Loan programs for teachers in the Philippines offer essential financial assistance to educators facing various needs. These loans range from personal expenses, educational support, emergency relief, to livelihood opportunities, ensuring that teachers can access the financial resources they require. Each program is designed with different terms and benefits, allowing educators to choose based on their specific situation.

Knowing about these loan programs is important for teachers who may need financial aid at some point during their careers. By being informed about available options, teachers can make better decisions regarding loans that suit their circumstances, whether for emergencies, personal projects, or professional development.

Types of Available Loans for Teachers in the Philippines

Loan programs for teachers in the Philippines can be categorized into several types based on their purpose, eligibility, and repayment structures. These programs are designed to provide financial support for various needs, including personal expenses, education, and emergencies. Below are the general categories of loan programs available for teachers:

- Personal Loans: Personal loans are unsecured loans offered by banks or financial institutions to meet individual financial needs. They are often used for personal expenses such as medical emergencies, home renovations, or travel. Since they are unsecured, the borrower is not required to provide collateral, but interest rates tend to be higher due to the associated risk.

- Educational Loans: Educational loans are funds borrowed to pay for tuition fees, books, and other school-related expenses. These loans help students or their parents cover the costs of education and typically have lower interest rates than other loan types. Repayment terms often begin after the student completes their education.

- Emergency Loans: Emergency loans are short-term loans designed to cover urgent, unforeseen expenses such as medical bills, car repairs, or home repairs. These loans are usually approved quickly, and they may come with higher interest rates to account for their fast processing and short repayment periods.

- Livelihood and Business Loans: Livelihood and business loans are loans aimed at entrepreneurs or individuals looking to start or expand a small business. These loans provide funding for working capital, equipment, or other operational needs. Financial institutions may offer such loans to support economic development and promote self-employment.

- Policy Loans: Policy loans are loans taken out against the cash value of a life insurance policy. These loans are unique because the insurance policy serves as collateral, and the loan amount is deducted from the policy’s cash value. Repayment is flexible, but failure to repay can reduce the policy’s payout or benefits.

Now that we’ve covered the general types of loan programs, it’s time to explore the specific options available to teachers in the Philippines. These programs are tailored to meet the unique financial needs of educators, offering various terms and benefits. Below is a detailed list of loan programs that teachers can apply for, providing solutions for both personal and professional expenses.

1. Sariling Sikap Loan (SSL)

Offering institution: Philippine Public School Teachers Association (PPSTA)

Best for: Teachers seeking financial support for personal projects, education, or unexpected expenses.

The Sariling Sikap Loan (SSL) is designed to provide accessible financial assistance to public school teachers. With no collateral requirements and low interest rates, it offers an affordable loan option. It features hassle-free repayment with automatic salary deduction for convenience.

Loan amount, benefits, and other terms:

