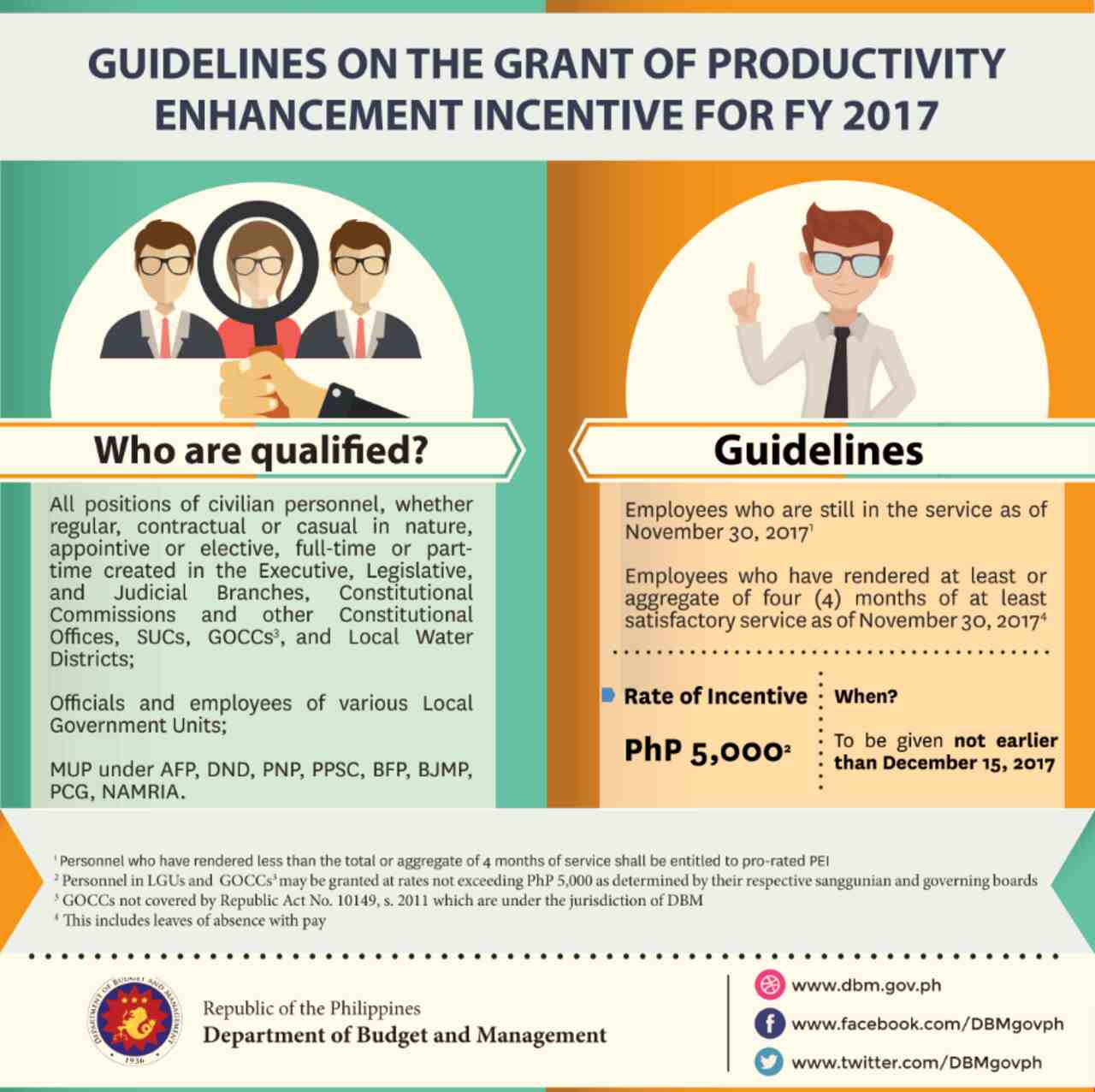

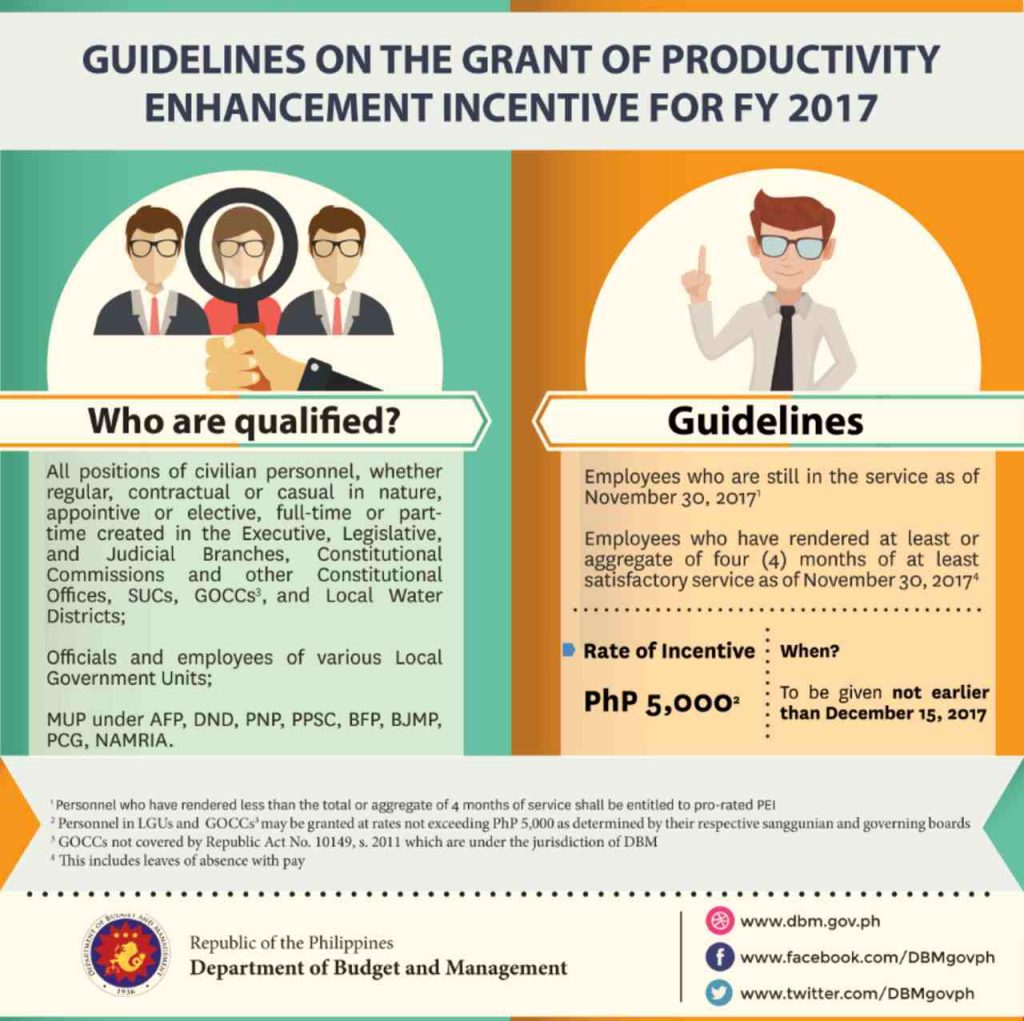

The Productivity Enhancement Incentive (PEI) is a ₱5,000 year-end bonus given to qualified government employees in the Philippines. It’s released every year, not earlier than December 15, as part of the government’s effort to support workers and recognize their service. If you work in the government—whether civilian, military, or uniformed personnel—the PEI is something you are likely to look forward to because it helps with holiday expenses and gives a little financial relief at the end of the year.

