The SSS Employee Compensation (EC) Program is a government initiative designed to provide financial assistance to private-sector employees, including self-employed Social Security System (SSS) members, particularly in cases of work-related sickness, injury, disability, or death..This government initiative aims to ease the burden of medical expenses and lost income, ensuring employees and their families are well-supported during challenging times.

Applying for the SSS EC Program is a simple process that requires proper documentation and compliance with guidelines. Whether you are employed, self-employed, or separated from employment, understanding the steps and requirements is essential to successfully claim your benefits. In this guide, we will walk you through the key details of the EC Program, including eligibility, benefits, and the application process.

Program Overview

The Employees’ Compensation (EC) Program is a government-mandated initiative under the SSS that provides financial assistance benefits to workers who suffer work-related injuries, illnesses, or death. Established in 1975 through Presidential Decree No. 626, the program aims to offer financial assistance and medical support to affected workers and their families. It covers both private and public sector employees, as well as self-employed individuals, provided they are active SSS members. The program includes benefits such as medical services, disability pensions, rehabilitation services, and death benefits. By addressing workplace-related risks, the EC Program helps workers manage the financial impact of work-related contingencies, such as sickness, injury, or death, ensuring better protection and security for the Philippine workforce.

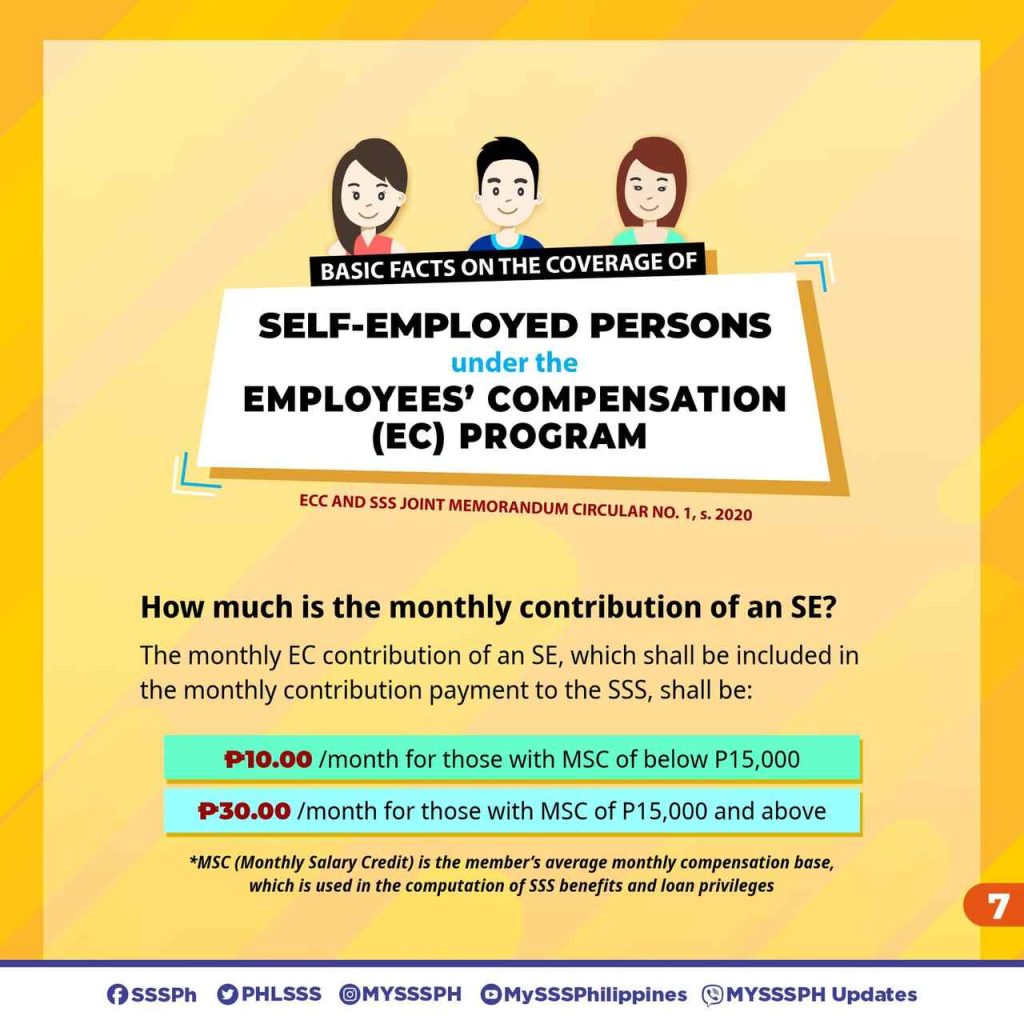

EC Contributions

Employers are responsible for paying the EC contribution for their employees, including household helpers. Self-employed members, on the other hand, pay their contributions themselves.

- Contribution Rates

- Monthly Salary Range: Below ₱15,000.00

- Employer/Self-Employed Contribution: ₱10

- Monthly Salary Range: ₱15,000 and above

- Employer/Self-Employed Contribution: ₱30

- Monthly Salary Range: Below ₱15,000.00

- Deadlines for Contribution Payments

- Employers: Contributions are due within the first 10 days of the following month.

- Self-employed members: Contributions must be paid consistently as long as the member is actively working. Late payments result in missed months being considered payment gaps.

When does Coverage Begin?

- For employees, coverage starts on the first day of employment.

- For self-employed members, coverage begins after the first SSS contribution payment.

Who is Covered Under the EC Program?

The following individuals are covered under the EC Program:

- Private sector employees who are mandatory SSS members.

- Household helpers (kasambahays).

- Sea-based Overseas Filipino Workers (OFWs).

- Self-employed SSS members.

Who are the Qualified Beneficiaries?

The beneficiaries of the program are divided into two types, including the following:

- Primary Beneficiaries

- The legitimate spouse living with the employee at the time of death.

- Legitimate, legally adopted, or acknowledged children under 21 years of age who are unmarried and not gainfully employed.

- Secondary Beneficiaries

- Legitimate parents who are wholly dependent on the employee.

- Legitimate descendants or illegitimate children under 21 years of age.

Note: If no primary or secondary beneficiaries exist, the benefit will accrue to the EC Fund.

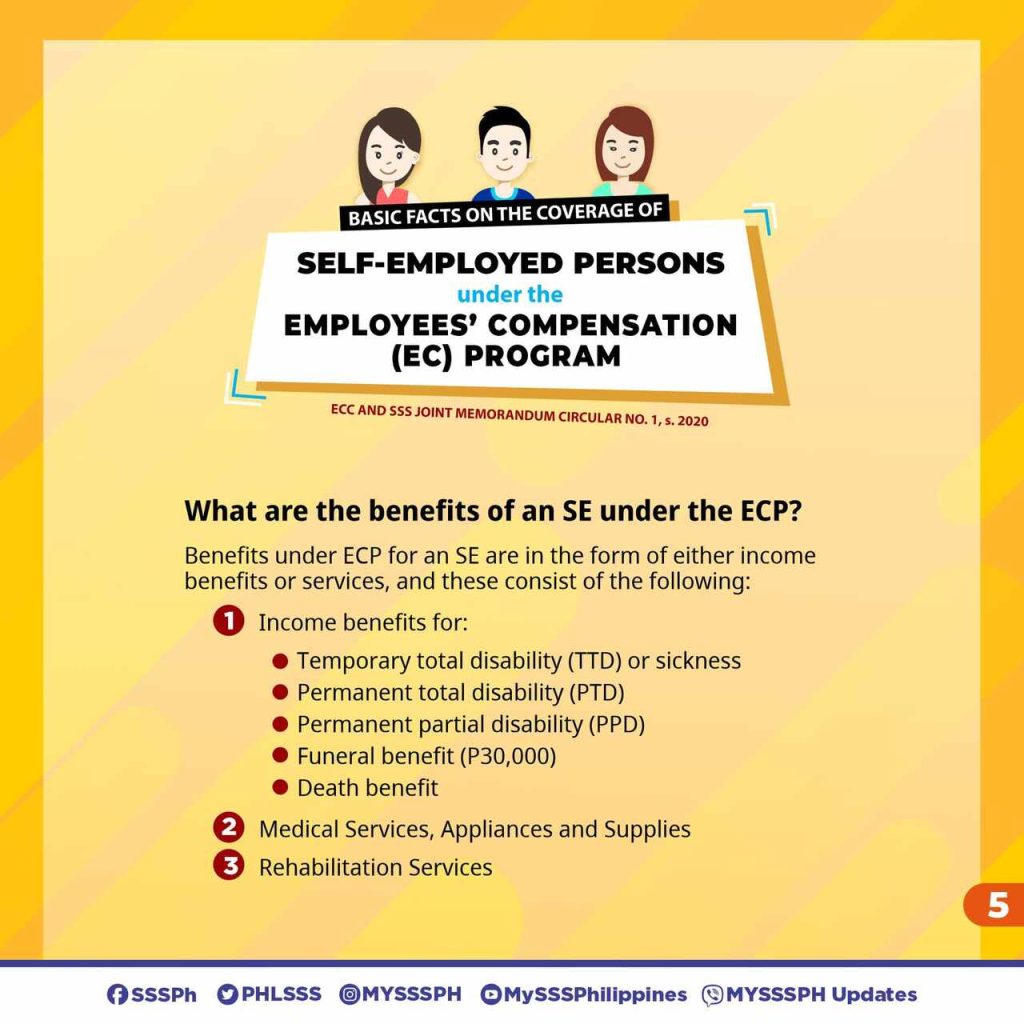

Benefits

Some of the benefits offered under the EC Program include the following:

- Income Benefits: Income benefits provide compensation for loss of income due to work-related contingencies. These benefits include:

- Temporary Total Disability (TTD): Compensation for up to 240 days if an employee cannot work due to a work-related sickness or injury. Daily allowances range from ₱110 to ₱480.

- Permanent Total Disability (PTD): Granted to workers who can no longer perform gainful work. Conditions like complete blindness or loss of two limbs qualify as PTD.

- Permanent Partial Disability (PPD): Provided for the loss of a body part or its functionality.

Note: Additional Benefit: ₱1,150 is added to all EC permanent disability pensions.

- Medical Services, Appliances, and Supplies: The program covers the cost of medical care, including:

- Medicine expenses.

- Hospital and surgical fees (ward services only).

- Necessary medical appliances and supplies.

- Rehabilitation Services: Rehabilitation services include:

- Physical restoration

- Psychosocial counseling

- Skills or entrepreneurial training

- Job placement assistance

- Carer’s Allowance: Workers with permanent disabilities are entitled to a ₱1,000 monthly carer’s allowance.

- Funeral Benefit: A ₱30,000 funeral benefit is provided to the beneficiaries of a deceased employee.

- Death Benefit: The EC death pension is granted to the beneficiaries of an employee who dies due to a work-related illness or injury. Primary beneficiaries receive a monthly pension, with an additional 10% for each minor dependent child (up to five children).

Qualifying Conditions

To qualify for EC benefits, the following conditions must be met by the program applicants:

- The sickness, injury, or death must be work-related.

- The employee must have been duly reported to the SSS.

- The SSS must be notified within:

- 5 days for home confinement.

- 1 year for hospital confinement.

