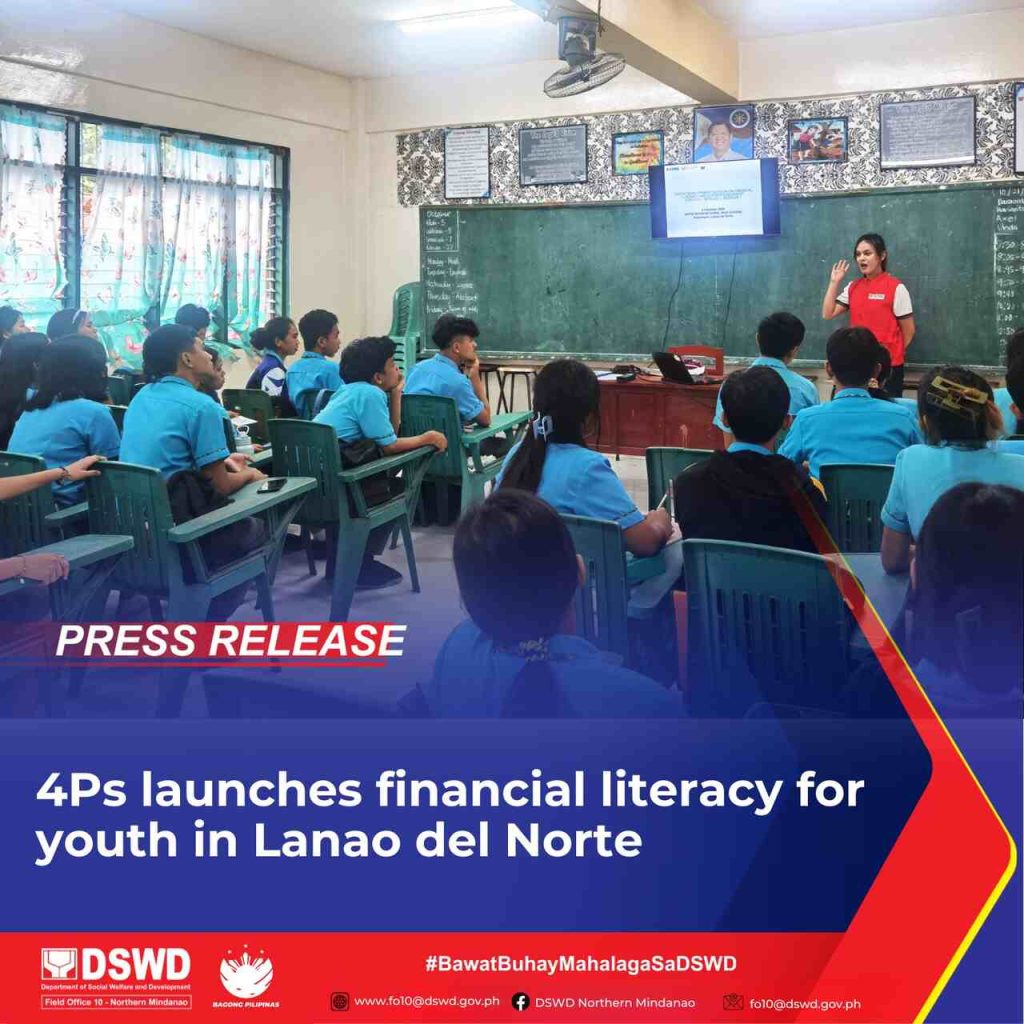

On October 21, 2024, the Department of Social Welfare and Development (DSWD) in Northern Mindanao initiated a financial literacy program for the youth of Lanao del Norte. This initiative, focused on senior high school students at Kapatagan National High School, is part of the ongoing efforts under the Pantawid Pamilyang Pilipino Program (4Ps). The program aims to equip young individuals with essential financial management skills, laying the groundwork for future financial independence.

The program’s integration into the monthly Youth Development Sessions (YDS) marks a key step in the government’s strategy to provide beneficiaries with the tools needed for making informed financial decisions. It is designed to address topics such as responsible budgeting, savings strategies, and consumer protection policies, with Kapatagan town serving as the pilot site for this initiative.

Empowering Youth through Financial Education

The DSWD’s initiative is part of a broader framework known as the Kilos Unlad (Progress Movement) which supports the goal of poverty alleviation by focusing on household financial management. With the increasing importance of financial literacy in today’s world, the DSWD aims to teach these skills early, preparing students for life beyond school.

This financial literacy module emphasizes several crucial topics, including the significance of cash grants, how to create and manage a budget, saving for the future, and understanding consumer protection laws. The program is tailored to ensure students grasp fundamental financial concepts that can influence their long-term economic well-being. DSWD-10 Regional Director Ramel Jamen highlighted that the goal is to empower the youth to make smarter financial decisions, ultimately contributing to poverty reduction efforts in the region.

Local Support for Financial Literacy

The financial literacy program has garnered support from educational leaders in Lanao del Norte. Dr. Joselito Epe, the Public School District Superintendent of Kapatagan, expressed enthusiasm for the initiative, emphasizing the potential long-term benefits it could provide students. According to Dr. Epe, the program will help instill positive financial behaviors in students, preparing them for real-world financial challenges as they near graduation. This focus on financial literacy, combined with the town’s involvement as a pilot location, is expected to enhance the economic outlook for the younger population of Kapatagan.

The support from local educators, including the Kapatagan National High School administration, has been crucial in implementing the program. The curriculum will be delivered in 15 senior high school classes at Kapatagan National High School throughout the rest of the year.

Expanding the Program Across Northern Mindanao

The financial literacy program is set to expand across Northern Mindanao in 2025. The 4Ps Regional Program Management Office plans to roll out the Youth Development Sessions (YDS) on financial literacy to all high school students in the region. This expansion is part of the government’s broader commitment to ensuring that young people from beneficiary households are equipped with financial skills necessary for long-term success. By integrating financial education into the regular curriculum, the DSWD hopes to foster an understanding of sound financial practices that can last a lifetime.

Kilos Unlad Framework and the 4Ps Initiative

The financial literacy program is a key component of the Kilos Unlad (Progress Movement) Framework, which aims to help low-income households achieve economic stability. The 4Ps program, which has been a cornerstone of the government’s poverty reduction strategy since its launch in 2008 and later legislated in 2019, emphasizes education, health, and nutrition as primary tools for breaking the cycle of poverty. The inclusion of financial literacy as part of this framework underscores the government’s commitment to providing families with the skills necessary to achieve financial independence.

Since its inception, the 4Ps initiative has supported millions of Filipino households, providing conditional cash transfers in exchange for commitments to health and education. This latest financial literacy initiative is a reflection of the government’s continued focus on equipping citizens, especially the youth, with the knowledge and skills needed to navigate financial systems effectively.

Commitment to Financial Stability

As part of its mission to promote financial independence and stability, the DSWD remains committed to supporting Filipino families. By helping students understand the basics of managing their finances, the agency is taking a proactive approach to reducing poverty and improving the well-being of the next generation. The financial literacy initiative in Lanao del Norte is just the beginning of what the DSWD hopes will become a nationwide effort to empower the youth.

The expansion of the financial literacy curriculum is a key part of the DSWD’s strategy to support the Pantawid Pamilyang Pilipino Program (4Ps) and help beneficiaries break free from the cycle of poverty. As these young individuals acquire financial skills, they are better prepared to make sound decisions, paving the way for greater economic opportunities in the future.