Authorization letters are documents that grant a representative the authority to act on behalf of an individual, particularly for claiming financial assistance in the Philippines. These letters are commonly used when the original applicant, beneficiary, or rights holder cannot be present to complete transactions, such as when collecting the assistance funds or accessing the benefits itself.

Generally, the letter of authorization is given to a trusted representative to facilitate transactions and legally safeguard both issuing and receiving parties involved in the transaction. It usually follows a specific format, and is designed to include details such as the purpose of the authorization, the names of the parties involved, the specific task being authorized, the date, and the necessary identification documents of both the authorized representative and the authorizing party.

It is a legal and formal document that not only facilitates financial transactions but also clearly specifies any limitations regarding the authorization.

Claiming Financial Assistance Using Authorization Letters

Financial assistance in the Philippines refers to monetary support provided to individuals or families facing economic hardships, often due to unemployment, health crises, or natural disasters. These programs, administered by various government agencies such as the Department of Social Welfare and Development (DSWD), aim to alleviate poverty, promote social mobility, and provide short-term relief to vulnerable sectors of society. By offering cash aid, scholarships, and other forms of support, financial assistance programs help enhance the well-being and stability of affected communities.

An authorization letter is necessary for claiming financial assistance because it formally designates a representative to act on behalf of the individual who is unable to claim the aid personally. This document serves to ensure that the process is secure and legally recognized, preventing any potential misuse of funds or misrepresentation. Claiming financial assistance using authorization letters means that the authorized person has the legal right to collect funds or benefits on behalf of another, thereby facilitating access to essential resources for those who may be incapacitated or otherwise unavailable.

Common Reasons for Needing an Authorization Letter

Authorization letters are often required in the Philippines for individuals needing to claim financial assistance due to various circumstances. These letters serve as a formal means of granting permissi1on for someone else to act on their behalf, ensuring that the process is secure and legally recognized.

Some of the most common reasons for needing an authorization letter to claim financial assistance include:

- Health Issues: Individuals who are hospitalized or dealing with serious medical conditions may be unable to attend in person.

- Work Obligations: Those with demanding jobs or travel commitments might find it difficult to claim assistance personally.

- Family Emergencies: Situations such as caring for a family member in crisis can prevent individuals from attending to financial matters.

- Distance or Relocation: People living far from the assistance provider or those who have recently moved may require someone local to handle the claim.

- Legal Restrictions: In some cases, legal issues may prevent an individual from claiming funds directly, necessitating a representative.

Purpose and Benefits

An authorization letter serves as a formal document that grants someone the authority to act on behalf of another individual or entity. This essential tool is used in various situations where personal presence is not possible, ensuring that the authorized person can perform specific tasks legally and effectively.

The purposes and benefits of having an authorization letter include:

- Delegation of Authority: It allows individuals to delegate responsibilities to trusted representatives, ensuring that the task of claiming financial assistance is completed efficiently without unnecessary delays.

- Legal Protection: The letter provides a legal backing for the actions taken by the authorized person, minimizing risks and protecting the interests of both parties involved.

- Enhanced Accountability: By clearly outlining the scope of authority, the letter ensures that the authorized individual is accountable for their actions, promoting transparency and responsibility.

- Secure Transactions: Authorization letters help safeguard sensitive information and transactions by designating trusted individuals to handle important matters.

- Streamlined Processes: They facilitate smoother interactions with external entities such as banks, government agencies, or vendors, reducing confusion and enhancing credibility.

Key Elements or Parts

An authorization letter is a formal document that grants someone the authority to act on behalf of another person. To ensure its effectiveness and legality, make sure that the following key elements are included in the letter:

- Date and Place: The letter should start with the date it is written and the location to establish its validity.

- Recipient Information: Include the full name, job title, and contact details of the person or organization receiving the authorization.

- Authorization Statement: Clearly state that you are authorizing the recipient to act on your behalf, specifying the scope of their authority. To specify the scope of authority in an authorization letter, clearly outline the following:

- Define Specific Actions: Clearly state what the authorized person is allowed to do, such as conducting business transactions, making decisions, or representing you in legal matters.

- Include Relevant Details: Mention any pertinent dates, locations, or contexts in which the authority applies to avoid ambiguity.

- Outline Limitations: If there are any restrictions on the authority granted, such as financial limits or specific tasks that are excluded, be sure to include these details to clarify the extent of the authorization.

- Duration of Authorization: Indicate how long the authorization is valid, specifying start and end dates, or contextual relevance, if applicable, to ensure that the authorization letter is effective and legally sound, protecting both the grantor and the authorized individual. Here are some important notes to consider:

- Start and End Dates: Clearly state the exact dates when the authorization begins and ends. For example, “This authorization is effective from [Start Date] to [End Date]” ensures that all parties know the time frame of the authorization.