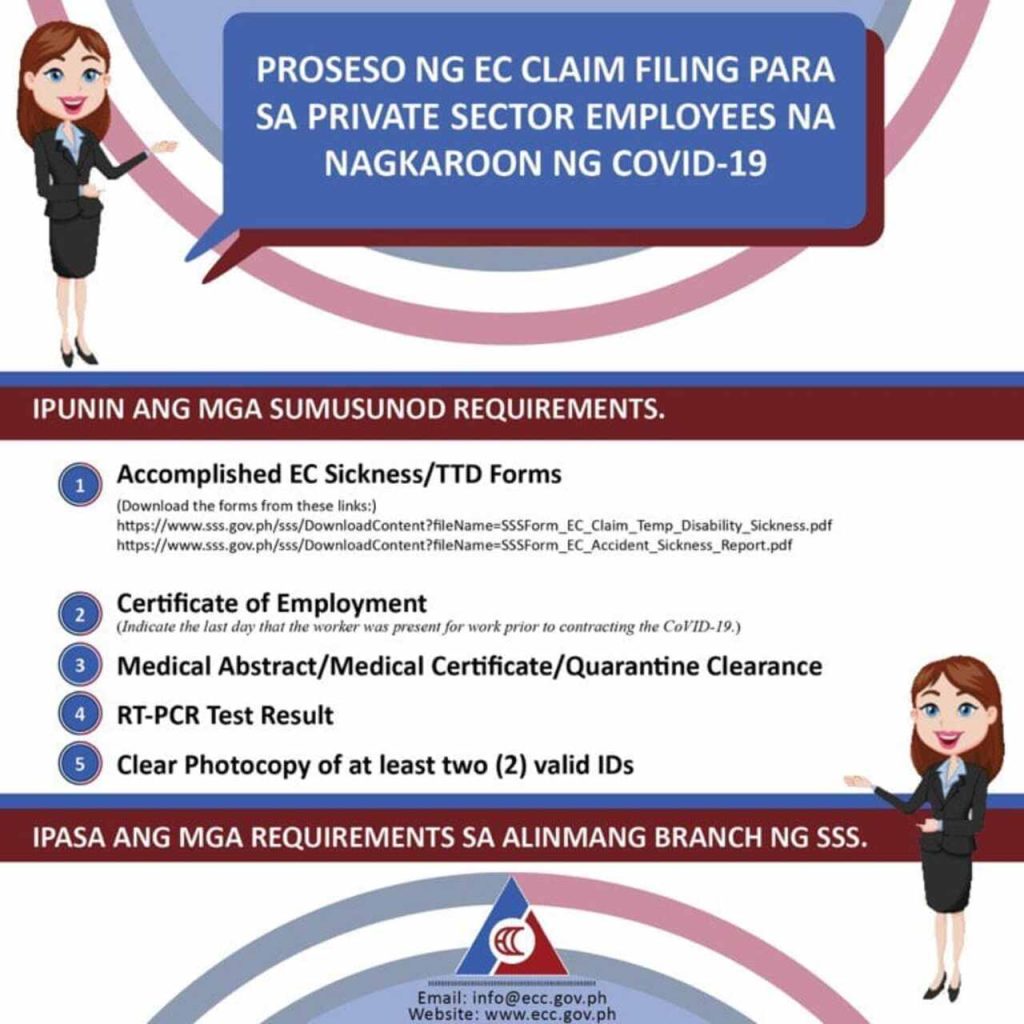

Requirements

Before filing claims, you also need to prepare the following documents:

For EC Temporary Total Disability or Sickness Claims

For Employed Members

- Accident/Sickness Report from employer (and Police Report if a vehicular accident with third-party involvement).

- Photocopy of the employer’s logbook entry describing the accident/sickness.

- Other medical documents, if needed.

Note: Employers must file the sickness notification for EC claims via the SSS web account. Once approved, the sickness benefit will be credited to the employee’s enrolled disbursement account in DAEM.

For Self-Employed or Members Separated from Employment

- If confinement happened during employment or before separation:

- Accident/Sickness Report from employer (and Police Report if a vehicular accident with third-party involvement).

- Certificate of separation stating the effective date and confirming no advance payment was given (signed by HR).

- Other medical documents, if needed.

- If confinement happened after separation:

- Submit the Certificate of Separation and other documents depending on the situation:

- If the company is on strike:

- Notice of strike acknowledged by DOLE.

- Notarized Affidavit of Undertaking confirming no advance payment was given.

- If the company has dissolved or ceased operations:

- Notarized Affidavit of Undertaking with the date of separation and a statement that no advance payment was given.

- If a case is pending in court about the separation:

- Certification from DOLE.

- Notarized Affidavit of Undertaking with the date of separation and a statement that no advance payment was given.

- If separation was due to AWOL or strained relations with the employer:

- Notarized Affidavit of Undertaking with the date of separation and a statement that no advance payment was given.

Note: Self-employed or separated members must file EC sickness claims through their My.SSS account. Once approved, payment will be credited to the member’s enrolled DAEM account.

For EC Disability Claims

- Disability Claim Application Form.

- Member’s Photo and Signature Card.

- Medical Certificate (completed by the attending physician).

- Physical Examination Report (if incident happened abroad).

- Accident/Sickness Report and Police Report (for vehicular accidents).

- Government-issued ID (SS ID/UMID or others).

- Supporting medical documents (e.g., logbook entries for work-related cases).

- Bank documents to confirm account details (e.g., ATM card, passbook, deposit slip).

Additional Requirements

- Foreign medical documents must have an English translation and be authenticated by the Philippine Embassy or notarized locally.

- If unable to file personally:

- Sketch of the member’s residence or confinement location.

- If a guardian files on behalf of the member:

- Special Power of Attorney (SPA) or Affidavit of Guardianship.

- In-Trust-For (ITF) savings account for the member.

For EC Death Claims

For Employed Members

- Death Claim Application Form.

- Member’s Photo and Signature Card.

- Death Certificate (from PSA/LCR or foreign equivalent).

- Affidavit of Death Benefit (SS Form CLD-1.3A).

- Bank documents (ATM, passbook, or validated deposit slip).

- Government-issued ID.

Additional Requirements

- If due to an accident:

- Accident Report/Death Report and police records (if applicable).

- Company logbook entries or reports.

- If due to illness:

- Medical records and statements from co-workers confirming the work connection (if the company no longer operates).

- Additional Requirements for Beneficiaries:

- For spouses: Marriage Certificate (PSA/LCR).

- For children: Birth Certificates (PSA/LCR).

- For secondary beneficiaries (parents or illegitimate children):

- Death Certificates of the spouse or parents (if applicable), plus

- Affidavits of Dependency.

- If filed by a representative:

- Two valid IDs (claimant and representative).

- Letter of Authority or Special Power of Attorney.

For EC Medical Reimbursements

- EC Medical Reimbursement Application Forms 1 and 2.

- Accident/Sickness Report and Police Report (if applicable).

- Government-issued ID.

- Certified receipts and billing documents for medical expenses.

Additional Requirements

- For work-related sickness: Pre-employment medical records and job description from the employer.

- For accidents outside the workplace: Certification of travel purpose and police report.

For EC Funeral Claims

- Funeral Claim Application Form.

- Proof of Death (e.g., Death Certificate from PSA/LCR).

- Original Official Receipt (OR) for funeral expenses.

- Government-issued ID of the claimant.

Additional Requirements

- If the claimant is not listed on the OR, provide a notarized waiver from the person named in the receipt.

- If the member passed away abroad, submit foreign-issued Death Certificate or Report of Death from the Philippine Embassy.

How to Apply for the EC Program

To apply, here are the steps to follow:

For Employed Members

Step 1. Prepare the required documents

Step 2. File your claim

- The employer should file the claim through the SSS web account.

Step 3. Wait for Notification – Once submitted, the SSS will review your claim and notify you of the result.

Step 4. Receive Payment – If approved, the benefit will be credited to the employee’s enrolled disbursement account.

For Self-Employed Members or Those Separated from Employment

Step 1. Prepare the required documents according to the need and conditions:

Step 2. File your claim through your My.SSS account:

Step 3. Wait for Notification

- Once submitted, the SSS will review your claim and notify you of the result.

Step 4. Receive Payment

- If approved, the benefit will be credited to your enrolled disbursement account in the DAEM.

Important Reminders

For your reference, here are some things you need to remember:

- Filing of Claims must be done within the designated schedule:

- Sickness: Claims must be filed within three years from the last day of confinement or absence from work.

- Injury: Claims should be filed within three years from the incident date.

- Death: Claims must be filed within three years of the date of death.

- EC Logbook Requirements: Employers must maintain an EC logbook that records all work-related contingencies. This logbook should include:

- Employee names.

- Dates and nature of contingencies.

- Absences due to work-related incidents.

- Entries should be made within five days of the incident.

- Employers must submit a report to the SSS if the contingency is deemed work-related.

- Limitations of EC Benefits: EC benefits are not granted if the sickness, injury, or death resulted from:

- Intoxication or drunkenness.

- Willful intent to harm oneself or others.

- Notorious negligence.

Frequently Asked Questions (FAQs)

For more information, do take note of the following questions and answers regarding the EC Program benefits:

1. What if an accident happens outside the workplace?

Accidents occurring outside the workplace may still qualify for EC benefits if they happen:

- During official work tasks.

- While traveling to or from work.

- During company-sponsored activities.

2. Can self-employed members pay contributions in advance?

Yes, self-employed members can pay contributions in advance. However, they must settle any underpayments resulting from changes in contribution rates to retain their intended membership status.

Video: Understanding the Employees Compensation (EC) Program

For a visual and more detailed guide that will help you better understand the SSS EC Program, you may check out this video from MYSSSPH:

Summary

The SSS EC Program offers valuable benefits to employees and their dependents in the face of work-related contingencies. By understanding the eligibility requirements, application process, and available benefits, SSS members can take full advantage of this program to safeguard their financial well-being. Start learning about the EC Program and the benefits you can get from it today!