aims to provide an alternate source of income for OFWs by facilitating micro, small, and medium enterprise (MSME) development. Participants can access loans without interest or collateral, fostering entrepreneurship among returning workers.

Purpose: To support repatriated OFWs in starting their own businesses and promote economic recovery through entrepreneurship.

Features:

- Loan Amount: Php10,000 to Php100,000

- Interest: None

- Collateral: Not required

- Service Fees:

- 6% for 24-month repayment terms

- 8% for 36-month repayment terms (includes 12 months grace period)

- Training: Online training through the Philippine Trade Training Center required for application.

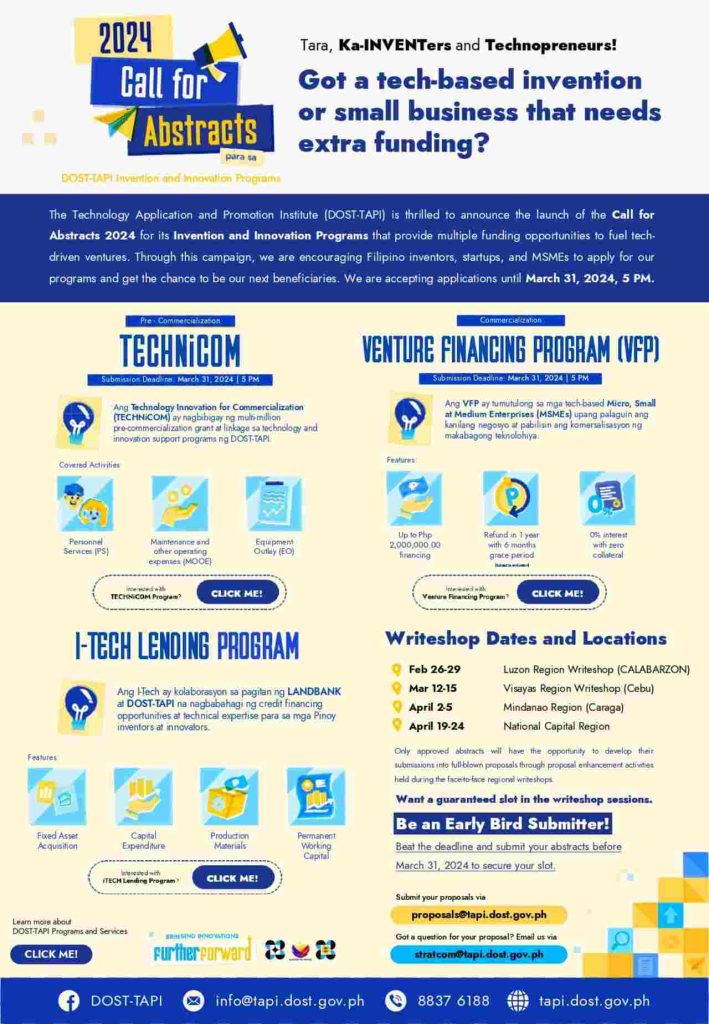

21. Venture Financing Programs (VFP)

Provider: Department of Science and Technology – Technology Application and Promotion Institute (DOST-TAPI)

The VFP by DOST-TAPI supports startups and SMEs looking to commercialize innovative products. It offers interest-free loans without requiring collateral to help businesses cover costs like equipment purchase or fabrication. The maximum loanable amount is PHP 2 million, repayable over three years with an initial six-month grace period.

Purpose: To accelerate the commercialization of innovations and technology-based projects for startups and SMEs in key industries.

Features:

- Soft loans with 0% interest

- No collateral required

- Loan amounts up to PHP 2 million

- 3-year repayment term with a 6-month grace period

- Focus on tech-based or intellectual property-driven projects

22. Environmentally-Sound Technologies (VFEST)

Provider: DOST-TAPI

The VFEST program is a funding initiative for Filipino-owned startups and SMEs that develop and promote green technologies. It aims to drive innovation in areas like sustainable energy and pollution reduction. The program provides financial assistance to support environmentally sound initiatives, fostering sustainable technopreneurship in the Philippines.

Purpose: To support startups and SMEs focused on green technologies and environmental protection.

Features:

- Funding of up to PHP 2.5 million

- Support for equipment purchases

- 3-year repayment term

- 6-month grace period

- Promotion of sustainable business practices

23. Purchase Order Financing Program

Provider: DOST-TAPI

The Purchase Order Financing Program provides financial support to startups and SMEs that lack sufficient funds to fulfill customer orders. This program specifically aids in purchasing raw materials, unlike others that focus on equipment or production facilities. Eligible businesses can access loans to ensure they meet customer demands and sustain growth.

Purpose: To help startups and SMEs meet customer order requirements by financing the cost of raw materials.

Features:

- Loan amount up to PHP 2.5 million

- 3-month repayment term

- 3-month grace period

- Targets funding for raw material purchases

- Supports efficient fulfillment of customer demands

24. Level-up Innovation Government Support for Technologies Against the Spread of COVID-19 (LIGTAS-COVID-19)

Provider: DOST-TAPI

LIGTAS-COVID-19 supports startups and SMEs that are involved in pandemic-response efforts, especially those previously aided by DOST. The program offers financial assistance to help these businesses remain operational and continue essential services. DOST-TAPI provides up to PHP 1 million in funding, primarily for purchasing necessary raw materials.

Purpose: To assist startups and SMEs in managing pandemic-related challenges and sustaining their operations.

Features:

- Funding of up to PHP 1 million

- Financial support for raw material purchases

- Focused on COVID-19 response solutions

- 12-month repayment term

- 6-month grace period

25. Startup Venture Fund (SVF)

Provider: Department of Trade and Industry – National Development Company (NDC)

The Startup Venture Fund (SVF) is a venture capital program introduced by the DTI-NDC to strengthen the startup ecosystem in the Philippines. With a fund of PHP 250 million, it supports startups in early-stage development from Seed to Series B. The program also includes mentorship and training collaborations with DTI and other organizations, enhancing startups’ skills and visibility.

Purpose: To support the growth and long-term success of Philippine startups through funding, mentorship, and strategic support.

Features:

- Access to PHP 250 million in funding

- Mentorship and training opportunities

- Visibility through pitching competitions

- Partnerships with government and international organizations

- Assistance in scaling business operations

Video: DOST Offers Financial Assistance to MSMEs in the Philippines

To learn more about the financial assistance offered by the DOST to the different MSMEs in the country, you may check out this video from ANC 24/7:

Summary

These programs collectively provide invaluable financial support and development opportunities for MSMEs, SMEs, farmers, and other sectors affected by economic challenges in the Philippines. By addressing various needs from startup capital to post-calamity assistance, these initiatives promote resilience, growth, and sustainable business practices to MSMEs across different industries.