The Kapital Access for Young Agripreneurs (KAYA) Program is a loan initiative by the Department of Agriculture (DA) through the Agricultural Credit Policy Council (ACPC), launched in 2020 to support young Filipinos in starting or expanding their agri-based enterprises. Guided by the principles of Republic Act No. 11321 or the Sagip Saka Act, the program aims to provide accessible, zero-interest, and collateral-free financing to young agripreneurs aged 18 to 30 years old. It was designed to promote inclusive growth in the agriculture sector by equipping the youth with financial support and capacity-building tools to pursue sustainable farming and agribusiness ventures.

This program addresses the need to attract a younger generation to agriculture, recognizing their potential to contribute to a food-secure Philippines and improve the livelihood of farmers and fisherfolk. Through the KAYA Program, young agripreneurs can gain easier access to capital, entrepreneurial training, and modern digital financial services, such as the KAYA cash card. Understanding how this loan program works is important for aspiring agribusiness owners who want to access financial assistance and contribute to revitalizing the country’s agricultural sector. To access these benefits designed for aspiring agripreneurs, here’s how to apply and everything else you need to know.

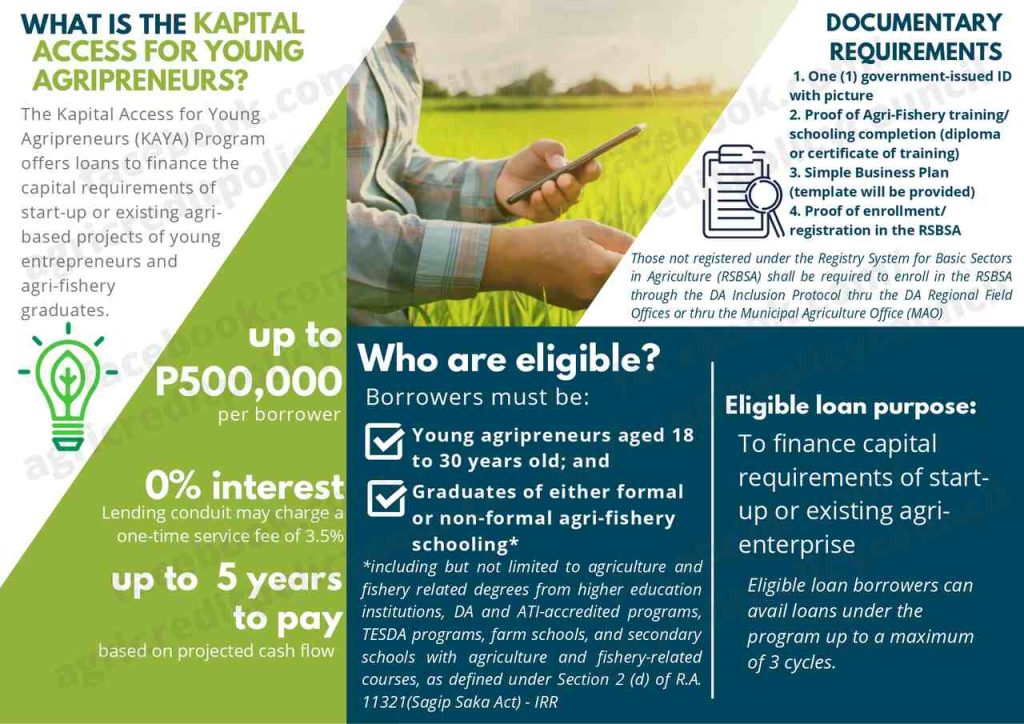

KAYA Program Overview

The KAYA Program is a loan and grant facility aimed at young Filipinos aged 18 to 30 who are interested in pursuing agriculture, fishery, or agribusiness ventures. The program is designed to support both start-up businesses and existing projects in the agricultural sector by providing them with financial assistance for their capital requirements. Loan recipients can use the funds for production, processing, marketing, or the acquisition of machinery and equipment.

It is also the first ever digitized loan program under the DA. By partnering with PayMaya, the DA has made it easier for loan beneficiaries to receive their funds and access additional financial services. Through the KAYA Cash Card, it has become easier for borrowers to manage their funds, transfer money, pay bills, and even withdraw the cash from ATMs.

Features

The program offers the following features:

- Loan Amount: Up to PHP 500,000

- Interest Rate: 0%

- Collateral: None required

- Repayment Terms: Payable based on the project’s cash flow, but not exceeding 5 years.

- Loan Disbursement: Through Partner Lending Conduits (PLCs) such as cooperatives, rural banks, and financial institutions.

- KAYA Cash Card: Loan beneficiaries can access funds through ATM terminals or PayMaya services.

The KAYA Program goes beyond just financial assistance. It also includes capacity-building programs to help borrowers succeed. These programs are delivered through partnerships with State Universities and Colleges (SUCs), government agencies, and other organizations. The training includes mentoring, entrepreneurship development, financial literacy, and product packaging.

Benefits

The program also offers several practical benefits that help young agripreneurs successfully start or expand their agri-based businesses. Some of them are as follows:

- Zero-interest loans of up to ₱500,000 per borrower

- No collateral requirement

- Flexible repayment terms based on project cash flow (up to 5 years)

- Access to capacity-building programs like business mentoring and entrepreneurship training

- Digital disbursement of loan funds through the KAYA cash card

- Availability of PayMaya services such as ATM withdrawals, fund transfers, and bills payment

- Up to three loan cycles allowed per eligible borrower

- Support from accredited partner lending conduits (cooperatives, rural banks, NGOs)

- Opportunity to grow sustainable agribusiness ventures in rural communities

Target Beneficiaries

The DA KAYA Program is designed to support the following groups of young individuals who are interested in starting or expanding their agri-based enterprises:

- Young agripreneurs between 18 to 30 years old

- Graduates of formal or non-formal agri-fishery education

- Agriculture and fishery-related degree holders from higher education institutions

- Graduates of DA and Agricultural Training Institute (ATI)-accredited programs

- TESDA-certified agri-fishery program graduates

- Alumni of farm schools and secondary schools with agri-fishery-related courses

- Registered members under the Registry System for Basic Sectors in Agriculture (RSBSA)

- Participants in agri-fishery training certified by government institutions

Who is Eligible to Apply?

To be eligible for the KAYA Program, applicants must meet the following criteria:

- Age: 18 to 30 years old

- Education: Must be a graduate of formal or non-formal agricultural or fishery training or schooling, such as those from higher education institutions, TESDA programs, farm schools, and secondary schools with agriculture and fishery-related courses.

- Project Type: Must have an existing agri-based business or a business plan for a new project in agriculture or fisheries.

Required Documents

To apply for the KAYA Program, you’ll need to submit the following documents:

- Government-Issued ID: A valid ID with a picture.

- Proof of Agri-Fishery Training: A diploma or certificate from an agriculture or fishery-related program.

- Business Plan: A simple business plan outlining the project’s objectives, target market, and financial projections.

- Proof of Registration: Registration under the RSBSA or the Farmers and Fisherfolk Enterprise Development Information System (FFEDIS).

How to Apply for the KAYA Program?

The application process is straightforward, but it requires several steps to ensure that your business plan aligns with the program’s objectives. Here’s a detailed guide to applying:

Step 1. Sign-Up

Visit the official ACPC Access Website (https://acpcaccess.ph/) to create an account and register for the program.

Step 2. Program Briefing

All loan applicants must attend a program briefing. This session will introduce you to the details of the KAYA Program and provide important information regarding the loan process.

Step 3. Business Planning Workshop

You may be required to attend a business planning workshop. This will help you refine your business idea and prepare you for the next steps in the application process.

Step 4. Submit Your Application

Once you’ve completed the briefing and workshop, submit the required documents, including your business plan and proof of registration with RSBSA or FFEDIS.

Step 5. Application Review

The Agricultural Credit Policy Council (ACPC) will review your application to verify that all documents are complete and meet the eligibility criteria.

Step 6. Application Forwarding

After ACPC completes the review, your application will be forwarded to the Project Lending Committee (PLC) for further evaluation.

Step 7. PLC Evaluation

The PLC will conduct an evaluation, which may include a credit investigation (CI) and business investigation (BI). They will assess your project’s feasibility and approve or disapprove your loan application.

Step 8. Loan Disbursement

If your application is approved, the PLC will release the loan amount. The funds will be deposited into your KAYA Cash Card, which you can access through ATMs or PayMaya services.

Program Partners

The KAYA Program is implemented through various Partner Lending Conduits (PLCs), which include government financial institutions, non-government financial institutions, cooperatives, rural banks, and other private entities. These PLCs manage the loan distribution and collection process. They also work closely with the ACPC to monitor the progress of funded projects.

Video: KAYA Program Application and Requirements

The Kapital Access for Young Agripreneurs (KAYA) Program is an opportunity for young Filipinos interested in agriculture and agribusiness offered by the DA in partnership with the Landbank. With its zero-interest loans, no collateral requirements, and focus on business development, the KAYA Program is set up to help you turn your agricultural ideas into reality. You can learn more about the program and how to apply for these program benefits or take the first step to start your journey as an agripreneur by watching this video from ACPC today.

Important Links and Contact Information

For more details and to begin your application process, visit the following websites:

- KAYA Program Website: https://acpc.gov.ph/kapital-access-for-young-agripreneurs-kaya/

- ACPC Website: https://acpc.gov.ph/

- KAYA Program Brochure: https://acpc.gov.ph/wp-content/uploads/2021/05/KAYA-Brochure-22Apr2021.pdf

For further inquiries or other concerns, you can contact:

- Phone: 0939-601-2988 (Smart/TNT) | 09086536320/22/23 (Smart/TNT) | 09063745063/65/67 (Globe/TM)

- Email: info@acpc.gov.ph | kaya@acpc.gov.ph

- Facebook: facebook.com/acpc.gov.ph