The SSS Maternity Benefit is a cash allowance provided to female members of the Social Security System (SSS) who cannot work due to childbirth, miscarriage, or emergency termination of pregnancy (ETP). This benefit aims to provide financial support during the recovery period after these life events.

This SSS benefit is available regardless of whether you are employed, self-employed, or a voluntary contributor. So, if you are an SSS member, this guide will help you understand the application process, requirements, and adjustments to the SSS maternity benefit under the Expanded Maternity Leave Law (RA 11210), helping you claim what is due.

Program Overview

The SSS Maternity Benefit program is a financial support system designed to assist female members during their maternity leave, ensuring they receive compensation for lost income during childbirth or pregnancy-related events. It was established under the Social Security Act of 1997 and later expanded by Republic Act No. 11210, also known as the Expanded Maternity Leave Law (EMLL), which took effect on March 11, 2019. This enhancement increased the benefit coverage from 60 to 105 days for live childbirth, with additional provisions for solo parents and pregnancy-related complications.

Initially offering limited benefits, the program’s scope broadened with the passage of the EMLL, reflecting a commitment to gender equality and maternal welfare. It now covers live childbirth (normal or caesarian), miscarriage, ETP, ectopic pregnancy, stillbirth, and related conditions. Female members, including self-employed, voluntary, and overseas Filipino workers (OFWs), are also eligible for this benefit, provided they meet specific contribution requirements. Employers also play a critical role by advancing maternity benefits to employees and applying for reimbursement through SSS.

Benefits

The SSS Maternity Benefit offers coverage to various maternity-related contingencies, providing both financial aid and the following benefits:

- Extended Leave Coverage

- Financial Support for Miscarriages and Pregnancy Termination

- Inclusivity for Different Pregnancy Outcomes

- Flexibility for Self-Employed and Voluntary Members

- Reimbursement for Employers

- Adjustment of Benefits for Unused Leave Credits

- Simplified Online Application Process

- Support for Qualified Solo Parents

- International Coverage

- Protection for Separated Employees

Target Beneficiaries

The benefits offered by this SSS program is designed to provide financial support to the following groups of female SSS members:

- Female Employees in the Private Sector

- Self-Employed and Voluntary Members

- OFW Members

- Solo Parents

- Unemployed or Recently Separated Members

- Female Employers

- Employers Filing for Reimbursement

- Members with Special Circumstances

Eligibility

To qualify for the SSS maternity benefit, those who are interested must at least meet the following criteria:

- Must have paid at least three (3) monthly contributions within the 12 months before the semester of childbirth, miscarriage, or ETP.

- Must have informed the employer about the pregnancy (for employed members) or notified SSS directly (for self-employed, voluntary, non-working spouses, and OFWs).

Documentary Requirements

Individual members must submit the following documents through their My.SSS accounts:

For Maternity Contingencies Occurring On or After March 11, 2019

- Live Childbirth (Normal or Caesarian):

- Within six months: Submit the child’s Certificate of Live Birth (CLB) or Certificate of Death (COD) registered with the Local Civil Registrar (LCR) and the corresponding official receipt.

- Beyond six months: Provide the PSA-issued CLB/COD along with the official receipt.

- Stillbirth or Fetal Death:

- Within six months: Provide the Certificate of Fetal Death (COFD) registered with the LCR and the official receipt.

- Beyond six months: Submit the PSA-issued COFD.

- Miscarriage, Ectopic Pregnancy, or Emergency Termination of Pregnancy (ETP):

- Proof of pregnancy, such as a pregnancy test or ultrasound result, must be included.

- Medical documents proving the termination of pregnancy are also required, such as a histopathological report or operating room record.