- Maximum loan amount: ₱500,000

- Loan term: Up to 5 years

- Interest rates: 3.56% to 4.62%

- No collateral required

- Fund disbursement via LANDBANK, BDO Remit, and EastWest Bank

- Automatic salary deduction for repayments

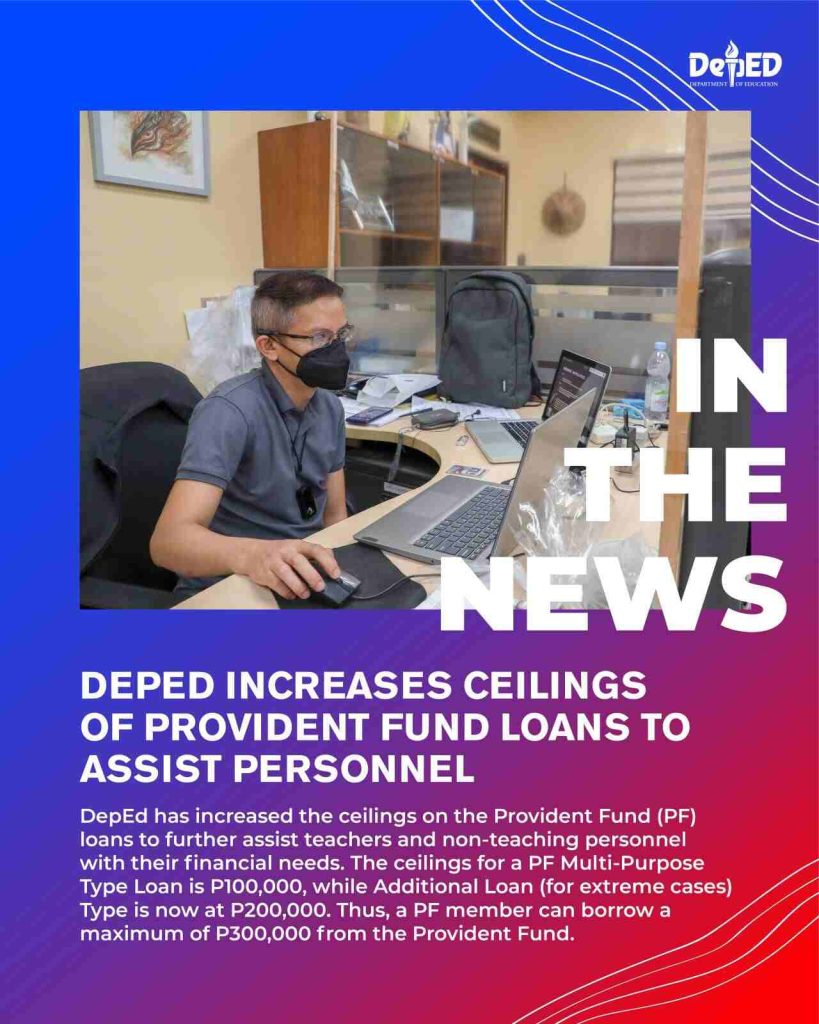

2. DepEd Provident Fund (PF) Loan

Offering institution: Department of Education (DepEd)

Best for: DepEd employees, teachers, and administrative staff in need of emergency loans

The DepEd Provident Fund provides financial assistance to DepEd employees for emergency needs, education, hospitalization, house repairs, and similar situations. Beneficiaries include teachers and staff with permanent employment status. The fund is managed by the National and Regional Boards of Trustees and offers a loan at six percent interest per annum.

Loan amount, benefits, and other terms:

- Regular loan: Up to P100,000

- Additional loan: Up to P100,000 (for severe financial distress)

- Calamity loan: Up to P20,000 (for areas declared under a state of calamity)

- Additional loans: Discretionary, up to P100,000

- Interest: 6% per annum (diminishing computation)

- Repayment: 1 to 5 years, automatic salary deduction

- New hires can also apply

- Eligibility: Teachers, administrative staff with regular status

- Documentary requirements: Accomplished application form, latest pay slip

3. Multi-Purpose Loan Flex (MPL Flex)

Offering institution: Government Service Insurance System (GSIS)

Best for: Public school teachers and GSIS members seeking flexible financial assistance

MPL Flex is designed to help public school teachers and other GSIS members access loans with lower interest rates starting at 6% and repayment terms of up to 15 years. This program addresses the financial needs of teachers, allowing them to use the loan for various purposes, including starting a business. Applicants can apply with as little as one month of premium contribution, offering greater flexibility in loan terms and repayment options.

