The GSIS Ginhawa for All Housing Account Restructuring and Condonation Program is designed to help GSIS (Government Service Insurance System) housing account buyers and borrowers update their accounts and regain current status. By providing options like penalty waivers, interest discounts, and extended payment terms, this program makes it easier for borrowers to settle their housing loan obligations.

This initiative offers financial relief to account holders who are in arrears or facing default, ensuring their housing accounts are more manageable. Below is a detailed guide on the program’s benefits, eligibility, requirements, and application process to help you navigate the steps effectively.

Program Overview

The GSIS Ginhawa for All Housing Account Restructuring and Condonation Program is a financial aid initiative designed to assist borrowers and buyers in managing their housing loans. It offers affordable solutions such as penalty waivers, interest reductions, and extended payment terms to help borrowers settle arrears or restructure defaulted accounts in an effort to reduce the financial stress associated with unpaid housing obligations and safeguard borrowers’ investments.

This GSIS program, which operates under the mandate of the GSIS charter, is designed to ensure the provision of financial assistance to members. It also aligns with national housing policies that aim to provide accessible and sustainable financing options to borrowers. Under the program, GSIS housing account holders with unpaid or defaulted loans, as well as heirs or successors, can update their accounts or restructure them under more favorable terms, ensuring financial stability for members and responsible housing loan management for the institution.

Benefits

This program provides several advantages for both eligible borrowers and buyers, making it more feasible for borrowers to either restructure or fully settle their housing loans, ultimately reducing their financial burden.

- Waiver of penalties and surcharges for overdue accounts.

- Easier payment option for housing buyers and borrowers to restructure or fully pay their housing obligations.

- Partial interest discount for borrowers opting to fully pay their obligations.

- Reduced interest rate to as low as 6% for restructured accounts.

- Lower monthly amortizations through extended payment terms of up to 10 years.

- Non-capitalization of unpaid interest, which is instead spread evenly over the term.

- A grace period for arrears caused by delayed remittance of the first monthly payment for accounts that have never been restructured.

Who Can Apply for the Program?

There are various types of loan restructuring and condonation schemes offered under the program and these schemes are open to the following GSIS housing borrowers:

1. Updating Accounts through Full Payment of Arrearages

The following account holders can apply for full payment to bring their accounts up to date:

- Deed of Conditional Sale (DCS) account holders with:

- Remaining terms and accounts that are up-to-date, in arrears (unpaid for six months or less), or in default (unpaid for more than six months).

- Real Estate Loan (REL) borrowers with:

- Remaining terms on accounts that are not foreclosed or accounts foreclosed but still within the redemption period.

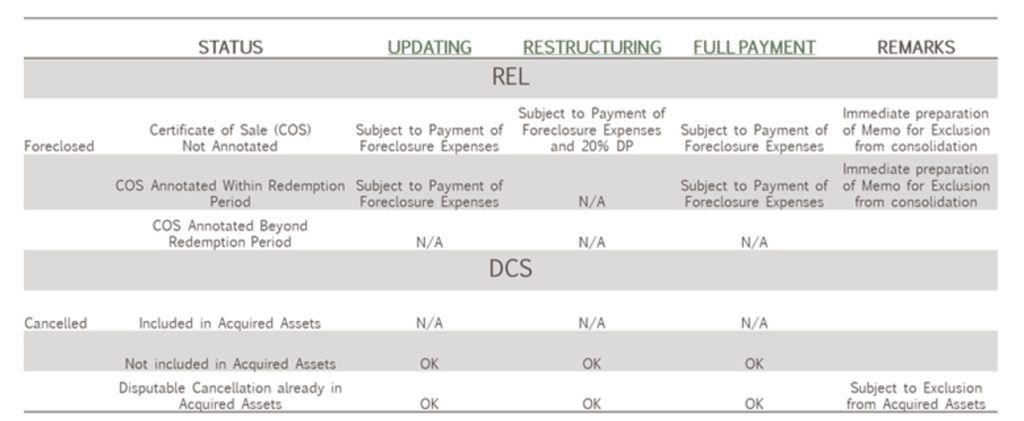

2. Restructuring with Condonation Options

Eligible applicants for restructuring include:

- DCS account holders with:

- Accounts that are current, in arrears, or in default.

- Disputed canceled DCS accounts uploaded as acquired assets but not yet sold.

- REL borrowers with:

- Foreclosed accounts where the Certificate of Sale (COS) has not been annotated on the title, subject to conditions such as a 20% down payment and full settlement of foreclosure expenses.

3. Full Payment with Condonation Options

Borrowers who wish to fully settle their accounts with condonation may apply if they meet the following conditions:

- DCS account holders

- With accounts that are current

- With accounts in arrears

- With accounts in default

- REL borrowers with:

- With accounts that are current

- With accounts in arrears

- With accounts in default

- Foreclosed accounts within the redemption period

Application Requirements

To apply for the housing loan restructuring and condonation program, you need to submit the following documents:

- Completed application form (available for download through GSIS).

- Valid government-issued ID (e.g., UMID, driver’s license, passport, or any ID from the provided list).

- Latest Real Property Tax Declaration (covering land and improvements, if applicable).

- Real Property Tax Clearance for both land and building.

