Ayala Multi-Purpose Cooperative (AMPC) is a financial platform created for Ayala Group employees through savings, loans, and member-exclusive benefits. It was established in October 1995 by 21 employees from the Ayala Group with an initial capitalization of Php 10,500. Today, it has grown to over 35,000 members nationwide and boasts more than Php 2 billion in capitalization. Recognized as one of the Top 10 institution-based cooperatives in the Philippines, AMPC is consistently awarded for its financial performance and member growth.

AMPC operates as a savings and microfinance vehicle for employees of the Ayala Group, offering a wide range of member-focused services, from loans to dividends, while promoting long-term capital build-up, especially for those seeking a dependable way to build financial security while staying connected to their workplace community.

Benefits

Some of the benefits associated with AMPC membership include:

- Opportunity to earn tax-free dividends on paid-up share capital

- Receive patronage refunds based on interest paid on loans

- Access to a wide range of loan products with competitive interest rates

- Flexible loan amounts based on share capital and company eligibility

- Continued membership as an Associate Member after resignation or retirement (with good credit standing)

- Option to build long-term savings through regular share capital contributions

- Share capital is refundable upon membership termination (net of any outstanding loan balance)

- Enjoy exclusive tie-ups and benefits with Ayala companies and partner institutions

- Receive stock certificates for every Php 50,000 share capital contribution

- Participate in the Coop’s General Assembly and decision-making processes

- Eligible to reapply for membership (subject to terms) if still employed by the Ayala Group

- Benefit from transparent dividend and refund calculations based on clear financial guidelines

- Access to customer support and services via email: customerservice@ampc.org.ph

- Continued loan eligibility and financial assistance for major life needs (e.g., education, travel, emergencies, housing, etc.)

Loan Products and Services

Members who meet tenure, share capital, and company-set loan eligibility may apply for loans. Loan applications can be submitted via the Membership & Loans Management System (MLMS) or manually through your HR coordinator.

- Auto Loan

- Amount: Php 150,000–Php 400,000

- Terms: 4 years

- Interest: 0.82%/month

- 3x Share Capital required

- Car Repair Loan

- Max: Php 149,999

- Term: 2 years

- 5x Share Capital

- Interest: 0.82%/month

- Educational Loan

- Max: Php 200,000

- Term: 2 years

- 5x Share Capital

- Interest: 0.82%/month

- Hospitalization/Wellness Loan

- Max: Php 200,000

- Term: 2 years

- 5x Share Capital

- Interest: 0.82%/month

- House Repair Loan

- Max: Php 149,999

- Term: 2 years

- 5x Share Capital

- Interest: 0.82%/month

- Housing Loan

- Max: Php 400,000

- Term: 4 years

- 3x Share Capital (min Php 50,000)

- Interest: 0.82%/month

- Multipurpose Loan

- Max: Php 400,000

- Term: 4 years

- 3x Share Capital (min Php 50,000)

- Interest: 2%/month

- Petty Cash Loan

- Max: Php 50,000

- Terms: 3 months to 1 year

- 5x Share Capital

- Interest: 1.5%/month discounted

- Providential Loan

- Max: Php 149,999

- Term: 2 years

- 5x Share Capital

- Interest: 1.5%/month

- Special Emergency Loan

- Max: Php 50,000

- Term: 2 years

- 5x Share Capital

- Interest: 5% (diminishing)

- Travel Loan

- Max: Php 200,000

- Term: 2 years

- 5x Share Capital

- Interest: 1.10%/month

- Wedding Loan

- Max: Php 200,000

- Term: 2 years

- 5x Share Capital

- Interest: 1.10%/month

Dividends and Patronage Refunds

Members earn tax-free dividends and patronage refunds based on:

- No outstanding loan dues

- Membership not under suspense account

- Membership not terminated before July 1 of the current year

Note: Dividends are based on the average share capital. Patronage refunds are computed based on total interest paid under regular loan products.

Who Can Join the Cooperative?

To join, you must be employed in an Ayala company with at least 20% Ayala ownership.

Steps to Join

Here’s how to become a member:

Step 1. Attend the Pre-Membership Education Seminar (PMES) or read the AMPC Brochure with FAQs.

Step 2. Complete and submit the Membership Application Form via email to: customerservice@ampc.org.ph

Step 3. A one-time Php 200 membership fee will be deducted from your salary.

Step 4. Commit to semi-monthly share capital contributions via payroll.

Step 5. You’ll be officially recognized as a member upon payment of at least 4 shares (Php 500/share), totaling Php 2,000.

Share Capital Contribution

Members are expected to comply with the share capital contribution guidelines implemented by the AMPC:

- Minimum Contribution: Php 100 per payday

- Maximum Holding: Php 1 million

- Share capital builds over time through semi-monthly payroll deductions

- Additional contributions may be made via BPI Expressonline or over the counter

- Reference format: 123456SHAR (6-digit Member ID + SHAR)

No decrease in share capital is allowed while loans are unpaid, and partial withdrawals are not permitted.

Membership Types

AMPC offers three types of membership:

- Regular Member: Regular or permanent employees of Ayala Group companies.

- Associate Member: Retired or resigned regular members with good credit standing.

