The Pag-IBIG Fund, also known as the Home Development Mutual Fund (HDMF), is a government-established savings and housing program in the Philippines. Created in 1978, its primary purpose is to provide Filipino workers with a national savings program and affordable shelter financing options. Learning about Pag-IBIG Fund is crucial as it offers various financial benefits and security, particularly in terms of homeownership and savings growth.

Pag-IBIG helps members by providing access to affordable housing loans, short-term loans, and various savings programs, including the popular MP2 Savings. By participating, members can secure financial assistance for housing, education, and emergencies, enhancing their quality of life. Knowing about Pag-IBIG Fund means being aware of these opportunities for financial stability and improved living conditions, which are essential for every Filipino worker.

What is Pag-IBIG

Pag-IBIG stands for “Pagtutulungan sa Kinabukasan: Ikaw, Bangko, Industriya at Gobyerno,” which translates to “Working Together for the Future: You, the Bank, Industry, and Government.” This acronym encapsulates the collaborative effort between individuals, financial institutions, industries, and the government to provide a robust savings and housing program for Filipino workers. The Pag-IBIG Fund was created to address the need for a national savings program and affordable housing finance, promoting financial security and stability.

The Pag-IBIG Fund is not just a savings scheme; it offers a range of financial services, including housing loans, short-term loans, and modified savings programs like the MP2 Savings. These programs aim to help members achieve homeownership, manage financial emergencies, and grow their savings. The organization’s mission is to generate savings from Filipino workers and provide accessible funds for housing, ensuring that all members benefit from the Fund’s resources and services.

History

The Pag-IBIG Fund, officially known as the HDMF, was established on June 11, 1978, under Presidential Decree No. 1530. Initially, the Fund was managed by the Social Security System (SSS) and the Government Service Insurance System (GSIS) for private and government employees, respectively. On June 4, 1979, Executive Order No. 538 merged these funds into a single entity, which was later made independent in 1980 with its own Board of Trustees. The Fund’s membership shifted from mandatory to voluntary and back to mandatory in 1995, solidifying its responsibility in providing affordable housing and savings programs for Filipino workers. Over the years, Pag-IBIG has introduced various innovative programs, significantly impacting the country’s economic and housing sectors.

Pag-IBIG Logo

The Pag-IBIG Fund logo features a stylized depiction of a home, symbolizing the organization’s commitment to providing affordable housing. The yellow circle within the house bears the Pag-IBIG acronym and Fund name, representing unity and the organization’s central position in Filipino financial security. The blue hands beneath the house signify protection and support, reflecting the Fund’s mission to assist its members. Overall, the colors and design elements highlight Pag-IBIG’s dedication to shelter and financial stability for Filipino workers.

Vision

“For every Filipino worker to save with Pag-IBIG Fund and to have decent shelter.”

Mission

“To generate more savings from more Filipino workers, to administer a sustainable Fund with integrity, sound financial principles, and with social responsibility, and to provide accessible funds for housing of every member.”

Corporate Values

The governing values Pag-IBIG Fund operates by in an effort to satisfy the Vision it has created for itself include:

- Professionalism

- Integrity

- Excellence, and

- Service

Corporate Objectives (5-year Plan)

It also operates with the goal of sustaining membership growth and retention initiatives that would result in a P2-billion annual increase in its members’ savings collection efforts until 2028, and to provide affordable home financing to at least 731,810 income earners through socialized and low-cost housing programs from 2023 until 2028.

Quality Policy

The Pag-IBIG Fund is dedicated to improving the quality of life for every Filipino by providing high-quality, member-focused services. Their Quality Policy outlines their commitment to enhancing their provident savings and home financing system. To maintain this quality, they adhere to the following key principles.

- To follow international standards and regulations to ensure their Quality Management System is effective and efficient.

- To identify and address risks to minimize them and seize opportunities for improvement.

- To protect member data by ensuring its confidentiality, privacy, integrity, and availability.