Loan amount, benefits, and other terms:

- Interest rates from 6%

- Loan term up to 15 years

- No pre termination fees for full repayment before loan term ends

- Waiver on surcharges for first-time borrowers with existing GSIS loan arrears

- Eligibility: Active members with at least one premium contribution in the last six months, not on unpaid leave, and with no pending administrative charges

- Application through GSIS Touch app, GWAPS kiosks, or GSIS branches

- Loan proceeds credited within one business day after approval

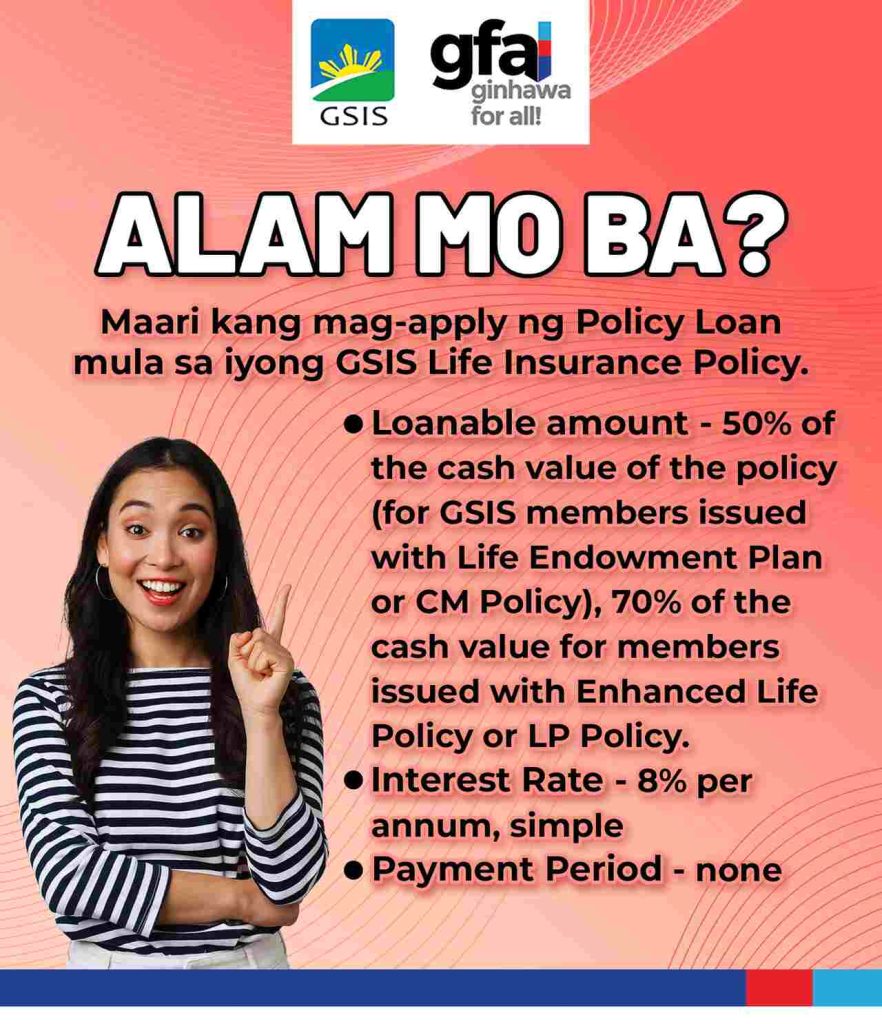

4. GSIS Policy Loan

Offering institution: GSIS

Best for: GSIS member teachers with a life insurance policy

The Policy Loan allows GSIS members to borrow against their existing life insurance policy. Borrowers can access a portion of the accumulated termination or cash value of the policy, with an interest rate of 8%. The loan is either paid back monthly or deducted from the policy upon maturity.