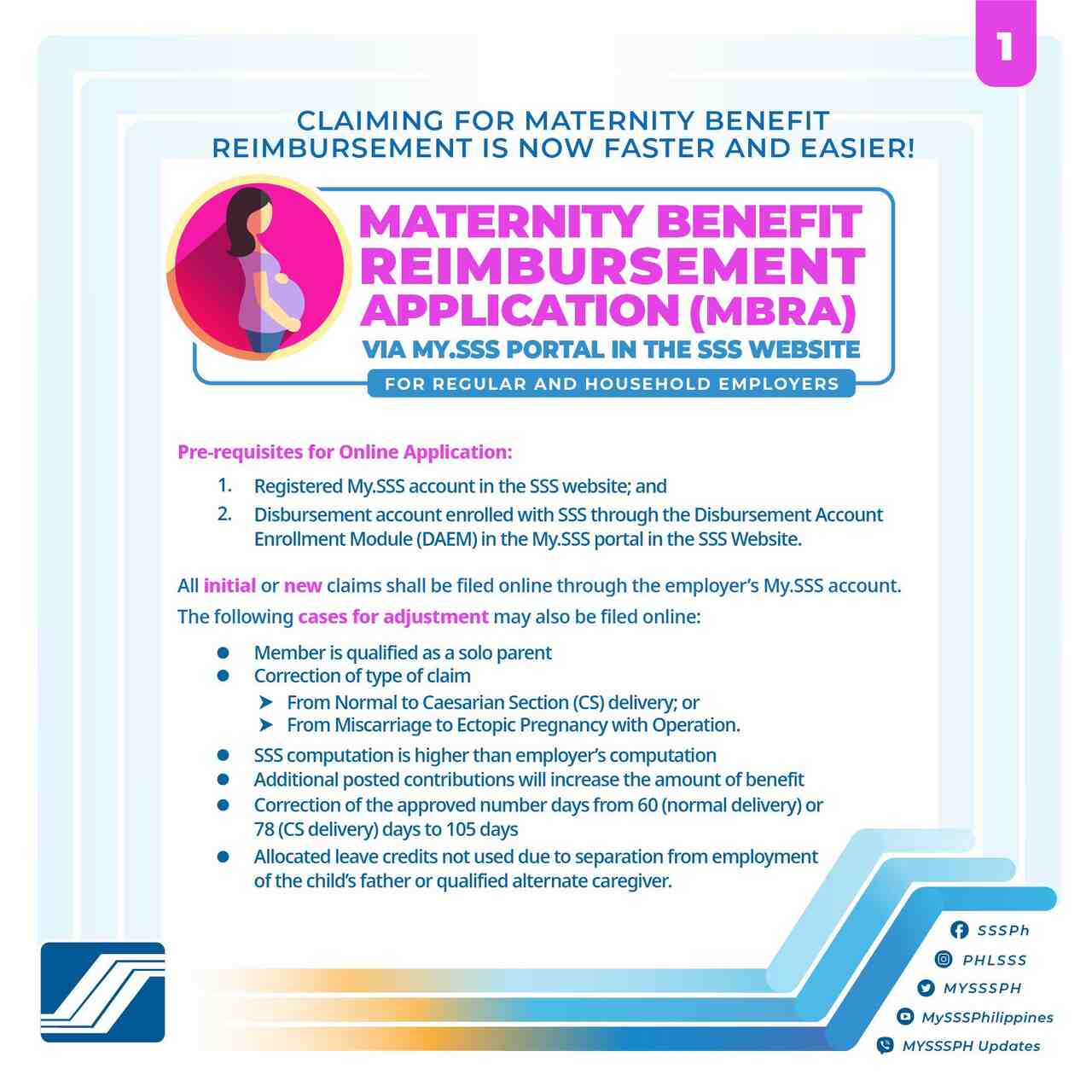

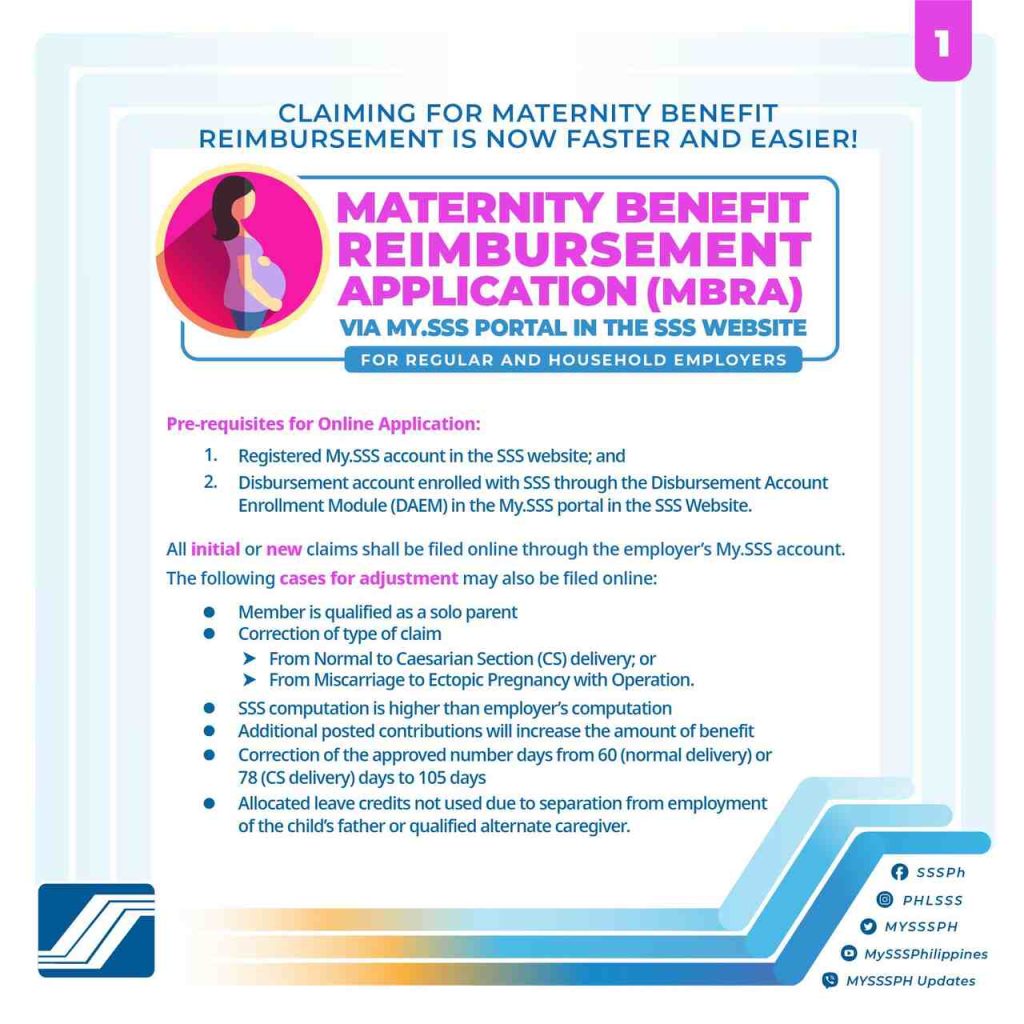

For Maternity Benefit Reimbursement Application (MBRA) for Employers

- For Live Birth: Provide the child’s CLB or COD, as described for individual members.

- For Miscarriage or Stillbirth: Submit medical documentation verifying the condition.

- If an Employee Fails to Return to Work: Provide proof of advance payment and a certification that the employee did not report back to work.

Note: Employers unable to furnish specific medical documents are eligible for partial reimbursement corresponding to 60 days for normal delivery or miscarriage.

Special Cases and Rules

- Local and Overseas Maternity Contingencies

- Locally Issued Medical Documents: Must include the physician’s name and PRC license number.

- Overseas Issued Documents: Must have an English translation but do not require embassy authentication or apostille.

- Solo Parents (RA 8972)

- Submit a valid Solo Parent ID or a certification signed by a municipal social worker and mayor. The delivery date must fall within the document’s validity period.

- Separated, Self-Employed, and Voluntary Members

- If separated within six months of delivery, a Certificate of Separation and an affidavit may be required.

- Members who cannot obtain a separation certificate may file an affidavit stating the reason for separation and confirm no advance payment was received.

For Members Requesting Adjustments to Settled Maternity Benefits (including unused leave credits due to the unemployment of a qualified caregiver)

- A notarized affidavit confirming unemployment.

- Certificates of separation from the caregiver’s employer, indicating the effective date.

Note: If the delivery occurred before March 11, 2019, specific documents like operating room records or surgical memorandums must be submitted for caesarian cases. Employers who advanced payments but cannot provide these documents will only receive reimbursement for the normal delivery period.

SSS Maternity Benefit Application Procedures

For a step-by-step guide to the application for SSS Maternity Benefit claim, please follow these steps:

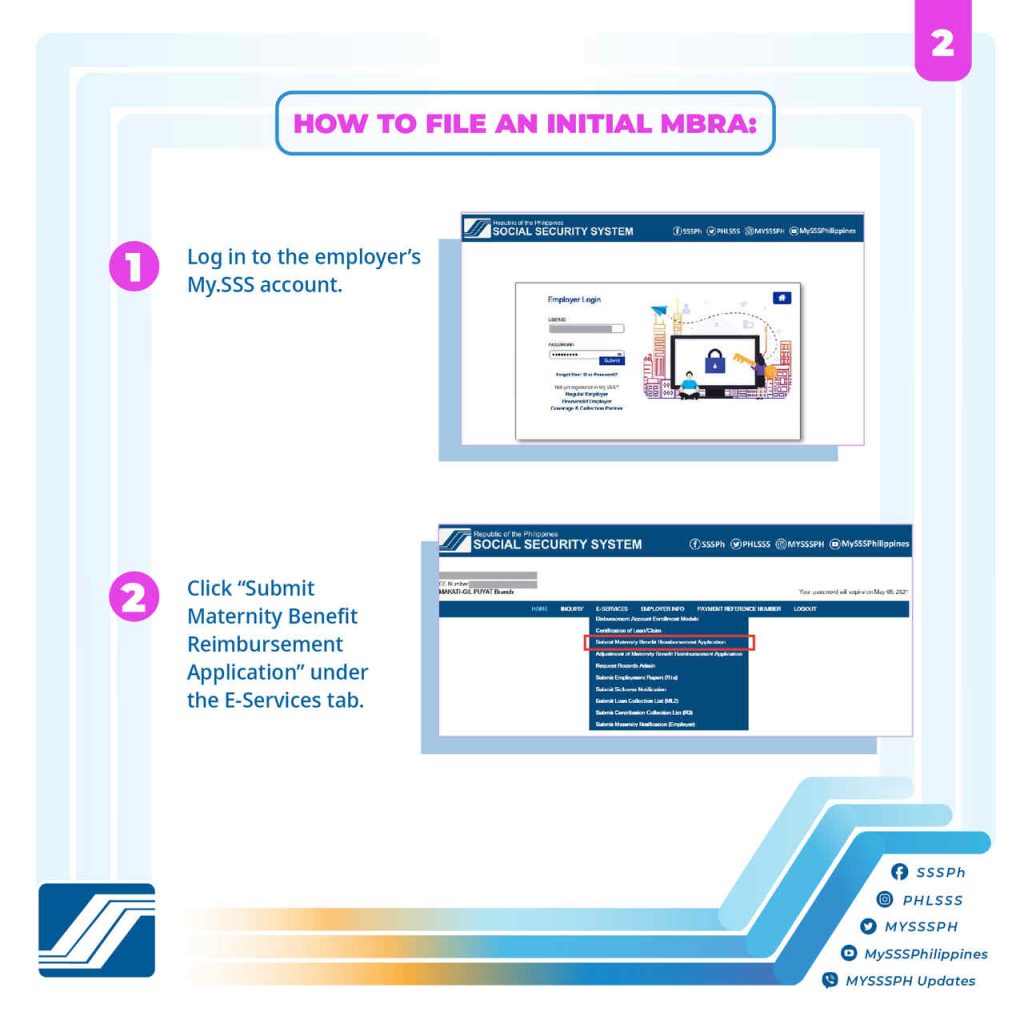

Step 1. Create an Account

Log in or register on the My.SSS portal.

Step 2. Check Eligibility

Ensure you meet the contribution and notification requirements.

Step 3. Notify SSS

Submit a maternity notification through your employer or directly to SSS by following these steps:

For Employed Members

- Submit a Maternity Notification Form to your employer, along with proof of pregnancy (e.g., ultrasound, pregnancy test result, or blood test).

- Your employer will notify SSS through their My.SSS account.

For Self-Employed, Voluntary Members, Non-Working Spouses, and OFWs

- Notify SSS directly via:

- My.SSS account

- SSS Mobile App

- Self-Service Terminals

Step 4. Calculate Your Benefit

Use the following ADSC formula to estimate your cash allowance. To do so, simply divide the total MSC by 180 days to get the ADSC, then then, multiply the ADSC by the compensable period:

- 60 days for miscarriage or ETP

- 105 days for childbirth

- 120 days for solo parents

Formula:

ADSC = Total MSC ÷ 180 days

Benefit Amount = ADSC * number of compensable days

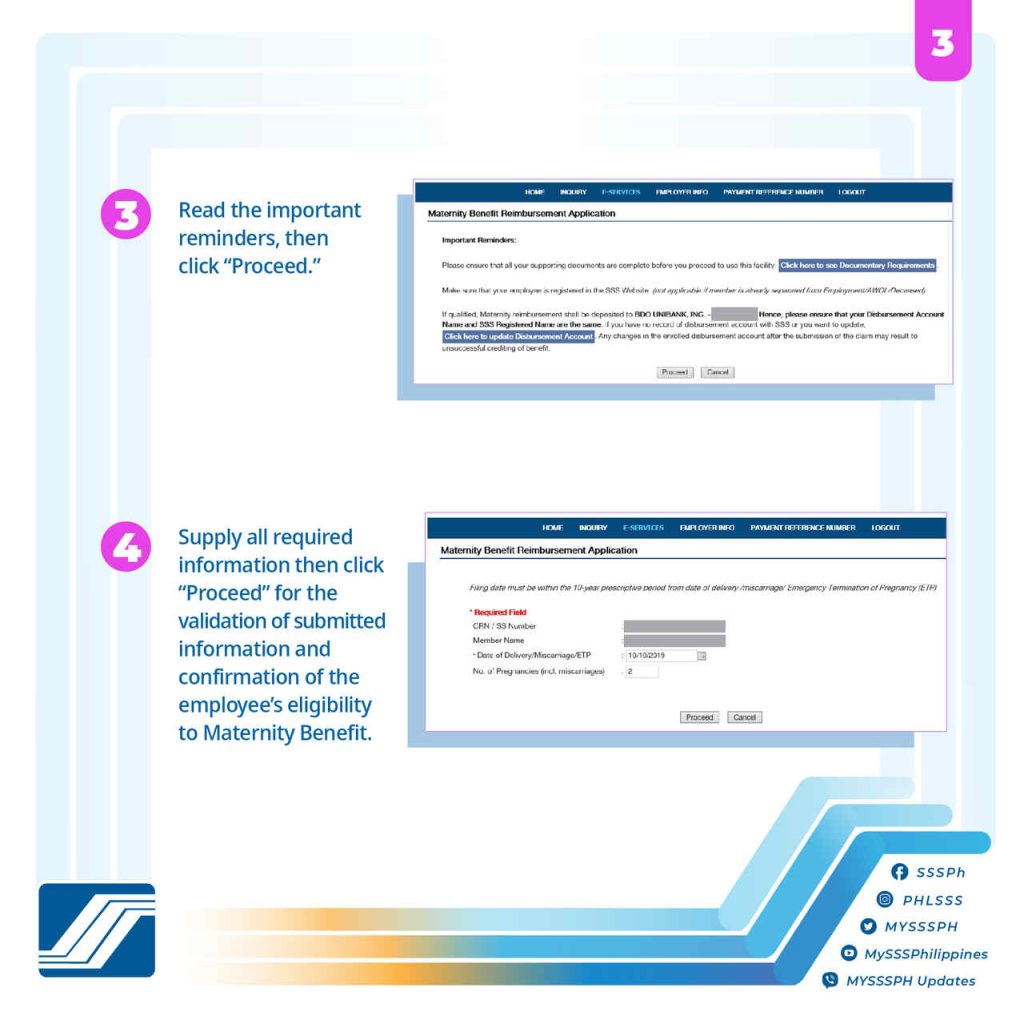

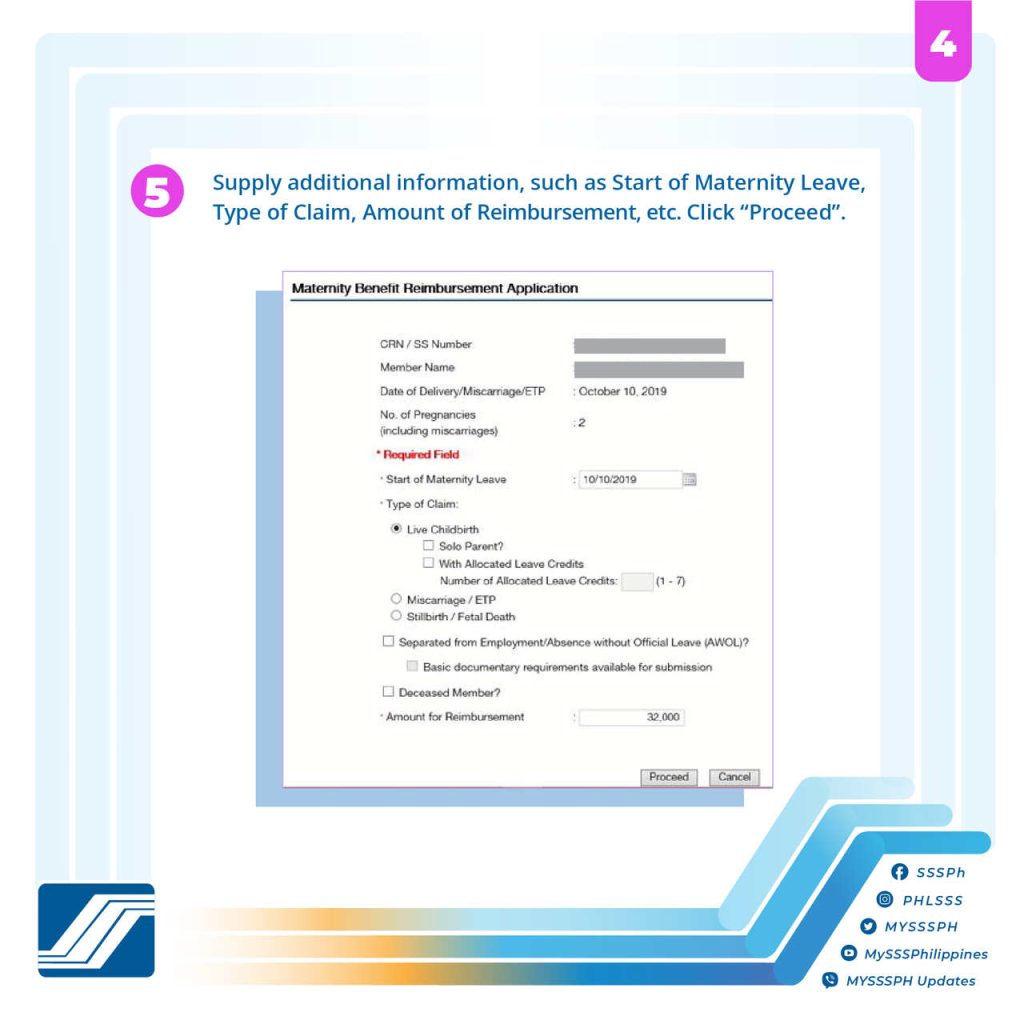

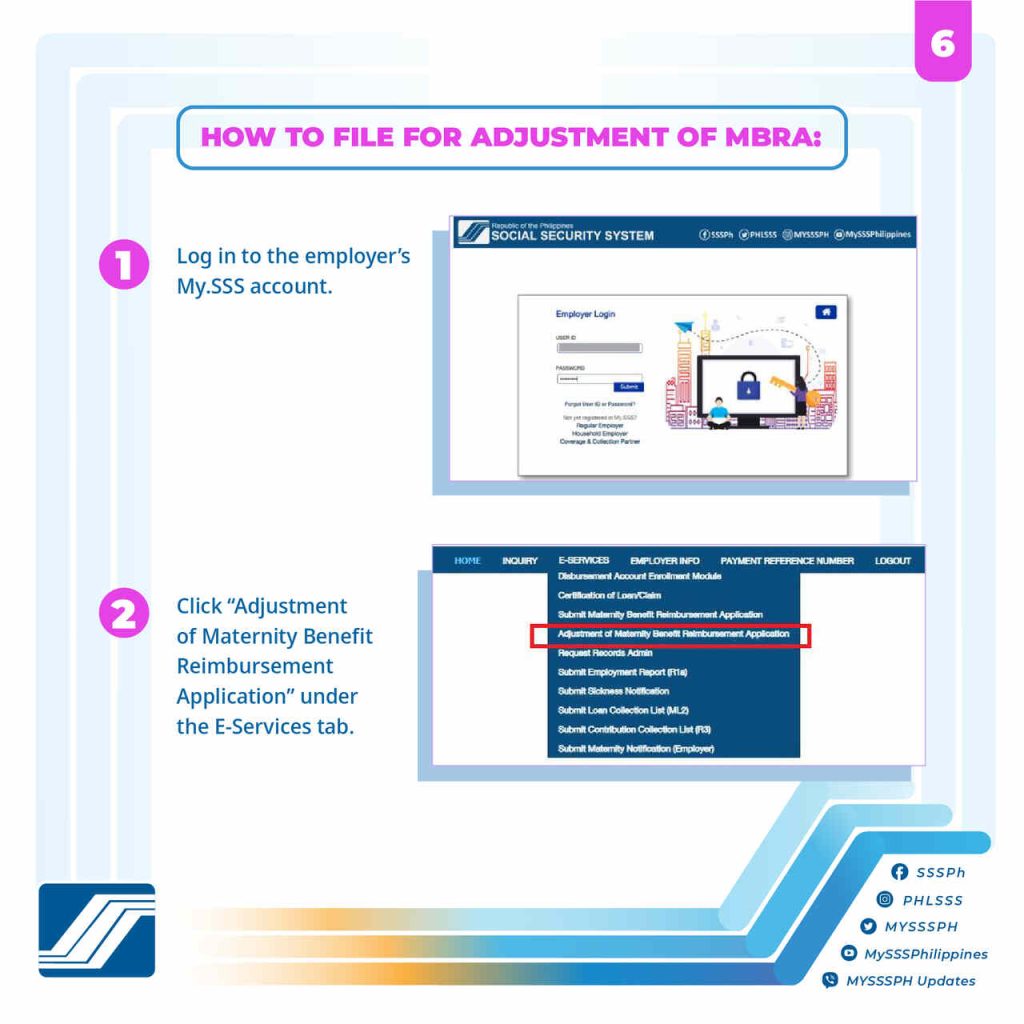

