Study Now, Pay Later” (SNPL) programs are programs designed to provide students with financial assistance to pursue their education without the immediate burden of tuition fees. These programs are generally tailored to various demographics, ensuring accessibility for low-income families, government employees, and private sector workers, so they can pursue their academic and vocational training without the immediate burden of tuition fees.

SNPL programs are particularly beneficial to these groups as they help reduce financial barriers to education, promote skill development, and empower students to achieve their academic ambitions. They often feature flexible repayment terms, low-interest rates, and assistance tailored to specific demographics, ensuring that a wide range of students can access the education they desire. Ultimately, these programs contribute to personal development and better economic prospects, fostering a more educated and skilled workforce in the country.

Types of Study Now Pay Later Programs in the Philippines

In the Philippines, “Study Now, Pay Later” (SNPL) programs are designed to provide financial assistance to students, enabling them to pursue their education without the immediate burden of tuition fees. These programs vary in terms of eligibility, loan amounts, interest rates, and repayment terms. They cater to different demographic groups, including government employees, private sector workers, and students from low-income families.

Here are the main types of SNPL programs available in the Philippines:

- Government-Backed Programs: Government-backed programs are initiatives funded and managed by government agencies aimed at making education more accessible. These programs often target low-income students or those in underserved communities, providing loans or grants that do not require immediate repayment to promote education and skill development, enabling individuals to pursue academic or vocational training without the stress of financial barriers.

- Bank and Financial Institution Programs: Many banks and financial institutions offer study now pay later programs that allow students to finance their education through personal loans or specialized educational loans. These programs are designed for individuals who may not qualify for government assistance. This type generally provides a quick and accessible funding solution for students pursuing higher education or specialized training.

- Specialized Training Programs: Specialized training programs focus on specific skills or vocational training that meet industry demands. These programs are often offered by technical schools, vocational institutions, or private training centers to equip individuals with the skills needed for in-demand jobs while alleviating the financial burden of training costs and may include partnerships with employers.

- Targeted Educational Support Programs: Targeted educational support programs are tailored to specific groups, such as underprivileged youth, single parents, or those pursuing education in critical fields. These initiatives may be funded by the government, non-profits, or educational institutions to support individuals who face unique challenges in accessing education, helping them achieve their academic goals.

These SNPL programs provide various options for students in the Philippines, helping them manage educational costs effectively while allowing them to focus on their studies without financial stress. Take note that each program has unique features and benefits, so you might want to look at each one to find the one that suits you best.

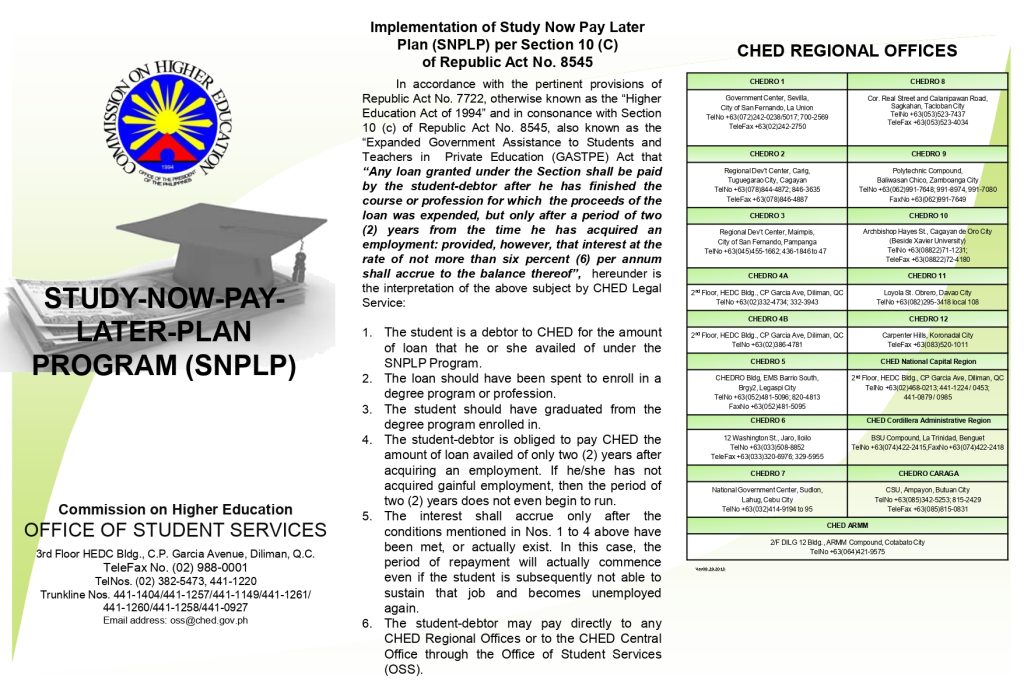

1. CHED Study Now Pay Later Plan (SNPLP)

Provider: Commission on Higher Education (CHED)

The CHED Study Now Pay Later Plan (SNPLP) is a financial aid program designed to help Filipino students access higher education. Under this program, students can avail loans for their tuition and miscellaneous fees, which they will repay once they gain employment, starting two years after securing a job. The loan carries a maximum annual interest of 6%, but only begins accruing after employment conditions are met. This initiative allows students to focus on their education without worrying about immediate financial obligations.

Purpose: The program aims to provide financial assistance to students, allowing them to pursue their education without the upfront burden of tuition costs. It ensures that students from low-income families have access to higher education and the opportunity to improve their future economic prospects.

Benefits and Other Terms:

- Loan covers tuition and miscellaneous fees up to Php 20,000 per semester.

- Repayment starts two years after the student gains employment.

- No maintaining grade or general weighted average is required.

- Open to Filipino students under 30 years old.

- Priority is given to students whose family income does not exceed Php 300,000 annually.

- Requires a co-borrower who is a member of GSIS or SSS and in good standing.

2. Ginhawa for All (GFAL) Educational Loan

Provider: Government Service Insurance System (GSIS)

The GSIS Ginhawa for All (GFAL) Educational Loan is a “study now, pay later” program designed for the children or relatives of active GSIS members who are pursuing a college education. The loan offers up to ₱100,000 per school year or a maximum of ₱500,000 for a five-year degree. Borrowers must meet specific requirements, including 15 years of service and up-to-date premium contributions. The student beneficiary can be up to the 3rd degree relative of the borrower.

Purpose: To financially assist GSIS members in supporting the educational needs of their children or relatives.

Benefits and Other Terms:

- Maximum loanable amount: ₱100,000 per school year (up to ₱500,000 for 5 years)

- Borrowers can nominate up to two student beneficiaries

- Loan repayment starts after a five-year grace period

- 10-year repayment term

- Interest rate: 8% per annum

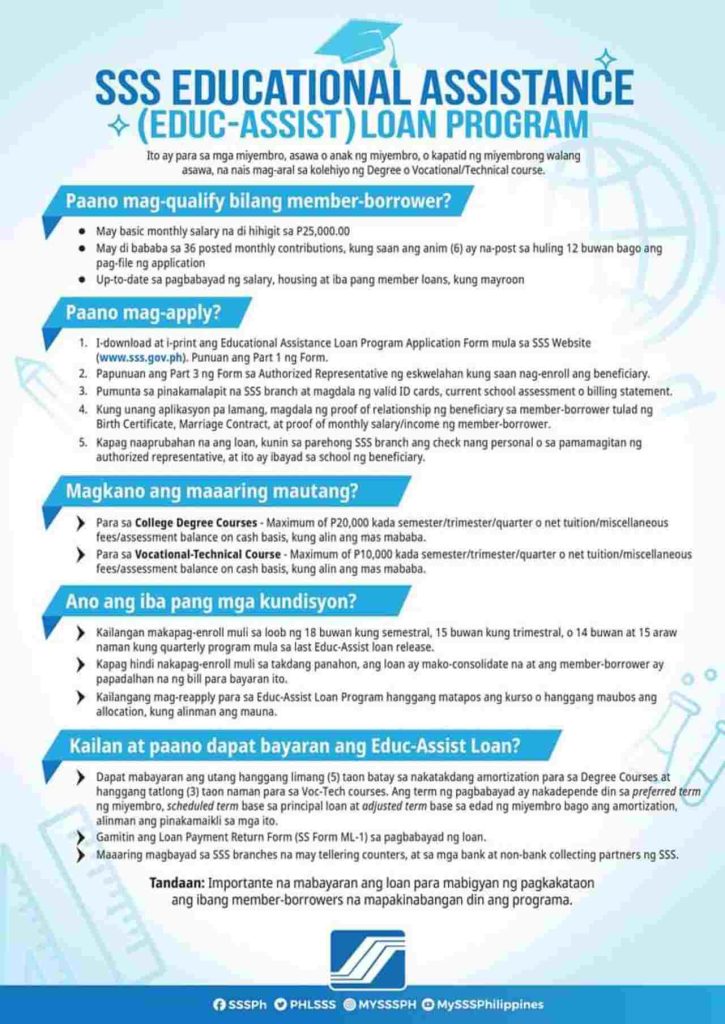

3. SSS Educational Assistance Loan (Educ-Assist)

Provider: Social Security System (SSS)

This program is a short-term loan offered by the SSS in partnership with the Philippine government, providing financial assistance to eligible SSS members. It helps cover educational expenses for beneficiaries pursuing undergraduate or technical/vocational courses. Qualified members can apply if they meet specific age, salary, and contribution requirements. Beneficiaries include spouses, children, or siblings of the member.

Purpose: To assist SSS members in defraying educational expenses for their beneficiaries, enabling them to pursue undergraduate or vocational studies.

Benefits and Other Terms:

- Loanable amount: Up to Php20,000 per semester for degree courses, Php10,000 per semester for vocational courses.

- Interest: 6% per annum on the SSS portion, zero interest on the National Government portion.

- Penalty: 1% per month for unpaid amortization.

- Repayment: 3 to 5 years depending on the loan amount.

- Documentary requirements include school assessment forms, identification, and proof of income.

4. Pag-IBIG Health and Education Loan Programs (HELPs)

Provider: Pag-IBIG Fund

The Pag-IBIG Health and Education Loan Programs (HELPs) are designed to provide financial assistance to active Pag-IBIG members for educational and healthcare expenses. Members can borrow funds directly from accredited schools and hospitals, facilitating easier payments. The program aims to alleviate the financial burden associated with education and healthcare, ensuring that members and their families have access to necessary services. Notably, there are no processing fees, allowing members to receive the full amount of their loans.

Purpose: The main purpose of the Pag-IBIG HELPs is to offer accessible financial support for health and education needs, making it easier for members to manage costs associated with schooling and medical care.

Benefits and Other Terms:

- No Processing Fees: Members receive the full loan amount without deductions.

- Interest Rate: A competitive rate of 10.5% per annum.

- Loan Amount: Borrow up to 80% of total Pag-IBIG Regular Savings, including contributions and dividends.

- Easy Repayment Options: Flexible installment terms of 6, 12, 24, or 36 months.

- Exclusive Discounts: Access to discounts at partnered schools and hospitals.

- Loan Renewal: Possible after making a minimum number of payments, depending on the loan term.

- Partner Institutions: Loans can be utilized at a variety of accredited schools and hospitals throughout the country.

- Eligibility Requirements: Active membership status, minimum contributions, and a good standing on existing loans.

5. Landbank I-STUDY Program

Provider: Land Bank of the Philippines

Landbank offers the I-STUDY Program, a loan of up to P300,000, designed to cover tuition and aid families affected by the pandemic. Parents or guardians can borrow up to P150,000 per student, for up to 1 school year or 2 semesters, but the total loan per borrower cannot exceed P300,000. The loan for preschool to secondary students has a fixed interest rate of 5% per annum, repayable within a year, while loans for tertiary students have a 3-year term with a 1-year grace period on the principal. This program aims to support students in completing their education despite financial challenges.

Purpose: The program aims to assist students in continuing their education by providing financial aid to parents or guardians, particularly those impacted by the economic effects of the pandemic.

Benefits and Other Terms:

- Loan amount up to P300,000

- 5% interest rate per annum

- 1-year repayment for preschool to secondary students’ loans

- 3-year term with a 1-year grace period for tertiary student loans

- Borrowers must have good credit standing

- Students must be of good moral character and meet school admission standards

- Not eligible if benefiting from Universal Access for Quality Tertiary Education Act of 2017 or holding any other scholarships

6. Special Installment Plan (S.I.P.) Loans

Provider: BPI (Bank of the Philippine Islands)

The BPI Study Now Pay Later Special Installment Plan (S.I.P.) loan offers students or their parents a flexible way to manage school-related expenses. Payments for tuition and other educational costs can be made through fixed monthly installments at a low add-on rate. The application process is fast, taking only about five banking days, and applicants can use up to 100% of their available credit limit. This loan also includes promotional offers at partner schools and stores for electronics and gadgets.

Purpose: To provide students and parents an affordable way to finance educational expenses by spreading payments over time.

Benefits and Other Terms:

- Fixed monthly installments

- Low monthly add-on rate (as low as 0.75%)

- Fast processing time (as fast as 5 banking days)

- 100% of the available credit limit can be used

- Special installment plans for school fees at partner schools

- Real 0% installment plans at partner electronics and gadget merchants

- 36-month installment plans available at select stores (e.g., Power Mac Center)

- 16.43% effective annual interest rate on a 24-month term

- Php 300 service fee per loan availment

- Promotional offers available

7. Bukas.ph Tuition Installment Plan

Provider: Bukas Finance Corp.

Bukas offers an alternative way for students to pay their tuition fees through a manageable installment plan. They cover up to 100% of tuition fees, with repayment terms ranging from 3 to 12 months. The interest rate starts at 1.9% per month, with a one-time service fee between 4.5% and 10%, depending on the school and other factors. Applications are processed online, and funds are disbursed directly to the partner school within 1-2 days.

Purpose: To provide affordable and flexible financing options for students to ease the financial burden of paying tuition fees.

Benefits and Other Terms:

- Loanable amount up to ₱100,000

- Interest rate starting at 1.9% per month

- Repayment terms: 3, 6, 9, or 12 months

- No pre-termination penalties (eligible for rebates on early payments)

- Available to students enrolled in partner schools like Ateneo, FEU, CEU, and more

- Online application process with approval in 3-5 working days

- Co-borrower option for additional financial security

8. InvestEd Student Loan

Provider: InvestEd (EDUC4ALL Lending Inc.)

InvestEd is a globally recognized social enterprise offering accessible student loans to under-resourced Filipino youth. Since 2016, it has provided financial support for educational needs like tuition, gadgets, rent, and thesis expenses. This program offers personalized loans with flexible repayment terms, ensuring that students can focus on their studies without financial stress. It is available to Filipino students enrolled in CHED-accredited universities for undergraduate or postgraduate degrees.

Purpose: To provide students with affordable financial aid to help them complete their education and succeed in their careers.

Benefits and Other Terms:

- Loan amount: Up to ₱40,000

- Monthly interest: 2.42% to 2.67%

- Repayment terms: Up to 28 months

- Pay after graduation

- Access to financial coaching and success community

- Flexible and personalized loan terms

- Fast approval (2-5 days)

- Convenient digital payment options

9. BlendPH Educational Loan

Provider: BlendPH

BlendPH Educational Loan offers financial support for students and professionals aiming to improve their education. The program allows borrowers to receive up to ₱25,000, which is directly sent to the school or training institution. The loan comes with a 3% monthly interest rate and can be repaid over six months. Applicants must provide basic documents such as government-issued IDs, employment certificates, and proof of income.

Purpose: To help students and working professionals afford education and training by providing financial assistance.

Benefits and Other Terms:

- Loanable amount: Up to ₱25,000

- Interest rate: 3% per month

- Repayment term: Up to six months

- Direct disbursement to partner schools/training centers

- Requirements: Valid ID, employment certificate, payslips, and proof of billing.

10. Cebu Pacific Cadet Pilot Program

Provider: Cebu Pacific Air and Airworks Aviation Academy

The Cebu Pacific Cadet Pilot Program offers aspiring pilots the chance to undergo extensive training in aviation. It includes around 120 hours of ground training, covering topics such as aerodynamics, navigation, and meteorology, among others. The course lasts approximately 96 weeks and guarantees a job upon successful completion. Cebu Pacific partners with BPI for financing options, allowing cadet pilots or their sponsors to avail loans for the training fees.

Purpose: The program aims to develop a new generation of qualified pilots for Cebu Pacific and ensure they are equipped with the necessary skills for professional airline operations.

Benefits and Other Terms:

- Guaranteed employment upon completion of the program.

- Financing assistance through Bank of the Philippine Islands (BPI) for personal or property equity loans.

- Full-board accommodation at Airworks Aviation Academy.

- Training fees approximately PHP 5,000,000 with milestone-based payment options.

- Mandatory 10-year service bond with Cebu Pacific after training completion.

- Free transportation from Cebu to the training facility.

11. AAG Study Now Pay Later (SNPL) Program

Provider: Alpha Aviation Group (AAG)

AAG, in partnership with Banco de Oro (BDO), offers the Study Now Pay Later (SNPL) Program to help aspiring pilots finance their pilot training. The program is designed for AAG trainees and can be used to pay for two courses: the Airline Pilot Program (APP) and the First Officer Transition (FOT) Program. It allows trainees to access loans with flexible terms, including a 10-year repayment period. The program is exclusively available for Filipino nationals and requires co-borrowers, typically parents or guardians.

Purpose: The SNPL Program aims to make pilot training accessible to aspiring Filipino pilots by providing financial support with flexible loan terms.

Benefits and Other Terms:

- Loan repayment period of up to 10 years

- Loan amount: Minimum of Php 500,000, up to 85% of appraised property value

- Waived appraisal fee for the first property

- Light payment options:

- Interest-only payments for 12 months (APP)

- Interest-only payments for 3 months (FOT)

- Built-in insurance

12. UPAE Study Now, Pay Later Program

Provider: UP Alumni Engineers (UPAE)

The Study Now, Pay Later program, offered by UPAE, provides financial support to engineering students from UP Diliman and UP Los Baños. This initiative covers tuition, allowances, and other educational expenses, allowing students to focus on their studies without the immediate burden of debt repayment. After graduation, repayments are based on the student’s income, making the program flexible and manageable. The program aims to make education more accessible while ensuring that students can invest in their futures.

Purpose: The primary goal of the program is to support students in their educational journey and to ease financial burdens through an income-based repayment scheme after graduation.

Benefits and Other Terms:

- Maximum funding of up to PHP 180,000 per student.

- Funding can be used for tuition, allowances (e.g., dormitory, food, transportation), and miscellaneous expenses (e.g., projects, gadgets).

- Funding is approved per semester, with allowances disbursed monthly.

- Repayment starts only when graduates secure a job with an income above a predetermined floor amount (e.g., PHP 18,000).

- If income is below the floor, repayment is deferred.

- Monthly payments are capped to ensure they do not exceed the borrowed amount, with a repayment period of up to five years.

Video: SSS Educational Loan

To learn more about one of the SNPL programs offered by the government via the Social Security System (SSS), you may check out this video from Traveling Morena:

Summary

There is a wide range of Study Now, Pay Later (SNPL) programs available in the Philippines and all of them are designed to offer financial support for needy students pursuing their education. There are numerous types and options available too, so students can make informed decisions that will empower them to achieve their academic and career aspirations. If you or someone you know are interested in any of the programs listed above, feel free to reach out to the provider directly for more information.