- Proof of paying capacity, such as:

- Latest payslip

- Certificate of employment with compensation

- Other sources of income

- For Successor-in-Interest: If original borrower and spouse are still living, photocopy of the following must be submitted and the original presented:

- SPA from original housing account buyer/borrower authorizing the successor-in-interest to apply and receive the title

- PSA-issued marriage contract of borrower/buyer, if applicable

- valid IDs

Additional Requirements for Deceased Borrowers

If the original borrower is deceased, the legal heirs or successors-in-interest must also provide:

- Legal Heirs:

- Transfer of rights documents such as:

- deeds of sale,

- conveyance of assignment duly signed by both parties

- Duly executed SPA (valid for 1 year from date of notarization)

- Duly accomplished Condonation and Restructuring Application Form

- Photocopy (original to be presented) of IDs such as

- GSIS eCard

- UMID, passport,

- PhilID or

- any two (2) valid IDs

- Latest real property tax declaration

- Real property tax clearance certificate for current year

- Transfer of rights documents such as:

- Successors-in-Interest:

- If original buyer, borrower or spouse is deceased, photocopy of the following must be submitted and the original presented:

- SPA from original housing account buyer/borrower authorizing the successor-in-interest to apply and receive the title

- Deed of Adjudication of Sole Heir or Deed of Extra-Judicial Settlement (for 2 or more surviving heirs)

- Affidavit of publication of the adjudication and extra-judicial settlement from the publishing company

- PSA-issued death certificate of the original housing account borrower, buyer, or spouse

- PSA-issued marriage contract of the original housing account borrower, buyer, if applicable

- PSA-issued birth certificate of heir/s

- Valid IDs

- If original buyer, borrower or spouse is deceased, photocopy of the following must be submitted and the original presented:

- For transferring rights, you will need additional documentation, such as:

- Transfer of rights documents such as

- deeds of sale,

- conveyance of assignment duly signed by both parties

- Duly executed SPA (valid for 1 year from date of notarization)

- Duly accomplished Condonation and Restructuring Application Form

- Photocopy (original to be presented) of IDs such as

- GSIS eCard

- UMID, passport,

- PhilID or

- any two (2) valid IDs

- Latest real property tax declaration

- Real property tax clearance certificate for current year

- Transfer of rights documents such as

- If the original borrower or spouse is deceased, the heirs who will execute the Deed of Transfer of Rights and SPA must present the following:

- Deed of Adjudication of Sole Heir or Deed of Extrajudicial Settlement (for two (2) or more surviving heirs) plus SPA from co-heirs authorizing the applicant to apply for condonation

- PSA-authenticated death certificate of the borrower

- PSA-authenticated marriage contract of the borrower, if applicable

- PSA-authenticated birth certificate of heir/s; and

- Valid IDs

Step-by-Step Application Process

Here’s how you can apply for the GSIS Ginhawa for All Housing Account Restructuring and Condonation Program:

Step 1: Request an Updated Statement of Account (SOA)

Submit your request for reconciliation and SOA using any of these methods:

- Postal mail or courier

- Phone call

- GSIS online appointment system

Step 2: Wait for Notification

You will receive updates on the status of your request from GSIS.

Step 3: Attend Counselling and Submit Documents

Schedule an appointment with GSIS for counselling. During this session, your updated SOA will be discussed, and you will submit your required documents.

Payment Options

The GSIS offers flexible payment methods depending on whether you’re fully paying or restructuring your account.

- Full Payment and Account Updating

- Cash

- Manager’s check

- Debit from Union Bank of the Philippines account

- Restructuring

- Salary deduction

- Cash or manager’s check

- Post-dated checks

- Union Bank debit

- External payment services (e.g., Bayad)

Note: For default accounts eligible for full updating without restructuring, penalties and surcharges must also be settled in full.

Where to Secure the Application Form

The application form for the GSIS Ginhawa for All Housing Account Restructuring and Condonation Program can be downloaded for free from the official GSIS website (https://www.gsis.gov.ph/downloads/forms/2021/20220607-Housing-Loan-Condonation-Restructuring-Program-Application-Form_Codified.pdf). Applicants may also secure the form by visiting any GSIS branch office nationwide. The processing of applications typically takes 30 to 60 days, depending on the completeness of the submitted documents and the verification process.

Video: Ginhawa for All Housing Account Restructuring and Condonation Program

The Ginhawa for All Housing Account Restructuring and Condonation Program provides existing housing account buyers or borrowers an opportunity to bring their housing accounts back to current status. It encourages full payment due to waiver of penalties and partial discount on interests effectively reducing the balance on housing accounts. To learn more about the program and what it actually entails, watch this video from GSIS Official today.

Summary

The GSIS Ginhawa for All Housing Account Restructuring and Condonation Program provides valuable support for borrowers struggling to manage their housing accounts. With benefits such as waived penalties, interest discounts, and flexible payment terms, the program eases the financial burden of housing loans. Eligible borrowers, heirs, and successors-in-interest are encouraged to apply by following the straightforward application process and submitting the necessary requirements. This initiative not only helps borrowers settle their obligations but also secures their housing investments, ensuring financial stability in the long term.

Contact Information

For further inquiries or assistance, you can reach out to:

Real Estate Asset Disposition and Management Office

Email: hard@gsis.gov.ph

Phone: (02) 7976-4900 (loc. 3361-3364)