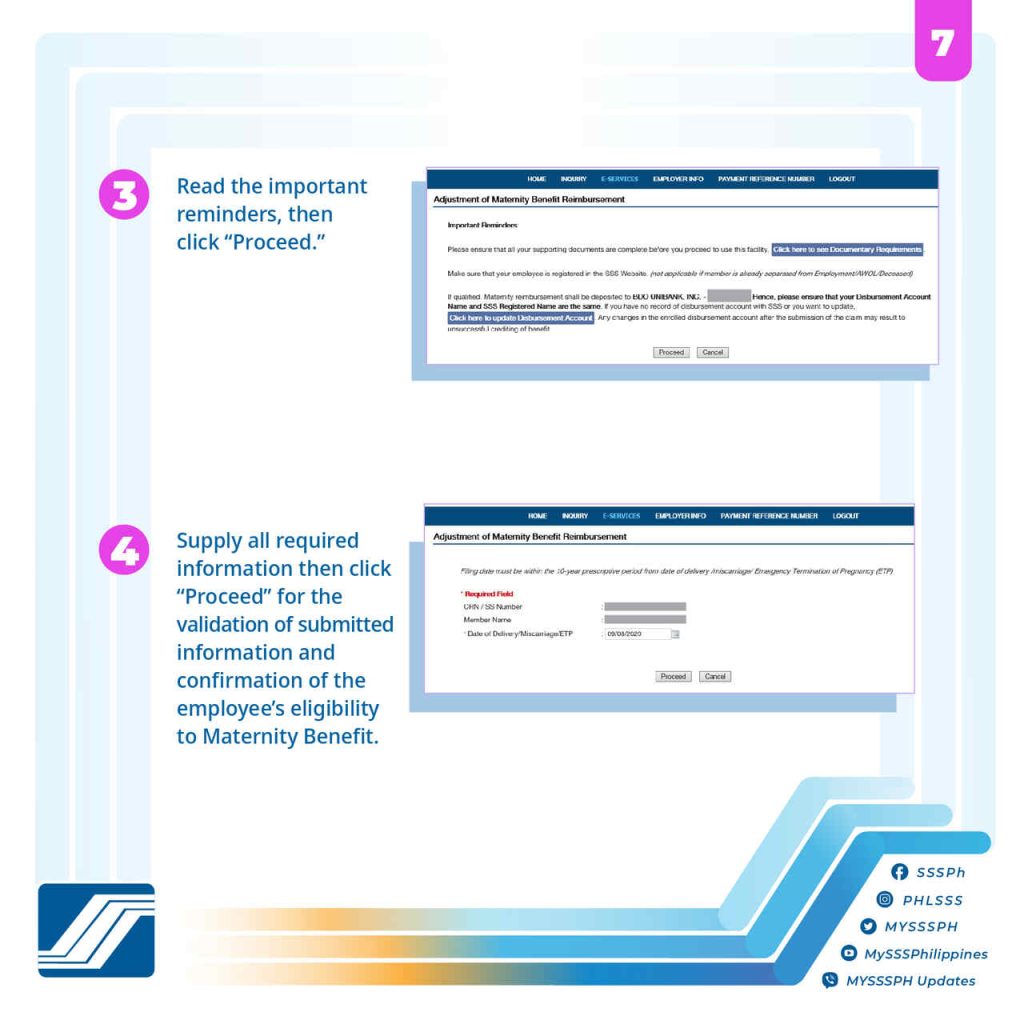

Step 5. File the Claim

Employers advance payments for employed members, while others receive the benefit directly from SSS.

