The DA Survival and Recovery (SURE) Assistance Program is a financial relief initiative spearheaded by the Department of Agriculture (DA) through the Agricultural Credit Policy Council (ACPC). Launched in 2017, the program was developed as a proactive response to help small farmers and fisherfolk recover from the adverse impacts of natural disasters, pest outbreaks, and other agricultural shocks. It is anchored on the government’s commitment to inclusive rural development and disaster resilience, with legal backing from Republic Act No. 10000 or the Agri-Agra Reform Credit Act of 2009 and other credit and financing policies under the DA framework.

The main objective of the SURE Assistance Program is to provide accessible, zero-interest credit to affected agricultural households in areas declared under a state of calamity. It aims to help sustain food production, support livelihood recovery, and prevent vulnerable communities from falling into debt traps due to high-interest informal lending. Knowing about this program is important, especially for those in the agriculture sector, because it offers a vital safety net that promotes economic recovery, strengthens food security, and empowers marginalized farmers and fisherfolk to bounce back after crises. If you are a small farmer or fisherfolk affected by calamities, the DA offers a lifeline through the SURE Assistance Program. This guide will tell you everything about the eligibility, loan features, application steps, and where to apply to avail of the benefits of this program.

Features

The DA SURE Assistance Program is a financial assistance program initiated by the DA through the ACPC. It aims to support agricultural households — specifically small farmers and fisherfolk — in areas declared under a state of calamity. This agriculture-focused assistance program provides both loan and grant packages to help communities recover from the economic impact of natural disasters. It was first implemented in 2017 and continues to serve as an accessible and affordable recovery mechanism in disaster-stricken regions of the Philippines.

Here are some of the key features of the SURE Assistance Loan Program:

- Loan amount: Up to ₱25,000

- Interest: 0% interest rate (a 3% service fee may be charged by partner lending conduits)

- Collateral: No collateral required

- Repayment: Payable up to 3 years

- One-year moratorium for borrowers with existing loans under other ACPC programs

- Disbursement: Loans are released through Partner Lending Conduits (PLCs) such as cooperatives, cooperative banks, and rural banks

The loan may be used for:

- Rehabilitating farming or fishing activities

- Purchasing agricultural inputs

- Repairing farm or fishing equipment

- Acquiring livestock or work animals

SURE Aid Program: Expanded Financial Support for Rice Farmers

A special component of the SURE Assistance Program is the SURE Aid, which focuses on rice farmers affected by low palay prices.

SURE Aid Loan Features:

- Loan amount: ₱15,000 (one-time assistance)

- Interest rate: 0% interest

- Repayment period: Payable up to 8 years

- Disbursement through LandBank ATM cards

This specific aid is intended for registered rice farmers with land holding of at least one hectare or less. It is part of the broader strategy to support the agriculture sector in the Philippines, especially those hit by market fluctuations.

Areas Previously Covered by the SURE Program

The program has been previously activated in multiple regions declared under a state of calamity. These include:

- MIMAROPA (Region 4-B)

- Western Visayas (Region 6)

- Central Visayas (Region 7)

- Eastern Visayas (Region 8)

- Northern Mindanao (Region 10)

- CARAGA (Region 13)

Calamities such as Typhoon Odette have prompted the allocation of P500 million in credit funds to support affected agricultural households in these areas.

Program Benefits

Applying for the DA SURE Assistance Program offers several practical benefits that can greatly support the recovery and livelihood of farmers and fisherfolk:

- Zero-interest loan assistance with flexible payment terms.

- Quick access to financial support during and after calamities or agricultural emergencies.

- No collateral required, making it more accessible to small-scale farmers and fisherfolk.

- Prevents dependency on informal lenders with high-interest rates.

- Helps restore agricultural production and livelihood activities immediately after disasters.

- Promotes financial inclusion and credit access for marginalized rural communities.

- Supports long-term recovery and resilience in the agriculture and fisheries sector.

Target Beneficiaries

It was designed to support the most vulnerable sectors in agriculture by providing financial aid to the following target beneficiary groups:

- Small farmers and fisherfolk affected by natural disasters, calamities, or emergencies

- Marginalized and low-income rural households dependent on agriculture

- Agripreneurs and micro and small agri-based enterprises (MSEs)

- Returning Overseas Filipino Workers (OFWs) venturing into agri-based livelihoods

- Youth agri-entrepreneurs under DA’s KAYA (Kapital Access for Young Agripreneurs) initiative

- COVID-19 affected agricultural workers and displaced rural laborers

Who Can Apply?

