Owning a home is now possible even for minimum-wage earners in the Philippines, thanks to the Pag-IBIG Fund’s Affordable Housing Program (AHP). This initiative offers homeownership through various loan options with low monthly payments and flexible terms, making it an excellent option for those with limited incomes. Here’s a detailed guide on eligibility, requirements, loan details, and application procedures to help you confidently apply for this program and move one step closer to achieving your dream home.

Loan Features and Benefits

This Pag-IBIG program was designed to make homeownership accessible and favorable for low-income individuals seeking financial stability through property ownership.

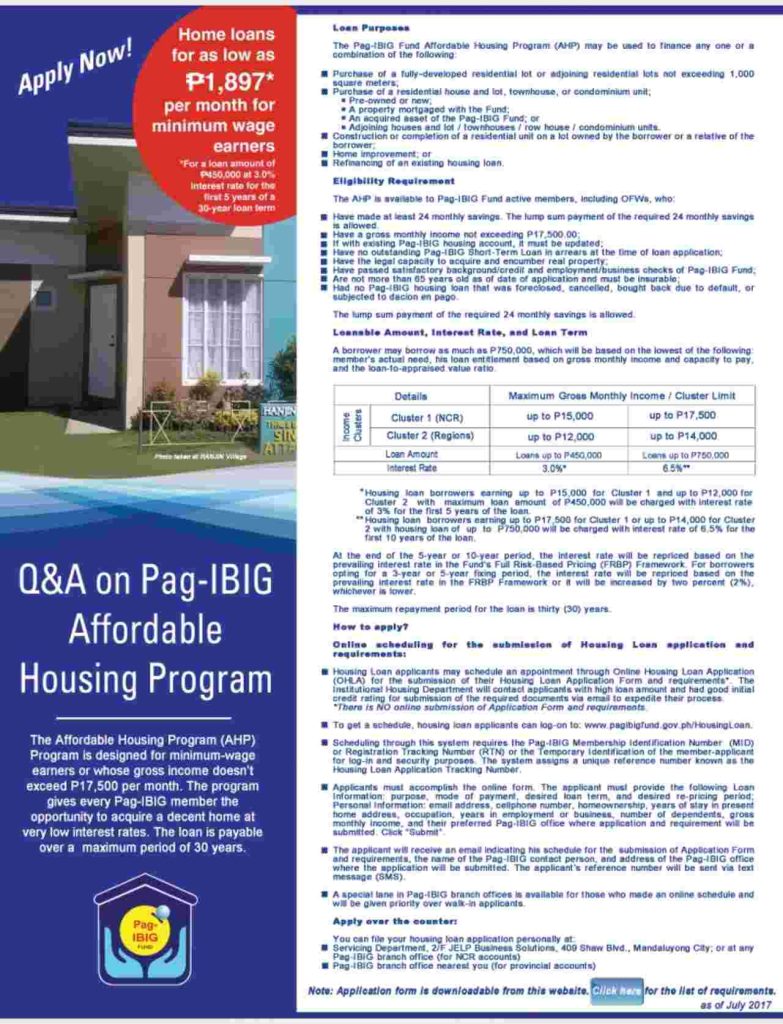

- It allows borrowers to loan up to ₱750,000, depending on the borrower’s actual need, capacity to repay, and the loan-to-appraised value ratio.

- For members with a monthly income of up to P15,000 (NCR) or P12,000 (outside NCR), the loan amount is capped at P450,000, with a 3% interest rate for the first 5 years.

- For those earning up to P17,500 (NCR) or P14,000 (outside NCR), the loan amount can go up to P750,000 with a 6.5% interest rate for the first 10 years.

- Affordable Payments

- Low monthly amortization rates.

- Monthly payments start as low as ₱2,445.30, depending on the loan amount and repayment term chosen.

- Competitive interest rates

- For loans up to P450,000, you may enjoy a 3% interest rate for the first five years.

- For loans between P450,000 and P750,000, the interest rate will be 6.5% for the first ten years.

- After the initial period, interest rates will be adjusted based on the prevailing market rate or increased by 2%, whichever is lower.

- Flexible Terms

- The loan repayment period can extend up to 30 years, but it should not exceed the borrower’s age of 70.

- Comes with insurance coverage

- The loan is also covered by Mortgage Redemption Insurance (MRI) or Sales Redemption Insurance (SRI), and Fire and Allied Perils Insurance (FAPI).

- Accessible to members with monthly income up to P25,000

- Can be used for purchasing a lot, residential unit, or house construction

- Purchase of Property: This includes a fully developed residential lot, house and lot, townhouse, or condominium unit.

- Home Construction: You may use the loan to build or complete a house on land owned by you or a relative.

- Home Improvement: Use the loan to make improvements to your home.

- Refinancing Existing Loans: The loan can be used to refinance an existing housing loan, provided it is up-to-date.

- No need for collateral for loans below P450,000

- Inclusive Eligibility

- Open to Pag-IBIG members locally and abroad, including overseas Filipino workers (OFWs)

- Fast processing and approval time

- Streamlined Process

- Online scheduling and priority queues enhance convenience.

- Can be availed through accredited developers

Target Beneficiaries

It targets low-income individuals, including:

- Low-income employees with a monthly income of up to P25,000

- Government and private sector workers

- Overseas Filipino Workers (OFWs)

- Members of the Pag-IBIG Fund with at least 24 monthly contributions

- First-time homebuyers

- Individuals who do not own a house or lot

Eligibility Requirements

To qualify for the AHP, applicants must meet the following conditions:

- Membership and Savings: Active Pag-IBIG members with at least 24 months of contributions. Lump-sum payments for missed contributions are allowed.

- Income Threshold: Gross monthly income must not exceed ₱17,500.

- Loan and Credit Status: Applicants must not have existing arrears on any Pag-IBIG Short-Term Loan or housing loan accounts. Additionally, prior housing loans must not have been foreclosed, canceled, bought back, or subjected to dación en pago.

- Legal and Financial Standing: Must possess the legal capacity to own property and pass credit and employment/business checks.

- Age Limitation: Must be under 65 years old at the time of application and insurable.

Documents Required

Here are some of the documents that applicants need to prepare before applying for the program:

From the Borrower:

- Housing Loan Application Form with ID photos of borrower/co-borrower.

- Proof of Income: The required documents vary depending on the borrower’s employment status:

- Locally Employed: A Certificate of Employment and Compensation (CEC), the latest Income Tax Return (ITR), and one month’s payslip.

- Self-Employed: ITR, Audited Financial Statements, and other supporting documents like Commission Vouchers or Bank Statements.

- Overseas Filipino Workers (OFW): Employment Contract, CEC, and Special Power of Attorney (SPA) notarized prior to departure.

- Valid ID: Photocopies of a valid government-issued ID for the borrower, co-borrower, and spouses.

From the Seller:

- Property Documents: Transfer Certificate of Title (TCT) or Condominium Certificate of Title (CCT), updated tax declarations, and real estate tax receipts.

- Property Location: Vicinity or sketch map of the property.

Additional Requirements by Loan Purpose

Purchases through Pag-IBIG Accredited Developers

For individuals purchasing a home through Pag-IBIG’s accredited developers, the following documents are required:

- Notarized Borrower’s Conformity form (HQP-HLF-108).

Additional documents may include:

- License to Sell (for developers)

- Secretary’s Certificate (if applicable)

- Real Estate Tax Receipts and Tax Declaration.

Purchase of Lot or Residential Unit

For those purchasing a lot or residential unit, the following documents are required:

- Property Documents

- Vicinity Map/Sketch of the Property

House Construction or Home Improvement

For those seeking to build or improve a home, the requirements are as follows:

- Property Documents

- Building Plans and Bill of Materials signed by a licensed civil engineer or architect

- Vicinity Map/Sketch

Purchase of Lot with House Construction

When purchasing both a lot and constructing a house, the required documentation includes:

- Property Documents

- Building Plans and Bill of Materials signed by a licensed civil engineer or architect

- Vicinity Map/Sketch

Refinancing

For those looking to refinance their existing property loans, the following requirements are essential:

- Existing Loan Documents: If refinancing an existing property loan, additional documents related to the current loan may be requested by Pag-IBIG.

- Property Documents

For OFWs

- Special Power of Attorney (SPA)

- Income proof

- Other supporting documents such as a valid OWWA Membership Certificate or Overseas Employment Certificate.

- Health questionnaires may be necessary depending on the loan amount or borrower age.

Step-by-Step Guide to Applying for Pag-IBIG AHP

Applying for the program requires following these steps:

Step 1: Complete the Requirements to Apply for a Pag-IBIG Housing Loan

Before applying, ensure you have all the necessary documents. These include:

Step 2: Submit Your Pag-IBIG Housing Loan Application

You can submit your application online via Virtual Pag-IBIG (www.pagibigfundservices.com/virtualpagibig) or in person at any Pag-IBIG Housing Business Center or local Pag-IBIG Fund branch. Through Virtual Pag-IBIG, you can schedule a time to submit the required documents.

Step 3: Receive Your Notice of Approval (NOA) and Letter of Guaranty (LOG)

Once Pag-IBIG reviews your application and confirms that your documents are in order, you will receive a Notice of Approval (NOA) and a Letter of Guaranty (LOG). These documents will inform you that your loan has been approved, and you will be given instructions on where to collect them.

Step 4: Complete the Requirements Stated in Your Notice of Approval

Once you receive your NOA, you must complete the additional requirements stated in it. This may include transferring the title and annotating the mortgage. You must accomplish these steps within 90 days from receiving the NOA.

Step 5: Receive Your Pag-IBIG Housing Loan Proceeds

After submitting all the post-approval requirements, you will receive the proceeds of your housing loan. The funds will be released within 10 working days. Pag-IBIG will inform you about the safe and convenient method of receiving your loan proceeds.

Step 6: Start Paying Your Pag-IBIG Housing Loan

Your first payment will be due one month after the loan proceeds are released. You can pay using your Pag-IBIG Housing Loan Account number, either online via Virtual Pag-IBIG or through accredited collecting partners.

Walk-In Application

You may also apply in person at the following locations:

- NCR Accounts: Servicing Department at 2/F JELP Business Solutions, Shaw Blvd., Mandaluyong City, or other NCR branches.

- Provincial Accounts: The nearest Pag-IBIG branch to your location.

Where to Secure the Application Form

You can obtain the Pag-IBIG AHP application form from:

- Pag-IBIG Fund Branches: Visit the nearest Pag-IBIG office and request the housing loan application form.

- Pag-IBIG Official Website: Download the form online by visiting their website at www.pagibigfund.gov.ph.

- Authorized Satellite Offices: Check for Pag-IBIG desks in government offices or malls.

Video: Applying for the Pag-IBIG AHP

The Pag-IBIG AHP offers a wide range of housing loans tailored to different purposes. With low-interest rates, flexible repayment terms, and minimal income requirements, the program makes homeownership possible to minimum-wage earners looking to buy a home with low monthly payments and flexible terms. In this video, we’ll walk you through the steps to apply for the Pag-IBIG Affordable Housing Loan for Minimum-Wage Earners. Watch and learn from Prof. Allan Noguerra MBA, LPT about eligibility, requirements, and how to submit your application seamlessly.

For more information, you may also check out this brochure on AHP: