The Government Service Insurance System (GSIS) is an important part of social security in the Philippines, providing support to public sector employees through a range of benefits and cash assistance programs. Since its inception in 1937, GSIS has evolved to meet the changing needs of its members, ensuring that government workers receive the support they deserve. From life insurance, retirement, disability, and survivorship benefits to management of the Employees’ Compensation Program and the General Insurance Fund, GSIS promises comprehensive support for all government workers in the country.

Trivia: While the Social Security System (SSS) handles the insurance system for private employees, GSIS handles the insurance for government employees.

Understanding GSIS is crucial as it directly impacts the financial security and well-being of government employees and their families. Knowledge about GSIS benefits can help public sector workers make informed decisions about their careers and retirement planning. Additionally, being aware of GSIS programs ensures that employees can maximize the support available to them, enhancing their overall quality of life. In this article, we looked into what GSIS is, its history, coverage, programs and services, and how its various cash assistance programs benefit Filipinos.

What is GSIS?

The GSIS is a chartered government-owned and controlled corporation (GOCC) supervised by the Department of Finance. It offers social security coverage primarily to employees in the public sector. It also administers the Employees’ Compensation Program and the General Insurance Fund, which covers government properties. Initially starting with a life insurance program in 1937, GSIS expanded its offerings in 1951 to include old-age, disability, and survivors’ benefits. The institution’s purpose was further solidified with the enactment of Republic Act (RA) 8291 in 1997, which modernized and expanded the GSIS program to better serve its members.

GSIS operates under the mandate of Commonwealth Act No. 186 and Republic Act No. 8291 (GSIS Act of 1997). Its Board of Trustees, appointed by the President of the Philippines, governs the organization, ensuring the proper management of funds and delivery of services. By collecting monthly premium contributions from members and their agencies, GSIS funds its programs and ensures long-term sustainability and support for government workers.

History

GSIS began its operations on May 31, 1937, with a focus on life insurance. By 1951, the system had grown to include more comprehensive benefits. The passage of RA 8291 in 1997 marked a significant development, enhancing the program to include more robust coverage and benefits for government employees. Today, GSIS manages various programs including the Employees’ Compensation Program, which provides benefits for work-related injuries and disabilities, and the General Insurance Fund, which covers government assets.

GSIS Logo

The GSIS logo features a stylized image of a rising sun over a green landscape, symbolizing hope, growth, and a bright future. The sun represents the Filipino spirit and the promise of security and prosperity that GSIS aims to provide its members. The green landscape suggests stability and the commitment to nurturing and supporting public sector employees.

The logo’s color scheme incorporates blue, green, and yellow. Blue often signifies trust and dependability, aligning with GSIS’s goal to be a reliable institution. Green stands for growth and renewal, while yellow is associated with optimism and energy. Together, these elements convey GSIS’s mission to offer comprehensive social security and insurance services to government employees, ensuring their welfare and peace of mind.

GSIS Mission

“GSIS commits to:

- Provide social security and insurance to members and pensioners;

- Capture the non-life insurance needs of the government;

- Strengthen the fund through sound fund management;

- Form and sustain enduring partnerships; and

- Uphold the highest standards of corporate governance.”

GSIS Vision

“By 2028, GSIS will be a world-class pension and insurance institution run by esteemed professionals, using digital platforms to provide excellent customer experience while contributing to nation-building.”

Core Values

According to the latest GSIS Citizen Charter, the agency promises to uphold the following values while creating value for all the stakeholders involved:

- Professionalism;

- Integrity; and

- Dedicated and Excellent Service

Quality Policy

The chartered GOCC also pledged to offer their service in accordance with the following quality policy:

“In the Government Service Insurance System, we are committed to provide quality service to our stakeholders for all their social security benefits and non-life insurance needs. The design of our QMS shall consider the context and strategic direction of our organization. Our systems and processes shall be continually evaluated and improved for effectiveness, efficiency, and compliance with legal and other regulatory requirements. We will invest in the competence of our people through continued professional development.”

Organizational Structure

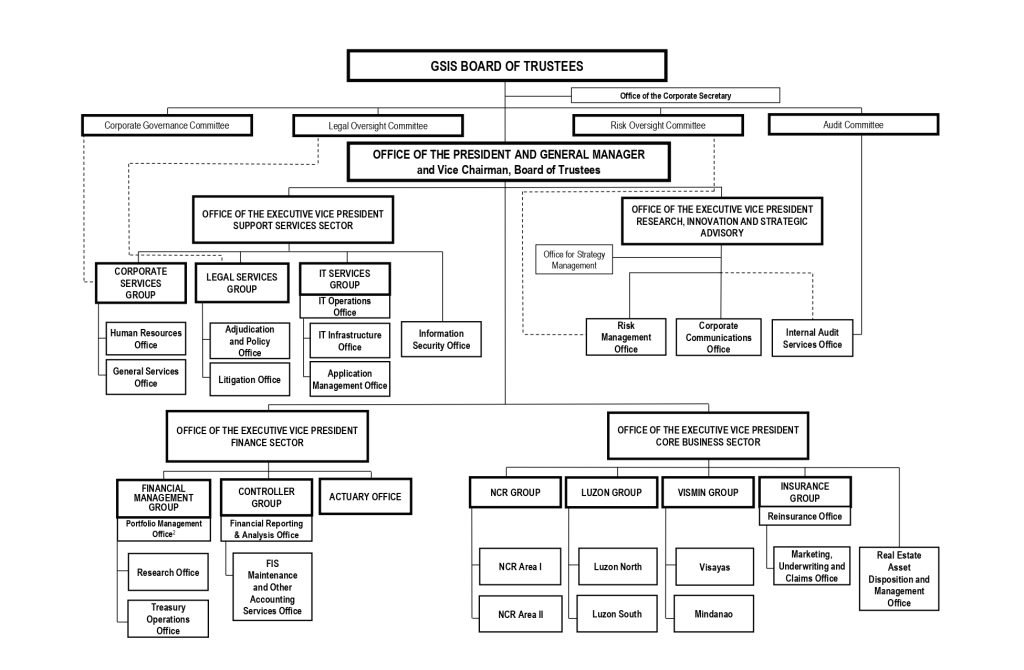

The GSIS organizational chart outlines the structure and hierarchy of the institution. Here’s a detailed description:

1. GSIS Board of Trustees: At the top of the chart, the Board of Trustees is responsible for governance and strategic oversight.

2. Office of the Corporate Secretary: This office supports the Board and ensures compliance with corporate governance practices.

3. Committees

- Corporate Governance Committee

- Legal Oversight Committee

- Risk Oversight Committee

- Audit Committee

4. Office of the President and General Manager: This office is headed by the President and General Manager, who also serves as the Vice Chairman of the Board of Trustees.

5. Executive Vice Presidents

- Support Services Sector: Manages support functions, including:

- Corporate Services Group: Oversees Human Resources and General Services.

- Legal Services Group: Includes Adjudication and Policy Office and Litigation Office.

- IT Services Group: Encompasses IT Operations, IT Infrastructure, Application Management, and Information Security.

- Research, Innovation, and Strategic Advisory: Focuses on strategy and innovation with:

- Office for Strategy Management

- Risk Management Office

- Corporate Communications Office

- Internal Audit Services Office

- Finance Sector: Handles financial management and control, consisting of:

- Financial Management Group: Includes Portfolio Management, Research, and Treasury Operations.

- Controller Group: Manages financial reporting and analysis.

- Actuary Office: Provides actuarial services.

- Core Business Sector: Divided into regional groups and insurance management:

- NCR Group: Manages areas within the National Capital Region (NCR).

- Luzon Group: Covers Luzon North and Luzon South.

- VisMin Group: Includes Visayas and Mindanao.

- Insurance Group: Manages reinsurance, marketing, underwriting, claims, and real estate asset disposition.

Each group and office within the GSIS organizational chart has specific roles and responsibilities aimed at ensuring efficient operation and service delivery to its members.

How GSIS Supports its Beneficiaries

The GSIS offers a comprehensive range of benefits aimed at ensuring the financial security and welfare of government employees in the Philippines. Through its various programs, GSIS provides essential support and peace of mind to its members, making it a crucial institution for public sector workers. Here is a list of the beneficiaries and what they get out of GSIS:

1. Government Employees: Primary beneficiaries who receive direct benefits from GSIS programs.

2. Families of Government Employees: Spouses, children, and dependents benefit from survivorship and life insurance payouts.

3. Retirees: Former government employees who receive pensions and retirement benefits to support their post-employment life.

4. Disabled Members: Individuals who receive disability benefits due to incapacity to work.

5. Beneficiaries of Deceased Members: Family members who receive funeral and survivorship benefits.

It also helps and supports public sector employees and their families. Through retirement, separation, disability, and survivorship benefits, GSIS ensures financial security and peace of mind for its members. Additionally, its various loan programs and cash assistance schemes provide crucial support in times of need.

Coverage

The Government Service Insurance System (GSIS) provides a wide range of insurance and financial benefits to its members. Its coverage extends primarily to government employees, ensuring their welfare and financial security through the provision of life insurance, retirement benefits, disability benefits, survivorship benefits, separation benefits, and funeral benefits. It also covers employees from the following sectors, ensuring that both the members and their beneficiaries are financially supported in times of need.:

- National government agencies

- Government-owned and controlled corporations (GOCCs), and

- Local government units (LGUs).