Loan amount, benefits, and other terms:

- Loanable amount: Up to 70% of the policy’s termination value (Enhanced Life Policy) or 50% (Life Endowment Policy)

- Interest rate: 8% (compounded monthly for ELP, annually for LEP)

- Proceeds credited to member’s eCard or UMID card

- Repayment options: Monthly payments or deductions from the policy’s termination or renewal

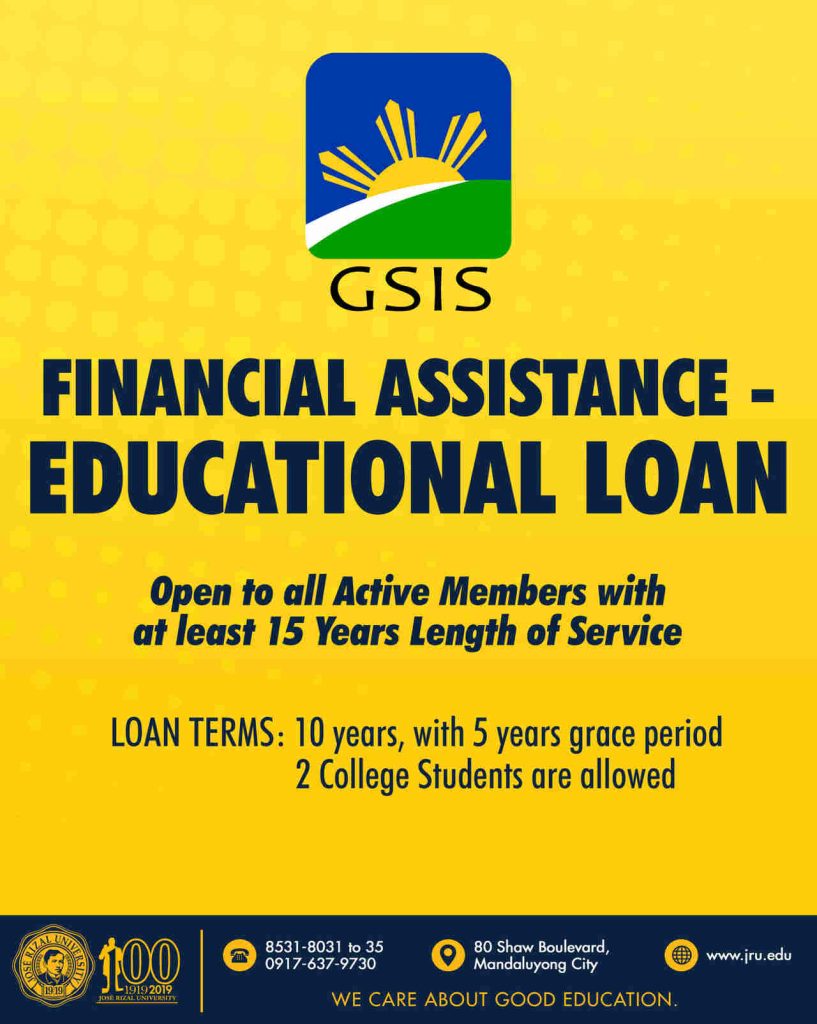

5. GFAL-Educational Loan (GFAL-EL)

Offering institution: GSIS

Best for: Active GSIS member teachers with dependents in college

The GFAL-EL helps GSIS members finance their dependents’ tuition fees and other school-related costs. It offers a “study now, pay later” arrangement, allowing members to delay repayment until the student finishes their course. This loan is available to qualified GSIS members supporting up to two dependents.

Loan amount, benefits, and other terms:

- Maximum loan amount: Php100,000 per academic year

- Beneficiaries: Up to two relatives enrolled in a 4or 5-year college course

- Interest rate: 8%, computed in advance

- Grace period: 5 years, repayment starts after the final semester

- Repayment term: 10 years, with up to 5 years for repayment after grace period

6. SSS Salary Loan

Offering institution: Social Security System (SSS)

Best for: Active SSS member teachers who are in need of short-term financial aid.

This loan provides financial assistance for personal needs. The loan amount is based on the member’s Monthly Salary Credits (MSC) and contribution history. It offers flexible repayment terms to help address urgent financial requirements.

Loan amount, benefits, and other terms:

- One-month loan: Equivalent to the average of the last 12 MSCs or the amount applied for, whichever is lower.

- Two-month loan: Twice the average of the last 12 MSCs, rounded to the next higher MSC, or the amount applied for, whichever is lower.

- Interest Rate: 10% per annum on the diminishing balance.

- Repayment Period: Up to 24 months.

- Additional Terms: Interest continues if not paid in full; default amounts are deducted from future benefits (e.g., retirement). Loan renewal is possible after 50% payment and time lapse.

7. SSS Educational Loan

Offering institution: SSS

Best for: Active SSS member teachers seeking financial support for education or their dependents’ education.

This loan program is designed to help SSS members fund degree or vocational courses for themselves or their legal dependents. It provides financial aid for tuition and other related school fees. The loan aims to ease the financial burden associated with pursuing higher education.

Loan amount, benefits, and other terms:

- Up to Php 20,000 per semester for degree programs

- Up to Php 10,000 per semester for vocational programs

- 6% per annum interest rate

- Repayment term: 5 years for degree courses, 3 years for vocational courses

8. Multi-Purpose Loan (MPL)

Offering institution: Pag-IBIG Fund

Best for: Teachers needing financial assistance for various personal needs

The Pag-IBIG MPL offers financial support to Pag-IBIG members for purposes like education, health, business capital, and home improvements. It allows members to borrow up to 80% of their Pag-IBIG Regular Savings. The loan is repayable through salary deduction or other approved methods, with penalties for late payments.

Loan amount, benefits, and other terms:

- Loan Amount: Up to 80% of Pag-IBIG Regular Savings

- Interest Rate: 10.5% per annum

- Loan Term: 2 to 3 years (default of 3 years if unspecified)

- Loan Release: Via disbursement card, bank account, or check

- Penalty: 1/20 of 1% per day of delay

9. Health and Education Loan Programs (HELPs)

Offering institution: Pag-IBIG

Best for: Teachers seeking funds for education and healthcare expenses

Pag-IBIG HELPs provides loans to cover educational and healthcare expenses for members and their families. The funds are directly credited to Pag-IBIG-accredited schools and hospitals, offering discounts at partner institutions. The loan offers flexible repayment terms and can be renewed after certain payments.

Loan amount, benefits, and other terms:

- Loan Amount: Up to 80% of Pag-IBIG Regular Savings

- Interest Rate: 10.5% per annum

- Loan Term: 6, 12, 24, or 36 months

- Payment Methods: Salary deduction or payments through Pag-IBIG branches or partners

- Discounts: At accredited institutions

10. Puhunang Pangkabuhayan ng mga Namamasukan (PPN) Loan Program

Offering institution: Agribank

Best for: Teachers who experience delayed salary payments

This loan program is designed for teachers facing late salary releases. It provides an option of a one-year or two-year loan term with competitive interest rates. A simple application process with required documents ensures access to the funds.

Loan amount, benefits, and other terms:

- Loan tenure: Up to 2 years

- Interest rate: 1% for two years, 0.9% for one year

- Required documents: Application form, 3 months’ payslips, PRC ID, DepEd ID, and other credentials

- Guarantor’s documents: PRC ID, DepEd ID, payslip, and identification photos

11. Teachers’ Salary Loan

Offering institution: City Savings Bank

Best for: DepEd teachers needing salary-based financial assistance

The Teachers’ Salary Loan is designed for DepEd employees with at least six months of service, offering a flexible repayment term and convenient payroll deduction. Borrowers must have a net take-home pay of at least P5,000 after deductions and an active email address. The loan’s interest rate varies based on the loan term, and pre-termination is available without hidden charges.

Loan amount, benefits, and other terms:

- Maximum loanable amount: P2,000,000

- Bank charge: 6% of loan amount

- Loan term: 12 to 60 months, flexible

- Interest rate: Variable, based on the loan term

- Requirements: Latest payslip, valid ID, permanent appointment photocopy

- No need to open a separate savings account for loan approval

- Integrated into the Automatic Payroll Deduction System (APDS)

12. EastWest Personal Loan

Offering institution: EastWest Bank

Best for: Teachers seeking personal loans for various needs, such as emergency expenses or major purchases.