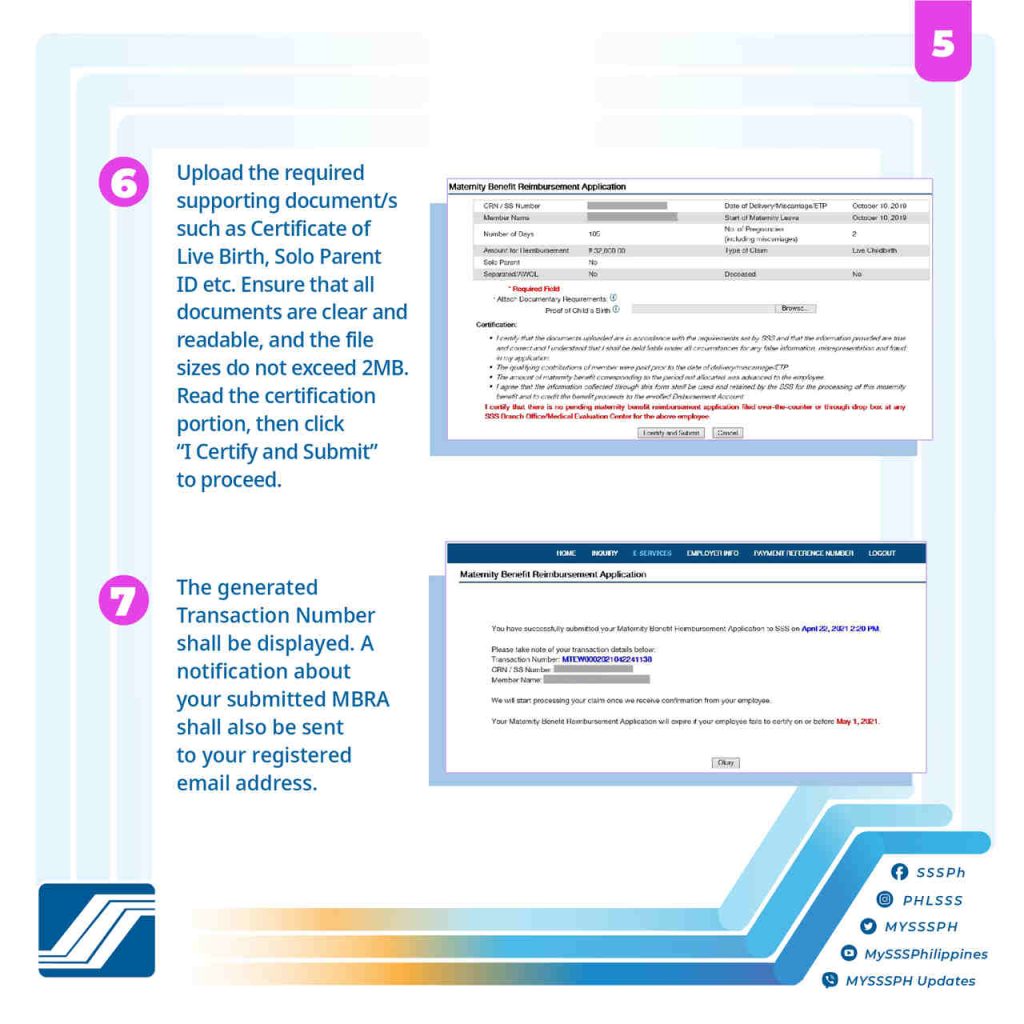

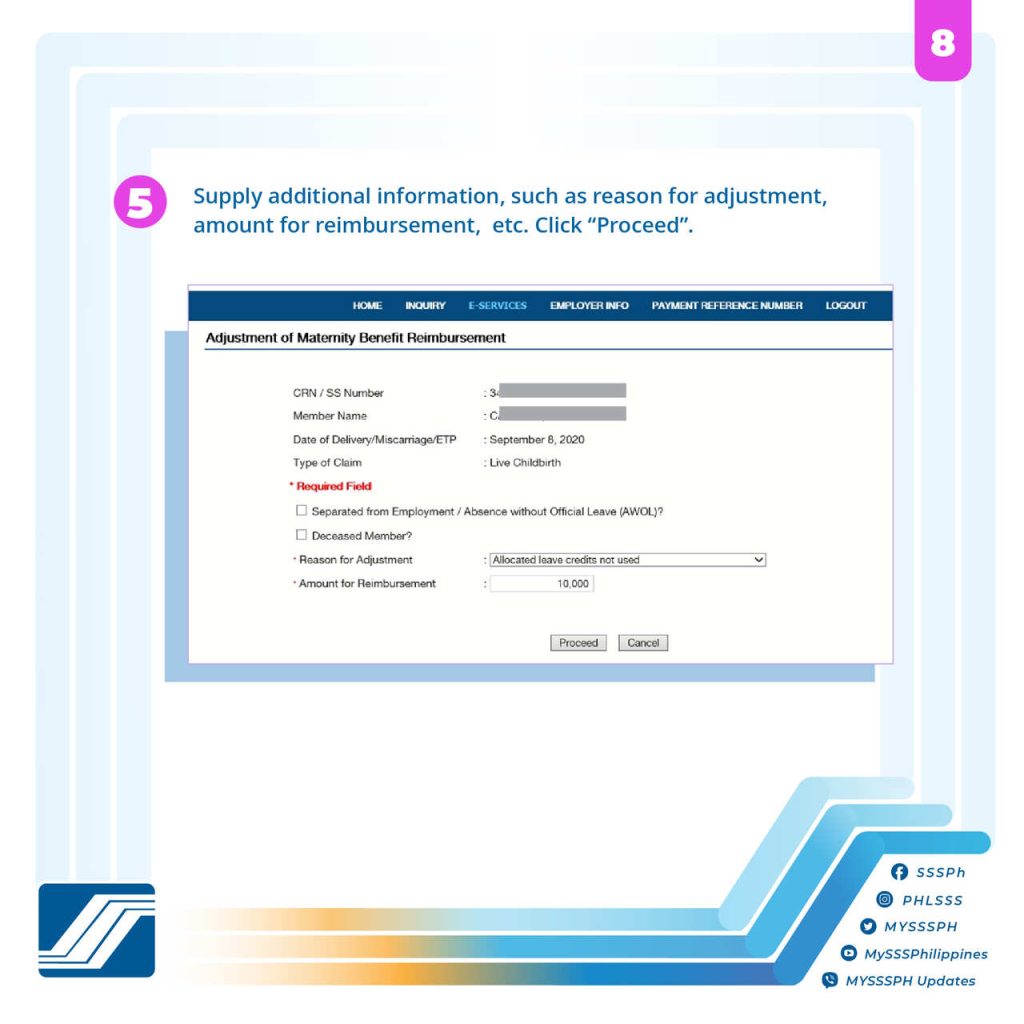

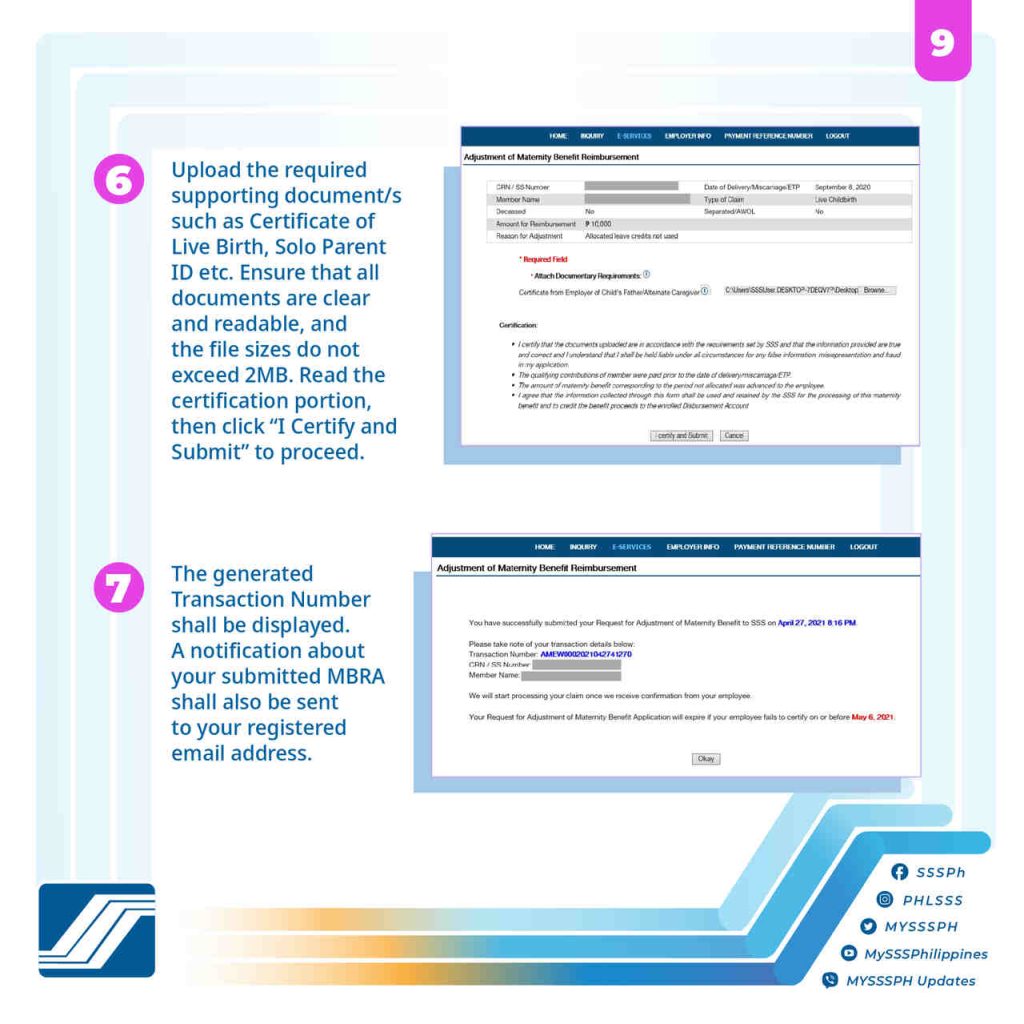

Step 6. Submit Documents

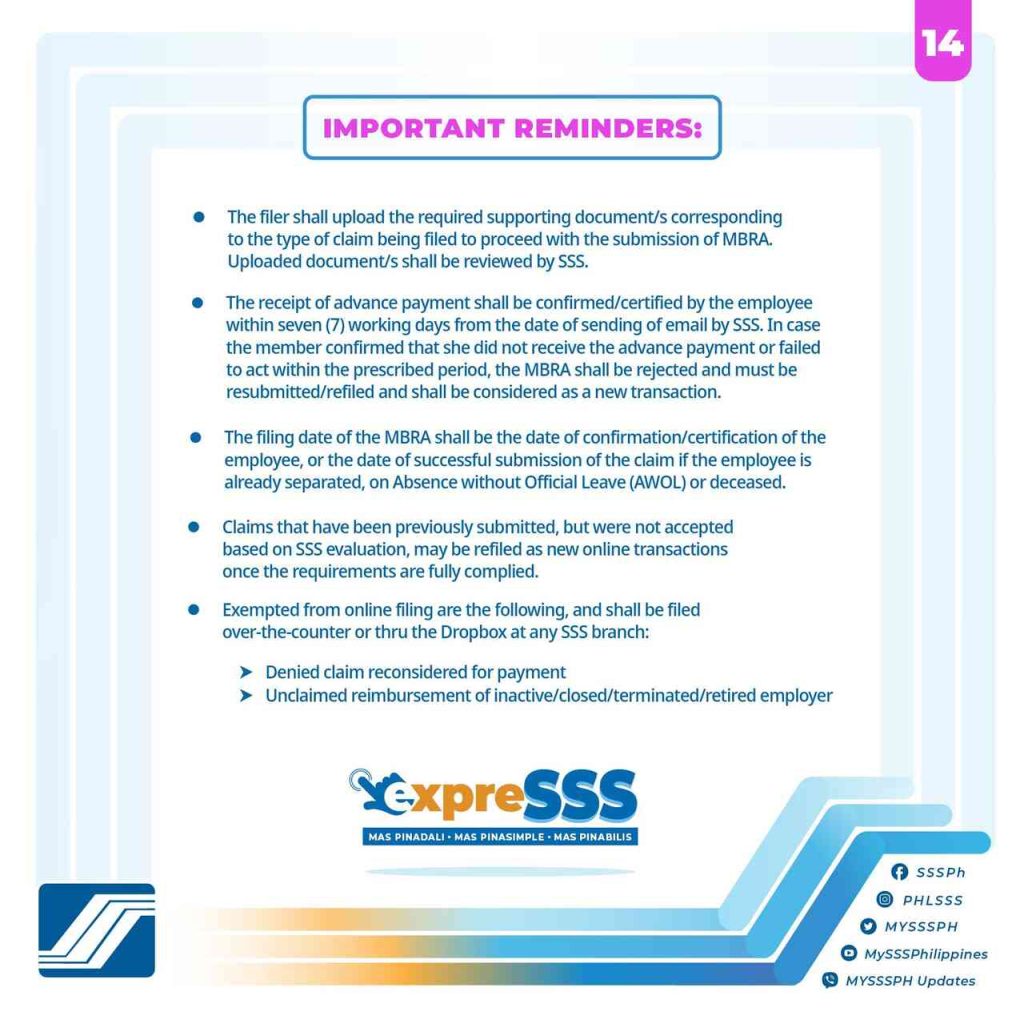

Upload scanned copies of required documents. Ensure high-quality images of colored originals or certified true copies.