Consequently, the following are not covered by the GSIS:

- Members of the Judiciary and Constitutional Commissions who are covered by separate retirement laws;

- Contractual employees who have no employee-employer relationship with their agencies; and

- Uniformed members of the Armed Forces of the Philippines (AFP) and the Philippine National Police (PNP), including the Bureau of Jail Management and Penology (BJMP) and the Bureau of Fire Protection (BFP).

- The GSIS also does not include Barangay and Sanggunian officials who are not receiving fixed monthly compensation.

- It also doesn’t cover employees who do not have monthly regular hours of work and are not receiving fixed monthly compensation.

Membership

Membership in GSIS is mandatory for all government employees, with a few exceptions such as members of the judiciary and constitutional commissions who have separate retirement systems. To be eligible for GSIS benefits, employees must make regular contributions, which are deducted from their salaries. Membership provides access to various loans, including emergency loans, housing loans, and educational loans, helping members meet their financial needs and allowing them to provide security and support for themselves and their families throughout their careers.

Benefits and Services Offered by GSIS

The GSIS provides a range of benefits and services designed to ensure the financial security and well-being of government employees and their families. These benefits cover various aspects of members’ lives, from retirement and insurance to loans and special pensions. Here is a comprehensive list of the benefits and services offered by GSIS, along with their descriptions:

1. Retirement Benefits

Provides a monthly pension or a lump-sum payment to members who have reached retirement age, ensuring financial stability during their retirement years.

2. Separation Benefits

Available to members who separate from government service before reaching retirement age, providing financial assistance based on the length of service.

3. Life Insurance Benefits

Includes various insurance policies to protect members’ families financially in case of the member’s death.

- Life Endowment Policy (LEP): An old insurance cover issued to GSIS members who entered government service before 1 August 2003, offering endowment benefits upon meeting any of the following conditions:

- Maturity

- Cash Surrender Value

- Permanent Total Disability

- Death Benefit

- Accidental Death Benefit

- Sickness Income Benefit

- Annual Dividend

- Enhanced Endowment Policy (ELP): Issued to new entrants in government service on or after 1 August 2003, to LEP holders who opted for conversion, and to those whose policy matured on or after 31 July 2003, providing enhanced endowment benefits including the following:

- Termination Value

- Death Benefit

- Annual Dividend

4. Disability Benefits

Offers financial support to members who become disabled, with coverage for permanent total, permanent partial, or temporary total disabilities.

5. Survivorship Benefits

Provides ongoing financial support to the surviving spouse and children of deceased members.

- Basic Survivorship Pension: A pension paid to the eligible spouse and dependent children of a deceased member, ensuring their continued financial support.

6. Survivorship Benefits of Inactive Members

Financial benefits provided to the dependents of inactive members who have passed away.

7. Funeral Benefit

A lump-sum amount provided to help cover the funeral expenses of deceased members.

8. Unemployment Benefit

Offers financial assistance to members who are involuntarily separated from government service.

9. Loan Privileges

- Enhanced Consolidated Loan Plus: A loan program consolidating various loans into one, with enhanced terms for easier repayment.

- Enhanced Emergency Loan: Provides quick financial assistance to members in times of emergency.

- Pension Loan: Available to pensioners, offering loans with favorable terms.

- Pensioners’ Emergency Loan: Special emergency loans for pensioners needing urgent financial aid.

10. Additional Benefits

- Inflation Adjustment of Pensions: Periodic adjustments to pensions to help maintain purchasing power despite inflation.

- Christmas Cash Gift for Pensioners: A yearly cash gift given to pensioners during the Christmas season.

- Milestone Benefits for Pensioners: Special benefits awarded to pensioners upon reaching significant milestones.

- Cash Benefit: Various cash benefits provided to members in different situations, ensuring financial assistance when needed.

These benefits and services underscore GSIS’s commitment to supporting government employees and their families throughout their careers and into retirement.

Video: GSIS Institutional Video

Get to know GSIS better and in a more comprehensive way by watching this video from GSIS Official.

Summary

The Government Service Insurance System (GSIS) continues to be a pillar of social security in the Philippines, offering essential support through its diverse range of benefits and cash assistance programs. Whether you are a government employee looking to understand your benefits or a public sector worker in need of financial support, GSIS is committed to providing the necessary assistance to secure your future and enhance your quality of life.

Contact Information

For more information about GSIS programs and services, you can contact them via the following:

Government Service Insurance System

Main HQ Address: Financial Center, Pasay City, Metro Manila

New Email Address: gsiscares@gsis.gov.ph

GSIS CALL CENTER NUMBERS:

For Calls within Metro Manila: (02) 8-847-4747

For International Calls: (632) 8-847-4747

For Provincial Calls: 1-800-8-847-4747 (for Globe subscribers) or 1-800-10-8474747 (for Smart subscribers)

Facebook: https://web.facebook.com/gsis.ph/

Youtube: https://www.youtube.com/user/GSISMembersHour/videos