EastWest Personal Loan provides up to 7 times your monthly salary, with a maximum loanable amount of Php 3 million. This loan offers flexible payment terms of up to 60 months, and approval is subject to the bank’s evaluation. The application process takes 5 to 7 banking days, and loan proceeds are released within an additional 2 to 4 days.

Loan amount, benefits, and other terms:

- Minimum Loan Amount: Php 25,000

- Maximum Loan Amount: Php 3 million

- Loan Term: 12 to 60 months

- Processing Time: 5 to 7 banking days

- Contractual Interest Rates: 33.55% to 41.51% p.a., depending on loan terms and credit history

- Effective Interest Rates: 40.65% to 56.19% p.a.

- Monthly Rates: 1.79% to 1.99%, depending on loan terms and credit history

- Additional Fees: Processing fee of Php 1,900 and documentary stamp tax

13. DepEd Livelihood Loan Facility

Offering institution: Department of Education (DepEd) in collaboration with LandBank

Best for: DepEd teaching and non-teaching staff looking for financial assistance

This loan program is designed to provide financial support to DepEd employees, allowing them to borrow up to eight months of their salary. The loan is available at an interest rate of 10.5% per annum. Borrowers with good standing can increase their loan amount without any change in the interest rate.

Loan amount, benefits, and other terms:

- Maximum loan: Up to eight months of salary, capped at PHP 500,000

- Interest rate: 10.5% annually

- Eligible applicants: DepEd staff aged 18 to 62 with no pending retirement applications

- Requirement: Must have an existing payroll account with LandBank

- Terms may vary; check with the lending institution for the latest details.

14. Manila Teachers’ Mutual Aid System (MTMAS)

Offering institution: Manila Teachers’ Savings and Loan Association, Inc. (MTSLAI)

Best for: Public school teachers needing financial assistance

MTMAS provides financial aid to teachers, including loans and benefits to members’ beneficiaries. Membership is required to access the loans, and applicants must submit specific documents. Loans are available at low interest rates, with flexible repayment terms through amortization.

Loan amount, benefits, and other terms:

- Php 35,000 financial aid for deceased members’ beneficiaries

- Php 20,000 Calamity Loan available via the MTMAS-OLA app

- Low interest rates

- Loan amortization periods: 12, 15, 18, 24, 30, and 36 months

- Online loan application through the MTMAS-OLA app

15. DepEd Salary Loan

Offering institution: Etiqa

Best for: Public school teachers employed by the Department of Education (DepEd)

This loan is specifically designed for DepEd teachers and is repaid through salary deduction. It does not require collateral or a co-maker, making it more accessible. The loan offers flexible terms with a range of loan amounts.

Loan amount, benefits, and other terms:

- Loan amount: Php 10,000 to Php 500,000

- Repayment terms: 12 to 36 months

- No collateral or co-maker required

- Requirements: Latest payslip, two months’ payslip, service record or appointment letter, two government IDs, two ID pictures

Video: Loan Program for Teachers with the Lowest Interest

If you are a teacher or you know someone who is looking for a loan with low interest rates, then watch this video from Guro, Batas, at Bayan Atty. Risty Adarayan to learn more about the DepEd Provident Fund Loan, which offers a 6% interest rate—perfect for teachers’ everyday financial needs.

Summary

In the Philippines, teachers do not necessarily get the salary they desire. For this reason, a lot of institutions offer a variety of loan programs to address their financial needs, from personal loans to livelihood support. These options offer flexibility in repayment and cater to different financial situations, helping educators manage both personal and professional expenses. Explore the available loan programs today and choose the best option for your financial goals. Learn more about these programs and apply now!