The program is open to small farmers and fisherfolk in areas declared under a state of calamity. To qualify, applicants must meet the following criteria:

- Must be registered in the Registry System for Basic Sectors in Agriculture (RSBSA)

- Must be tilling one hectare of land or less (for specific SURE Aid assistance for rice farmers)

- Must be endorsed by the Municipal Agriculture Office (MAO)

- Only one borrower per household can apply.

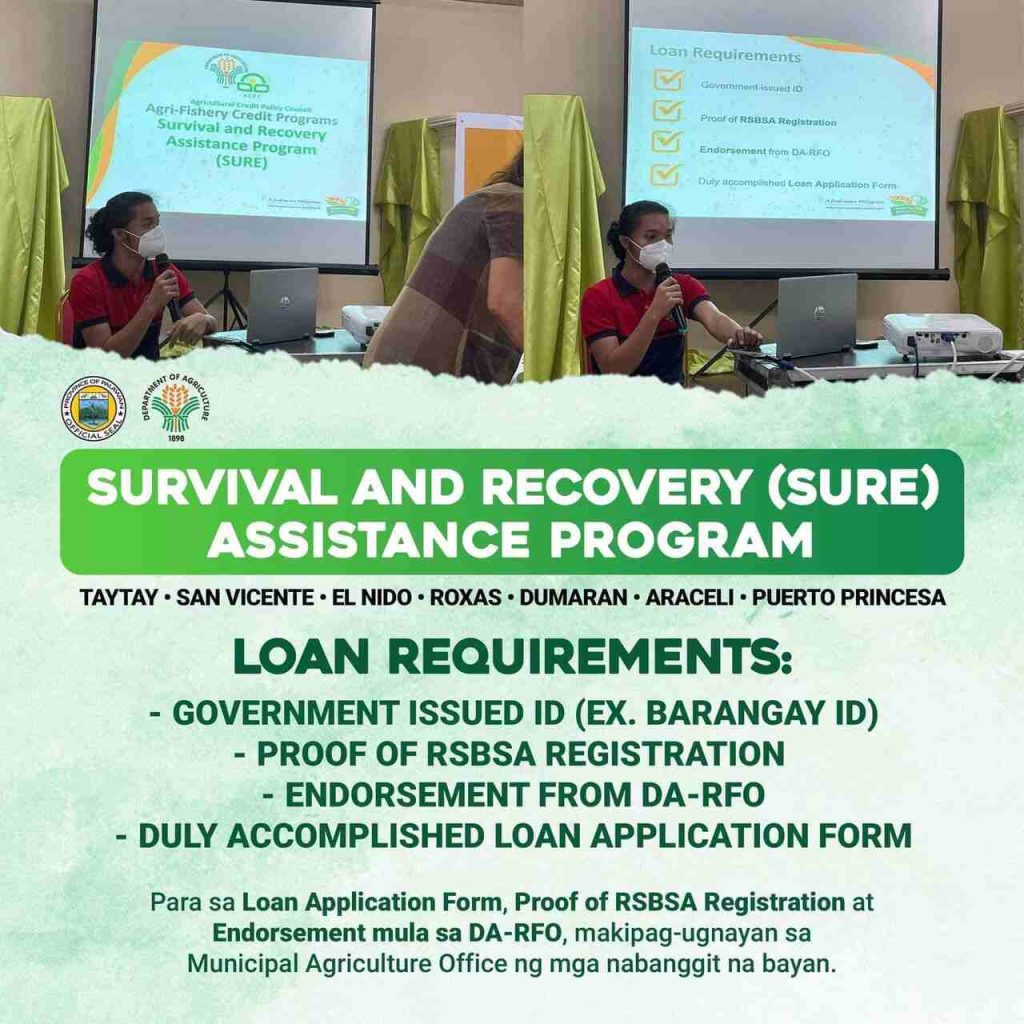

Documentary Requirements

To apply, interested parties need to prepare and submit the following requirements:

- Photocopy of a valid ID with 3 signatures

- 1×1 or 2×2 ID picture (1 copy)

- Duly accomplished SUREAID Loan Application Form

- Certification or Endorsement from your Municipal Agriculture Office

- Proof of registration in the RSBSA

Application Process: Step-by-Step Guide

Applying for the DA Survival And Recovery (SURE) Assistance Program involves coordination with your local government offices. Here’s a detailed breakdown:

Step 1: Coordinate with Your Local Municipal Agriculture Office

Visit your Municipal Agriculture Office (MAO) and sign in at the Public Assistance Desk.

