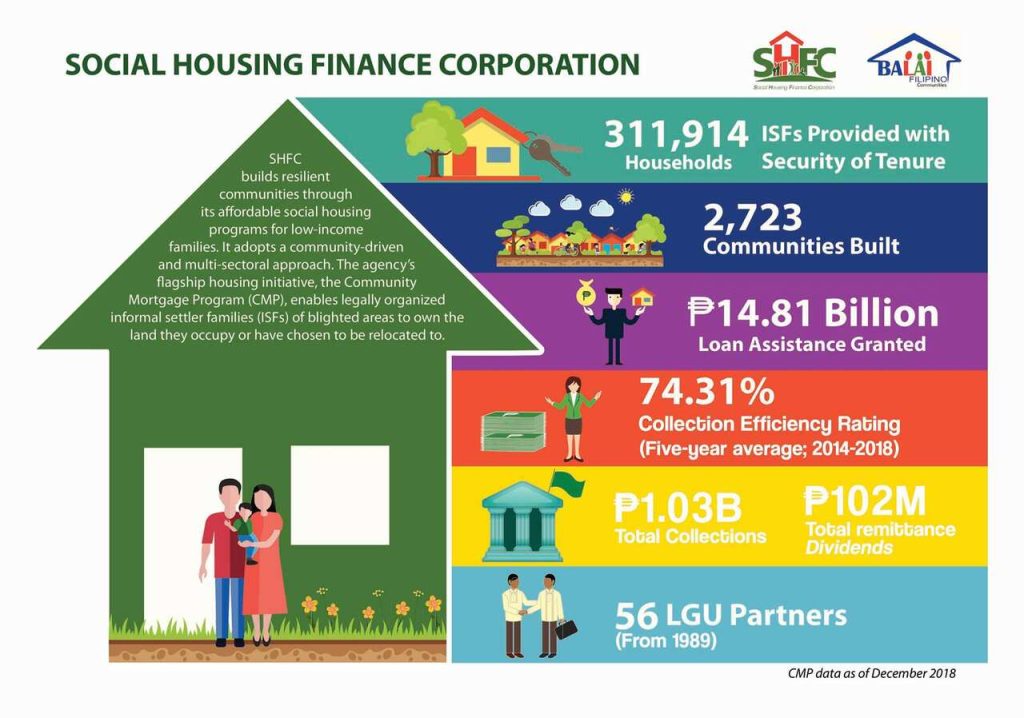

The Community Mortgage Program (CMP) is a flagship housing finance initiative in the Philippines designed to help low-income and informal settler families acquire land and secure affordable housing. Established under Executive Order No. 272 in 2004, the CMP is implemented by the Social Housing Finance Corporation (SHFC) as part of the government’s socialized housing strategy. It aims to empower organized community associations (CAs) by providing accessible loans for land acquisition, site development, and housing construction, ensuring security of tenure for beneficiaries.

The program is crucial in addressing urban poverty and homelessness, enabling informal settlers to collectively purchase the land they occupy or relocate to safer areas. By fostering community-led development, the CMP strengthens social cohesion, reduces the risks of eviction, and improves overall living conditions. Understanding the CMP is essential for low-income communities, government agencies, and stakeholders, as it promotes inclusive growth, urban resilience, and sustainable housing solutions in the Philippines. If you belong to informal settler families (ISFs) from a low-income community, this initiative will help you get affordable financing to secure land ownership and develop sustainable housing, enhancing their quality of life. To help you secure the benefits offered by this program, then keep reading this guide.

Program Overview

The CMP is a financing program designed to help legally organized community associations (CAs) purchase and develop land. It supports informal settlers in acquiring land tenure, upgrading their living conditions, and building sustainable communities in coordination with local government units (LGUs).

Under the CMP, financial assistance is provided in different phases:

- Phase 1: Land Acquisition

- Phase 2: Site Development

- Phase 3: House Construction or Home Improvement

Loan Features

- Loan Amounts: Eligible communities can avail of loans based on their specific housing needs:

- On-site housing: Up to PHP 400,000 per beneficiary

- Horizontal housing: Up to PHP 480,000 per beneficiary

- Vertical housing: Up to PHP 600,000 – PHP 750,000 per beneficiary

- Farm Lot: Up to PHP 350,000 + PHP 50,000 Farmer Support Assistance

- Loan Terms:

- Interest Rate: 6% per year

- Repayment Period: Up to 25 years with equal monthly payments

- CMP Housing Modalities: The program offers multiple CMP options to cater to different community needs:

- On-Site CMP: For communities currently residing in an area where they do not have legal ownership. The CA must secure the landowner’s approval for purchase.

- Special Projects CMP: For ISFs affected by government infrastructure projects or those living on government-owned land. This initiative is funded by government agencies or private entities.

- LGU CMP: Implemented by Local Government Units (LGUs) as part of their housing programs. LGUs oversee the entire process from planning to application.

- Sectoral CMP: For specific groups such as labor unions, displaced workers, and other marginalized sectors requiring resettlement assistance.

- Farm Lot CMP: Designed for ISF-farmers involved in agricultural activities. Each beneficiary can access 500-1,000 square meters of farmland, with a portion reserved for housing.

- Industrial Workers CMP: Provides housing for employees working in industrial zones, construction, commercial, and tourism sectors.

- Housing for Peace Process & Nation Building CMP: For individuals who have abandoned armed conflicts and require housing assistance as part of national peace efforts.

- Post-Disaster Recovery CMP: Supports communities affected by natural or human-made disasters, helping them rebuild homes with disaster-resilient designs.

- Vertical CMP: Provides housing in multi-story buildings, suitable for in-city or near-city relocation.

- Mixed-Use CMP: Aims to create self-sustaining communities with a balance of residential, commercial, and green spaces.

- Culturally Sensitive CMP: Respects the traditions and lifestyles of Indigenous Peoples (IPs) and ethnic minorities by incorporating culturally appropriate housing designs.

- Turnkey CMP: Allows private developers to contribute to the CMP by constructing fully developed socialized housing projects.

Benefits

The program itself also offers the following benefits to anyone who applies for it:

- Affordable Financing: Low-interest loans tailored for informal settlers.

- Security of Tenure: Enables families to own land legally.

- Community-Driven: Empowers organized groups to manage housing development.

Target Beneficiaries

The Social Housing Finance Corporation (SHFC) Community Mortgage Program (CMP) is designed to assist various low-income and marginalized groups in securing affordable housing and land tenure. The target beneficiary groups include:

- Informal Settler Families (ISFs): Households living in danger zones, government lands, or private properties without formal ownership.

- Renters and Sharers: Individuals or families renting spaces or sharing accommodations in CMP project sites who seek long-term housing security.

- Urban Poor Communities: Low-income groups residing in congested urban areas with limited access to socialized housing.

- Displaced Families: Households affected by government infrastructure projects, demolition, or eviction orders.

- Indigenous Peoples (IPs): Recognized indigenous groups seeking assistance for community-based land acquisition and housing development.

- Low-Income Earners: Workers, laborers, and other individuals struggling with financial constraints but willing to pay affordable housing loans.

- Community Associations (CAs): Organized groups of informal settlers or renters applying for CMP as a collective to acquire land and housing.

Eligibility

To qualify for CMP, beneficiaries must meet the following criteria:

- Must be a Filipino citizen and at least 18 years old (not exceeding 60 years old upon loan release)

- Must not have received any government housing loan before

- Must not own any residential property

- Must be a structure owner, renter, or sharer in the project site

- Must be an informal settler family (ISF) residing in a qualified project site.

- Must be a member of a Community Association (CA) duly registered with the Housing and Land Use Regulatory Board (HLURB).

- The CA must be willing to purchase the land where they reside or be relocated to an identified project site.

- Must have no existing housing loan obligations under SHFC or other government housing programs.

Required Documents

Before applying for this program, it is imperative for interested applicants to prepare the following requirements:

For Project Application

- Duly accomplished CMP application forms (CMP-001 & CMP-002)

- For New Private CMP-M Applicants:

- SEC/CDA Registration

- Articles of Incorporation/By-laws

- Bio-data of officers

- Track record in CMP/social housing development

- For LGUs/Other Government Entities:

- Council Resolution or Sangguniang Bayan Resolution

- Permanent unit/department handling CMP

- For Existing CMP-Ms:

- At least 80% Collection Efficiency Rating

For Issuance of Letter of Guaranty (LOG)

- Community Profile with list of beneficiaries

- Lot Plan, Vicinity Map, and Technical Description

- Schematic Subdivision Plan (signed by a licensed Geodetic Engineer)

- Masterlist of Beneficiaries with Loan Apportionment (MBLA)

- Passbook showing updated savings (equivalent to 3 months amortization & 1 year MRI premium)

- Notarized MOA between CA and landowner

- 1 government-issued ID of landowner & their representative

- Notarized Board Resolution/Secretary’s Certificate for HOA representatives

- Zoning Certification

- Real Property Tax Clearance

For Loan Release

- Notarized Deed of Absolute Sale

- Transfer Certificate of Title (TCT) under CA’s name

- Updated Tax Declaration in CA’s name

- Real Estate Mortgage (REM) & Deed of Assignment

- Collection Agreement between CA and SHFC

- Loan Agreement

Other Requirements

- DAR Conversion Order (if land title is a CLOA/Emancipation Patent)

- Road Right of Way (for off-site projects)

Loan Application and Processing

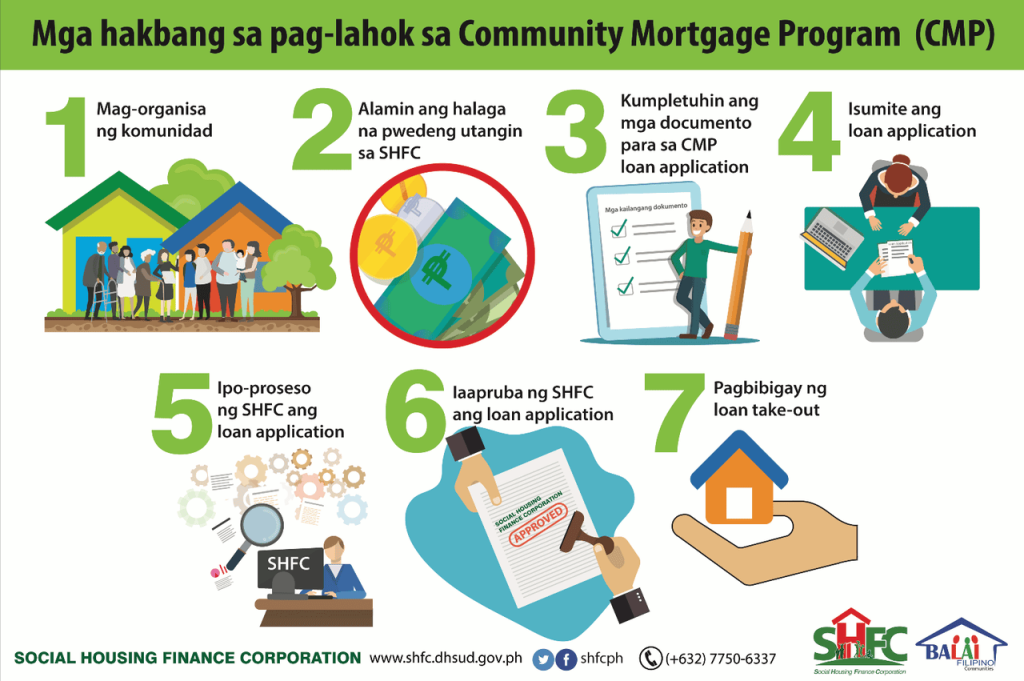

To apply, here are the steps that you need to follow:

Step 1: Organizing a Community Association (CA)

- Informal settlers form a Community Association (CA) registered with HLURB.

