The Department of Education’s (DepEd) Adopt-a-School Program (ASP) allows private entities to partner with schools to provide support through donations or resources to public schools, thereby helping to strengthen the K to 12 curriculum. As a perk, these adopting entities can apply for tax incentives, which means they can potentially lower their tax payments by claiming deductions based on their contributions. Tax incentives are a benefit granted by the government to encourage individuals and businesses to contribute to causes that support public welfare, like education.

Under the Adopt-a-School Act of 1998 (Republic Act No. 8525), businesses that donate to public schools can receive tax exemptions or deductions on their contributions. Knowing how to apply for these incentives can help companies reduce their tax liabilities while also making a positive impact on the education system, which is why it’s valuable for adopting entities to understand the application process and its benefits. This guide will walk you through the steps to apply for these incentives, explaining the process and the legal foundations behind it.

Program Overview

DepEd’s ASP came to be by virtue of Republic Act No. 8525, also known as the Adopt-a-School Act of 1998. Under this law, the private sector is encouraged to participate in the development of public schools by offering tax incentives to entities that donate resources in any form. While the program primarily focuses on enhancing the quality of education and improving the facilities available to students and teachers in public schools across the country, it also offers tax incentives calculated according to the value of donations, thereby encouraging private entities to be more proactive in supporting the public education sector.

Types of Assistance and Valuation

The value of the donation or assistance provided by the private sector partner will also vary depending on the form of contribution. Needless to say, such differences will also reflect on the tax incentive they can apply for. This section explains the different types of assistance and how their value is calculated under the ASP.

- Funding Assistance/Donation: The value of monetary donations is based on the actual amount contributed, which should be reflected in the official receipt or acknowledgment issued by the recipient school.

- Use of Facilities: If the donation includes access to facilities, such as laboratories or office spaces, the value will be calculated based on the rental rate agreed upon in the MOA. The formula for computation is:

- Rental rate (per hour) x Number of hours used = Total value of donation

For example, if the rental rate is Php 1,000 per hour and the facility is used for 80 hours, the total donation value would be Php 80,000.

- Services and Professional Expertise: If the donation involves professional services such as lectures or workshops, the value is based on the hourly compensation rate for the services rendered. The computation follows this formula:

- Hourly rate x Number of hours worked = Total value of donation

For instance, if the hourly rate is Php 300 and the service was rendered for 80 hours, the total value of the donation would be Php 24,000.

- Equipment, Machines, and Other Materials: For donations in the form of equipment, the value is based on the acquisition cost or, if the items are second-hand, their depreciated value. The formula is:

- Acquisition cost x Number of units = Total value of donation

For example, a brand-new oven costing Php 40,000 per unit donated in two units would have a total value of Php 80,000.

- Land/Real Estate: If the donation involves land or real estate property, the value is based on either the zonal value or assessed value of the property at the time of donation, whichever is lower. The formula is:

- Zonal value per square meter x Total area of the property = Total value of real estate donation

For example, a property of 1,000 square meters with a zonal value of Php 5,000 per square meter would have a total donation value of Php 5,000,000.

Target Beneficiaries

The tax incentives under the Department of Education’s Adopt-a-School Program (ASP) can be availed by the following target beneficiary groups:

- Private corporations: Businesses that contribute funds, goods, or services to public schools under the program.

- Non-government organizations (NGOs): NGOs that support public schools through donations and educational programs.

- Individual donors: Individuals who provide financial aid or educational resources to public schools.

- Foundations: Charitable foundations that focus on education and contribute to schools under the Adopt-a-School Program.

- Professional groups: Professional associations that make donations or offer services to improve public schools.

These entities are eligible to receive tax deductions for their contributions to public education.

Qualifications for Private Sector Partners

To qualify for tax incentives under the Adopt-a-School Program, the private entity must meet the following criteria:

- Credible Track Record: The entity must have a solid reputation and proven history as a reliable organization.

- Tax Compliance: The entity should be compliant with its tax obligations, filing and paying taxes on time.

- Business Longevity: It must have been in operation for at least one year, as evidenced by its Articles of Incorporation or business permit.

- No Legal Violations: The entity should not have been found guilty of illegal activities.

- Non-affiliation with Tobacco Industry: The entity should not have any association with the tobacco industry.

- Alignment with DepEd Values: The entity should align with DepEd’s core values, which promote education and societal growth.

Requirements for Submitting Tax Incentive Claims

Private sector partners need to provide the following documents when applying for tax incentives:

- Letter of Intent: Addressed to the Secretary of Education, expressing the company’s intent to participate and apply for tax incentives.

- Duly Notarized MOA: The signed agreement between the partner and the DepEd school.

- Deed of Donation and Deed of Acceptance: Formal documentation confirming the donation and its receipt.

- Official Receipts or Acknowledgment: Proof of the value of the donations or contributions.

- Real Property Documents: If the donation includes real estate, a Certificate of Title and Tax Declaration must be submitted, along with a tax clearance certificate.

- Other Supporting Documents: Documentation linking the expenses claimed to the Adopt-a-School Program and proof of receipt.

The Tax Incentives Application Process

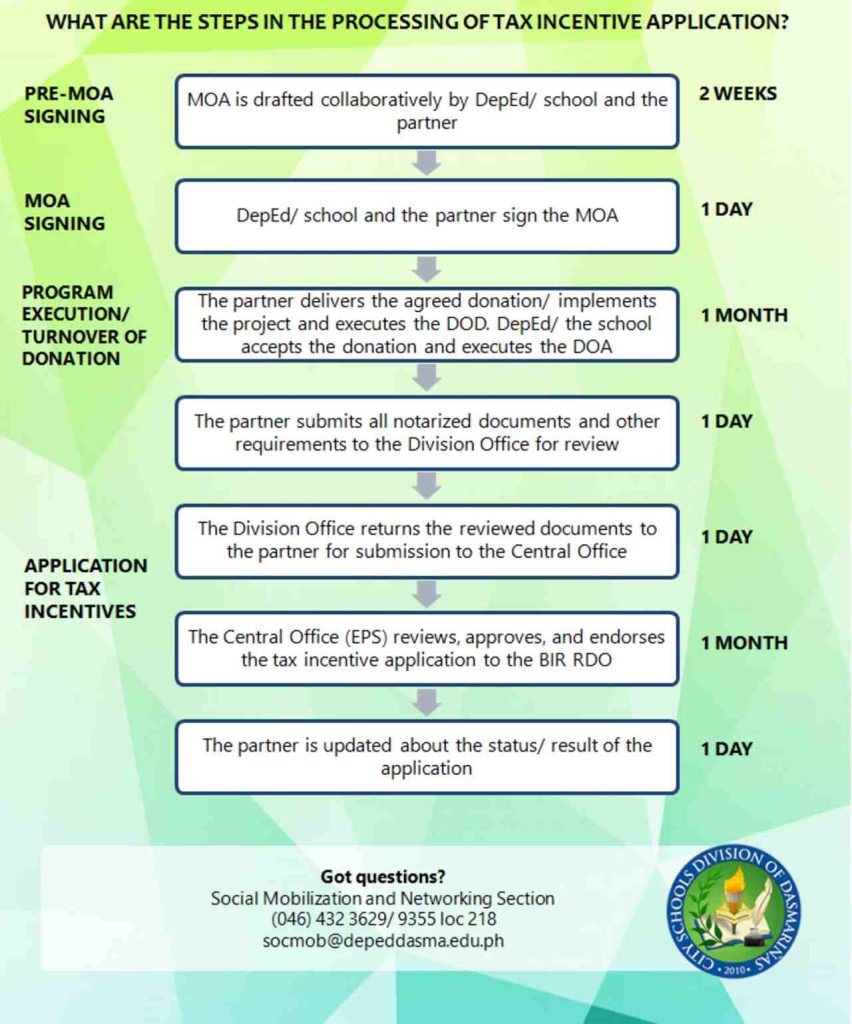

The application process for tax incentives under the Adopt-a-School Program is straightforward but involves several key steps. Below is a detailed overview of the procedure for applying:

Step 1: Pre-MOA Signing

Before anything can be finalized, the DepEd and the private sector partner need to draft a Memorandum of Agreement (MOA). This agreement will specify the terms of the partnership, including:

- The details of the donation or contribution (e.g., financial support, supplies, or other resources)

- The program implementation timeline

- The specific beneficiaries of the donation

- The value of the donation

Once the draft MOA is prepared, it will be reviewed by DepEd’s legal team to ensure all terms are compliant with regulations.

Step 2: Signing the MOA

Once the MOA is reviewed and deemed satisfactory, official representatives from both parties (DepEd and the private entity) will sign the agreement. This formalizes the partnership and sets the foundation for the donation process.

Step 3: Program Implementation

With the MOA signed, the private sector partner will deliver the agreed-upon donations, whether financial or in-kind. The private entity must also execute a Deed of Donation (DOD), which details the actual value of the donation. The receiving school will then execute a Deed of Acceptance to formally acknowledge receipt of the donation.

Step 4: Applying for Tax Incentives

After the donation is made, the private sector partner may apply for tax incentives based on the expenses incurred as part of the Adopt-a-School Program. The application must be submitted to the Adopt-a-School Program Secretariat, which is managed by the DepEd’s External Partnerships Service (EPS).

The application should include all necessary documentation, and the Secretariat will review the application before forwarding it to the Revenue District Office (RDO) of the Bureau of Internal Revenue (BIR) for final approval.

Step 5: Submitting the Application

After preparing the required documents, the private sector partner must submit the application to the Adopt-a-School Program Secretariat. This is part of the DepEd’s External Partnerships Service (EPS). Once the application is reviewed and deemed complete, it will be forwarded to the Bureau of Internal Revenue (BIR)’s Revenue District Office for final processing.

Step 6: Claiming Tax Incentives

Once the BIR approves the application, the private sector partner can claim tax exemptions or deductions on their tax returns, including the donor’s tax return and Income Tax Return (ITR) for the period when the donation was made. All relevant documents, including the MOA, Deed of Donation, and tax-related certificates, must be attached to the tax returns for the claim to be processed.

Important Considerations

For your reference, here are some other important considerations worth remembering:

- BIR Approval: The value of the donation is subject to final approval by the BIR.

- Overseas Donations: Donations coming from overseas may require additional shipping documents and clearance from the Department of Finance.

- Documentation: Ensure that all documents are accurate and complete to avoid delays in the approval process.

Video: DOF Streamlines Tax Incentive Applications for Private ASP Benefactors

Private sector entities that wish to contribute to the development of public schools through the DepEd’s Adopt-a-School Program can enjoy tax incentives as a reward for their efforts. By following the outlined procedure, preparing the necessary documentation, and working closely with DepEd and the BIR, adopting entities can successfully apply for tax benefits while making a meaningful impact on education in the Philippines. For a detailed guide on the streamlined tax incentive application process by the Department of Finance (DOF), watch this video from PTV Philippines:

For other concerns or inquiries, interested parties can contact the Adopt-a-School Program Secretariat at DepEd’s Central Office.