To receive the PEI, you need to meet the basic requirements: you must still be working in government service by November 30 of the current year and you must have completed at least four months of satisfactory service. Even if you worked less than four months, you may still receive a pro-rated amount. The guidelines are updated through DBM Budget Circular No. 2017-4, which implements the rules under Executive Order 201, s. 2016.

What Is the PEI Bonus?

The PEI is a fixed ₱5,000 year-end bonus granted to qualified government employees in the Philippines. It was first implemented as part of the government’s effort to support worker productivity and was formally strengthened through Executive Order 201, s. 2016, which standardized the yearly release of the incentive.

According to the DBM Budget Circular No. 2017-4, here is a summary of the provisions for the PEI.

- ₱5,000 annual incentive, given not earlier than December 15

- Available to civilian personnel, AFP, and uniformed services (PNP, BFP, BJMP, PCG, NAMRIA, PPSC)

- Covers personnel in NGAs, LGUs, SUCs, LWDs, and GOCCs under DBM

- Requires active service as of November 30

- Requires at least four months of satisfactory service to get the full amount

- Pro-rated amounts for employees with less than four months of service

- Part-time workers receive proportionate PEI based on actual service

- Employees with pending cases may receive PEI until found guilty with final judgment

- LGUs and GOCCs may grant lower but uniform rates if funds are limited

- Released through agency funds, local government funds, or approved corporate operating budgets

- Intended to help improve employee productivity.

- Part of the benefits under EO 201, along with salary adjustments and mid-year bonuses.

Who Is Covered?

The PEI bonus is intended for qualified government personnel across national agencies, LGUs, GOCCs under DBM, LWDs, and uniformed services. It covers employees who render actual government service and excludes individuals hired without an employer–employee relationship.

Included Beneficiaries:

- Civilian personnel (regular, casual, contractual; appointive or elective; full-time or part-time)

- Employees in National Government Agencies (NGAs)

- State Universities and Colleges (SUCs)

- Government-Owned or -Controlled Corporations (GOCCs) under DBM

- Local Water Districts (LWDs)

- Local Government Unit (LGU) employees

- Military personnel of the AFP and DND

- Uniformed personnel of:

- PNP

- PPSC

- BFP

- BJMP

- Philippine Coast Guard

- NAMRIA

Excluded:

- Consultants and experts hired only for a project

- Laborers paid by piecework or job contracts (pakyaw)

- Student workers and apprentices

- Individuals hired under job orders or contracts of service

Guidelines to Receive the PEI

To get the full ₱5,000, you must:

- Be in active service as of November 30

- Have rendered at least four months of satisfactory service (including paid leaves)

- For those who have rendered less than four months of satisfactory service, the PEI is pro-rated as follows:

- 3 to <4 months: 50%

- 2 to <3 months: 40%

- 1 to <2 months: 30%

- Less than 1 month: 20%

Other Rules:

- Part-time employees get a proportionate amount based on hours served.

- If working in more than one agency, amounts are split but cannot exceed ₱5,000 total.

- Transfers: PEI comes from your new agency.

- Employees in detail: PEI comes from your parent agency.

- Those on service extension due to compulsory retirement may still qualify.

For Employees with Pending Cases:

- Employees with administrative or criminal cases still pending may still receive the PEI.

- If later found guilty with a final decision, they must return the PEI for that year.

- If the penalty is only a reprimand, they remain entitled.

For Employees of LGUs and GOCCs

- LGUs and GOCCs may give a lower but uniform rate if funds are insufficient.

- GOCCs covered by RA 10149 follow separate guidelines from the Governance Commission for GOCCs.

When Is the PEI Paid?

If you’re a government employee in the Philippines, PEI is a benefit paid not earlier than December 15 every year. You can actually look forward to receiving thia extra benefit each year—as long as you meet the guidelines.

Video: PEI 2025 AVP

To learn more about this incentive program, watch this video below