- Specific Duration: If applicable, mention a specific duration instead of exact dates, such as “This authorization is valid for 30 days from the date of this letter.” This approach provides flexibility while still defining a clear time limit.

- Revocation Clause: Include a statement indicating that the authorization can be revoked at any time in writing. This clause provides additional security and clarity regarding the authority granted.

- Contextual Relevance: Ensure that the duration aligns with the purpose of the authorization. For instance, if it’s for a single transaction, specify that it is only valid for that particular action.

- Closing and Signature: Conclude with a polite closing, followed by your signature and printed name to authenticate the document.

- Witness Signature (if needed): If required, provide a space for a witness to sign, adding an extra layer of legitimacy to the letter.

Including these elements ensures that the authorization letter is clear, legally binding, and effective in granting necessary permissions, especially when sending a representative to claim financial aid on your behalf.

How to Write an Authorization Letter

Just like any business letter, writing a letter of authorization to claim financial assistance on behalf of another person involves a structured approach to ensure clarity and legality. Following these step-by-step procedures can help create an effective and valid document.

Step 1. Format the Letter

Start with your name, address, and date at the top, followed by the recipient’s details.

Step 2. Use a Formal Salutation

Address the letter appropriately, using “Dear [Recipient’s Name]” or “To Whom It May Concern.”

Step 3. State Your Intent

Begin by clearly stating that you are authorizing someone to act on your behalf for claiming financial assistance.

Step 4. Provide Details of the Authorized Person

Include the full name and contact information of the person you are authorizing.

Step 5. Specify the Purpose

Clearly outline that the authorization is specifically for claiming financial assistance, mentioning any relevant details about the assistance.

Step 6. Define the Scope of Authority

List the specific actions the authorized person can undertake, such as signing documents or collecting funds.

Step 7. Indicate Duration of Authorization

Specify the start and end dates for which the authorization is valid.

Step 8. Mention a Call to Action

In case something goes wrong, always provide your contact information in the note. Remember that even after distributing responsibilities, you are still liable.

Step 9. Include Your Signature

Sign the letter to authenticate it and provide your printed name below your signature.

Step 10. Keep a Copy

Retain a copy of the letter for your records in case it is needed for future reference.

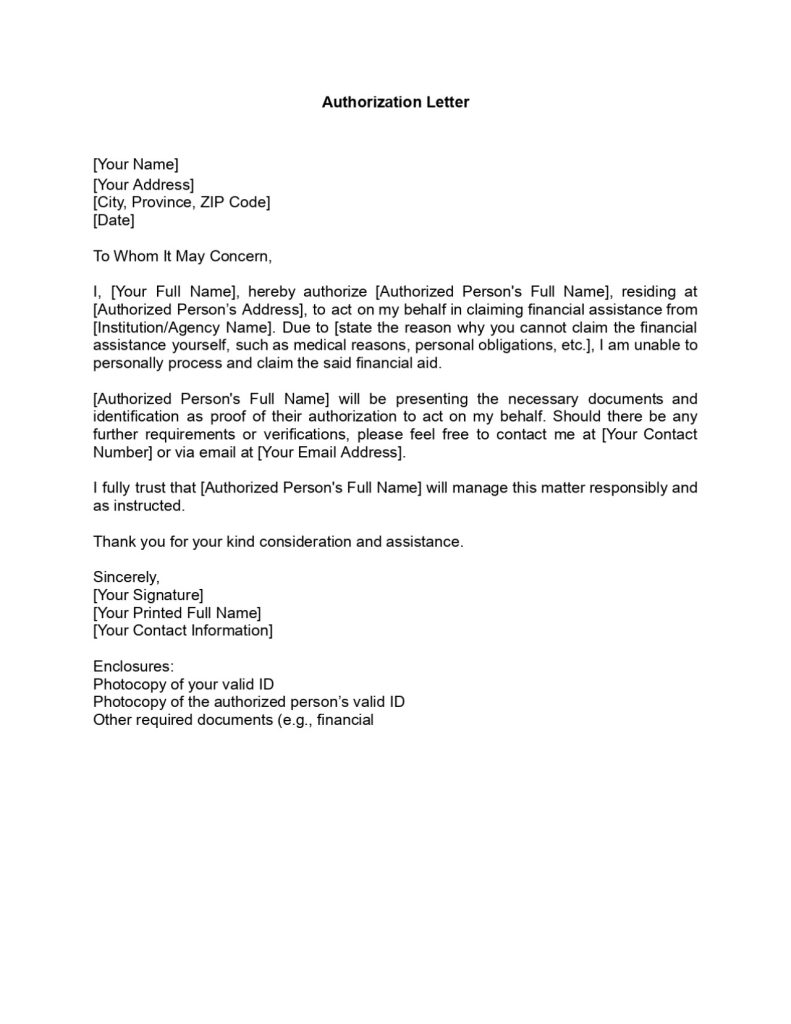

Sample Authorization Letter to Claim Financial Assistance

When circumstances prevent someone from personally claiming financial assistance, an authorization letter allows them to delegate the task to a trusted individual. This sample below can be used to write an authorization letter that will give the proper legal authorization to your trusted representative, along with necessary details for a smooth transaction.