Step 2: Initial Interview and Application Form

Assigned personnel will conduct an interview and assist in filling out the SURE Assistance Loan Application Form.

Step 3: Submit Required Documents

Provide the required documents listed above.

Step 4: Review and Encoding

The assigned personnel will review your documents and encode your basic information for tracking and master listing.

Step 5: Endorsement and Processing

The application will be endorsed to the DA Regional Field Office (DA-RFO) and processed by partner lending conduits or LandBank.

Where to Secure Application Form

You can secure the application form for the DA SURE Assistance Program through the following channels:

- Municipal or City Agriculture Office (MAO/CAO): Visit your local agriculture office to request the SURE Loan Application Form and receive assistance in completing the process.

- Provincial Agriculturist’s Office—Agribusiness Marketing Assistance and Institutional Development Division (PAGRO – AMAIDD): You may also obtain the application form and other requirements from this office if applicable in your area.

- Department of Agriculture Regional Field Offices (DA-RFOs): These offices coordinate closely with local government units and can assist with the distribution and submission of application forms.

- Official DA-ACPC Website or Helpdesk: You may inquire online or email helpdesk@acpc.gov.ph to request digital copies or further guidance.

Cost and Processing Timelines

The application process for the DA SURE Assistance Program is free of charge. This means that there are no processing or application fees required from beneficiaries. However, applicants are expected to shoulder minor incidental expenses such as photocopying of documents or transportation to the application site, if necessary.

The total estimated processing time for the application is approximately 47 minutes, excluding the time needed for endorsement feedback and evaluation from concerned offices (e.g., LGU or DA-RFO). Actual processing timelines may vary depending on the volume of applicants and responsiveness of endorsing agencies, but the DA and ACPC strive to maintain an efficient and streamlined process to ensure immediate assistance delivery.

Partner Lending Conduits (PLCs)

Loan proceeds are distributed through accredited lending institutions, including:

- Rural banks

- Cooperative banks

- Cooperatives

- Government banks like LandBank

These institutions serve as the bridge between DA-ACPC and the eligible small farmers and fisherfolk.

Support from Government Leaders

The SURE Assistance Program has received strong backing from government officials. Agriculture Secretary William Dar emphasized its role in helping rice farmers recover from falling palay prices. The program was launched in areas like Zaragoza, Nueva Ecija, where over 1,000 farmers initially received financial assistance.

The DA, in partnership with LandBank, aims to simplify the application process and speed up loan disbursement. In fact, loan processing time has been shortened to just three hours in some cases.

Integration with Other Agricultural Programs

The SURE Assistance Program is part of a broader framework of agricultural support in the Philippines. It aligns with the Rice Tariffication Law and the implementation of the Rice Competitiveness Enhancement Fund (RCEF), which includes:

- Mechanization support (PhilMech)

- Seed distribution (PhilRice)

- Farmer training and extension (ATI)

- Credit assistance (LandBank, DBP)

- Skills training (TESDA)

These programs aim to provide long-term solutions to challenges in the agriculture sector while the DA SURE Assistance Program addresses short-term recovery needs.

Video: DA SURE Assistance Program

The DA Survival And Recovery (SURE) Assistance Program offers a practical and accessible financial assistance option for small farmers and fisherfolk in the Philippines. Whether you need support after a natural disaster or help reviving your livelihood, this DA assistance program can help you get back on your feet. If you’re affected by calamities and need financial assistance, don’t hesitate to visit your local Municipal Agriculture Office or reach out to DA-ACPC to begin your application. You may also check out this video from Serbisyong Bayanihan to get you started:

Contact Information

If you need assistance or want to follow up on your application, you can contact:

Department of Agriculture – Agricultural Credit Policy Council (DA-ACPC)

Office Address: 28F One San Miguel Avenue Building, San Miguel Ave corner Shaw Blvd., Ortigas Center, Pasig City

Phone: (02) 8634-3320 to 21

Email: helpdesk@acpc.gov.ph