The GSIS Ginhawa for All – Lease with Option to Buy (GFAL LWOB) Program is a unique housing initiative designed to provide eligible individuals with access to affordable housing. This program allows applicants to lease housing units owned by the Government Service Insurance System (GSIS) for one year, with the option to purchase the property anytime during the lease term. This initiative not only benefits lessees by offering flexible homeownership opportunities but also ensures that GSIS-acquired properties are made accessible to Filipinos—GSIS members or otherwise.

Understanding how to apply for the GFAL LWOB Program is essential for those interested in availing of this housing program. By leasing properties with an option to buy, individuals can secure their dream homes at reasonable costs—a dream that many Filipinos have but can’t afford most of the time. In this guide, we will walk you through acquiring your dream home by providing the detailed steps, eligibility requirements, and essential tips to help you avail of the benefits of the GFAL LWOB program and navigate the application process without too much trouble.

Program Overview

The GFAL LWOB Program is a GSIS housing initiative designed to offer affordable leasing options with the unique opportunity to purchase the property during the lease term. Targeted at individuals with a steady income, it enables participants to lease GSIS-owned properties on an “as-is, where-is” basis, prioritizing current occupants and making improvements their responsibility. This program promotes financial flexibility by allowing lessees to decide when they are ready to transition from renters to property owners.

Launched to address the housing needs of Filipinos, the GFAL LWOB program supports the GSIS vision to maximize the utilization of its acquired assets. By transforming idle properties into livable spaces, the initiative fosters economic value while offering sustainable housing solutions. The program also aims to provide housing opportunities for individuals and families, offering flexible terms that allow lessees to buy the property anytime during the lease term and the security of eventual ownership through lease-purchase agreements.

Features and Program Terms

The program offers flexible lease-to-own housing arrangements with the following features, terms, and conditions:

- Lease Duration: The lease is valid for one year and is renewable at the discretion of GSIS.

- Priority Occupants: Current occupants are prioritized for leasing and purchase options.

- Property Condition: Properties are leased on an “as-is, where-is” basis, with any improvements shouldered by the lessee.

- Purchase Option: Lessees can purchase the leased property anytime within the lease period.

- Payment Requirements: Two months’ advance rental and two months’ security deposit are required upon signing the lease.

- Payment Modes: Rent can be paid via cash, post-dated checks, or manager’s/cashier’s checks.

- Eligibility: Applicants must be Filipino citizens with a stable source of income and meet all GSIS requirements.

- Application Process: Interested parties must submit complete documents, including proof of income and valid IDs, to GSIS for review and approval.

Benefits

It also offers several advantages to program participants, such as:

- Affordable Housing Access: Allows qualified individuals to lease properties at reasonable rates with the option to purchase them later.

- Flexible Purchase Terms: Provides the freedom to buy the leased property anytime during the lease period.

- The program also allows buyers to spread costs over several years.

- Cash Payment: Full payment within 30 calendar days of approval is required.

- In-House Financing: GSIS offers an installment sale option with no down payment for GSIS members.

- Non-members must pay 10% of the total price as a deposit.

- For installment buyers, the loan term depends on the property type:

- House and Lot: Up to 25 years.

- Condominium Units: Up to 20 years.

- Lot Only: Up to 15 years.

- Priority for Current Occupants: Gives existing occupants first priority to lease and eventually own the property they already reside in.

- Lessees can test living in the property before committing to a purchase.

- Lessees can make improvements to the property, ensuring it meets their specific needs.

- No Immediate Down Payment: Lessees are not required to make a down payment upon leasing, easing initial financial burdens.

- GSIS members benefit from exclusive financing options with no required down payment.

- Ownership Opportunity: Offers lessees the potential to transition from renting to owning, ensuring long-term housing security.

- Transparent Payment Options: Rent and purchase payments can be made conveniently via cash, checks, or other approved methods.

- The interest rate for in-house financing is set at 6% per annum, subject to periodic review.

- Payments are made through salary deduction or alternative methods in specific cases.

Target Beneficiaries

The program is designed to benefit the following groups:

- Filipino citizens with a regular source of income who are legally allowed to enter into a lease agreement.

- Current occupants of GSIS-owned residential properties, who are given priority for leasing and eventual purchase.

- Interested lessees seeking affordable housing options, provided they meet the program’s qualifications.

- GSIS members and employees, eligible to apply for financing options when transitioning to property ownership.

- Low- to middle-income earners seeking flexible housing solutions without immediate purchase obligations.

Eligibility Criteria

To qualify, interested applicants must meet the following qualification requirements:

- Filipino Citizenship: Applicants must be Filipino citizens legally allowed to enter into agreements.

- Stable Income: Applicants should have a regular source of income to meet rental obligations.

- For those participating in the Public Bidding Option:

- Must be a Filipino citizen or an authorized entity under Philippine laws.

- For those opting for in-house Financing:

- Must be an active GSIS member with updated premium contributions.

- Have at least three years of service and no pending cases.

- Maintain a net take-home pay of at least ₱5,000 after deductions.

Note: Priority is given to current occupants of GSIS properties, but non-members can still avail of installment options but must meet separate requirements, including a 10% down payment. Non-occupants of GSIS properties can apply for unoccupied units. Applicants must also shoulder any costs related to property improvements.

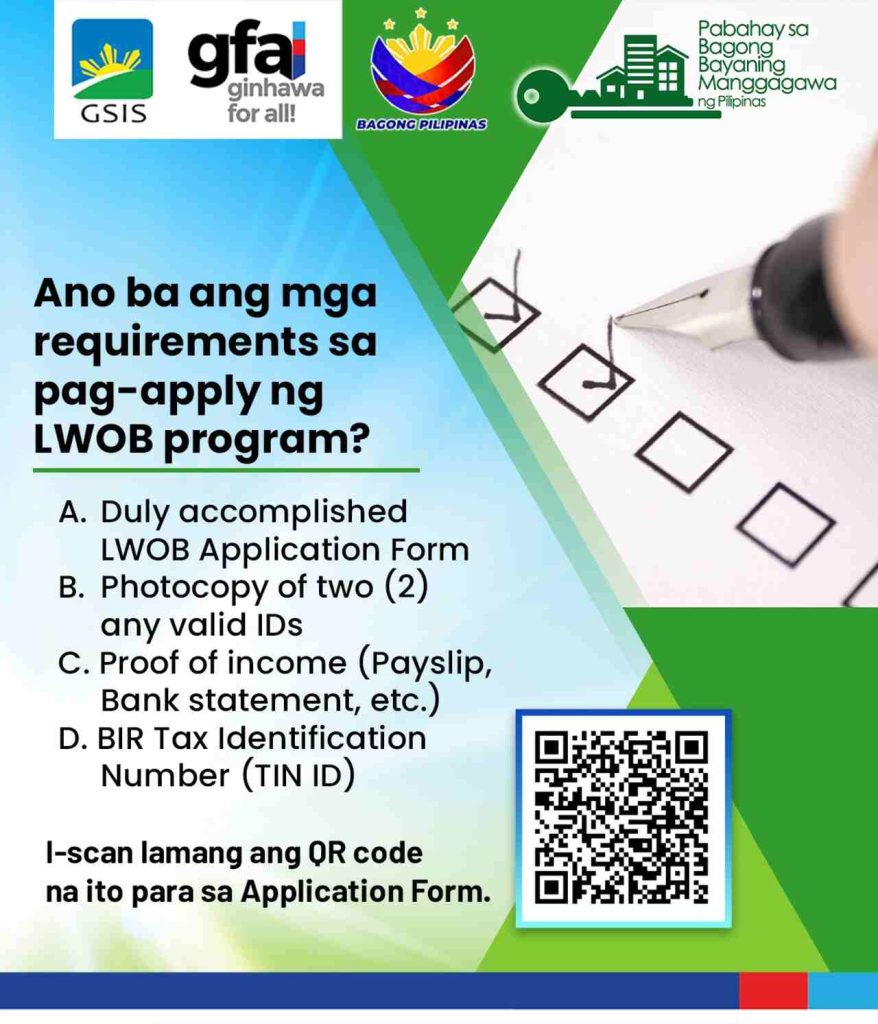

Required Documents

Applicants must prepare and submit the following documents based on their eligibility and status when applying for the program:

General Requirements

- Properly accomplished Application Form

- Manager’s Check payable to GSIS covering at least 10% of the bid offer plus 12% VAT, if applicable

- Two (2) proofs of occupancy (for current occupants)

- Barangay certificate confirming residency in the property.

- BIR Tax Identification Number (TIN)

- A valid government-issued ID or latest billing statement showing the property’s address.

- Special Power of Attorney (SPA) if represented by another person.

- Proof of income (e.g., payslip or employment certificate).

Additional Requirements Based on Bidder Type

For GSIS Members:

- Duly accomplished Personal Profile form with two (2) recent 2×2 ID photos.

- Photocopy of GSIS eCard, UMID, or government-issued ID.

- Notarized Certificate of Employment with Compensation and updated pay slip.

- Clearance or Certification of no pending administrative or criminal cases.

For Non-GSIS Members:

- Photocopy of valid government-issued IDs (at least one from the list provided by GSIS).

- Proof of income or employment certificate.

For Occupant Bidders:

- Barangay Certificate and valid ID showing proof of current residency in the property.

For Non-Occupant Bidders:

- General bidding requirements

- Bid Form

- Manager’s Check, and

- SPA if applicable

- No proof of occupancy required.

For In-House Financing:

- Be an active GSIS member with updated premium contributions.

- Have at least three years of service and no pending cases.

- Maintain a net take-home pay of at least ₱5,000 after deductions.

- Non-members can still avail of installment options but must meet separate requirements, including a 10% down payment.

Note: All required documents must be submitted in a sealed bid envelope following GSIS guidelines. They must be complete to avoid delays in processing.

Step-by-Step Application Process

Here is a detailed procedure when applying for the program:

Step 1. Document Submission

- Submit all required documents to the GSIS Real Property Accounts Management Department (RPAMD) at the GSIS head office or any nearby branch.

- For Public Bidding Option: Submit a sealed bid with proper documentation, including a bid deposit equal to 10% of the offer price.

Step 2. Notification

Wait for GSIS to review your application. If approved, a Letter of Approval will be issued, valid for 30 calendar days from receipt.

- Winning bidders receive a Notice of Approval of Sale (NOAS) and must settle the remaining 90% of the property price within 30 days. Failure to comply may lead to forfeiture of the 10% deposit.

Step 3. Lease Agreement

Once approved, sign the lease agreement and pay two months’ advance rental fees along with a two-month security deposit.

Step 4. Payment Options

Rental fees can be paid through cash, post-dated checks, or manager’s/cashier’s checks.

By following these steps, applicants can lease properties under the GFAL LWOB Program and secure the option to purchase their chosen property.

Frequently Asked Questions

For your reference, here are some common questions and answers regarding GFAL LWOB:

1. Is the GFAL LWOB Program open to non-GSIS members?

Yes, non-members can lease GSIS properties but may face different requirements when opting to purchase.

2. Can I prepay my loan under the installment sale?

Yes, prepayments are allowed at any time without penalties.

3. What happens if I fail to pay on time?

Late payments incur a 2% penalty per month, compounded annually.

4. Can I mortgage the property purchased under the GFAL LWOB Program?

No, GSIS prohibits mortgaging properties acquired through this program.

5. What happens if I fail to meet the terms of the lease?

GSIS may terminate the lease agreement, and the lessee forfeits any fees or deposits made.

Video: GSIS Ginhawa for All – Lease with Option to Buy (GFAL LWOB) Program

Learn more about the terms, conditions, and everything else related to application for and availment of the benefits of the GFAL LWOB Program by watching this video from GSIS Official:

Summary

The GSIS GFAL LWOB Program provides a flexible way for individuals to secure affordable housing. Through this program, applicants can lease GSIS-owned properties for one year with the option to buy at any time during the lease term. The step-by-step initiative is ideal for both GSIS members and non-members, offering flexible payment terms, affordable interest rates, and no down payment for qualified members. Whether you aim to lease or purchase, the GFAL LWOB Program presents a practical solution for Filipinos seeking homeownership. For more information or assistance regarding the GSIS GFAL LWOB Program, you can reach the Real Property Accounts Management Department (RPAMD) at:

Phone: (02) 8479-3600 or (02) 7976-4900 (local 3374, 3396, 3425)

Mobile: 0939-986-5962

Email: gsisrpamdcst@gsis.gov.ph