[Your Name]

[Your Address]

[City, Province, ZIP Code]

[Date]

To Whom It May Concern,

I, [Your Full Name], hereby authorize [Authorized Person’s Full Name], residing at [Authorized Person’s Address], to act on my behalf in claiming financial assistance from [Institution/Agency Name]. Due to [state the reason why you cannot claim the financial assistance yourself, such as medical reasons, personal obligations, etc.], I am unable to personally process and claim the said financial aid.

[Authorized Person’s Full Name] will be presenting the necessary documents and identification as proof of their authorization to act on my behalf. Should there be any further requirements or verifications, please feel free to contact me at [Your Contact Number] or via email at [Your Email Address].

I fully trust that [Authorized Person’s Full Name] will manage this matter responsibly and as instructed.

Thank you for your kind consideration and assistance.

Sincerely,

[Your Signature]

[Your Printed Full Name]

[Your Contact Information]

Enclosures:

Photocopy of your valid ID

Photocopy of the authorized person’s valid ID

Other required documents (e.g., financial assistance claim forms)

Note: This sample is left blank so it can be used as an authorization letter template that covers most situations in the Philippines where financial assistance needs to be claimed by someone other than the recipient. Always make sure that the authorized person has the proper identification and documents to support the authorization.

Download Authorization Letter to Claim Financial Assistance

To download a PDF copy of this authorization letter and use it to claim financial assistance by sending a representative, you may click on the download link below:

Download Authorization Letter to Claim Financial Assistance PDF Copy

Tips and Warnings

When writing or receiving an authorization letter, it’s important to follow specific guidelines to ensure clarity and avoid legal complications. Here are some essential tips and warnings to consider when dealing with such documents.

- Only grant authority to someone you trust to handle the task responsibly.

- If you’re the representative, never forge the signature of the person you are representing, as this is a serious offense. If they cannot sign, request their e-signature and attach it instead.

- The letter should be formal and professional in tone, maintaining a respectful and polite language.

- Keep the content brief and concise, explaining the reason for your absence in just 3-4 lines.

- Avoid sharing overly personal details in the letter.

- Ensure that the format and content of the template are appropriate for the intended purpose to prevent confusion.

- Proofread the letter for any grammatical or spelling errors before submission.

Frequently Asked Questions (FAQs)

For your reference, here are some frequently asked questions about authorization letters for claiming financial assistance:

1. Can I authorize anyone to claim my financial assistance?

Yes, but it is important to authorize someone you trust fully, as they will be acting on your behalf in a financial matter.

2. Is it necessary to have the authorization letter notarized?

Not all organizations require notarizing an authorization letter, but it is recommended to check with the specific institution or agency where the assistance is being claimed. It can also help prevent doubts about its authenticity. The cost typically ranges around ₱300, though fees may vary depending on the notary public.

3. What documents should accompany the authorization letter?

Typically, you should provide a photocopy of your valid ID, the authorized person’s valid ID, and any forms or documents required by the institution providing the financial assistance.

4. Can the authorized person sign the authorization letter on my behalf?

No, the authorization letter must be signed by you. If you are unavailable to sign physically, you can use an e-signature or make alternate arrangements for signing.

5. How long does an authorization letter remain valid?

The authorization letter is only valid for the date(s) specified within the document, unless stated otherwise in the letter.

6. How many copies of the authorization letter should I prepare?

Prepare as many copies as necessary, depending on how many parties are involved and whether each party requires their own copy.

Video: How to Write an Authorization Letter for DSWD

For a visual guide on writing an authorization letter for use in DSWD, watch this video from Miss Laher until the end:

Summary

Authorization letters are essential for authorizing a trusted individual to claim financial assistance on your behalf, especially when you’re unable to do so in person. Ensuring the letter is properly formatted, clearly written, and legally sound helps streamline the process and protects both parties involved to prepare an effective authorization letter, You may also consider having the document notarized, if needed. Remember, a well-crafted authorization letter ensures smooth and secure transactions for all parties.