The DOST-TAPI Venture Financing Program (VFP) is a specialized funding support initiative from the Department of Science and Technology – Technology Application and Promotion Institute (DOST-TAPI) aimed at advancing Filipino technology-based Micro, Small, and Medium Enterprises (MSMEs). It supports businesses engaged in the commercialization of innovative technologies and inventions. The financial assistance provided under this program helps cover key operational costs that directly contribute to product distribution, market entry, and overall business growth. If you’re an MSME with a tech-based product and are looking for funding to fulfill purchase orders or secure certifications, this program is designed for you.

This comprehensive guide will walk you through how to apply for Financial Assistance Service under the VFP—from eligibility and requirements to the step-by-step application and fund release process.

Program Overview

The VFP provides financial assistance to help qualified MSMEs accelerate commercialization of technologies, support unserved purchase orders, pay for packaging, certifications, and other commercialization needs. It aims to improve the viability and competitiveness of local tech enterprises.

The funding covers:

- Raw and packaging materials for unserved purchase orders

- Slotting or rental fees for retail display

- Web hosting and maintenance

- Licensing fees

- Certification fees for local and international standards

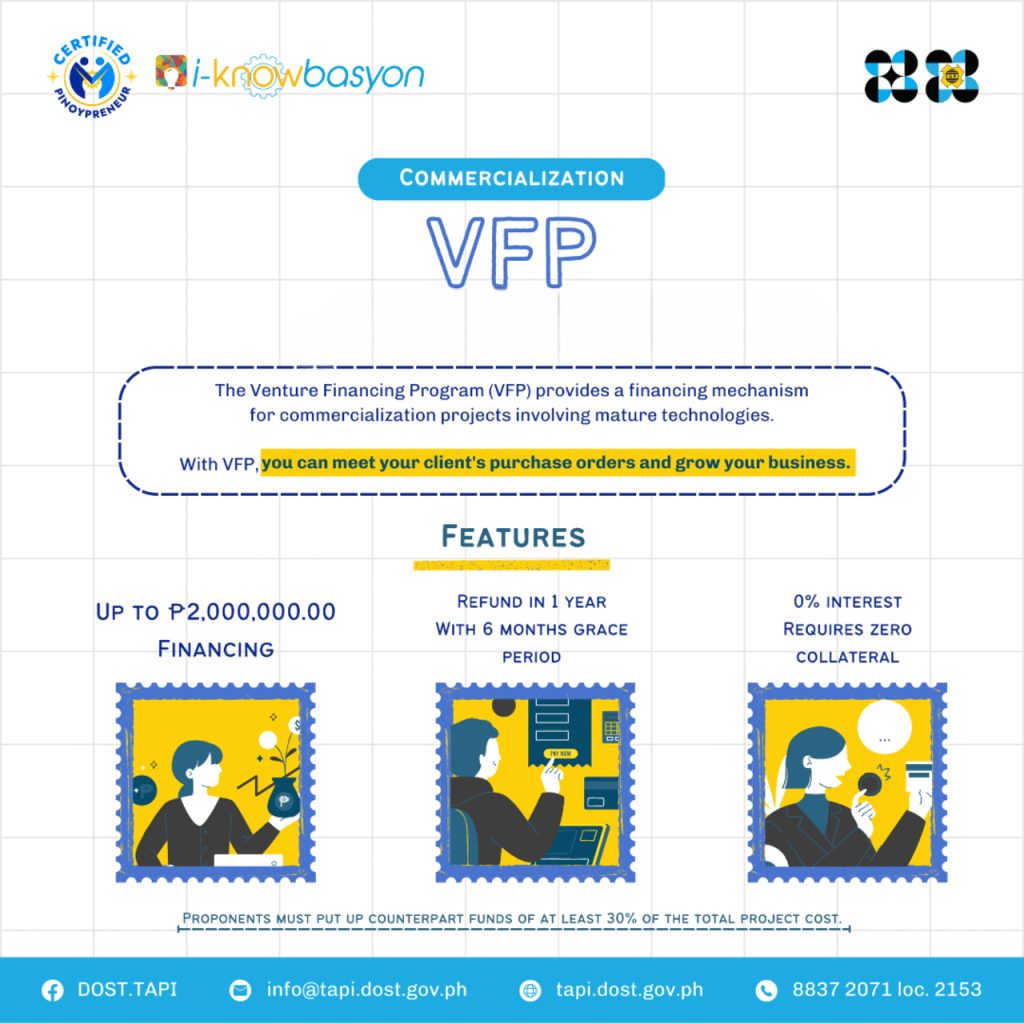

Features

The program offers the following:

- Covers up to 70% of the total project cost

- Maximum amount: ₱2,000,000.00

- Remaining 30% should be covered by the proponent

- No interest

- 1-year refund period plus a 6-month grace period

Benefits

Applying for the DOST-TAPI Venture Financing Program offers both financial and operational advantages for eligible technology-based MSMEs. Whether the application is approved or not, proponents can gain useful insights and resources that may support their future business plans.