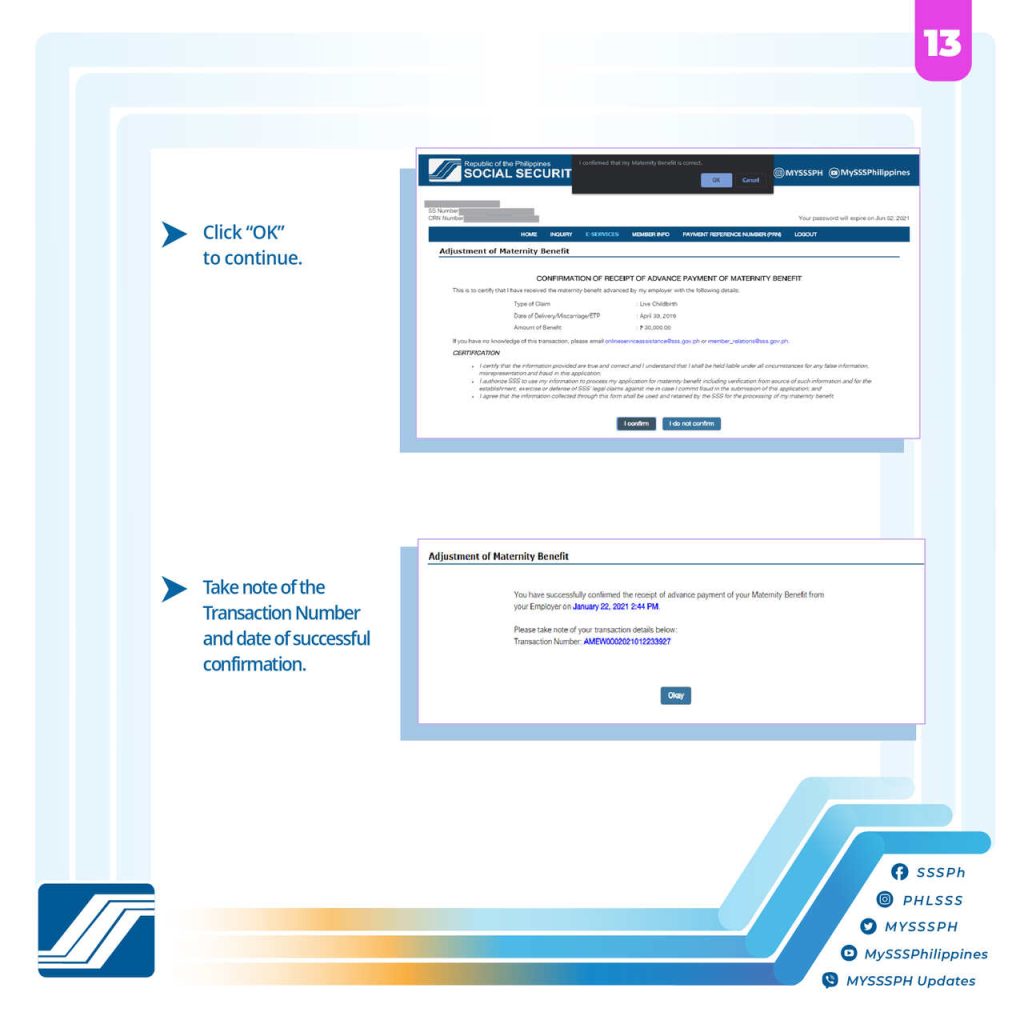

Step 7. Track Status

Monitor the application status through the portal.

Step 8. Receive Payment

The benefit is credited to your registered disbursement account.

- Enroll Your Disbursement Account: Register up to three bank or e-wallet accounts in your My.SSS account.

