The AFP Retirement and Separation Benefits System (AFP-RSBS) is a government-owned and controlled corporation (GOCC) in the Philippines established to provide financial assistance to retired and separated members of the Armed Forces of the Philippines (AFP). Created under Presidential Decree No. 361 on December 30, 1973, AFP-RSBS was envisioned as a self-sustaining funding mechanism to support the AFP retirement system.

Officially beginning its operations in 1976, AFP-RSBS was designed to secure the welfare of AFP members by guaranteeing the continuous payment of retirement and separation benefits. Now, though the AFP-RSBS is in the process of being dismantled after being officially abolished in 2016 by virtue of Memorandum Order No. 90, it continues to honor valid contracts and limited membership services, particularly refunds and loan-related obligations. However, no new contributions are being collected, and its services are being phased out in line with the liquidation process.

History and Legal Framework

The AFP-RSBS was created under Presidential Decree No. 361, signed on December 30, 1973. This decree established the system as a funding mechanism to guarantee continuous financial support for the AFP’s retirement plan. Some of the following subsequent amendments were enacted to enhance the system’s viability and address inequities in retirement pensions:

- Presidential Decree No. 361 (1973): Established the AFP-RSBS as a funding scheme for military retirement benefits.

- Presidential Decree No. 1656 (1979): Modified provisions related to membership and contributions.

- Presidential Decree No. 1909 (1984): Aimed to address inconsistencies in retirement benefit distribution among military retirees, particularly those separated before September 10, 1979.

- Presidential Decree No. 1638 and No. 1650: These decrees sought to consolidate and improve existing military retirement laws.

Despite these efforts, the system encountered sustainability issues due to underfunding, lack of government counterpart contributions, and increasing pension demands.

Mission and Vision

Following developments that led to its phased termination, AFP-RSBS adopted a new mission:

Mission

Its new mission statement reads,

“To orderly and efficiently wind down the operation of AFPRSBS, liquidate its assets, and return to members their contributions.”

Vision

Now, its official vision statement is:

“To be the best provider of services to AFP personnel until the full liquidation of the System’s assets.”

Core Values

Despite its current state, the AFP-RSBS remains committed to serve with the following values at its core:

- Excellence

- Leadership

- Integrity

- Teamwork

Funding and Operations

Its financial foundation was built on three sources:

- a seed capital of P200 million from the national government,

- mandatory contributions from AFP members equivalent to 5% of their basic pay, and

- retained investment earnings from real estate, joint ventures, and financial instruments.

AFP-RSBS also engaged in lending operations, money market and stock investments, real estate ventures, and joint partnerships to grow its funds.

Services Offered

AFP-RSBS provided several services to its members during its operational years. These services include:

- Advance refund of contributions

- Discounting of leave commutation

- Multi-purpose loans

- Discounted house and/or lot packages

It also engaged in:

- Lending operations

- Stock and money market investments

- Real estate development and joint ventures

These initiatives were aimed at growing the fund and providing benefits while managing its own financial obligations.

Challenges and Limitations

Unfortunately, while the AFP-RSBS was created to lessen the government’s financial burden for soldier pensions, it failed to fully assume this role. Several structural limitations hindered its sustainability:

- Underfunding from inception: The system relied heavily on member contributions and initial seed funding without continued government support.

- No government counterpart contributions: Unlike systems such as the GSIS and SSS, the AFP-RSBS did not benefit from recurring government funding.

- Refund Policy: AFP-RSBS was required to return contributions to members, unlike GSIS and SSS, which reinvest contributions.

- Generous Pension Structure:

- Based on the base and longevity pay of the next higher grade.

- Pension amounts increased in tandem with active soldiers’ salary hikes.

- Retirees eligible at age 56.

- High percentage pension benefits extended to surviving dependents (e.g., widows receiving 75%).

- Growing pensioner population: Improvements in life expectancy and an increasing number of pensioners created a growing financial obligation.

These issues culminated in the issuance of Memorandum Order No. 90 on April 8, 2016, directing the abolition of AFP-RSBS, the privatization of its subsidiaries, and the liquidation of its assets.

Winding Down and Liquidation

Under MO No. 90 and the subsequent directives including Executive Orders No. 590 (2006) and 590-A (2007), the following actions were mandated:

- Abolish the AFP-RSBS

- Privatize its subsidiaries

- Liquidate its assets

- Cease collection of contributions (effective March 31, 2016)

The Board of Trustees was also made to assume the role of the Board of Liquidators, and was tasked to:

- Stop the accrual of interest on member contributions

- Maintain only essential staff

- Collect outstanding receivables

- Refund members’ contributions as they become due

- Continue its loan services in a limited capacity

- Dispose of and liquidate all assets

The Governance Commission for GOCCs (GCG) was also made to oversee the liquidation process, with support from a Technical Working Group (TWG) comprising representatives from the DND, DOF, DBM, PMO, AFPRSBS, and AFP.

Transactions and Ongoing Operations

Although the System is in the process of being dismantled, it continues to honor valid contracts and limited membership services, particularly refunds and loan-related obligations. However, no new contributions are being collected, and its services are being phased out in line with the liquidation process.

Current Status

As of May 31, 2016, it reported its total assets to be approximately P17.1 billion and its total liabilities at around P16.2 billion, resulting in total equity of around P916 million. The system officially claims that it is not bankrupt and that it remains capable of settling its obligations, with the outstanding liabilities mainly consisting of members’ contributions and interest accrued before the cutoff date.

Video: AFP-RSBS Abolition ordered by PNoy

The AFP-RSBS was a dedicated initiative to financially support Filipino soldiers after their service. Despite its operational hurdles, underfunding, and eventual phaseout, it delivered benefits and investment services to thousands of AFP members. Now under liquidation, its legacy continues through the careful handling of refunds and asset disposition in alignment with government orders. This ongoing process aims to refund members’ contributions and conclude the system’s operations responsibly. Here’s a video with more details on the abolition of the AFP-RSBS:

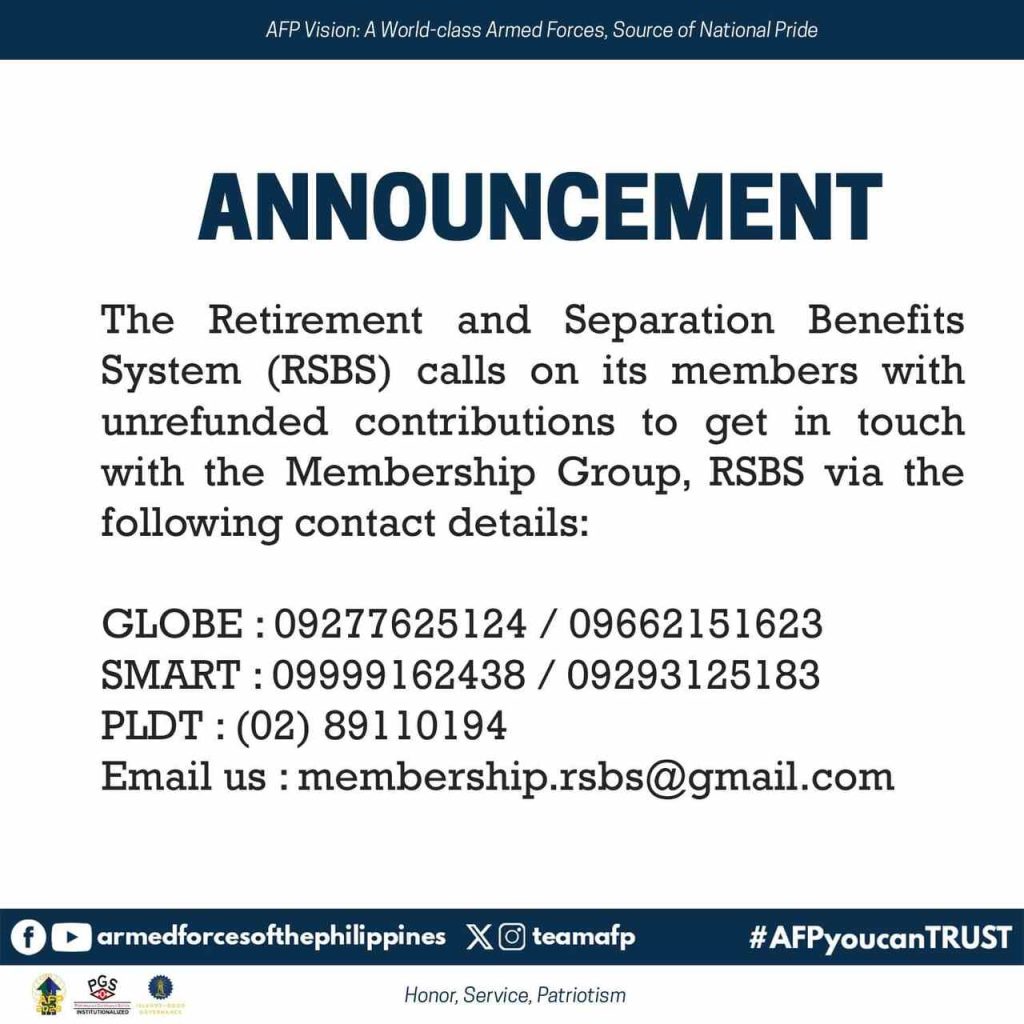

Contact Information

For former members and beneficiaries seeking updates or transactions or for any inquiries regarding the refund of contributions, members are advised to refer directly to consult with the Governance Commission for GOCCs for guidance on the liquidation and refund process. They may also contact them via the following AFP-RSBS’s official communications channels:

- Globe: 09277625124 / 09662151623

- Smart: 09999162438 / 09293125183

- PLDT: (02) 89110194

- Email: membership.rsbs@gmail.com