For successful applicants:

- Receive up to ₱2 million in non-interest financial assistance

- Funding support for production materials, certifications, licensing, and packaging

- Enhanced capacity to fulfill purchase orders and expand market reach

- Access to DOST network and possible future collaborations

- Boosted credibility for potential investors and business partners

For unsuccessful applicants:

- Gain a comprehensive evaluation of their business proposal

- Receive feedback that can guide future improvements

- Opportunity to reapply once requirements are updated or business is more ready

- Increased awareness of government support programs and how to qualify

Who Can Apply?

To qualify for financial assistance under the DOST-TAPI VFP, you must be:

- A Filipino-owned MSME (minimum 60% local ownership)

- Operating for at least 3 years

- Duly registered as a Sole Proprietorship, Partnership, Cooperative, or Corporation

- A technology-based company, and must meet at least one of the following:

- Has an active intellectual property (IP) filing

- Is an adopter of DOST-generated or funded technology

- Has received DOST support in the past

- Is a technology licensee

- MSMEs that are already in the commercialization phase of their product or technology

Note: Companies in the discovery or pre-commercialization stage are not eligible.

Required Documents

Here’s a list of required documents you will need to prepare:

- Letter of interest and commitment to DOST-TAPI

- Latest Mayor’s or Business Permit

- Data Privacy Consent Form

- Unserved valid Purchase Order(s)

- Full Project Proposal/Feasibility Study with:

- Company Background

- Marketing Plan

- Technology Description

- Waste/Social Impact

- Financial Projection

- Endorsement from concerned DOST office or R&D institute

- Latest Audited Financial Statement (at least one year)

- Technology Licensing Agreement or MOA (if applicable)

- Deed of Assignment (if applicable)

- Latest certification quotations (if applying for certification funding)

- Merchant’s letter of acceptance and billing proof (for slotting fees)

- Job Order Contract (for web hosting and maintenance)

For Cooperatives:

- Certificate of registration with the Cooperative Development Authority (CDA)

- Latest General Information Sheet (GIS)

- Notarized Secretary’s Certificate (borrowing authorization)

For Partnerships/Corporations:

- SEC registration certificate

- Latest General Information Sheet (GIS)

- Notarized Secretary’s Certificate (borrowing authorization)

Step-by-Step Application Process

To apply, simply follow these steps:

Step 1: Proposal Submission & Initial Review

- Submit your complete application to DOST-TAPI Records Section

- The office will check if the application falls under VFP

- Your documents will be assessed for completeness

- You will be notified whether your submission is accepted or incomplete

Step 2: Technical Evaluation Committee (TEC) Review

- A Technical Committee will be assigned via Special Order

- They will review your proposal, potentially conduct site visits

- A report and recommendation will be drafted and reviewed

- The recommendation will be forwarded to the Executive Committee

Step 3: Executive Committee Review

- The proposal is deliberated by the TAPI Executive Committee

- A resolution is issued either approving or denying the proposal

- You will be formally notified of the decision

Step 4: MOA Drafting, Orientation, Signing, Notarization

- DOST-TAPI will prepare the Memorandum of Agreement (MOA)

- You’ll attend an orientation before signing

- The MOA is notarized and routed for final signature

Step 5: Fund Release

For Check Payments:

- Disbursement documents are processed and approved

- Check is prepared and signed

- You are notified when the check is available

For LDDAP-ADA (List of Due and Demandable Accounts Payable with Authority to Debit Account):

- Digital disbursement process via Landbank

- Payment is credited to your account after Landbank validation

- Notification of fund release is sent

Where to Get the Application Forms

All required forms and letter templates, including the application letter, Data Privacy Consent Form, project proposal template, endorsement form, and notarized Secretary’s Certificate, can be downloaded from the official DOST-TAPI website. These templates are designed to guide applicants in submitting complete and properly formatted documents. For easy access, visit www.tapi.dost.gov.ph or check the specific call for proposals section for the Venture Financing Program.

Where to Submit and Who to Contact

Applications and inquiries may be submitted through the DOST-TAPI Public Assistance Office:

- Website: http://www.tapi.dost.gov.ph/

- Facebook: https://www.facebook.com/DOST.TAPI

- Email: info@tapi.dost.gov.ph

- Phone: (02) 8837-2072 to 82 local 2153

Cost and Processing Timelines

The DOST-TAPI VFP covers up to 70% of the total project cost, with a maximum of ₱2,000,000, while the applicant provides the remaining 30% as counterpart funding. The processing time for check payments takes approximately 47 working days and 2 hours, while LDDAP-ADA (digital disbursement) may take up to 51 working days. Applications disapproved during formal evaluation are resolved in about 5 working days, while those rejected during Executive Committee review take around 35 working days.

Video: DOST Programs and Services for Various MSMEs

If you’re a Filipino MSME with a technology-focused business that needs support for commercialization, the DOST-TAPI VFP offers non-interest funding of up to ₱2 million. The program covers costs like production materials, certifications, licensing, and more. However, if you don’t qualify for this, you may also check out the other DOST programs and services specifically designed for MSMEs by watching the video below: