The GSIS Multi-Purpose Loan Lite (MPL Lite) is a financial assistance program offered to active members of the Government Service Insurance System (GSIS). This short-term loan aims to address the immediate financial needs of members while ensuring affordability and convenience. By providing a structured loan option, MPL Lite helps government employees manage their finances and avoid resorting to predatory lending practices.

Introduced in September 2023, the MPL Lite is a supplemental loan program designed for members with sufficient Net Take-Home Pay (NTHP) to qualify for additional or renewed GSIS loans. This guide will provide all the details you need to know about MPL Lite, from eligibility to application procedures.

Program Overview

The GSIS Multi-Purpose Loan Lite (MPL Lite) program is a “Quick Loan” version of the MPL Flex—a financial assistance initiative designed for GSIS members—to consolidate debts, access funds for personal needs, and promote financial wellness. Launched to improve the accessibility and affordability of loans, the program streamlines repayment terms and offers lower interest rates. Its legal basis stems from the GSIS Charter (Republic Act No. 8291), which empowers the institution to provide loan products that benefit government employees and help them restructure and manage their finances by offering an alternative to costly private lending institutions.

The key features of MPL Lite include:

- Loanable amounts ranging from PHP 5,000 to PHP 50,000.

- Flexible repayment terms of 6, 12, 18, or 24 months.

- Competitive interest rates of 6% or 7%, depending on the member’s status and years of service.

- Convenient application through the GSIS Touch mobile app.

Loanable Amount, Interest Rates, and Other Details

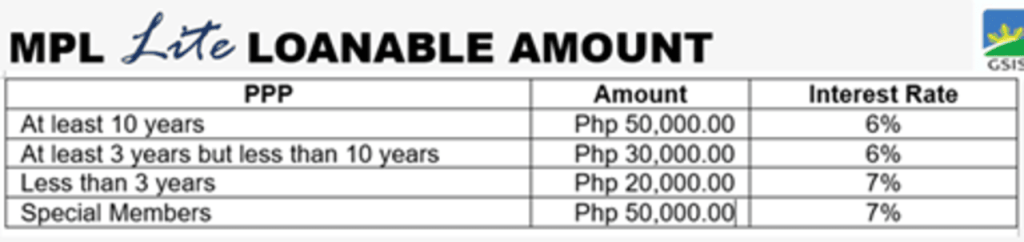

The program offers the following loan amounts, interest rates, and repayment terms and conditions according to the member’s years of service and financial capacity.

- Loanable amount:

- Less than three years of service: Maximum of PHP 20,000

- Three to less than 10 years of service: Maximum of PHP 30,000

- 10 years or more of service: Maximum of PHP 50,000

- Special members are eligible for a maximum loan amount of PHP 50,000, regardless of their years of service.

- Fast approval and crediting: Once approved, funds are credited within three days.

- Interest Rates

- Regular Members: 6% or 7% per annum, depending on their years of service.

- Special Members: Fixed at 7% per annum.

- Interest is computed on a diminishing balance, ensuring lower interest charges as the loan balance decreases.

- A prorated interest is also deducted in advance for the period between loan approval and the first due month.

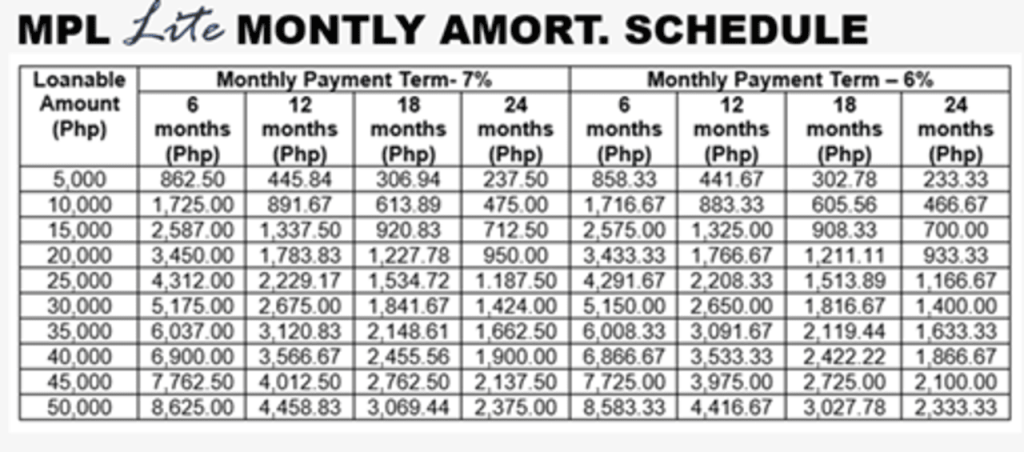

- Repayment Terms and Conditions: Members can choose from four repayment options, depending on their financial situation:

- 6 months

- 12 months

- 18 months

- 24 months

- Loan payments are deducted directly from the borrower’s monthly salary, with agencies responsible for remitting the payments to GSIS on or before the 10th day of the following month.

- Loan Redemption Insurance (LRI): It includes a Loan Redemption Insurance (LRI)—a one-time premium deducted upfront and varies based on the loan term and amount, designed to protect both the borrower and GSIS in case of the member’s untimely death.

- Service Fee: A 1% service fee, calculated based on the gross loan amount, is deducted upon loan approval.

- Members with active MPL Flex accounts are exempt from this fee.

- Monthly Amortization and Interest

- The monthly amortization is computed using the following formula: Monthly Amortization = Loan Amount × (1 + Annual Interest Rate × Loan Term) ÷ (12 × Loan Term)

Benefits

This program is more than just a loan program. It also offers several benefits for government employees, such as:

- Flexible Loan Terms: Members can choose repayment periods that suit their financial capacity.

- Affordable Rates: With low interest rates, the program reduces financial strain.

- Convenient Application: The fully digital process saves time and effort.

- Financial Relief: MPL Lite helps members manage urgent expenses without turning to high-interest lenders.

Target Beneficiaries

The GSIS Multi-Purpose Loan Lite (MPL Lite) program is designed to assist various groups of active government employees in addressing their financial needs. Below is the list of target beneficiary groups:

- Permanent government employees.

- Non-permanent government employees.

- Special Members as tagged in their Member Service Profiles (MSPs).

- Employees of agencies with an active Memorandum of Agreement (MOA) with GSIS.

- Members with at least one month of premium contributions for both Personal Share and Government Share.

- Members not on leave without pay at the time of application.

- Members with no default GSIS loans, except for housing loans.

- Employees with no pending administrative or criminal cases, except for light offenses.

- Employees with a sufficient Net Take Home Pay (NTHP) as required by the General Appropriations Act (GAA).

- Employees of agencies not marked as “Suspended” in GSIS records.

Eligibility Criteria

To qualify for the program, applicants must at least meet the following criteria:

- Not on Leave: Is not on leave of absence without pay at the time of application.

- Active Membership: Applicants must be active GSIS members, whether under permanent or non-permanent status, including special members.

- Sufficient Contributions: At least one month of premium contributions (personal and government shares) within the last six months or during the service period (if shorter) is required.

- No Pending Major Cases: Members with pending administrative or criminal cases for light offenses are eligible, but those with serious cases are not.

- No Defaulted GSIS Loans: Applicants must not have any GSIS Financial Assistance Loan (GFAL) accounts in default, except housing loans.

- Agency Eligibility: The applicant’s agency must have a Memorandum of Agreement (MOA) with GSIS and not be listed as “suspended.”

- Net Take-Home Pay Compliance: After loan deductions, the NTHP must meet the minimum amount mandated by the General Appropriations Act (GAA).

Requirements

To apply, you just need the following:

- GSIS Mobile Touch App, available for free download from either the Google Play Store or the App Store

- A GSIS member account

Application Process

Applying for MPL Lite is quick and hassle-free if you follow this step-by-step guide:

Step 1. Download GSIS Touch

Ensure the app is installed and updated on your mobile device.

Step 2. Login or Register

Access your GSIS member account using your credentials. First-time users need to create an account.

Step 3. Submit Loan Application

Select the MPL Lite option from the menu, fill out the required details, and attach any necessary documents.

Step 4. Certification by AAO

The Agency Authorized Officer (AAO) must certify the application through GSIS’s online certification module.

Step 5. Loan Approval and Crediting

Once approved, the loan proceeds are credited directly to the member’s GSIS eCard or ATM account. Notifications are sent via email or SMS.

Where to Secure the Application Form

The application form for the GSIS MPL Lite is available online and is integrated into the GSIS Touch mobile app. There is no need to secure physical forms, as the entire application process can only be completed digitally.

Frequently Asked Questions (FAQs)

For your reference, here are some commonly asked questions and answers regarding the GSIS MPL Lite:

1. What happens if I miss a payment?

GSIS coordinates with the borrower’s agency to deduct loan payments directly from the salary. Any missed payments may lead to penalties and reduced benefits upon loan renewal or termination.

2. Can I renew my MPL Lite loan?

Yes, MPL Lite loans can be renewed anytime, provided the member meets the eligibility criteria and the outstanding balance is cleared.

3. Are retirees eligible for MPL Lite?

No, the MPL Lite is exclusively for active GSIS members.

4. Can I apply in person?

No. The MPL Lite is only available for application online, via the GSIS Mobile Touch App.

Video: GSIS MPL Lite Loan Program

To learn more about the GSIS MPL Lite Loan Program, watch this video from Master Jet:

Summary

The GSIS Multi-Purpose Loan Lite (MPL Lite) offers a reliable and accessible solution for government employees in need of financial assistance. With its flexible repayment terms, low interest rates, and convenient application process, MPL Lite provides an affordable alternative to private lending institutions. By understanding the program’s features and requirements, members can take full advantage of this GSIS benefit and improve their financial well-being, especially in times of urgent need.