- Associate Project Member: Project-based employees directly hired by an Ayala company with at least one year of service and a remaining contract term of at least eight months.

Inactive Members

Members whose share capital has not moved for six months will be classified as inactive and are no longer eligible for loan services. If inactive status persists, the member is considered resigned and will stop earning dividends.

Rights and Responsibilities of Members

Members are expected to:

- Contribute to the capital build-up

- Patronize AMPC services

- Follow the rules and regulations of the Cooperative

- Participate in meetings and decision-making processes

Termination and Reapplication

To terminate membership:

- Fill out and submit the Membership Termination Form and a valid ID to customerservice@ampc.org.ph

- All loans must be settled

- Share capital refund is released 7 working days after the last remittance is received

Note: Reapplication is allowed after 3 months for employees who continue to work within the Ayala Group, but not for those who resigned twice.

Member Transfers and Special Cases

In special cases, here are some things worth taking note of:

- Transferring to another Ayala company? Notify the Coop so share capital and loans are transferred.

- In case of member’s death: Benefits are released to the declared beneficiary (minus outstanding balances).

- Loan balance after share capital offset? The Coop will issue a Statement of Account and offer repayment options.

Video: Ayala Coop Institutional Video

Ayala Multi-Purpose Cooperative has a long track record and wide range of loan options, making it one of the strongest cooperatives in the Philippines worth joining—especially for those seeking a dependable way to build financial security while staying connected to their workplace community. Watch this video to learn more.

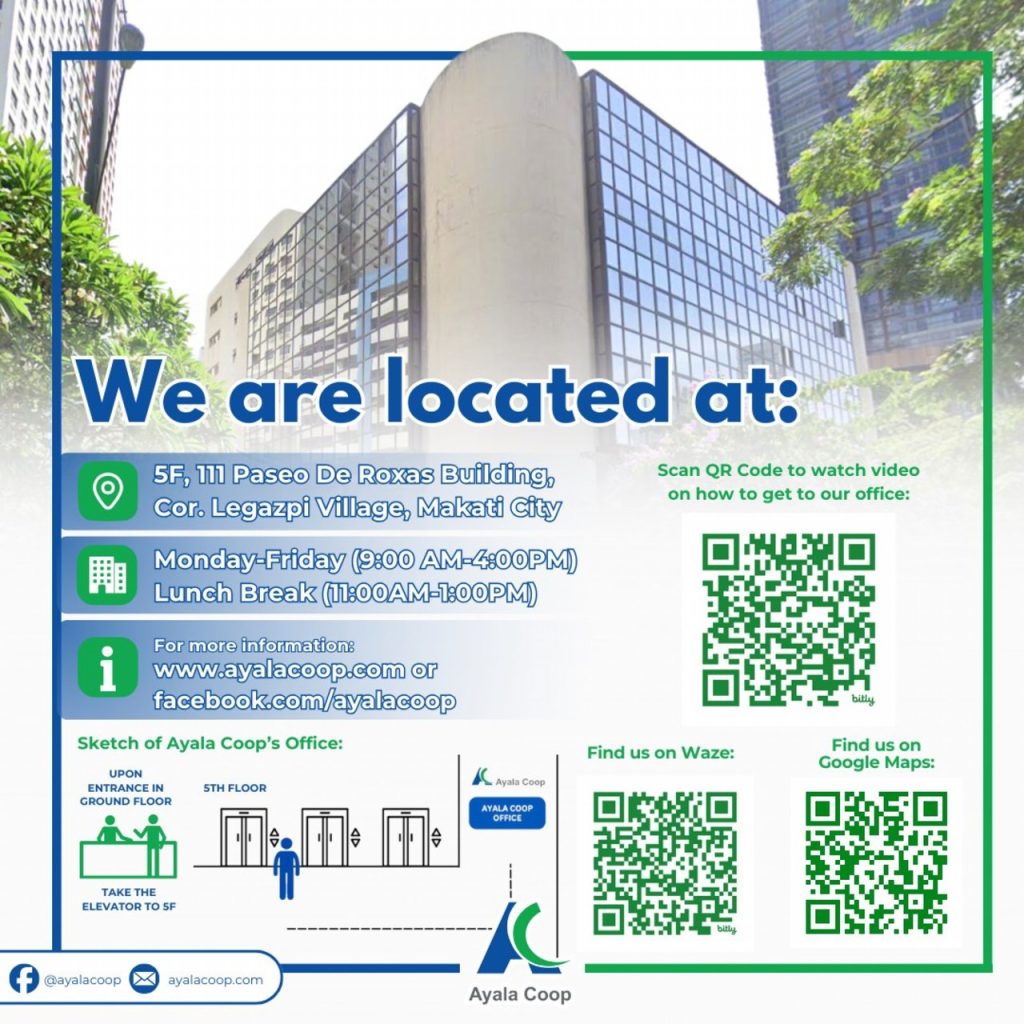

Contact Information

If you have other questions or concerns, you may also reach out to them via the following:

- Address: 8F 111 Paseo de Roxas Bldg., Paseo de Roxas corner Legaspi Village, Makati City

- Customer Service Hours: Monday–Friday, 9:00 AM–4:00 PM (break: 11:00 AM–1:00 PM)

- Email: customerservice@ampc.org.ph