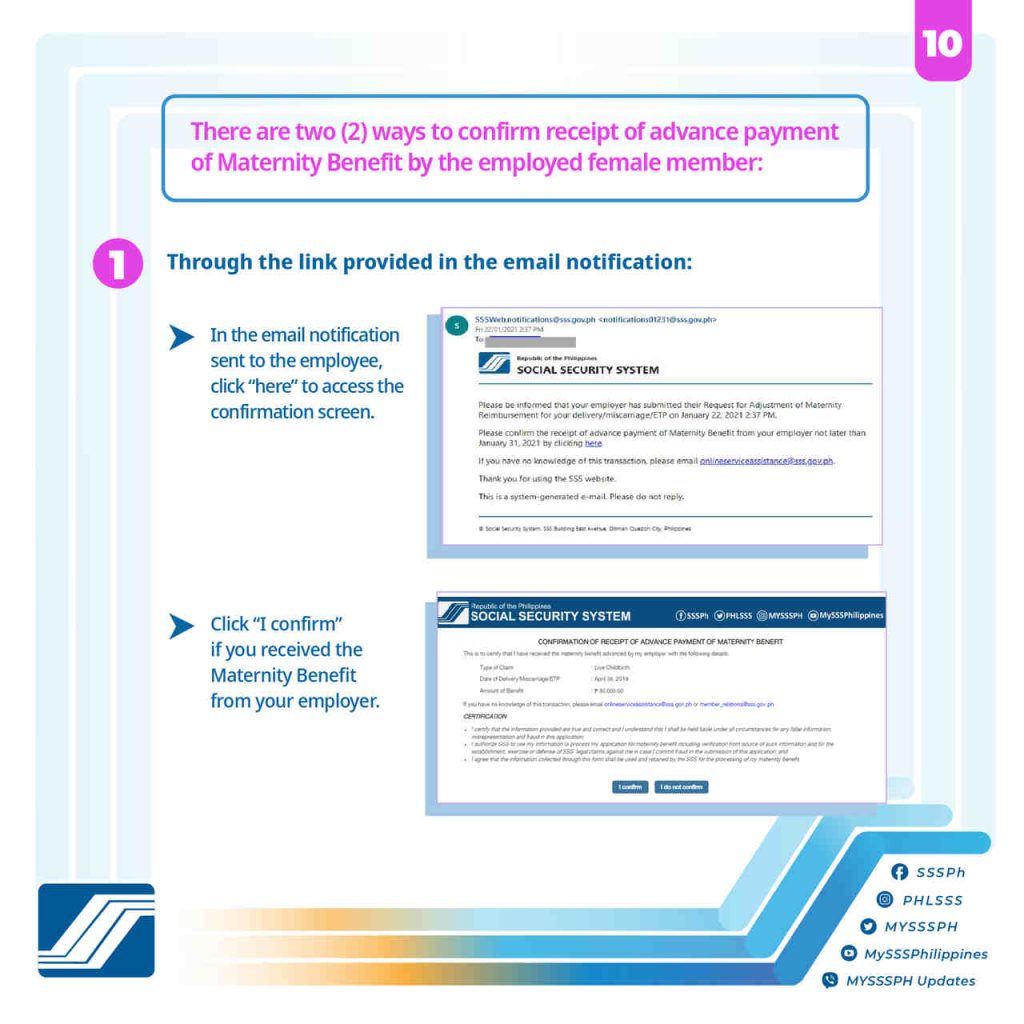

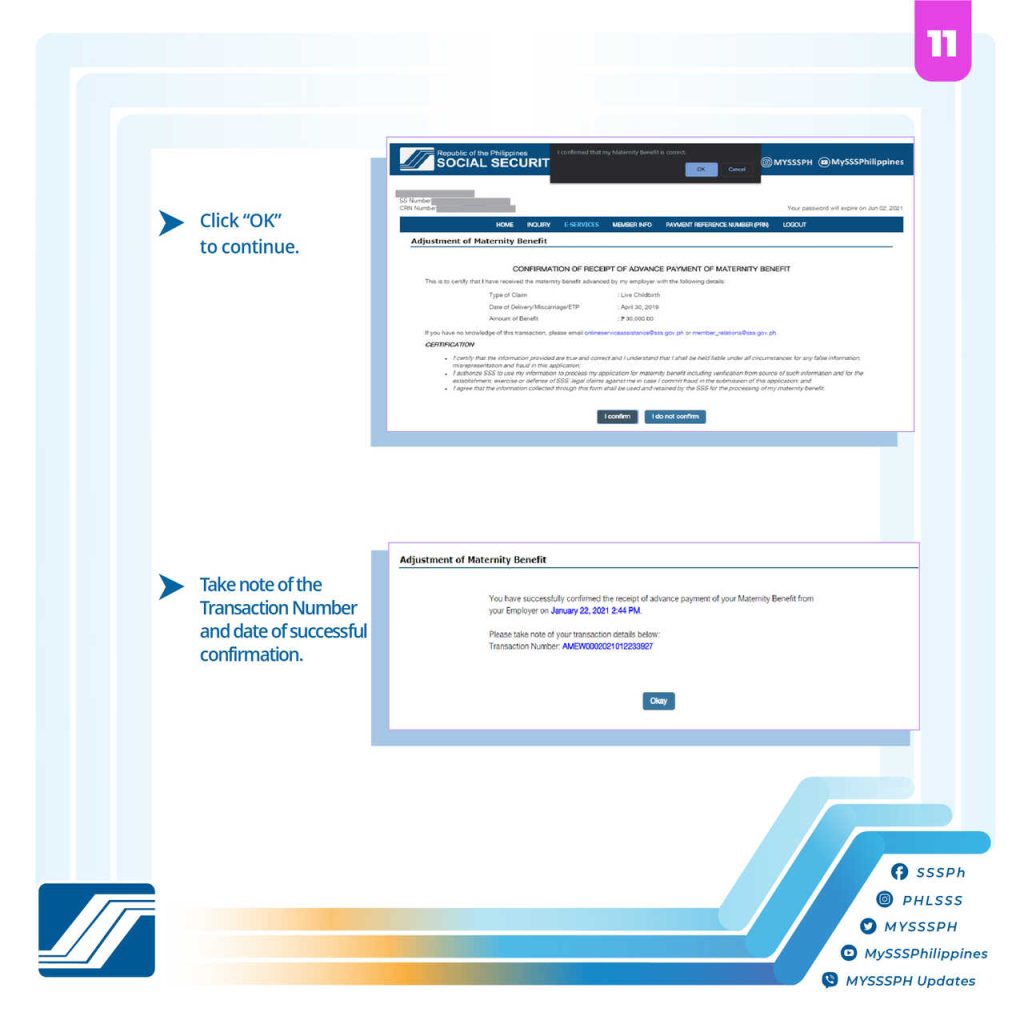

- Benefit Payment: If you’re employed, your employer advances the full amount within 30 days of your maternity leave application. SSS reimburses the employer upon submission of proof of payment. For other members, SSS pays directly.

- Notification: You will receive an electronic notification once the payment is credited.

Note: If there are issues with the crediting process, you must update your disbursement details and request re-disbursement through your My.SSS account.

Rules and Limitations

There are specific rules that limit the SSS maternity benefit claims. These include the following:

- Single Maternity Benefit Per Event: You can claim only one maternity benefit per childbirth, regardless of the number of babies delivered (e.g., twins or triplets).

- Overlapping Claims: If you have overlapping pregnancies, you will receive benefits for both, but overlapping periods will be deducted from the second claim.

- No Sickness Benefits for the Same Period: The maternity benefit period cannot overlap with claims for sickness benefits under RA No. 11199.

- Allocation of Maternity Leave Credits: Female members can allocate up to seven (7) days of their maternity leave to the father of the child or a qualified caregiver. The caregiver must be a relative or partner living in the same household. This allocation must be supported by a written notice. However, this option is unavailable for cases of miscarriage or ETP.

- Special Cases: Death or Incapacity: If the female member dies or becomes incapacitated during the maternity leave, the remaining benefit or leave credits transfer to the child’s father or an alternate caregiver. Proof of the member’s death or incapacity is required to process this transfer.

- Filing Period and Important Notes

- You have up to ten (10) years from the date of childbirth, miscarriage, or ETP to file your claim.

- For childbirth or pregnancies before March 11, 2019, older laws such as RA No. 8282 or RA No. 11199 apply.

Video: Maternity Benefit Application

To make your filing process easier, here’s a helpful video walkthrough of the SSS maternity benefit application process from MYSSSPH:

Summary

The SSS maternity benefit is a significant financial aid for women facing life-changing events like childbirth or pregnancy complications. However, claimants are expected to prepare the required documents based on their circumstances, while employers must ensure compliance for reimbursements. Once done, simply follow the steps outlined here and you can be sure of a smooth and timely claim process. For additional details, visit the official SSS website or contact their support services.