- Beneficiaries must register the CA, which will be responsible for applying for the loan and managing the project.

- The CA identifies a CMP Mobilizer (CMP-M)—either a government entity, NGO, or People’s Organization (PO)—to assist in documentation and application processing.

Step 2: Submission of Documents

The CA submits all necessary documents to the SHFC for review.

Step 3: Verification & Due Diligence

- SHFC conducts due diligence to verify the loan application and land ownership status.

- SHFC evaluates the application and ensures compliance with requirements.

- The process typically takes 120 working days.

- If approved, SHFC issues a Letter of Guaranty (LOG) to the landowner.

Step 4: Loan Approval & Release

- Upon successful verification, SHFC releases the loan to fund the project phases.

- The landowner transfers the property title to the CA.

- SHFC releases the loan proceeds to the landowner.

- The CA manages amortization payments among its members.

Step 5: Monthly Repayment

The CA manages the repayment of the loan through equal monthly installments.

CMP Loan Collateral & Borrower Responsibilities

The land acquired through CMP serves as collateral for the loan. To qualify:

- The land must not be agricultural

- It must have a clear title with no existing liens or legal issues

- It must have road access

- The landowner must have legal capacity to sell

Borrowers must also sign a Lease Purchase Agreement (LPA) with the CA, outlining their payment obligations and rights to eventually own the land.

Delinquency, Default, and Penalties

A CA account is considered in default if it fails to make payments for three consecutive months. In such cases:

- A penalty of 1/15 of 1% per day of delay applies

- Mortgage Redemption Insurance (MRI) covers borrowers in case of death, ensuring that their families are not burdened by unpaid loans

Substitution of Beneficiaries

The Masterlist of Beneficiaries submitted during loan application is final and substitutions are generally not allowed, except under the following conditions:

- Failure to pay his/her share in the monthly amortization

- Voluntarily waiving rights to the allocated lot/property in favor of the CA

- Failure to occupy the assigned unit for one year

- Death of the beneficiary with insufficient MRI coverage

- A final court decision for replacement

In case of inevitable substitution, priority is given to the following:

- Renters and sharers within the project site will be prioritized.

- The CA is responsible for finding a suitable replacement, subject to SHFC’s approval.

- SHFC reserves the right to disqualify any substitute member who does not meet qualifications or if misrepresentation is found.

In cases of foreclosure, SHFC follows strict procedures to ensure compliance and prevent abuse of the program.

Community Mobilizers (CMP-M)

Accredited Community Mobilizers (CMP-M) are accredited government agencies, NGOs, or POs tasked with helping informal settlers organize into CAs. They were designed to help ISFs organize into community associations and facilitate the loan application process. CMP-Ms can be government agencies, non-government organizations (NGOs), or people’s organizations (POs).

Their responsibilities include:

- Assisting in the documentation and submission of CMP loan applications.

- Providing access to other government housing assistance programs.

- Ensuring community coordination and mobilization.

Service Fee for CMP-Ms: CMP-Ms receive a service fee equivalent to 2% of the total loan amount or PHP 1,000 per member, whichever is higher.

Video: How to Join the CMP

The SHFC CMP provides affordable housing solutions for informal settlers, helping them secure land tenure and build safe communities. It involves organizing a Community Association (CA) and following the application process before beneficiaries can access financial assistance for land acquisition, site development, and housing construction. For a more detailed visual walkthrough on the application procedures for the SHFC CMP, watch this video from SHFC Public Affairs:

For more information, visit the Social Housing Finance Corporation (SHFC) website at shfc.dhsud.gov.ph. You may also contact Community Support Unit at (02) 750-63-37 or (02) 750-63-46 (local 140 & 530).