- To continually develop and improve services to meet the evolving needs of their members.

- To create a productive and safe work environment that encourages employee growth, teamwork, and well-being.

- To emphasize transparency and accountability in all their operations.

Note: The same policies have been in effect since 2020, and have remained unchanged despite the change in Pag-IBIG Fund leadership.

Mandate

The Pag-IBIG Fund, or HDMF, was established with a clear mandate to provide Filipinos with a reliable savings program and affordable housing solutions. Its goal is to harness the collective efforts of individuals, banks, industries, and the government to ensure that every Filipino worker has access to these essential services. The Fund’s comprehensive mandate also encompasses a range of responsibilities and services, including the following:

- Provide Affordable Housing: Offer financial assistance to help members acquire affordable homes.

- Savings Program: Implement a national savings program that encourages Filipino workers to save regularly.

- Financial Security: Ensure financial security through various loan programs for housing, education, and emergencies.

- Collaborative Effort: Foster cooperation among individuals, banks, industries, and the government.

- Member-Focused Services: Deliver services that are responsive to the needs of its members.

- Enhance Quality of Life: Commit to improving the overall quality of life for every Filipino worker.

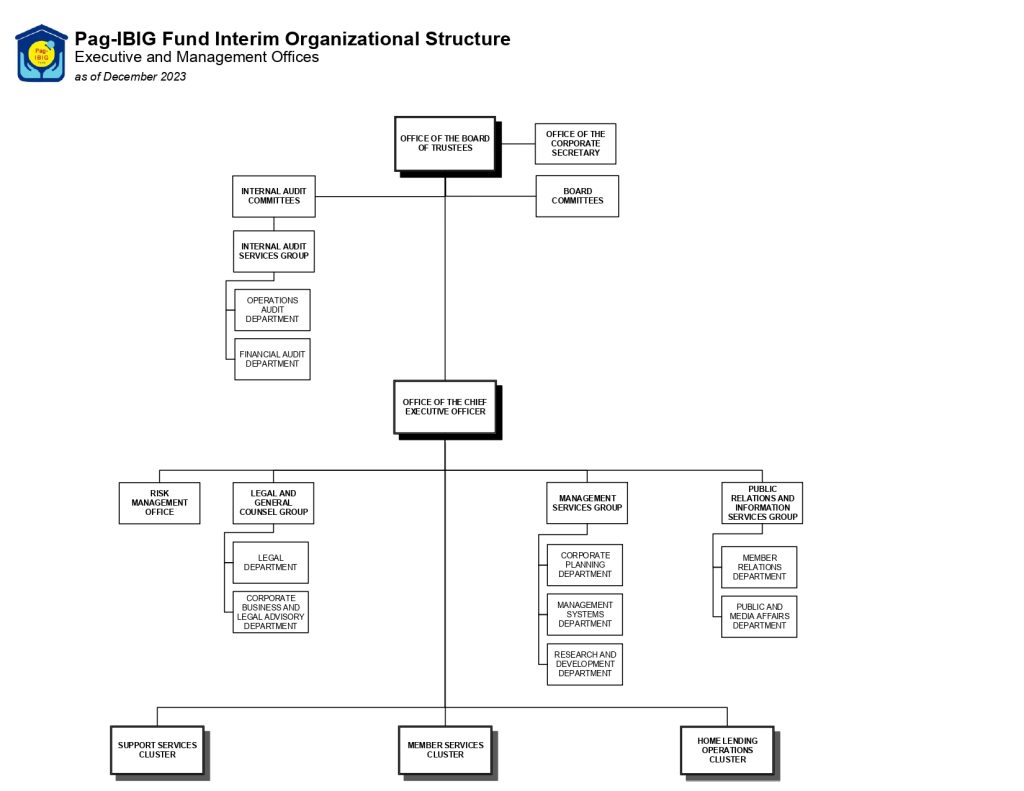

Organizational Chart

The Pag-IBIG Fund’s organizational structure consists of several key components to ensure efficient management and service delivery. At the top is the Office of the Board of Trustees, supported by the Office of the Corporate Secretary and various Board Committees. Below this, the Office of the Chief Executive Officer oversees multiple departments, including the following:

- Internal Audit Services

- Risk Management

- Legal and General Counsel

- Management Services, and

- Public Relations

The structure is further divided into clusters:

- Support Services

- Member Services, and

- Home Lending Operations

Each cluster focuses on specific areas of the Fund’s operations. This arrangement ensures comprehensive governance, effective risk management, and dedicated member and housing services.

Benefits

The establishment of the Pag-IBIG Fund offers numerous benefits to Filipino workers and the country’s economy. It provides affordable housing options, a systematic savings program, and various loan services, enhancing the financial stability and quality of life for its members. Here are some key advantages of the Pag-IBIG Fund:

- Affordable Housing Loans: Enables members to purchase homes through low-interest loans.

- Savings Programs: Encourages systematic savings, offering regular and MP2 savings options with competitive interest rates.

- Calamity Loans: Provides financial assistance to members affected by natural disasters.

- Multi-Purpose Loans: Offers short-term loans for various needs, including education, health, and emergency expenses.

- Voluntary Membership: Allows overseas Filipino workers and other groups to voluntarily join and benefit from the programs.

- Loyalty Card Plus: Offers discounts and rewards in partner establishments for members.

- Financial Stability: Helps members build a secure financial future through mandatory and voluntary contributions.

- Nationwide Coverage: Ensures all Filipino workers, regardless of employment status, can access these benefits.

Coverage and Membership

In 2009, Republic Act No. 9679, also known as the HDMF Law of 2009, was passed. This law expanded Pag-IBIG Fund coverage, making membership mandatory for all employees, including self-employed individuals earning at least ₱1,000 per month. It also covered overseas Filipino workers (OFWs) and allowed voluntary membership for Filipino immigrants, naturalized citizens, and permanent residents abroad.

The Fund also provides comprehensive coverage and membership options designed to benefit all Filipino workers, regardless of their employment status. By offering various membership types, the Fund ensures that everyone, from private employees to OFWs, can take advantage of its financial and housing services. Here’s an overview of Pag-IBIG Fund’s coverage and membership details.

1. Mandatory Membership

All employees, including private and government workers, are required by law to be members of the Fund, along with the following groups of people:

- Private employees (permanent, temporary, or provisional) under sixty years old.

- Household helpers earning at least ₱1,000 per month.

- Filipino seafarers with signed standard employment contracts.

- Self-employed individuals earning at least ₱1,000 per month and under sixty years old.

- Expatriates working in the Philippines.

- Government employees covered by the Government Service Insurance System (GSIS).

- Uniformed personnel of the AFP, BFP, BJMP, and PNP.

- Filipinos employed by foreign-based employers, both locally and abroad.

2. Voluntary Membership

This is a membership type specially designed for self-employed individuals, OFWs, and other eligible Filipinos individuals aged 18 to 65 who follow the rules and contribute as required. Eligible voluntary members include:

- Non-working spouses managing the household, with consent from their employed spouse who is a registered Pag-IBIG member.

- Filipino employees of foreign governments or international organizations in the Philippines, without an administrative agreement with the Fund.

- Employees of employers granted a waiver or suspension of coverage by the Fund under RA 9679.

- Leaders and members of religious groups.

- Individuals separated from employment, either locally or abroad, who want to continue their contributions, such as pensioners or those with passive income.

- Public officials not covered by GSIS, including Barangay officials and members of the Sangguniang Kabataan.

- Other earning individuals or groups as determined by the Board.

Programs and Services

The Pag-IBIG Fund offers a range of programs and services designed to improve the financial well-being and housing opportunities for Filipino workers. These services encompass membership and savings programs, various loan options, and eServices to ensure easy access and convenience for its members. Below is a detailed overview of these offerings:

1. Membership & Savings Programs

- Get a Membership ID (MID) Number: Obtain a unique identifier for all Pag-IBIG transactions.

- Regular Savings: Basic savings program with contributions from members and their employers.

- MP2 (Modified Pag-IBIG 2) Savings: Voluntary savings program with higher dividend rates.

- Membership for OFWs: Special membership for Filipinos working abroad.

2. Housing Loan

- Pag-IBIG Housing Loan: Loans for purchasing, constructing, or renovating homes.

- Pag-IBIG Home Equity Appreciation Loan (HEAL): Loans for members with existing housing loans needing additional funds.

- Affordable Housing Loan for Minimum-Wage Earners: Special loans with low-interest rates for minimum-wage earners.

- Home Saver Programs: Programs aimed at helping members save for future home purchases.

- Acquired Assets: Purchase foreclosed properties at affordable rates.

- 4PH Program: Provides affordable housing options through public-private partnerships.

3. Short-Term Loans

- Multi-Purpose Loan: Loans for various personal needs such as education, health, and emergencies.

- Health and Education Loan Programs (HELPs): Loans specifically for health and education expenses.

- Calamity Loan: Financial assistance for members affected by natural disasters.

4. Other Services

- Pag-IBIG Savings Claim (Regular & MP2 Savings): Claiming matured savings.

- Loyalty Card Plus: Card offering discounts and rewards in partner establishments.

- Asenso Rider Raffle Promo: Special promos and raffles for members.

5. eServices

- Membership

- Membership Registration: Online registration for new members.

- Kasambahay Membership Registration: Online registration for household helpers.

- Housing

- Housing Loan Payment Viewer: View and track housing loan payments online.

- Housing Loan Online Application: Apply for housing loans through the internet.

- Developer’s Online Housing Loan Application: Developers can apply for loans on behalf of buyers.

- Application for Housing Loan Interest Repricing: Request for interest rate adjustments on existing loans.

- Other Services

- Online Payment Facilities: Various options for online payments.

- MP2 Savings Enrollment: Enroll in the MP2 Savings Program online.

- Electronic Submission of Remittance Schedule (eSRS): Employers can submit remittance schedules electronically.

Video: Pag-IBIG Regular Savings

The Pag-IBIG Regular Savings program is a mandatory savings scheme designed to provide financial security and housing opportunities for Filipino workers. Contributions are made by both employees and their employers, accumulating funds that can be used for various purposes, including home loans and other benefits. This program not only fosters a culture of saving but also supports members in achieving their long-term financial and housing goals. Watch this video from Pag-IBIG Fund to learn more.

Summary

The Pag-IBIG Fund is a cornerstone in the Philippine financial and housing sector, providing essential cash assistance programs that help Filipinos secure their future. Through its wide range of savings and loan programs, Pag-IBIG ensures that its members have the financial support needed for housing, education, health, and other essential needs. With a vision of providing decent shelter for every Filipino worker and a mission grounded in integrity and social responsibility, the Pag-IBIG Fund continues to be a strong partner in improving the quality of life for millions of Filipinos.

Contact Information

For more information on Pag-IBIG and its cash assistance programs, you may reach out to Pag-IBIG Fund via the following:

Pag-IBIG Fund (Home Development Mutual Fund)

Corporate Office Address: Petron Mega Plaza, # 358 Sen. Gil J. Puyat Avenue, Makati City

Pag-IBIG Mailing Address: 2nd Flr, JELP Business Solution Center, 409 Shaw Boulevard, Brgy. Addition Hills, Mandaluyong City, Philippines

Phone Number: (02) 8-422-3000

Pag-IBIG Fund 24/7 Hotline: 8-724-4244 (8-Pag-IBIG)

Email Address: contactus@pagibigfund.gov.ph

Pag-IBIG Official Website: http://www.pagibigfund.gov.ph